China’s growing health and wellness market—which is expected to reach nearly $70 billion by 2020—presents an enormous opportunity for forward-looking companies. But to gain a share of this market, manufacturers must understand the unique characteristics of Chinese consumers and how best to reach and serve them.

Chinese consumers are increasingly health conscious, buying a wide variety of products to treat common ailments, boost their energy, and strengthen their immune systems. The reasons for this growing trend are many: rising incomes, the stress effects of urbanization, an aging population, and the country’s ongoing issues with food safety and quality. More and more, consumers are self-medicating with health supplements and over-the-counter (OTC) health treatments—even buying brand names and higher-quality products that are more expensive.

For manufacturers of health and wellness products, the Chinese consumer market is an increasingly attractive target. But before jumping in and committing valuable resources to secure a foothold, most companies are wrestling with a variety of strategic issues, such as which consumer segments to target, what products to offer, how city size affects consumer behavior, and which distribution channels to use.

To gain more insight into these issues and to better understand consumers’ behaviors and attitudes with regard to health and wellness products, The Boston Consulting Group’s Center for Consumer and Customer Insight (CCCI) surveyed 2,600 Chinese consumers from the middle and affluent classes who range in age from 18 to 65 and live in large, medium, and small cities across the country. (The middle class was defined as having an annual household income of at least RMB 75,000 in real 2010 RMB.) All the consumers who participated in the survey had in recent months purchased products in the vitamins, minerals, and supplements (VMS) segment, the OTC-treatments segment, or both.

Key Insights

Our analysis of the results of the consumer survey revealed nine key insights, which we distill here along with their implications to help guide companies as they develop strategies for capitalizing on this growing market.

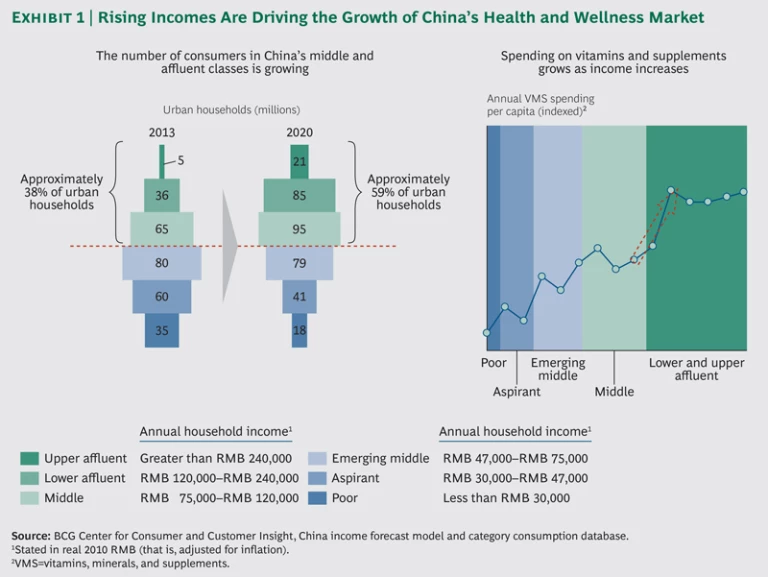

Chinese consumers are the world’s most health conscious. Compared with consumers in Brazil, Russia, and India, as well as those in the developed economies of the United States, Western Europe, and Japan, Chinese consumers are very concerned about their health. According to our survey, 73 percent are willing to trade up and pay a premium for products deemed healthier. That percentage is 12 points higher than the global average. Besides aspiring to physical health and wellness, people in China want to be happy, look good, and have enough energy for an active lifestyle. In 2013, health care and nutrition products jumped to number 2 among 15 product categories in which Chinese consumers plan to spend more, up from number 11 in 2011. Rising incomes among China’s middle and affluent classes are driving this market shift. Earning an annual income of RMB 120,000 and crossing the threshold of the lower-affluent class is the inflection point for increased consumption of vitamins and supplements. (See Exhibit 1.) Between 2012 and 2020, we project solid growth for the OTC segment and even stronger growth for the VMS market. Estimated at $18 billion in 2012, the OTC segment should grow at a compound annual rate of about 8 percent. The VMS market, estimated to be $13 billion in 2012, is expected to grow even faster, with a projected CAGR of about 13 percent. Overall, the value of China’s retail health market is predicted to more than double, reaching $67 billion.

