Since 1970, according to the WWF, Earth’s wildlife population has fallen by an average of 69%. Fully a quarter of our plants and animals are currently at risk of extinction. And recent studies have shown that in some areas, insects—which form the basis of our food webs and ecosystems—have declined by more than 75% over the past 30 years. In hopes of reversing this alarming loss of biodiversity, representatives from 188 countries came together at the December 2022 United Nations Biodiversity Conference (COP15) to sign a new Global Diversity Framework, whose primary aim is to preserve 30% of the planet’s land and water by 2030.

The loss of biodiversity isn’t just a concern for ecologists and others interested in the natural world. Rather, it has real consequences for businesses in virtually every industry. The World Economic Forum has estimated that around $44 trillion—more than half of global GDP—is dependent on high-functioning, healthy biodiversity, which, in turn, is a key component of the ecosystem services that nature provides . These include our food, water, energy, and other resources, as well as the pollination of plants and regulation of the planet’s climate. Biodiversity—and its loss—affects everything from the health of the soil in which we grow our crops to the genetic variety of the food we eat to the value of the biomass that supplies more and more of the energy we use.

In short, the business case for protecting and increasing the planet’s biodiversity is strong. And according to a recent report from BCG and the Sustainable Markets Initiative’s Private Equity Task Force, private capital can play a key role in this effort. On the one hand, private equity firms could benefit from a range of significant financial opportunities by taking biodiversity-positive actions. On the other, failure to take biodiversity into account as part of their investment process can create substantial risks.

Why Private Equity?

The need for private investment in promoting biodiversity and ecosystem services is great. According to the Paulson Institute, $700 billion in annual financing will be needed to promote biodiversity through 2030—in addition to the funds already committed. PE firms are especially well placed to help fill this gap. Their medium- to long-term focus should encourage them to consider the future impact of biodiversity-related risks and opportunities on the companies in which they invest. And because they have direct access to the management of those companies, they can exert considerable influence over their operations.

Moreover, many PE firms and private companies already have solid ESG and environmental policies regarding water use, sourcing, deforestation, and other issues, which can serve as a strong basis for a sound, strategic approach to biodiversity.

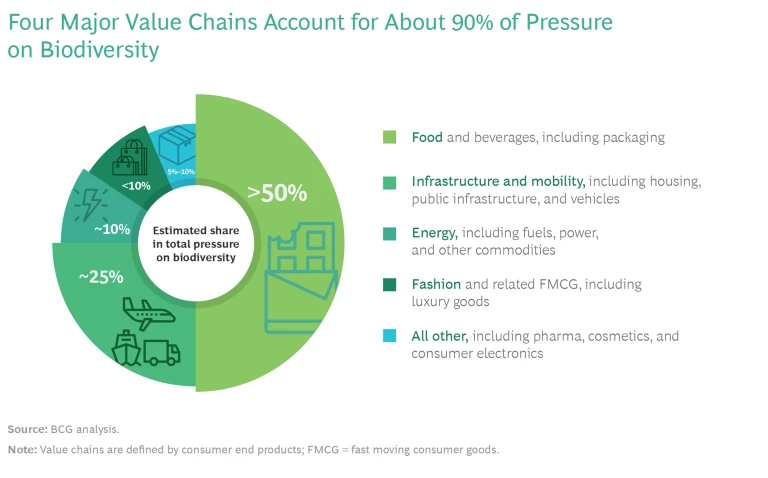

In seeking biodiversity-related investment opportunities, PE firms should consider those industries that are especially dependent on improvements in biodiversity. As the exhibit shows, four major value chains in particular—food, infrastructure and mobility, energy, and fashion—are responsible for the great majority of global biodiversity loss and offer especially promising investment possibilities.

Pros and Cons

As PE firms look out for potential investments, they need to consider not just the opportunities presented by companies making improvements in biodiversity-related issues but also the risk in companies that don’t.

Consider a hypothetical small supplier of 100% biodegradable and biodiversity-friendly packaging. Its financials aren’t impressive, and its production costs are significantly higher than those of its competitors. But the company offers a real opportunity for a PE firm to reduce production costs through economies of scale and sustainable waste reduction levers. As greater regulation of plastics simultaneously drives demand for sustainable alternatives, the company’s valuation could increase substantially.

In contrast, a successful food company, with popular products and strong branding, might secure investment at a high valuation. But if investors fail to pay sufficient attention to biodiversity during due diligence and it’s subsequently revealed that the company is implicated in rainforest deforestation through its substantial use of unsustainable palm oil, the company’s value could plummet as consumers turn away from its products.

Subscribe to our Climate Change and Sustainability E-Alert.

Strategies for Biodiversity

It’s likely that both the opportunities and the risks will only increase in importance as concerns about biodiversity loss increase and efforts to slow it ramp up. In seeking out, acquiring, and managing strong target companies for investment, PE firms should develop a structured, five-step strategy that covers both the due diligence process and the operational changes needed to ensure the greatest potential for growth:

- Assess the impact. Undertake a materiality assessment to understand the current portfolio’s exposure to biodiversity-related risks.

- Define the approach and ambition. Determine the degree of commitment to biodiversity goals, from compliance with current regulations to active engagement in efforts to mitigate biodiversity loss.

- Set targets. Choose quantifiable, trackable targets based on existing biodiversity metrics that correspond to the outcome of the materiality assessment and the firm’s chosen approach and ambition.

- Implement and monitor. Develop and implement value creation plans and roadmaps specific to portfolio companies where biodiversity is deemed relevant, and monitor progress toward the value creation plan.

- Report on progress. Use consistently applied KPIs to report on the biodiversity-related progress of both individual portfolio companies and the firm as a whole.

Investment opportunities in companies impacted by the biodiversity crisis will likely increase substantially in the coming years. The need for investment is great, and the benefits, both financial and environmental, are considerable.