Getting CEO succession right is harder and more important than ever. Business environments are changing in unprecedented ways, and an increasing number of companies are transforming their organizations and their business models. Boards of directors, executive management teams, and CEOs face stricter regulatory requirements and higher investor expectations. To successfully manage these challenges, it is imperative for board members to find a CEO with the right profile to tackle the company’s evolving strategic priorities.

For Nordic companies, these challenges have arisen as they continue a long run of great success. For the past 30 years, value creation by Nordic companies has significantly exceeded the global average of companies in other regions. Indeed, Nordic stock market indexes have consistently outperformed those in Continental Europe, the UK, and the US in terms of total shareholder return (TSR) during this period.

The unique model for corporate governance at Nordic companies plays an important role in promoting their superior performance, a relationship we explored in How Nordic Boards Create Exceptional Value. The Nordic model establishes a board of directors that does not include any of the company’s executives. This nonexecutive board’s responsibilities include appointing and monitoring the CEO, determining the company’s strategic direction, and overseeing legal compliance and risk management.

As a follow-up to our 2016 study, BCG collaborated with executive search firm and leadership consultancy Egon Zehnder to assess the current state of CEO succession planning at Nordic companies and identify a set of best practices. Our discussions with board members and executives revealed that many boards approach succession planning as an art, with the chairperson’s instinct often driving the process. By complementing such experience-based judgments with a structured and disciplined approach, boards can respond more effectively to the dynamic environment and generate significant shareholder value. Human resources leaders can play a crucial role in facilitating the process.

Why Succession Planning Is More Important Than Ever

From May 2017 through September 2018, BCG and Egon Zehnder interviewed more than 70 executives and board members of companies in the four Nordic countries and surveyed approximately 400 people in these roles. We also analyzed the performance of the four most recent CEOs of the 20 largest public companies located in each Nordic country. Although the research considered only Nordic companies, we believe that our findings are relevant globally.

Three main findings from our study point to the need for boards to raise their game in succession planning.

The Required Skill Set for CEOs Is Rapidly Changing

Fast-changing business conditions make it challenging for a board to match the CEO’s capabilities to the company’s strategic priorities. Our latest survey of Nordic executives and board members revealed a significant shift in key priorities since our last study. Respondents in the latest study assigned greater importance to digital strategy and innovation than those in the first study, while assigning diminished importance to operational efficiency and structural growth. The shift in priorities means that it is increasingly important for companies to have a CEO who can spearhead the development of new business models and products and lead the organization into new markets.

However, while digital is the dominant strategic theme today, other priorities will likely emerge. A Norwegian CEO emphasized that it is important to ask, “What will we look like in five years and what capabilities are needed?” Boards need to stay ahead of changing strategic priorities and ensure that the CEO has the capabilities required to help the company make course corrections. As a Norwegian CEO explained, “The important leadership qualities for us going forward are knowledge of digital and media as well as change management.”

One-Third of Nordic CEO Successions Aren’t Successes

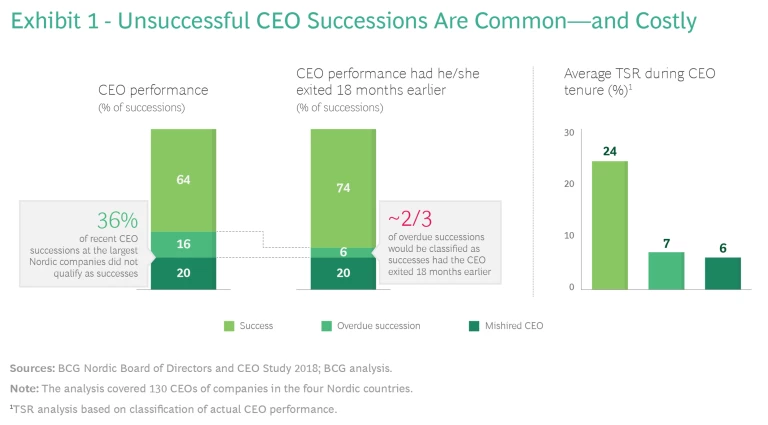

Our study found that a substantial number of boards have struggled to adjust their approach to succession planning in response to the changing imperatives of CEO leadership. As a consequence, many have hired a new chief executive with the wrong skill set, while others have failed to recognize that a longtime CEO is no longer equipped to take the company forward. (See Exhibit 1.)

