Chasing new ways to manage volatility, advance sustainability, and build resilience can boost individual companies and benefit the broader business ecosystem.

Oil and gas companies can contribute to easing constraints on global supplies and promote sustainability while building their resilience. But to do so, they need to empower their supply chain functions to create value rather than prioritize only cost reduction. They must give these functions an explicit mandate to search for value in ways that go beyond simple cost cutting, support them with strong talent and additional resources, and provide supply chain leaders with a seat at the table for strategic discussions.

Although oil and gas companies have started to expand their supply chain’s role, few have pursued the full scope of value creation opportunities. We see three main areas to focus on:

- Managing volatility responsibly through asset-backed trading and asset monetization

- Advancing sustainability through a transparency-enabled journey to address environmental, social, and governance (ESG) topics

- Building resilience through capabilities that promote flexibility and effectiveness while controlling costs and managing risks

Initiatives in these areas are mutually reinforcing. Managing volatility generates revenues to fund initiatives that promote sustainability and resilience. At the same time, success in the latter two objectives has become table stakes for generating value in an industry that faces increasing pressure to reduce emissions and balance tradeoffs in complex global supply chains. We estimate that addressing these strategic opportunities could generate up to $100 billion in additional value over three years across the oil and gas industry globally.

Looking Beyond Costs

The war in Ukraine is the latest in a series of shocks to hydrocarbon markets. These markets have seen increasing volatility of supply and demand in recent years driven by COVID-19, geopolitical events, and continued underinvestment in large oil and gas projects. Strategic assets (such as storage capacity, marketing agreements, and marine transportation) provide companies with options to manage supply-and-demand volatility, share resources with other players, and deliver products to markets with the greatest need. These value creation opportunities will gain importance as fossil fuel demand decreases.

Oil and gas companies have not pursued such opportunities aggressively, in large part because they have lagged other industries in focusing on the strategic importance of their supply chains. Historically, most oil and gas firms have treated their supply chain organizations like support functions and, in recent years, required them to prioritize cost reduction. Supply chain executives are typically not consulted before strategic decisions are made. In contrast, many organizations with top-performing supply chains have elevated executives leading these functions to the C-suite, and these leaders regularly participate in strategic discussions with the CEO.

New value creation opportunities will gain importance as fossil fuel demand decreases.

Since the 2014 oil price crash, a strict focus on costs has hampered the flexibility and effectiveness of supply chains and made it hard to gain the optionality that is vital to creating value. Access to capital has been constrained by low financial returns and investors’ wariness stemming from fossil-fuel-related ESG concerns. Industrywide, capex has declined by 50% since 2014. Companies have responded by aggressively slashing supply chain costs, practically to the bone.

Although managing costs is essential, well-considered investments to achieve function excellence have the potential to generate significant value, for individual companies as well as the broader business ecosystem. Oil and gas executives often point to the complexity of managing their diverse supply chains as an obstacle to gaining the scale benefits that promote functional excellence. It is true that each business area—upstream (oilfield production), midstream (pipelines and storage), and downstream (refining and marketing)—has distinctive supply chain priorities. But we have seen other industries with a complex mix of business, such as pharmaceuticals, reorganize and take advantage of commonalities and scale across diverse enterprises.

Three Value Creation Opportunities

Building a more effective, strategically empowered supply chain function will enable oil and gas companies to pursue three types of value creation opportunities. (See Exhibit 1.)

Managing Volatility Responsibly

Oil and gas supply chains can generate substantial value by responsibly pursuing asset-backed trading and the monetization of infrastructure and idle assets.

