For years, automakers have been looking for business models beyond car sales to diversify their profit pools. While pay-per-use models—car sharing, ride hailing, and other mobility modes—have become more common, the alternatives to outright ownership have been limited to short-term rental (not always cheap) or leasing, with typically longer-term commitments and restrictive terms.

With the rise of the sharing economy and subscription services, from software-as-a-service to Spotify and Netflix to mobility services, it was only a matter of time before car subscriptions would arise.

Vehicle subscription offerings from OEMs have been around for several years. But the market only recently has begun to gain traction with consumers and investors, as business models continue to evolve and an expanding pool of providers hone their formulas for competing. In 10 years, car subscriptions could easily become a $30 billion to $40 billion market. For many OEMs, the results have been lackluster, yet some startups, particularly in Europe, have fared well. Does this mean car subscriptions are an improbable bet for the automotive industry? Or is it just a matter of time before the business model kinks are worked out? What will it take, in resources, capabilities, and strategy, to turn car subscriptions into a thriving part of the auto retail industry? And how are the different providers poised for advantage?

Car Subscriptions at a Glance

In Europe and the US, OEMs and other players—dealers, traditional rental and leasing companies—have already made their foray into subscriptions, joining a number of startups. So far, Europe remains the largest market by revenues. Venture capital continues to flow in.

The subscription model is showing it has legs in the mobility arena, if Amsterdam-based micro-mobility provider Swapfiets is any indication. This pioneer in mobility subscriptions offers programs for bicycles, electric bikes, scooters and mopeds throughout Europe, and many others are following suit.

How Subscriptions Work

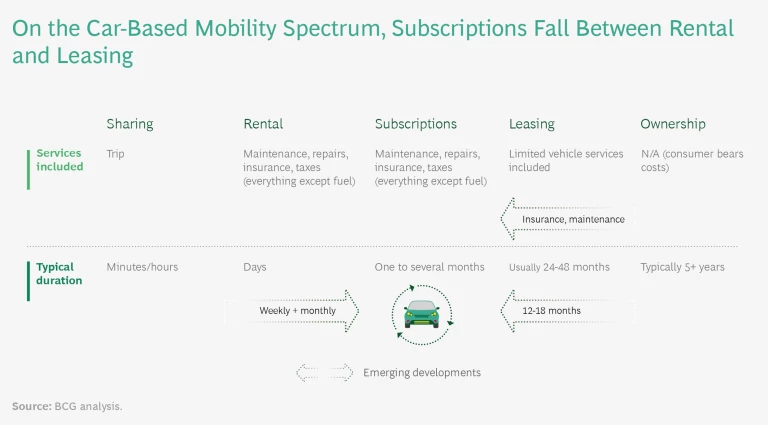

Subscriptions share some characteristics with rentals and leasing, but the distinctions (particularly with leasing) can be fuzzy. (See “Subscriptions Versus Rentals and Leasing.”) Basically, the consumer pays a monthly fee for a car, with most or all costs (except fuel) included: maintenance, repairs, roadside assistance, registration fees, insurance, and taxes. The commitment period varies from one to several months or in yearly increments from one to two years or more. Typically, the longer the commitment, the lower the monthly fee.

Subscriptions Versus Rentals and Leasing

Leasing is another story. Most leases require a minimum two- to four-year contract and impose stiff penalties for canceling. Many exclude additional services, such as insurance or repairs. However, full-service (or “all-inclusive leases”), more common in certain European markets, cover everything but fuel. They are essentially subscriptions, only with a longer minimum duration. Although customers generally get to configure the car they’d like, choice and flexibility typically end there.

Another way to view the difference is in the way the product is marketed and sold. Subscriptions make car acquisition a modern digital experience—from shopping and comparing to transacting. And consumers deal directly with the provider. In this respect, subscriptions represent an opportunity for OEMs to establish a digital channel for selling to end users. They’re a natural entry point into digital and direct sales.

Interestingly, since subscriptions were introduced, rental and leasing companies have begun to blur the distinctions even further. (See exhibit.) Some leasing companies have moved the terms closer to those of subscription services (in particular, shortening the minimum contract period). At the same time, to hedge against cancellation risk and costs, subscription companies are offering monthly fee discounts that encourage customers to accept longer-term (for example, minimum one-year) agreements.