Based on a review of financial data and media reports, we assigned the successions in our study sample to one of three categories:

- Successes. In 64% of the successions we reviewed, planning led to a positive outcome: the CEO remained in the role for at least three years and performed satisfactorily throughout a tenure free from scandals or unethical behavior.

- Mishired CEOs. In 20% of the successions in our study, the CEO was mishired—that is, he or she stayed in the position for less than three years or was fired because of performance issues, a scandal, or unethical behavior. We excluded CEOs who left voluntarily for reasons beyond the company’s control (to take a more attractive position at another company, for example).

- Overdue Successions. In 16% of the successions, the board allowed the CEO to remain at the helm too long. We considered a succession to be overdue if the CEO held the position for at least three years but was fired or oversaw unsatisfactory financial performance at the end of his or her tenure. We again excluded CEOs who left voluntarily for reasons beyond the company’s control. Companies that experienced overdue successions showed a decline in financial performance (relative to peers and their own subsequent performance) beginning approximately 18 months, on average, before the CEO’s departure. These same companies showed a significant improvement in performance shortly after a new CEO took over. Had the CEOs whose final years saw declining performance exited 18 months earlier, approximately two-thirds of those successions would have been categorized as successes based on our criteria.

The benefits of a successful CEO succession are significant. Our analysis indicates that companies with a successful CEO generate TSR that is three times higher, on average, than that of companies with mishired CEOs or overdue successions. Further, failing to remove an unsuccessful leader is costly. In the last 18 months of a poorly performing CEO’s tenure, companies generate TSR that is, on average, only 50% of what they achieved during the rest of the CEO’s tenure.

Companies with a successful CEO generate TSR that is three times higher, on average, than that of companies with mishired CEOs or overdue successions.

Management and Boards Differ on Their Companies’ Succession-Planning Capabilities

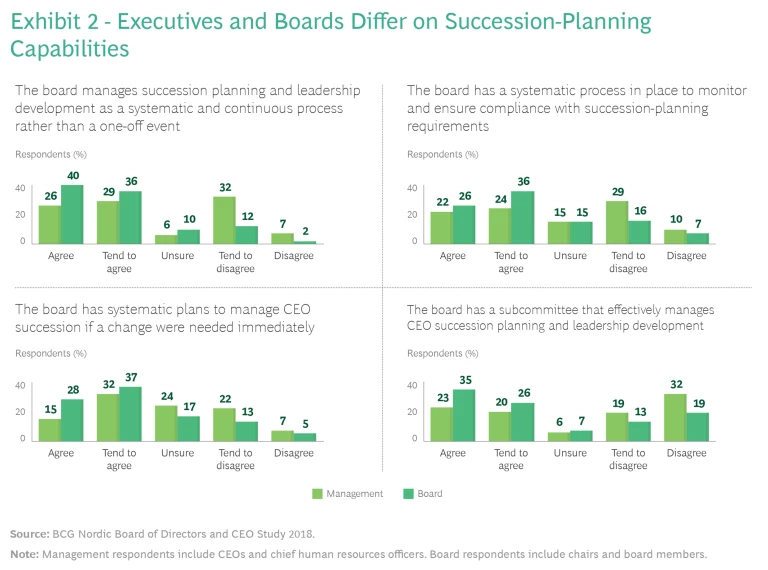

Are boards ready for the challenges? Our survey found that board members and executives rate their board’s succession-planning capabilities quite differently. (See Exhibit 2.)

More than three-quarters of board members believe that their board manages succession planning as a systematic and continuous process rather than as a one-off event—but only about one-half of executives agree. Nearly two-thirds of board members say that they have a systematic process in place to monitor and ensure compliance with succession-planning requirements or have systematic plans to manage urgent successions, but fewer than half of executives share these views. We received similarly divergent responses from these two groups when we asked whether the board has a subcommittee that effectively manages CEO succession planning.

