The precision-scheduled railroading (PSR) playbook used by most North American freight railroads has allowed companies to more efficiently generate profits and has fueled a period of record-breaking financial success. Shareholder returns have reliably exceeded benchmarks for the entire market as well as for other transportation and logistics companies. But this playbook will no longer be sufficient in the coming years.

The financial performance of railroad companies that have been applying PSR for more than a few years has started to plateau, whether measured by the profitability metric known as operating ratio (OR) or return on invested capital (ROIC). What’s more, a harsher business environment threatens to make further performance improvements even more difficult to achieve.

To overcome the challenges and embrace new opportunities, railway companies need to build upon their efficiency gains from PSR by adopting an expanded set of management principles that we call beyond PSR. This augmented playbook allows railroads to operate effectively and smartly, pursue new growth opportunities, and enhance increasingly important digital capabilities—all while preserving PSR’s focus on operational excellence. And while PSR has been applied, so far, mainly in North America, the beyond PSR approach can be used to accelerate returns of freight railroads in any market.

Going beyond PSR allows railroads to operate effectively, pursue new growth opportunities, and enhance digital capabilities—all while preserving PSR’s focus on operational excellence.

The Common Principles of PSR

PSR has become ubiquitous among railroad companies, much like lean management among manufacturers and zero-based budgeting among consumer goods companies. Railroad executive Hunter Harrison developed the playbook and implemented it at each of the railroads he led as CEO: Illinois Central Railroad, Canadian National Railway, Canadian Pacific Railway, and CSX Transportation. Within the past two years, three other railway operators—Union Pacific, Kansas City Southern, and Norfolk Southern—have announced implementation of their own versions of PSR. The playbook’s principles influence how organizations seek to reduce costs even among those that have not explicitly adopted PSR, whether in North America or elsewhere.

Because each railroad has its own set of opportunities and corporate culture, implementation of PSR inevitably varies for each organization. For all companies, however, PSR prioritizes operational efficiency to reduce cost and improve capital efficiency. There are five commonly applied methods to achieve this goal:

- Simplify and balance the network. Focus on eliminating variability and stabilizing workloads by balancing and smoothing the schedule at all hours each day of the week. This requires communicating new rules of engagement to employees, customers, suppliers, and interchange partners (such as by requiring reservations and explicit demand profiles, setting schedule adherence incentives, ensuring carload consistency, and enforcing demurrage fees).

- Maximize asset utilization. Optimize train and car usage. For example, run longer and heavier trains, streamline switching, reduce the number of locomotives and railcars used, increase speed, reduce dwell time, and more effectively turn around cars between trips.

- Control operating and capital costs across the organization. Reduce locations and operations (such as hump yards) that add time and costs, reduce headcount, and cross-train crews so that they can better perform multiple tasks. At the same time, focus on more effectively procuring and deploying capital assets.

- Reduce complexity across the network. Maximize point-to-point trips, eliminate unprofitable origin-destination pairs, and run more multiuse trains. Eliminate nonessential activities. Deploy multiuser cars and trains as much as possible to support a consistent daily schedule.

- Foster culture change by aligning the leadership team behind PSR. Create an all-hands-on-deck culture by making changes at the top to upgrade talent as necessary. Manage the entire organization’s performance using a handful of financial and operational KPIs, and rigorously pursue those targets to give them visibility across the organization. Ensure that a sense of urgency and discipline, as well as a willingness to make decisions and try new things, cascades throughout the company.