From the consumer’s perspective, car subscriptions are an attractive proposition when compared with car purchasing, offering convenience, flexibility, and a minimal commitment. The customer avoids the substantial upfront cost of a car purchase, along with the other hidden costs of ownership. (Although some plans involve an upfront sign-on fee.) This is an important selling point, as people generally underestimate the total cost of car ownership. A survey of 7,000 households in Germany showed that people underestimate the total cost of car ownership by more than 50%. Subscriptions also eliminate the tedious and paperwork-laden process of a conventional purchase. Customers needn’t worry about maintenance, inspections, finding a trustworthy mechanic, or buying tires. Subscriptions eliminate the risk of trying a new brand or type (such as an EV) even more than traditional leases—and more important, the financial risks associated with a long-term commitment for an asset that depreciates quickly.

Subscription customers needn’t worry about maintenance, inspections, finding a trustworthy mechanic, or buying tires.

Subscription offerings are not at all homogeneous. Some providers offer multiple brands, models, and types. Some (namely, OEM subsidiaries) offer just single brands. Some specialize in vehicle segments: premium or mass, internal combustion engine (ICE) cars or battery electric vehicles (BEV). Some, such as Porsche Drive, let customers swap for a different type of car for no extra cost—say, exchanging the SUV for a convertible when spring arrives. Importantly, in their brief history, subscription models have been evolving. The premium-priced, single-brand product (offered primarily by OEMs) that touted the option to swap cars has not gained traction. What is succeeding, at least in Europe, is a different model, one similar to full-service leasing. (See “Three Myths About Car Subscriptions.”)

Three Myths About Car Subscriptions

Myth #1: Consumers want to swap vehicles regularly. Only one out of four consumers list swapping as a major criterion for buying a subscription. Affordability and cost transparency are much more important. Moreover, the swapping feature and its associated costs drive up the price.

Myth #2: Subscriptions are too expensive. Actually, some vehicles are available for as little as €199 a month, all inclusive. The perception about high cost is largely a leftover from swapping-type models.

Myth #3: Most consumers want month-to-month subscriptions. Month-to-month plans are considerably more expensive, and eight out of ten consumers favor a lower price over a premium experience and features. Many consumers are simply looking for mobility, viewing it as a commodity. Month-by-month subscriptions (which can be canceled anytime) are proving to be in low demand. At this point, providers are offering them primarily for marketing purposes.

Why Now?

Changing customer preferences, among them the waning interest in owning physical products, have been accelerating the shift to subscription-based offerings beyond software and digital services. In addition, the COVID-19 pandemic drove many urban residents and commuters away from public transit and shared mobility modes to seek the safety of private vehicles.

There are a number of other reasons that car subscriptions are gaining consumer interest.

Buying a car the traditional way is tedious. Many consumers find the conventional car-buying experience—at least everything past the test-driving part—to be a hassle. They dislike the sales pressure. The purchasing process itself is slow and complex, and involves a lot of paperwork, especially the financial portion. Price transparency is often lacking. At this point, online purchasing is still a fairly limited option for new cars, mostly because of industry structure and the patchwork of regulations governing direct OEM sales, particularly in the US. (As of 2020, only 1% of new car purchases took place online.)

Changing customer preferences, among them the waning interest in owning physical products, have been accelerating the shift to subscription-based offerings beyond software and digital services.

Ownership is less flexible and can be risky. The commitment is long, whether buying the car outright, financing it, or leasing, and leasing comes with severe cancellation fees. The residual value loss in buying a car discourages people from changing their vehicle as often as they’d like. The individual car owner takes on residual value risk, a risk that can prove painful for anyone who buys a car and then experiences a job loss or other form of financial instability, as many did during the pandemic.

Car ownership is losing its luster in many parts of the Western world. Ownership for young people is no longer the status symbol or all-consuming aspiration it was just a generation ago. A study among Baby Boomers and Gen Z consumers showed that while about 75% of Baby Boomers consider owning a car a necessity, only 45% of Gen Z respondents think so. The proportion of 20- to 24-year-olds in the US holding a driver’s license fell from 92% in 1983 to less than 80% in 2018—a more than 10 percentage point decline in one generation. People have a more utilitarian attitude about driving, and studies show that growing numbers of people (especially city dwellers) do not think they need a car to get around.