Moreover, two-thirds of executives said that their board’s assessments of key executives and the leadership pipeline could benefit from more rigor and objectivity. In addition, nearly three in four executives indicated that their boards should be more active in succession planning and leadership development.

Building a Systematic Approach to Succession

What are companies that already take a systematic approach to succession planning and talent development doing right? Our survey and discussions with Nordic executives and board members revealed a set of best practices that can help ensure that planning is guided more by science than by art.

Planning Ahead

Study participants emphasized the importance of taking a strategic perspective, assigning clear oversight responsibilities, and getting an early start.

Link succession to strategy. Our survey found that two-thirds of Nordic companies have established a clear link between succession planning and corporate strategy. A Finnish CEO described a two-part process that creates this link. The board assesses whether the current CEO and other leaders have the capabilities required to implement strategic priorities. And the board plans succession so the leadership team will have the capabilities that will enable it to pursue those priorities. The CEO explained: “You need both maintenance and change, as well as the ability to act fast when the time comes to select a new leader.”

Establish a responsible board committee. Approximately half of survey respondents said that their company has a board committee that effectively manages CEO succession. The chairwoman of a Norwegian company stressed the importance of assigning responsibility for succession planning to a specific committee. “We have extended the remuneration committee’s mandate to include diversity and succession,” she said. The committee follows an annual process for succession planning, uses a comprehensive set of structures to evaluate candidates, and receives administrative support for implementing initiatives. The committee oversees the vetting of candidates for CEO succession and has specific successors identified at all times.

Our study’s findings point to the need for boards to approach succession planning as a continuous, structured process.

Pursue transparent and early planning. Only 55% of survey respondents indicated that their board conducts regular sessions to comprehensively review potential internal CEO successors. The share drops to one-third when it comes to active oversight of potential external successors during periods without an active CEO selection process. Best-practice companies regard succession planning as an ongoing process. A Swedish CEO pointed to the value of having a transparent succession process and getting an early start. The company’s internal hunt for a successor begins three to four years into a CEO’s eight-year tenure. When the CEO is ready to transition out of the role, the successor is already identified and prepared to take the helm.

Talent Development

Succession planning must be supported by best practices in talent development. Study participants cited the importance of having a structured review process, a deep pipeline, and HR support.

Establish an annual review process. Among survey participants, 60% said they want their company to take a more systematic and objective approach to assessments of potential successors. A Norwegian chairman said that his board conducts an annual meeting at which members evaluate internal candidates in the CEO pipeline using objective criteria, including targets and milestones. Board members discuss the outcomes of a candidate’s stretch assignments (rotations that take candidates outside their comfort zone) and the quality of a candidate’s board presentations. Following the discussions, the board ranks candidates and recommends new assignments that will promote their development. This process frontloads the effort involved in selecting a new CEO. “When the time comes for an actual succession, the choice is rather clear,” the chairman said.

Companies can maximize the benefits of this practice by ensuring that the board has the right mix of industry specialists and former corporate leaders with experience in succession planning or HR generally. Additionally, comparisons with external benchmarks can help companies gauge the effectiveness of their annual process against that of competitors.

Establish a deep pipeline. A Danish chairman recommended that boards oversee a pipeline of the 25 to 30 most talented executives at the company. He explained that his board is responsible for succession decisions at the C-level and one level below. Board members maintain oversight by asking these executives to give presentations to the board, participating in informal workshops with executives, and traveling to meet with them. Management team members present the board with their perspective on the top succession candidates during an annual talent review meeting.

Ensure that HR is engaged. A majority of survey respondents (80%) believe that their company’s HR function is capable of facilitating succession planning and leadership development. A Finnish chairman said that his board relies on a strong HR function to facilitate these processes. HR identifies stretch assignments for candidates and ensures that the pipeline contains a sufficient number of candidates with the right qualifications. “The strength of a company’s HR function determines how well the board can prepare for succession planning and leadership development,” the chairman observed.

A Norwegian chief human resources officer said that her company uses internal training programs for executives as an opportunity to gauge leadership potential. “This gives us a unique opportunity to observe these leaders,” she said.