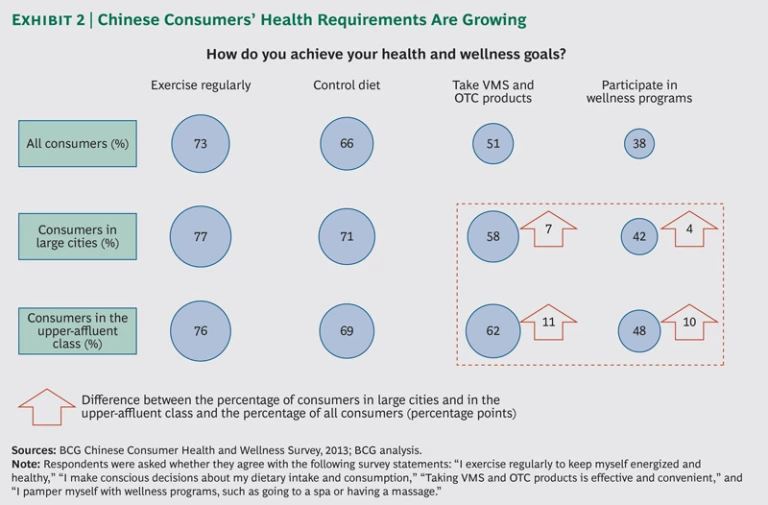

Many Chinese consumers report stress-related ailments—and seek to self-medicate. Almost half of the Chinese consumers we surveyed reported feeling subpar because of lifestyle factors, such as work pressures, family obligations, and long work hours. Common complaints were insomnia, fatigue, a lack of energy, obesity, and frequent illness. The incidence of these complaints is growing fast, especially among younger people. Thirty percent of respondents aged 18 to 24 reported lifestyle ailments, compared with only 18 percent of people over 40. Chinese consumers are looking not only for treatments but also for prevention through exercise, diet, VMS and OTC products, and total-wellness solutions. (See Exhibit 2.) As consumers become wealthier and more sophisticated, they are more likely to take VMS products and self-medicate. More than 60 percent of lower- and upper-affluent consumers said that “taking VMS and OTC products is effective and convenient.” When it comes to self-diagnosis and self-treatment, about one-third of consumers—mostly those with chronic problems such as indigestion—buy OTC products in advance to have at home.

- Chinese consumers have unique preferences, such as traditional Chinese medicine (TCM) and products with multiple functions. TCM is popular with consumers of all ages—not only the older generation. It is also popular among more sophisticated consumers, preferred by 55 percent of those in large cities, compared with 35 percent in small ones. More knowledgeable consumers have concerns about the side effects of Western OTC products. By contrast, less sophisticated consumers believe that Western OTC products are more effective than TCM remedies and more convenient. Moreover, the majority of consumers, especially those in large cities, prefer products with multiple functional benefits. Such products are perceived as more convenient and worth the premium paid.

- Chinese consumers often lack knowledge about health and wellness treatments and don’t trust their claims. Because health and wellness products are relatively new to China, some consumers are unsophisticated and don’t always have the knowledge to interpret the terminology used to describe these products. For instance, although the benefits of fortified foods and beverages are well established in the United States, Chinese consumers often feel that products with added ingredients or vitamins are artificial and less healthy. The prevailing belief is that health foods should be fresh, natural, and organic. A knowledge gap is also evident when it comes to VMS claims. Although 60 percent of our respondents said that efficacy is a key purchasing criterion for VMS products, almost 90 percent said they can’t differentiate among product claims on the basis of efficacy and functional benefits. This lack of knowledge, combined with a lack of stringent regulation and aggressive product marketing, leads to trust issues among Chinese consumers. More than half of our respondents said they worry that health food products may not be made as advertised. And many consumers take less than the recommended dosage of VMS products because they fear side effects or additives. In general, consumer knowledge in China still lags behind that of the developed markets—especially when it comes to VMS and other more advanced products.