Subscriptions are a low-risk way to try out new brands and BEVs. Consumers who might shy away from new brands or battery electric vehicles are more willing to try one out through a subscription. For BEVs in particular, subscribing eliminates a current drawback to ownership: the decline in resale value owing to reduced battery life. The closer a car is to the end of its battery warranty, the lower its resale value, as new batteries cost anywhere from $5,000 to $16,000. Given the rapid pace of improvement in battery technology, however, the cost of batteries will go down.

Subscriptions are an attractive supplementary option for B2B customers. Fleet services and companies that provide vehicles for their employees typically lease vehicles. Subscriptions enable business customers, particularly small and medium-size enterprises, to quickly adjust their fleet size based on demand, and nimbly react to changing business conditions.

The Emergent Ecosystem

As in other segments of the automotive industry, technology has allowed new business models to flourish, creating new opportunities and challenges for incumbents and startups alike.

For automakers, car subscriptions offer a way of getting closer to the end customer and having greater control over the customer experience by offering valuable digital services directly. At a time when consumers’ mobility needs and attitudes are changing so rapidly—and how and where we work is being redefined—that’s an important benefit.

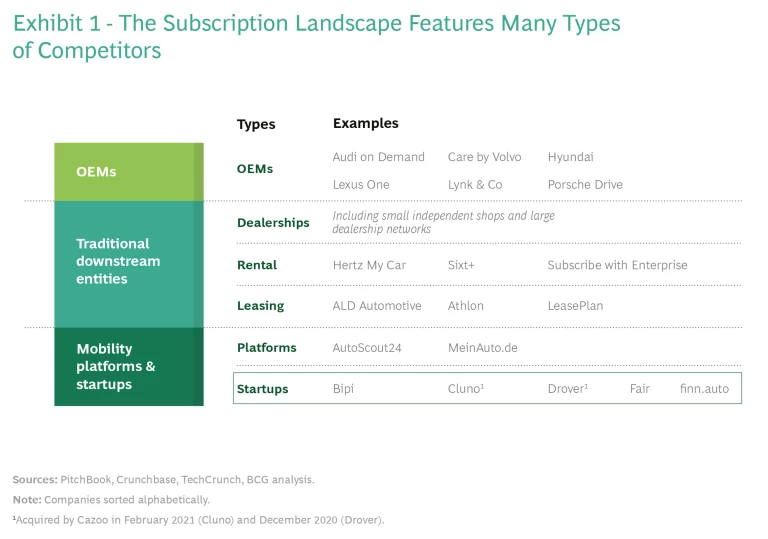

OEMs were among the first to offer car subscriptions. Audi Select (merged into Audi on Demand) was launched in 2014. Other OEM offerings included Care by Volvo, Porsche Drive, Lexus One, Access by BMW (since abandoned), Book by Cadillac (suspended), Mercedes-Benz Collection (since abandoned), Jaguar Land Rover’s Carpe (now Pivotal), and additional services from Nissan and Hyundai. The ecosystem of providers includes two other broad groups: traditional automotive downstream entities (dealerships, rental companies, and leasing companies), and digital mobility companies and startups, such as Fair, Cluno, Drover and Bipi, which have exploited the relatively low barriers to entry with a disruptive business model. Online car marketplaces such as AutoScout24 are tapping into the space via partnerships. Cazoo, the British online car seller, has entered the subscription market by acquiring Drover (in December 2020) and Cluno (in February 2021). (See Exhibit 1.) Cazoo aims to go public on the NYSE via a special purpose acquisition company (SPAC).