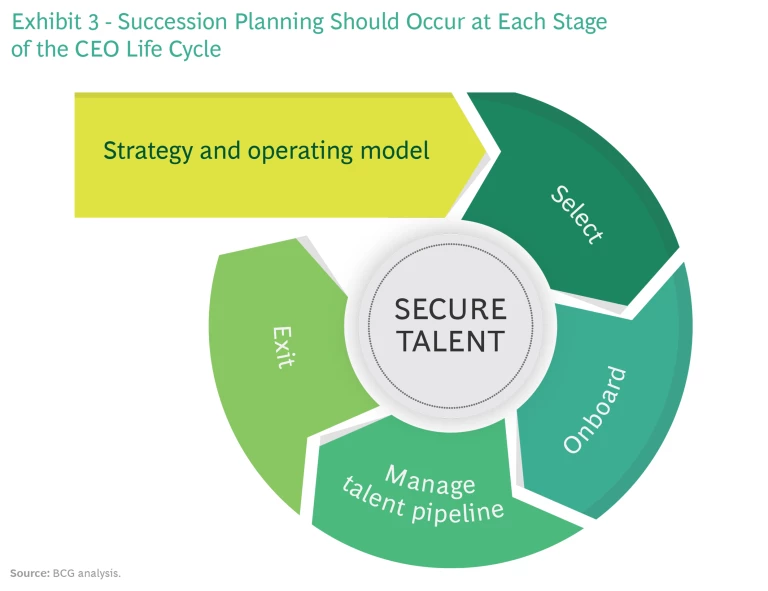

A Structured Process Across the CEO Life Cycle

Taken together, our study’s findings point to the need for boards to approach succession planning as a continuous, structured process. Proactive planning must occur during each phase of the CEO life cycle. (See Exhibit 3.) A significant degree of facilitation, such as by a qualified chief human resources officer, is essential to establishing this structure and instilling discipline.

Based on our study findings and experience, BCG and Egon Zehnder have compiled a chairperson’s checklist for succession planning. All board members should challenge themselves to answer each of these questions. In many cases, the answers will indicate that boards need to adopt the types of best practices we have discussed.

Strategy and Operating Model

- Does the company’s strategy provide the foundation for our discussions of succession planning?

- Do we treat succession planning as a capricious art or as a standardized science?

- Is our HR function capable of facilitating the board´s succession-planning process?

- Do we have an in-depth understanding of the core profile (experiences, skills, knowledge, and personal qualities) required of the next CEO?

- Are the board and the CEO aligned on how to conduct CEO succession planning?

Selection Process

- Is the selection process sufficiently objective, so that most board members would arrive at the same choice for CEO?

- Does the pipeline include at least three candidates who could be a successful CEO over the long term and are currently ready to assume the role?

- Are we being honest with ourselves about the readiness of candidates in the pipeline to become the CEO if the transition needed to happen immediately?

- Are we able to benchmark our internal talent against the best-in-class external talent?

Onboarding Process

- Do we prepare our newly chosen CEOs well enough to enable them to fully apply their enthusiasm and energy from day one?

Managing the CEO Talent Pipeline

- Does the board know the organization’s top 25 to 50 most talented leaders?

- Do our processes for identifying, assessing, and developing leadership talent enable us to create a broad and deep pipeline?

- Does our company’s CEO pipeline reflect our overall diversity goals?

- Are our views of candidates in the pipeline based on independent interactions, in addition to distilled information and planned meetings facilitated by management?

Exit Process

- Do we modify our ongoing approach to the succession planning process when the current CEO is about to exit?

- Are we ready, willing, and able to fire the CEO if we believe that the company needs a leader with a different profile in order to achieve continued success and growth?

A decade ago, a generalist CEO could meet the challenges facing most companies. Today, each board must tailor its planning so that it can hire a CEO with the capabilities required to address its distinctive strategic challenges and priorities. To do this, boards must move beyond art in succession planning. Those boards that transition to a structured and disciplined approach will ensure that the right person is leading the company at the right time.