In recent years, large-cap Nordic companies have achieved a remarkable level of value creation.

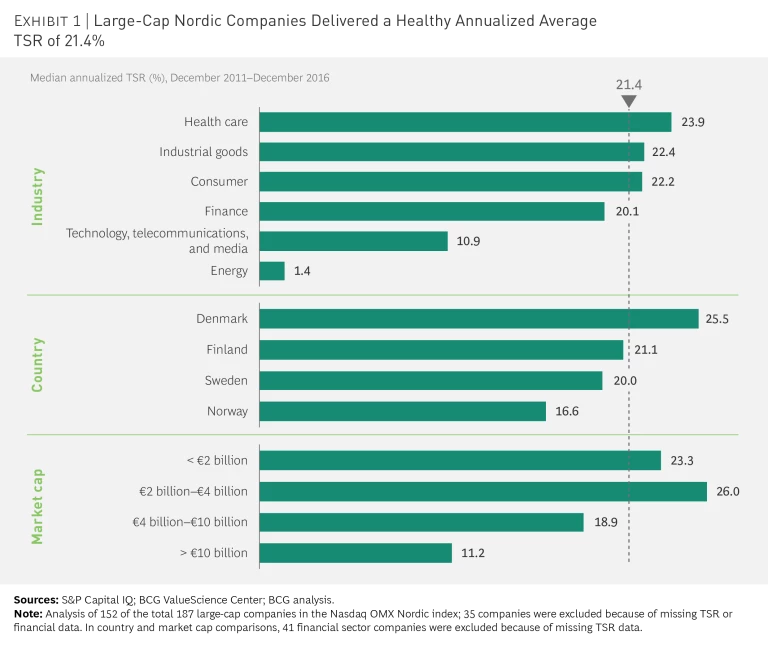

During the period from December 31, 2011, through December 31, 2016, the median total shareholder return (TSR) for Nasdaq OMX Nordic companies was 21.4%, compared with a median TSR for the S&P Global 1200 of 10.8%. (See Exhibit 1.)

Strong performance was fairly consistent across all industries, except technology, telecommunications, and media (TMT) and energy. It was also reasonably consistent throughout the Nordic countries. Denmark’s companies led the pack (with a median TSR of 26%), while Norway lagged (17% median TSR), primarily because of the oil and gas industry’s disproportionate representation in its economy. All but the largest market-capitalized companies—a bracket that is dominated by TMT and energy—achieved impressive TSRs.

Read more about the Nordic Comeback Kids

Read more about the Nordic Comeback Kids

- Overview

- Danske Bank: Rediscovering the Customer

- Husqvarna: Honing a Competitive Edge

- BillerudKorsnäs and Metsä Board: Two Paper Companies, Two Routes to Reinvention

- UPM-Kymmene: Evolving Beyond Declining Product Categories

- Nokia: Reprogramming for Growth

- Royal Unibrew: Crafting a Turnaround from a Winning M&A Move

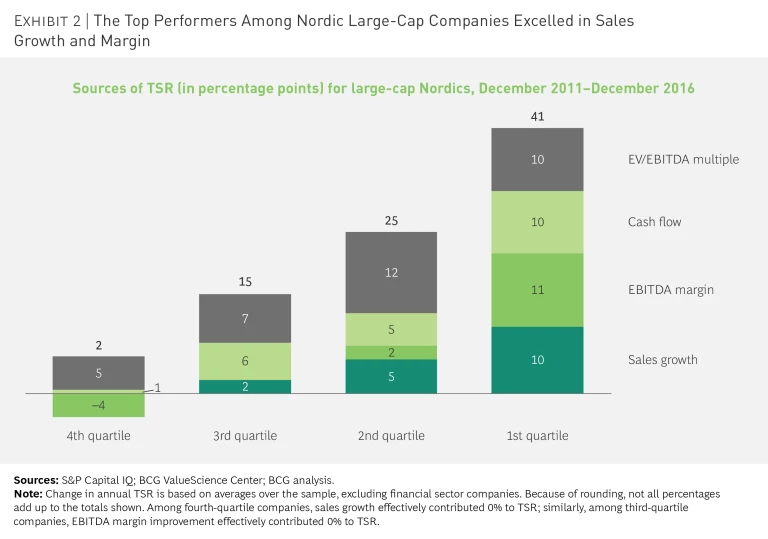

The top-quartile companies achieved a stunning average TSR of 41% during the five-year period—16 percentage points higher than the average TSR for companies in the second quartile, and 39 percentage points higher than the median figure for bottom performers. (See Exhibit 2.) Our analysis shows that strong fundamentals rule: robust top- and bottom-line performance is critical for achieving significant and sustainable value creation. Top-quartile performers distinguished themselves with faster sales growth and the ability to improve their margins. In contrast, companies in the third and fourth quartiles demonstrated little or no improvement on either metric.

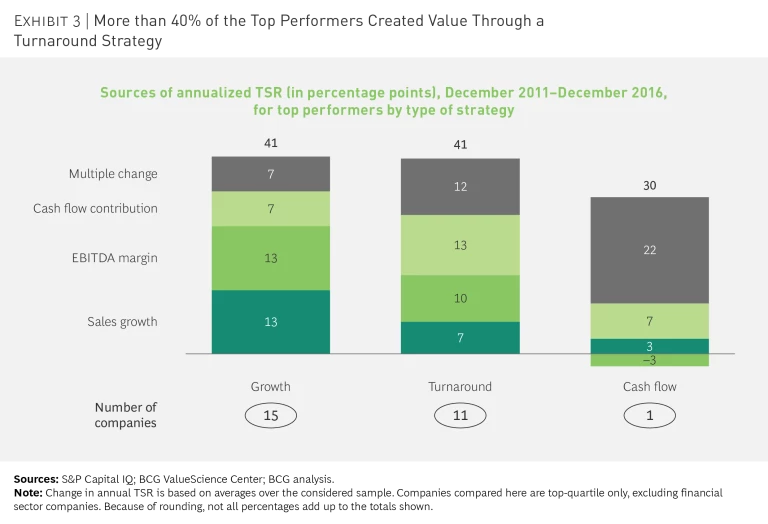

Of the 27 companies in the top quartile, 11 (more than 40%) created value through a turnaround, 15 created value through growth, and 1 depended primarily on cash flow (such as dividends) for its success. (See Exhibit 3.) Both the turnaround companies and the growth companies achieved average annualized long-term TSRs of 41%, while the cash-flow company managed an annualized TSR of 30%.

Collectively, the companies profiled in this report illustrate four basic turnaround strategies—accelerating growth, repositioning the strategy, boosting margin, and restructuring the portfolio. In many cases, companies combined two or more elements. Royal Unibrew mainly pursued accelerated growth; Nokia and BillerudKorsnäs strategically repositioned themselves; Metsä Board and UPM-Kymmene repositioned themselves and restructured their portfolios; and Danske Bank and Husqvarna focused on boosting margin. We offer a side-by-side comparison of BillerudKorsnäs and Metsä Board to highlight the contrasting approaches they took in the midst of a tectonic shift in their industry.