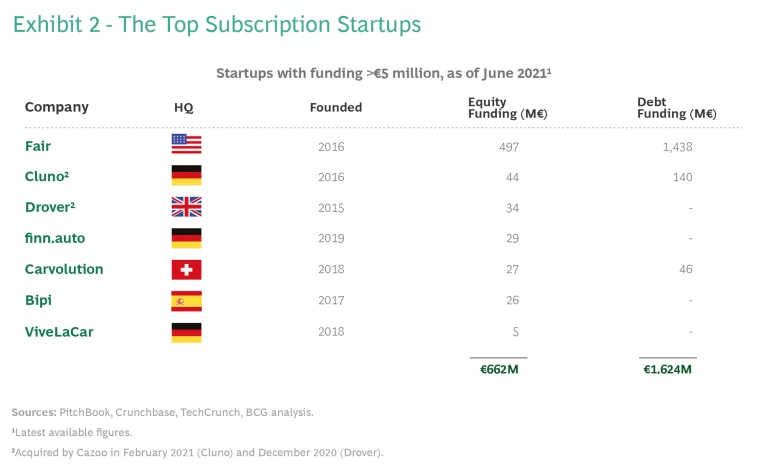

Since 2015, more than $700 million in venture capital has poured into car subscription startups. (See Exhibit 2.) Fair, launched in the US in 2016, topped the list in attracting equity funding (at $600 million to date), although eight of the ten startups with at least $1 million in equity funding are based in Europe. Compared with other emerging mobility markets, such as autonomous vehicles and battery-powered vehicles, funding levels for subscription startups are more modest. But that’s mainly because they don’t require comparable capital investments to develop new technologies.

A $40 Billion Prize

Some forecasts of subscription market growth envision penetration rates at 20 to 40% of new car sales by 2030—predictions we consider overstated. We estimate the market in Europe and the US could reach $30 billion to $40 billion by 2030—up to 15% of new car sales—based on volume of 5 to 6 million subscription vehicles. It’s worth noting that a share of this estimate may be served through longer-term rentals and full-service leasing, as the boundaries between these options and subscriptions are blurring.

We estimate the subscription market in Europe and the US could reach $30 billion to $40 billion by 2030—up to 15% of new car sales.

Europe holds the potential to be the largest subscription market. In the US, new-vehicle subscription programs typically have been run through OEMs. Fair, the US startup, built its business model around used cars. In China, the subscription model has elicited little interest thus far. License plate regulations and leasing requirements impede innovation, and perhaps more important, vehicle ownership there still confers social status.

Different Market Approaches

How service providers manage their vehicle supply is crucially important to their financial success. Some, such as Germany’s Cluno, purchase most vehicles. Vehicle costs for a subscription business account for roughly 50% of revenue, so savvy purchasing contributes substantially to value. A 20% purchasing discount can improve gross margin by 10%.

Notably, some startups are securing discounts of up to 35% from OEMs that are eager to push their sales volumes. Moreover, carrying vehicles on the balance sheet means accounting for their rapid depreciation in value. Every subscription provider that intends to own its vehicles needs to negotiate good spot deals on the cars it buys to boost financial performance. Still, outright purchase calls for deep pockets and carries the risks associated with asset utilization and residual values.

Vehicle costs for a subscription business account for roughly 50% of revenue, so savvy purchasing contributes substantially to value. A 20% purchasing discount can improve gross margin by 10%.

Other providers take an asset-light approach, through arrangements with dealers or leasing companies, as is the case with Madrid-based Bipi. Leasing banks buy thousands of vehicles every year to lease to enterprise customers, asset-light customers among them. Either way, the vehicles are not on the balance sheet of the subscription company. (See “Four Business Models” for more on this and other business models.)

