How We Help Clients with Value Creation in Business and Activism Defense

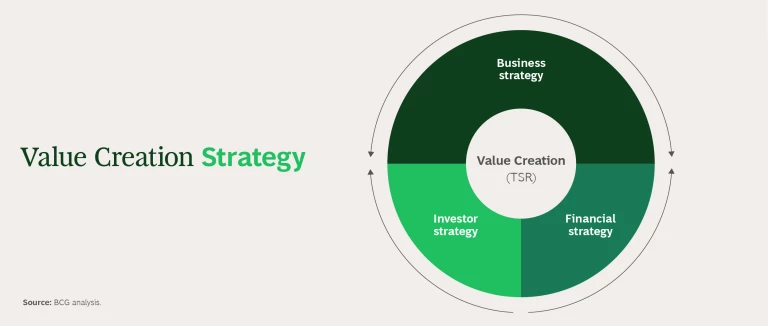

Whether an organization is focused on creating value in business, justifying a high multiple, guarding against an activist shareholder attack, or overcoming a new activist campaign, our value creation consulting team has the relevant experience. In our value creation strategy work with clients, we:

- Consider how to maximize shareholder value of current corporate and business strategies. What is the future cash flow from each of the corporation’s businesses likely to be—and how does it ladder up to an estimate of the company’s future multiple and TSR? What strategic options exist to enhance performance?

- Determine the optimal capital structure and best use for excess cash. When it comes to funding investments, what is the right mix of free cash flow, equity, and debt? And since most financially healthy companies generate cash well in excess of their reinvestment needs, how much of that cash should remain on the balance sheet versus being returned to investors via dividends and buybacks? Finally, how does the capital structure change under different strategic assumptions?

- Evaluate and optimize the match between the value creation strategy and the investor base. Do investors see the strategy as credible and consistent with their investment priorities? If not, what needs to change: the strategy, the shareholders, or both?

Our Client Work in Activism Defense and Creating Value in Business

Whether your organization is seeking to ignite a new wave of value creation, justify a high multiple, guard against an activist attack, or overcome a new activist campaign, BCG has the relevant experience. For example, we helped:

Spotlight: Defending Against Shareholder Activism

Shareholder activism is on the rise.

Defending against an activist attack is costly.

BCG is the industry leader.

Our Insights on Value Creation in Business and Activism Defense