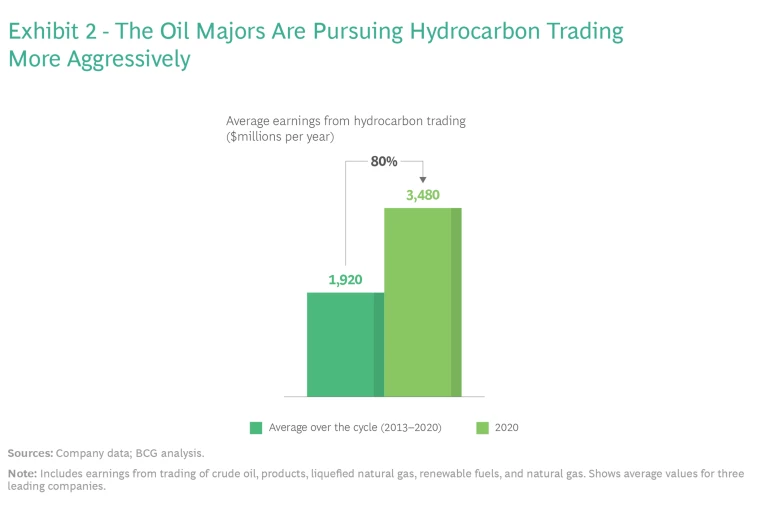

Asset-Backed Trading. This can be a powerful way to manage volatility and ease constraints on global supplies. The returns from hydrocarbon trading do not correlate with those from traditional upstream or downstream operations, nor are they directly affected by oil price trends. As a result, trading promotes diversification and stabilizes returns during periods of high price volatility. It can also create significant financial value across the commodities cycle. We see signs that the oil majors are pursuing these opportunities more aggressively. (See Exhibit 2.)

Unlike the operational optimization that supply chain leaders are accustomed to, asset-backed trading seeks to capitalize on market imperfections: companies arbitrage on the basis of price spreads between regions and different quality grades, as well as price differentials among time periods and those resulting from market volatility. For example, price spreads between locations may be attractive enough to allow a company to command a better price selling its crude to an external refinery. And if prices for future delivery are higher than those for immediate delivery, a firm might create an economic advantage by building up inventory.

The supply chain plays an integral role in a company’s ability to capitalize on such arbitrage opportunities. To succeed, supply functions must build or acquire trading skills as well as establish a tailored operating model that ensures the right interface to promote the efficiency and quality of decision making. Several oil majors have dramatically increased their trading revenues by developing more agile supply chains. An agile supply chain allows a company to move its products to different locations and markets relatively easily, thus giving traders more options to realize arbitrage.

A company needs to create incentive structures and policies that encourage trading and operations personnel to work toward common goals. By taking an enterprise-level perspective, an organization can break down silos and make calculated tradeoffs.

For example, consider the crude supply manager whose performance is measured by her success in ensuring supply reliability to the refinery. She may be unhappy if traders tell her on short notice to replace the crude that was set to be delivered with an alternative stranded cargo—the risk of needing to reoptimize the refinery for the replacement crude might affect her KPI. But if the move generates more money than additional transportation expenses and any refinery reoptimization costs, then the enterprise will benefit.

Incentivizing this enterprise-level perspective requires common goals and KPIs. Companies should also consider collocating personnel who work on trading and supply chain optimization, which will promote cooperation, quick collaboration, and collegiality.

Asset Monetization. Oil and gas companies incur high costs to maintain their assets when business activity is slow. If firms have excess capacity in their infrastructure—such as pipelines, systems that supply water to oilfields, or warehouses that store materials for maintenance, repair, and operations—they can seek to monetize these assets on the open market. For example, companies in the Middle East, Asia, and the Permian Basin in the US are leasing pipeline capacity as well as warehouse space. By sharing capacity that would otherwise be unused, such initiatives promote the full utilization of assets and contribute to easing supply chain constraints industrywide.

Some companies have formed innovative ecosystems to jointly monetize their assets. As one example, several players have joined forces to serve their clients in the Middle East. The companies transferred physical assets (such as warehouses, trucks, and other logistics assets) and organizational assets (including people from the procurement and supply chain functions) to a new enterprise that provides services to the third parties.

Any asset that does not confer a competitive advantage or constitute a trade secret can be offered to the larger ecosystem. This strategy not only streamlines cost but also helps ensure the security of supply more broadly. For example, two supermajors are sharing a digital tool that applies advanced analytics on historical data to optimize spare-part inventory levels. Their goal is to get better control over available equipment and optimize stock levels across the organizations.

Advancing Sustainability

Oil and gas companies need to accelerate efforts to improve the ESG performance of their supply chains. BCG recently interviewed executives of leading industry players globally to better understand their supply chain challenges. Although all said they face increasing pressure to improve their supply chain’s ESG performance, most are just starting the journey. We found that, on average, firms in Europe are slightly more advanced in the process than those in the Americas and Asia-Pacific.

Companies in this industry have typically focused their CO2 reduction efforts on their own operations, which account for approximately 60% of their total emissions. But supply chains account for nearly one-third of emissions today, and the share will increase as businesses meet their net-zero commitments for operations. Moreover, companies will likely need to accelerate the achievement of the emissions targets they have already set. We expect investors to demand that firms meet their 2030 targets by 2025 and their 2050 targets by 2030 or 2035. Those that fail to meet investors’ expectations will face escalating costs and risk losing their license to operate.