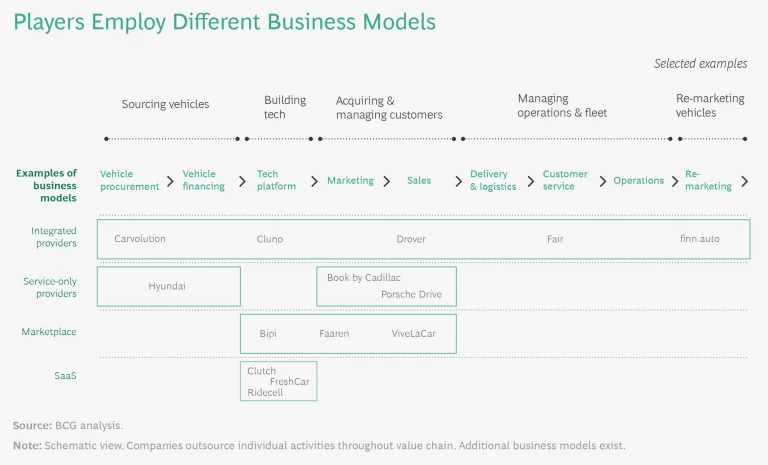

Four Business Models

The integrated provider. This type of provider handles every step in the value chain: sourcing its own vehicles, building its core technology, contracting with customers directly, handling delivery and operations, and re-selling vehicles at the end of their marketable life. But integrated providers needn’t perform all these activities internally. They may choose to outsource certain activities, such as vehicle delivery or servicing. Cluno, finn.auto and Drover are examples of this model. Cluno is more asset-heavy, while finn.auto and Drover are mixed, offering some vehicles that are on their balance sheet and others that are not. Integrated providers can design the customer experience to their specifications.

The service-only provider. Here, the provider typically creates the brand but partners with another entity that handles logistics, vehicle delivery, or customer-facing activities. This is the model many OEMs currently follow. But OEMs have begun investing heavily in tech infrastructure and capabilities in order to support online direct sales in the future. The subscription business may thus prove to be a good testing ground as they expand their digital capabilities.

The marketplace provider. With this model, the provider doesn’t offer its own vehicles. Instead, it provides the front-end interactions: marketing, listings, and directing customers to dealers, leasing companies, or others that actually provide the vehicle. In some cases, such as Bipi, it contracts with the customer directly. Its vehicle providers handle operations. With this asset-light model, the provider can piggyback on the infrastructure of its partner-providers, such as LeasePlan and ALD Automotive. It negotiates with the leasing companies, which then handle operations, re-marketing, and other functions. Once the partner-provider relationship is established, the marketplace provider can scale up quickly. The disadvantage of this model is that its adopters are subject to the processes and standards of the vehicle providers they rely on, with limited control over their services.

The software-as-a-service provider. The SaaS provider creates the customer-facing platform or front end (through a private-label relationship) to smaller subscription providers or those that actually provide the cars. It is therefore asset-light and scalable, like a software company. Examples include Ridecell, Clutch, and FreshCar.

Starting-Gate Advantages

The starting positions of the many companies entering the subscription business differ considerably. Tech entrants and startups have an edge in platforms and tech infrastructure, as well as in online B2C marketing and branding. They also have a disruptive mindset—and agility—on their side. Those adopting asset-light business models have lower capital requirements and can scale up quickly.

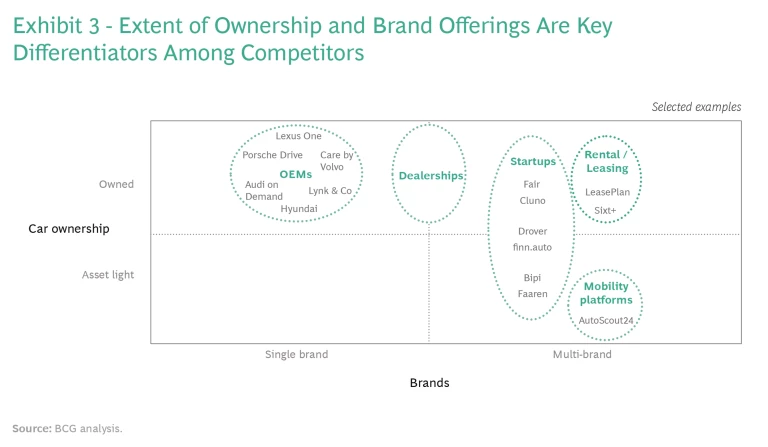

So how do the established entities stack up in terms of relative advantages? (See Exhibit 3.)

OEMs. As the supplier of new vehicles, OEMs hold two fundamental advantages: cost advantage (they acquire the vehicles at cost) and the ability to control (to a certain extent) the level of discounting. Today, volumes are still small, so the dependency is entirely one-sided, at least for startups.

Apart from building their own fleets at cost, OEMs have a pricing advantage, as well as the potential to capture margin with market growth.

Subscriptions can be seen as the ultimate test drive, a marketing tool for attracting future buyers who can try new models at no risk or even those who might not have otherwise considered owning a car.