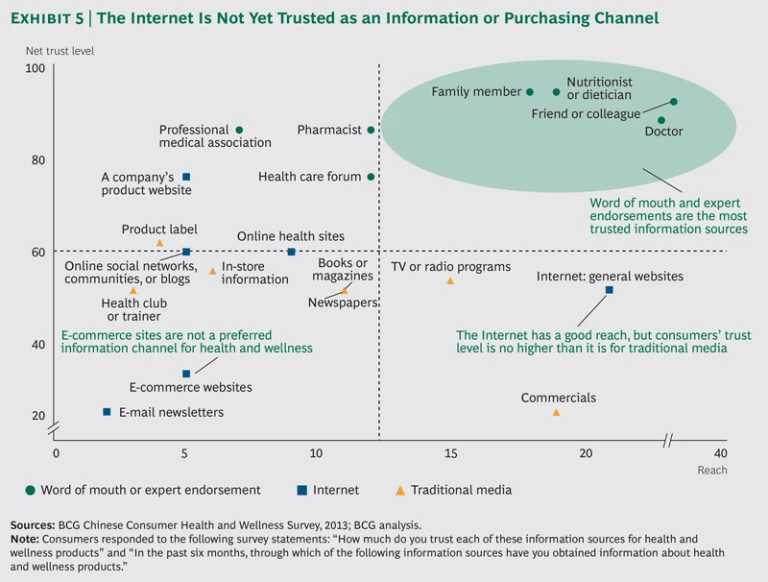

- Chinese consumers value credible, unbiased information sources when making purchase decisions. Rather than simply focusing on the taste or appearance of health foods and beverages, 80 percent of our respondents read product labels and nutritional fact sheets in an effort to make informed decisions. Still, for VMS products, word of mouth and expert endorsements are the most valued recommendations, trusted by more than 90 percent of Chinese consumers. And since most consumers can’t differentiate among product claims on the basis of efficacy and functional benefits, 50 percent said they would reach out to someone who has used the product to validate effectiveness. Only 12 percent of respondents would do additional research beyond word of mouth. Because government regulations are more stringent for OTC treatments than for VMS products, trust is less of an issue for the former, and VMS products registered as OTC remedies are more trusted than those registered as health foods, especially among seniors. Still, where Chinese consumers purchase products is important—especially for those who are less confident about self-medicating and want advice from a pharmacy. In these instances, consumers are very concerned about the quality of the in-store staff.

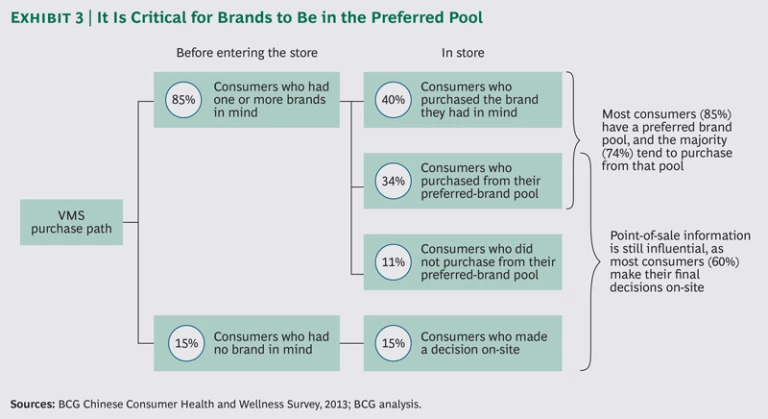

Brands are powerful—and their reputation matters. As with other product categories in China, well-known brands of health and wellness products are considered safer and of higher quality than lesser-known brands—and big-name brands are preferred. Umbrella brands tend to confer credibility across their product portfolio. Company specialization is another key factor when choosing a brand. For VMS products, 53 percent of our respondents preferred the brands of companies in a specialized VMS field, while only 38 percent favored the brands of pharmaceutical companies. It’s critical for VMS brands to be in consumers’ preferred-brand pool. (See Exhibit 3.) About 85 percent of respondents have preferred brands in mind when buying VMS products, and 74 percent choose from that brand pool.