Accurate and exhaustive measurement of emissions is a major challenge. In a BCG survey across nine industries, including energy, just 9% of respondents said their organization measures its total emissions comprehensively. Two-thirds indicated they do not report any of their supply chain emissions. Respondents estimated an average error rate of 30% to 40% in their emissions measurements.

Companies that fail to meet investors’ CO2 reduction expectations will face escalating costs and risk losing their license to operate.

Given today’s renewed ESG push, companies also need to step up engagement on social and governance topics. For example, they can support supply chain partners in implementing more advanced governance mechanisms, which are crucial to enabling local suppliers to expand internationally.

Our interviews confirmed that many oil and gas companies have struggled to measure supplier performance in the broad set of ESG topics and extract insights from the information they collect. The challenges are understandable given that companies work with many suppliers globally in dynamic and multitiered networks. The lack of visibility has, in turn, made it hard to engage with suppliers to elevate performance. The solution is a carefully planned ESG journey in which data-driven transparency provides the basis for setting performance targets, designing and implementing collaborative vendor development programs, and activating the broader business ecosystem.

A comprehensive vendor development program, for example, supports suppliers in balancing objectives for CO2 footprint reduction, value delivery, risk management and resiliency, as well as local ecosystem development. BCG is working with several national oil firms to design nationwide vendor development programs that help suppliers meet ESG performance targets and local content requirements while keeping costs in check. These programs are on track to be launched in 2022.

An example of a collaborative ecosystem approach can be found in coal supply chains. A group of major coal buyers has established a consortium to achieve more sustainable mining and sourcing of coal. The consortium assesses the operations of coal suppliers that are committed to the effort and creates a plan for continuous improvement. Purchases by consortium members from approved suppliers have increased substantially since the ecosystem was launched.

Building Resilience

By building resilience—the capacity to absorb stress, recover critical functionality, and thrive in altered circumstances—oil and gas firms can minimize the impact of normal volatility and major disruptions. To optimize tradeoffs between cost and efficiency versus flexibility and effectiveness, resilient companies have developed a variety of capabilities in their supply chains.

Predicting Disruptions. Comprehensive risk monitoring of suppliers, regions, finances, and cyber security provides companies with early warnings of disruption. Resilient players gather new data sources that monitor external risk indicators, such as weather forecasts, potential social unrest, trade policy shifts, and financial markets, and combine them with traditional operational data (including lead times, inventory levels, and order volume) in a central repository. To develop leading indicators of supply chain risk, they feed the data into risk-focused analytics engines powered by artificial intelligence. Companies then use the insights generated to design and prioritize mitigation actions.

Accelerating Response Times. To quickly react to disruptions as well as normal volatility, resilient companies apply agile, silo-breaking ways of working across functions and regions. When major disruptions occur, their rapid response is enabled by effective processes, a clear understanding of the impact on material flows, and full system control.

Managing Suppliers Actively. Resilient companies assess the criticality of suppliers and adjust supplier relationships to ensure resource availability. Gaining transparency into multiple tiers of suppliers enables a comprehensive assessment of upstream risks. To better understand suppliers’ reliability, leading players monitor traditional KPIs such as “on time, in full” and other risk KPIs such as credit ratings and geographic concentration. They also require suppliers to share relevant information periodically.

Reevaluating Supply Chain Buffers. The effective use of buffers and strategic inventory allows resilient companies to absorb shocks in end-to-end supply chain operations. Establishing accurate inventory targets in the supply chain’s high-volatility nodes is especially valuable. Resilient organizations periodically reevaluate capacity utilization targets and identify triggers that signal when to add capacity or activate ready-to-use capacity on the basis of utilization trends.

Managing Risk from End to End. Employing approaches that coordinate internal and external operations is essential. Resilient companies deploy sales and operations execution practices across the end-to-end supply chain to adapt to changes in supply and demand, thereby augmenting their plans that cover monthly time horizons or longer. Businesses can also apply scenario-based planning to understand the impact of multiple potential risks. By allowing companies to balance risks with requirements for service and inventory, this capability helps them avoid the tradeoffs between resilience, efficiency, and effectiveness.

To achieve these value creation objectives, supply chain executives must take a more assertive role in their company’s strategy-shaping discussions. They can lay the groundwork by assessing how well the supply chain currently supports value creation and what it will take to build the function’s strategic capabilities. Success requires defining a transformative set of initiatives that move beyond incremental adoption of tools and process changes. For oil and gas companies that realize the vision of a strategically focused supply chain, the reward will be greater agility to help them cope with the inevitable turbulence that lies ahead.