OEMs need to strike a balance—to find a way to make their subscription business additive, rather than one that cannibalizes new-vehicle sales to consumers—while maintaining good relationships with their dealer networks. OEMs need to balance these upsides with the risk of lower lifetime value from customers (for example, from a customer who stays in a subscription program for less than the average lease term). This means OEMs must design a business model that encourages customer retention.

Subscriptions can be seen as the ultimate test drive, a marketing tool for attracting future buyers who can try new models at no risk or even those who might not have otherwise considered owning a car.

Dealerships. As the traditional channel for car sales, dealers have always been close to the customer, both B2C and smaller B2B customers. They have brand recognition with consumers, access to supply, and their own lucrative service and maintenance operations. They also have re-marketing experience from selling turned-in lease vehicles, used cars, and trade-ins. Like OEMs, their interest in subscriptions is as an additional or supplemental source of revenue, not as an offering that erodes traditional sales. But subscriptions also pose a threat to dealers, if consumers get their subscription directly online. Dealers could also lose service and maintenance business as subscription sellers turn their service business over to third-party providers.

Leasing companies. Leasing companies have a history in the market as “proto-subscription” providers, with all the associated capabilities across the value chain. Those that offer full-service leasing, such as LeasePlan, ALD, and Arval, have an advantageous position in the value chain. They already provide all the steps involved in subscriptions. They understand the economics of the individual services, such as maintenance, repairs, inspections, insurance, and licensing and registration. However, because they historically come from B2B, they lack brand recognition among consumers, and many have only a limited online presence. Today, leasing companies are closely monitoring the dynamics of the subscription market, and in some cases, acting as suppliers.

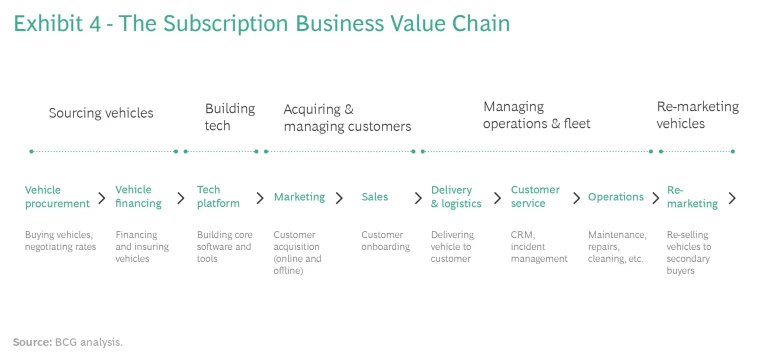

The Subscription Value Chain—and the Supply Management Question

The value chain of the car subscription market consists of five broad steps. (See Exhibit 4.) Some providers will handle just one of the steps, while others will handle multiple steps.

- Sourcing vehicles. This step consists of buying the vehicles as well as financing and insuring them.

- Building a tech platform. As with online sales, subscription providers need to create a user interface and user experience (the front-end software for customer-facing interactions such as marketing and booking) that’s as attractive as those of leading e-commerce sites. Offering an engaging experience is especially important in this still nascent market. Companies must also build the core back-end software and tools for operations and administrative processes.

- Acquiring and retaining customers. This step includes providing a seamless onboarding and sales process along with features that help retain customers. Companies must strive for the highest average contract duration, to ensure high contribution margin per customer.

- Managing operations and the fleet. This step includes processes as wide-ranging as customer service, auto maintenance, damage- and claim-handling, and vehicle delivery and return. The many component activities within these processes require maximum efficiency in order to maintain healthy economics.

- Re-marketing vehicles. Once vehicles are too used or too old to continue offering, they must be sold to secondary buyers: dealers, B2B or B2C marketplaces, auctions, or consumers. The proceeds from re-marketing are important income for companies with asset-heavy models. They also make subscription providers auto traders. They need to be adept at sourcing vehicles as well as re-marketing them at the end of their subscription life.

Current Roadblocks for OEMs

Car subscriptions fill a white space in the consumer market and add a new profit pool to an industry facing growth headwinds. Yet they haven’t taken off with anywhere near the intensity of other recent mobility options, such as e-scooters or even ride-hailing. Most companies have yet to land on a winning formula. Several, including Mercedes-Benz, Cadillac, and BMW, have already canceled their offerings or paused to rethink them.