- Most Chinese consumers make final purchase decisions on-site. Although consumers go into pharmacies with brand preferences, most VMS and OTC buyers make their final decision in the store, so point-of-sale influence matters. Sixty percent of consumers buy OTC products at pharmacy chain stores, which are perceived as having better-quality merchandise and being more convenient than independent pharmacies. In-store pharmacists have the greatest influence on consumers, followed by in-store staff. Although in-store pharmacists and staff influence the final purchase decisions, trust is still an issue. Only 8 percent of respondents said they fully trust in-store staff, and 66 percent reported that they ask for only basic information, if any at all, and try to make their own final decisions.

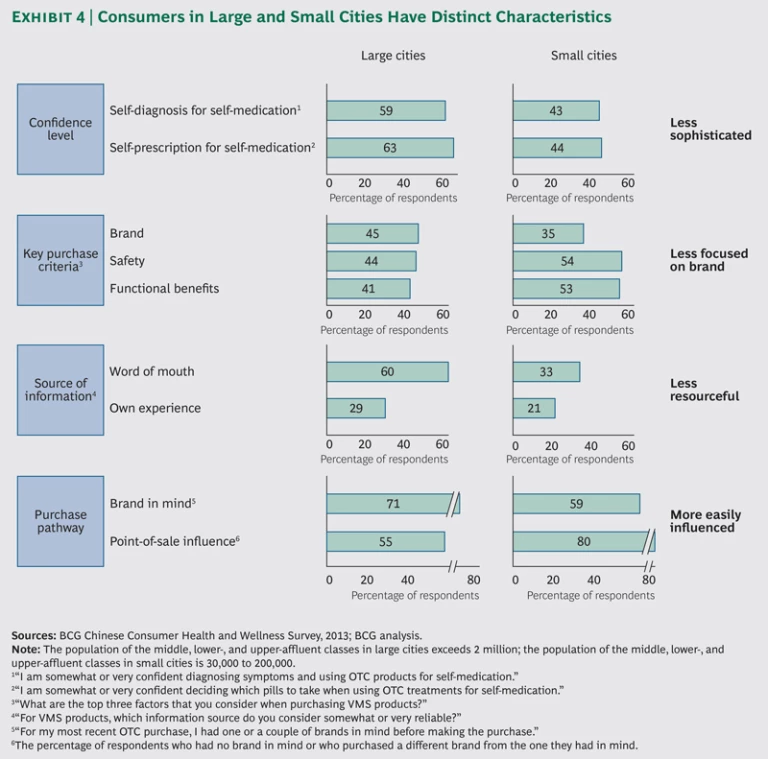

Chinese consumers in small cities have high health and wellness aspirations and some distinct characteristics. Chinese consumers in small cities are just as interested in health and wellness as those in big cities, ranking the category as their second highest for spending more in 2013. But consumers in small cities are less sophisticated and more easily influenced than their big-city counterparts and more focused on safety and functional benefits than on brand. (See Exhibit 4.) In large cities, consumers tend to compare product information on-site. In small cities, consumers are more receptive to in-store recommendations. These consumers are also considerably less likely than those in big cities to self-diagnose and self-medicate, to rely on word of mouth, and to have brands in mind when they shop.

The Internet isn’t an important purchasing channel for VMS and OTC products yet–but it’s fast emerging as one. China is a digital nation and will have twice as many people online as the United States and Japan combined by 2015. The Internet is a critical channel for information and sales in many product categories. The total number of online shoppers grew to 260 million in 2013, up from 180 million in 2011, and online sales already account for about 8 percent of total retail sales. But the Internet hasn’t yet become a major channel for consumer health products, and only 2 percent of these products—mostly those in the VMS segment—are bought online. Chinese consumers don’t trust the Internet for health and wellness information or purchases. (See Exhibit 5.)

Still, the online channel for consumer health products is developing quickly, as the government and industry players work to improve consumers’ confidence. The government has imposed stricter requirements for online vendors. And industry players have ramped up consumer education efforts, are working to improve product quality and distribution logistics, and are making certified pharmacists available for real-time consultations. The number of products available online is also growing quickly. The company JD.com—one of China’s largest e-tailers—offers more than 4,000 SKUs for health products.

Strategies for Winning

What are the implications of our findings, and how can companies capitalize on China’s growing health and wellness market? On the basis of our research and experience in the field, we’ve distilled six strategies to capture market share.