Car subscriptions fill a white space in the consumer market and add a new profit pool to an industry facing growth headwinds.

Clearly, the car subscription is a multifaceted offering whose many variables can make for challenging economics. What is holding OEMs—the linchpin of the entire subscription marketplace—back from scaling up? A number of factors are at work.

- Product-market mismatch. Some providers entered the business assuming that the ability to swap vehicles and the month-to-month feature would be essential to the customer value proposition. As our research shows, both of these assumptions have proven false (Myths #1 and #3). Both features drive up costs, and in turn, the price tag. Swapping, for instance, requires additional deliveries and results in underutilized reserve vehicles.

- The limitations of a single-brand offering. Program flexibility is inherently limited if only the OEM’s models are available. Often, customers are seeking a subscription not for the brand but simply because they need a car.

- Competencies beyond their core. Many of the capabilities required for a subscription car business are at this point outside automakers’ traditional core competencies, such as a digital-first, user-friendly technology platform; advanced fleet management; and an ongoing customer-relationship and customer-engagement model to ensure retention. Nonetheless, OEMs are increasingly recognizing that they need to develop digital and direct customer sales and journeys (as do other market participants). A subscription offering can be an entry point for these customers and ultimately a way to convert them to long-term buyers.

- Market constraints. In some markets, OEMs must avoid the appearance of competing with their dealers. Coordinating offerings with dealers, as Volvo has done, is a potential solution. Volvo’s participating dealers serve as delivery and service locations, boosting revenues and winning new customers. At the same time, such an arrangement results in less flexibility for the OEM.

- Sellers’ risk aversion. Some OEMs prefer the certainty of a vehicle sale over the uncertainty of a subscription’s duration. Yet this thinking presumes that subscriptions will largely cannibalize sales rather than augment them in a scenario of declining growth. Subscriptions may help increase sales, by giving consumers a robust product trial rather than the traditional 15-minute test drive. They might also bring new customers into the market who otherwise wouldn’t have considered having a private vehicle.

Stay ahead with BCG insights on the automotive industry

Sometimes, the failure to ignite has a simple cause: companies giving up prematurely on a new initiative because it hasn’t yet delivered on its ROI. Any new idea may need some pivoting and iterating to get right. Above all, the offering must be competitive and compelling. This may explain why some new OEMs, such as Lynk & Co and Canoo, are entering the subscription fray. They have no internal constraints (such as pressure against offering new models), and newer business models (leasing-type approaches) have worked through the initial stumbling blocks and are now better poised to succeed.

What Will It Take for Subscriptions to Take Off?

The subscription business won’t reach scale if it serves only those seeking a car for a few months. Subscriptions must be seen as a viable alternative to buying or leasing. By offering value (an attractive price) and convenient, seamless, worry-free service, providers can incentivize customers to choose longer subscription periods.

The subscription business won’t reach scale if it serves only those seeking a car for a few months. Subscriptions must be seen as a viable alternative to buying or leasing.

Subscription products call for a different orientation than manufacturers’ common “hit product” mindset. They call for innovating with the customer’s interests foremost in mind and structuring the organization in ways that foster collaboration and responsiveness to accomplish that goal.

All participants need to assess the risk/reward tradeoffs in entering the business. For all but startups, they’ll need to evaluate the potential impact on existing sales, recognizing that their core business is facing its own challenges.

To achieve viability, market participants must figure out how best to attract and retain customers and how to optimize their business model. Step one is to hone the customer value proposition. What do customers care most about? Whittle out the superfluous features or vehicles that aren’t big selling points. Use testing, customer research, reviews, and the agile method of iterating based on customer feedback to continuously sharpen the offering.

Attract and Retain Customers

Price competitively. High prices were a major pitfall for some early, unsuccessful offerings. Setting cost-competitive prices means more than challenging direct competitors. It also means pricing relative to buying, leasing, or other forms of mobility like ride-hailing and ride-sharing. Used cars, especially newer used ones, can be offered at cheaper monthly rates and still be appealing to customers.

Setting cost-competitive prices means more than challenging direct competitors. It also means pricing relative to buying, leasing, or other forms of mobility like ride-hailing and ride-sharing.

Build the brand. A strong brand increases direct and organic (online) traffic and lowers customer acquisition costs. For non-OEM providers, as their customer base grows, a strong brand can help them negotiate bigger discounts when they purchase cars. As the car is increasingly seen as a commodity, OEM brands may become less important to consumers, and subscription providers’ brands may well become associated with having a car.

Treat customer service as integral to the product. Providers need to offer outstanding customer service, as well as customer relationship management and engagement. They need to proactively identify and address changing consumer needs, through their constant engagement along the subscription journey.

Optimizing the Business Model

Companies should develop a business model that leverages their strengths. They should take stock of their core capabilities and consider partnering with other providers to fill in gaps when doing so won’t significantly weaken their value chain depth.

Hone a purchasing strategy. Considering the high cost of vehicles, managing supply is a critical aspect of building a sustainable subscription business. Non-OEM providers will need to negotiate discounts wisely. OEMs must be careful to not antagonize their dealers by letting their cars be offered at cheaper-than-dealer rates. Bundled subscription pricing can avert that problem.

Manage inventory for high asset utilization. Subscription programs that let customers swap vehicles have limited market potential. Efficiencies in operations, including maintenance, repairs, and customer service, are vital. Consider partnerships and outsourcing for non-core areas.

Weigh the Upside and Downside

Every type of provider needs to zero in on the benefits, risks, and tradeoffs of a subscription program. All market participants that physically own vehicles face residual value risk. They need to focus closely on vehicles’ residual values and utilization rates, given their impact on the balance sheet. Market fluctuations or miscalculations on residual value will hurt their business case. For OEMs and startups, the stakes may be higher.

For OEMs. Subscriptions provide an opportunity to develop an ongoing relationship with customers, something previously beyond their reach. Leaders need to ask themselves:

- How would a subscription program complement our traditional sales channel?

- What’s the best possible offering we could provide that would maximize customer value?

- Should we offer only a single brand or multiple brands?

- Which parts of the value chain should we participate in, and where should we seek partners?

OEMs that choose to build consumer-facing programs will need to evaluate their capabilities in online marketing, customer relationship management, and operations. They must decide which capabilities to build internally, and which ones to outsource to partners. Importantly, they must also assess the role that dealers will play in their subscription business.

For startups. The steep discounts that startups may be able to extract from OEMs or leasing companies could disappear as soon as volumes reach scale or dealers begin to complain. They face other macro risks, such as a sudden raft of cancellations following an economic downturn. To overcome such risks, new entrants in particular will need to strive to maximize user value and scale their businesses while also improving their economics. Where possible, they’ll need to build flexibility into their commitments with suppliers.

What Lies Ahead for Car Subscriptions?

Although still in their infancy, and despite their low-key start, car subscriptions are hardly a fleeting idea. Consumers’ increasing acceptance of online services and subscription-based models bodes well. Subscriptions have come about during a challenging time for the auto industry. Feeling the pressure on standard retail sales, OEMs and dealers recognize the need to offer attractive mobility products that meet changing consumer preferences outside of their traditional distribution system. So, while start-ups have momentum today, OEMs and leasing companies may well catch up, either with their own internal subscription business or through acquisitions.

Will subscriptions upend the auto industry? Not anytime soon. Although it makes movies, Netflix hasn’t yet overtaken Universal Studios, nor has Spotify’s success diminished Warner Bros. as a major record label. Yet these two subscription pioneers have managed to capture the customer interface—and in doing so, witness their valuations blaze past those of industry incumbents.

Will subscriptions upend the auto industry? Not anytime soon.

Continued momentum in funding is likely, as is some consolidation, once market leaders begin to emerge along the value chain. In our view, subscriptions will not be a winner-take-all market. Apart from the low barriers to entry, there is no one single product. There is plenty of room for multiple providers to cater to different segments—premium or mass market, private or commercial—and serve different locations with different brands, engine types, vehicle sizes, and contract features.

Put simply, subscriptions won’t smother new-car sales to consumers—and that’s not how their proponents see them. On the contrary, the ability to subscribe may spur future sales by exposing more people to brands. Most of all, subscriptions fulfill growing consumer demand for all-inclusive, digital car offerings. Who will prevail in meeting that demand remains to be seen.