- Choose your battlefields wisely. China’s consumer health market is very fragmented, with a wide range of consumer preferences—based on factors such as age group, city size, and income level—as well as a wide variety of health and wellness categories and products. These segments all present different opportunities and challenges. To succeed, companies must understand their targeted consumers and develop product portfolios that play to distinct business strengths. Ask yourself the following questions: In which product categories does my company have an advantage in scale, brand strength, product efficacy, or expertise? Are our products tailored to the targeted consumers’ needs—including their unmet needs? Does our expected return from specific categories justify the costs and risks that we’re taking on? Stress-related remedies and products targeting seniors are promising categories with huge potential demand, for instance. But some areas that offer the greatest opportunity, such as TCM, will also be more competitive. Your company may do better by focusing on a niche segment.

- Build your brands. Trusted brands are important to Chinese consumers, who often associate strong brands with higher quality—especially when it comes to OTC products and self-medication. Therefore, brand building is critical to raising consumer awareness, reinforcing product efficacy, and gaining entry to consumers’ preferred-brand pool. Multinational corporations should distribute their products and marketing messages broadly, leveraging their international appeal wherever possible. Companies with strong brand equity may be able to capitalize on it by extending the brand into other product areas or consumer segments. Pfizer built a powerful umbrella brand, Centrum, for its vitamin-product category, serving various consumer segments, including adults, children, and seniors, and then extended that brand to nonvitamin health-food categories.

- Educate and inform consumers. The typical barriers to product adoption in China are quality concerns, a general distrust of product claims, fear of side effects, and an overall lack of knowledge among consumers. To overcome these obstacles, companies must develop focused campaigns designed to educate and inform consumers about product quality and value—and correct common product misconceptions. Manufacturers of beauty supplements, for instance, are explaining the need to use products for an extended period of time in order to reap the full benefits. Lumi is telling consumers that its collagen products must be used for 28 days for visible results and is offering discounts to encourage bulk purchases. Other companies are educating consumers on their products’ functional claims. For manufacturers of VMS and OTC products, in-store displays that highlight ingredients and benefits can be effective, as can word of mouth, which companies can generate through public relations campaigns, social media, and advocacy marketing using beauty trendsetters and other celebrities. To further build trust, companies selling VMS or OTC products should seek to leverage credible and unbiased sources of information—such as expert endorsements or pharmacies near hospitals, both of which are widely respected.

- Manage retail outlets aggressively. Since most consumers make their final purchase decisions on-site, it’s critical to have a retail presence and shelf space in the major pharmacy chains—the most important sales channel for health and wellness products. Encourage consumers to try your products by providing free in-store samples and clear product information. Many major pharmaceutical companies treat chain pharmacies as key accounts, proactively managing them in order to secure shelf space and in-store promotions. You should aim to build relationships with pharmacists and in-store staff as well as educate them, as they can strongly influence consumers’ purchase decisions.

- Get ready for e-commerce—especially to sell VMS products. We expect that China’s health and wellness market will migrate to the Internet sooner rather than later, given that the Internet provides more convenience, greater price transparency, and more product information than offline shopping. VMS products are more likely to be sold online than OTC remedies, which are purchased as needed (rather than in advance) by the majority of consumers. VMS companies with desirable, well-established brands may find that the Internet is an effective channel. Online promotions and discounts may also engage consumers and drive sales—especially for known and proven products.

- Understand the role that city size plays in consumer behavior. Our survey revealed that consumers in small cities have different habits and preferences than consumers in large ones—differences that companies must take into consideration as they develop their market strategies. For instance, TCM is more popular among consumers in large cities than among those in small ones. Similarly, since brands matter more in large urban markets than in small ones, companies with strong brands can start with large cities. Manufacturers with less brand equity could do better focusing on small cities, highlighting the functional benefits of their products and leveraging in-store staff to drive on-site sales.

Consumers in China’s fast-growing health and wellness market are seeking trusted brands and are willing to pay a premium for quality. To capitalize on this enormous opportunity, companies must act quickly, tailoring their portfolios, building their brands, leveraging their strengths, and effectively reaching out to targeted consumers. The time to put a stake in the ground is now—before the window of opportunity closes.

Acknowledgments

The authors would like to thank Jian Zhang, Hui Zhang, and Shukun Lin for their data analysis, Martha Craumer and Belinda Gallaugher for their help in developing and writing this report.