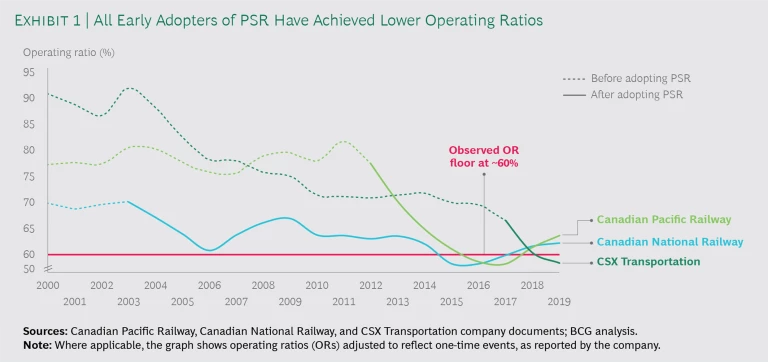

Each railroad company that has adopted PSR has achieved a marked improvement in OR, sometimes building upon and accelerating cost improvement that was already, if gradually, underway. (See Exhibit 1.) At CSX, for example, the level of cost reduction led to a dramatic improvement in OR in the first year of implementing PSR. From an operational perspective, the improvements increased the utilization of railcars by 17% and the productivity of employees by 8%; increased train speed by 19%; and reduced dwell time by 15%. Other railroads have implemented similar agendas, varying the emphasis across initiatives and moderating the speed of implementation to blunt the impact on customers.

So far, PSR’s profit improvement potential appears to have a limit, with initial gains reversing slightly and then leveling off. No application of PSR has been able to sustain OR below 60%; any reduction of OR below that level has rebounded. Railroads have seen the same quick rebound for ROIC, a more comprehensive metric that encompasses the balance sheet.

Challenges Loom Large

Railroad companies will likely find it hard to sustain their recent success, let alone further improve OR, ROIC, and shareholder returns going forward. Their strong financial performance is threatened by market headwinds, operational realities, and challenges related to their financial structure.

Market Headwinds

Railroads must cope with headwinds arising from threats to demand, evolving customer expectations (particularly for reliability and transparency), and increased competition from trucking.

Demand Uncertainty in Core Categories. Demand in railroads’ core revenue pools is threatened by declining use of coal, heightened international trade tensions, and a shift from the consumption of goods to the consumption of services.

- Coal carloads—historically a major source of railroads’ profits—declined by an average of 6.2% annually from 2014 through 2019 (the sharpest decline occurred from 2014 through 2016). Demand for coal is likely to continue to decline as users shift to lower-priced natural gas and more sustainable fuel sources.

- The long-term trend toward more open trade has been a tailwind for the transportation and logistics (T&L) industry. Recently, international trade tensions have posed a threat to freight volumes and established transportation patterns. Substantial railroad revenues (35%) and the volume of intermodal units (42%) are directly associated with international trade, and the industry has felt the effects of the US-China trade war. After China imposed a tariff on US agricultural products, grain volumes carried by North American railroads fell by 7% month-over-month from August 2018 through August 2019. While recent tariff agreements point to these issues subsiding, the long-term trend appears to be less certainty around trade policy than has prevailed over the past 30 years. Although the new USMCA trade agreement has been signed into law, the US is not party to any other major, ongoing trade bloc negotiations.

- Overall demand for freight networks is growing at a slower rate than the overall economy. The US population is aging, which is promoting a long-term shift from the consumption of goods to the consumption of services. As this shift continues, growth in the volume of commodities that particularly rely on rail transport—typically bulk commodities and those associated with the manufacturing sector—will decelerate.

Growing Expectations for Reliability and Transparency. In response to the demands of their customers, shippers of some consumer and industrial goods are requiring greater transparency into the status of their shipments, regardless of the mode of transportation. Thus far, however, shippers of the bulk commodities that are disproportionately carried by railroads have been less likely to push for greater transparency because the low value-density of these goods lessens the importance of knowing precisely where they are at any given moment and when they will arrive at their destination. Where these needs are already more critical—such as for retail goods that often travel via intermodal shipping—intermediaries have begun to provide transparency solutions to shippers. But rail still lags other modes of transportation in reliable, on-time performance, and railroads have not followed the lead of other logistics providers by offering transparency solutions to shippers.

Potential Threats from Trucking. In the long run, rail faces a new and potentially significant threat from trucking, which could benefit from a wave of efficiency and autonomy opportunities. The convergence of electrification, autonomy, and connectivity technologies could enable trucking companies to cut their operating expenses in half and reduce transit times. A BCG analysis, for example, finds that the lifetime operating cost of autonomous long-haul trucks may be 48% lower than that of nonautonomous equivalents. Such improvements would erode railroads’ price advantage. Even short of full autonomy, new in-development trucking methods, such as platooning, could make this mode cheaper in the near term. Considering that price advantage is the top reason shippers choose intermodal rail over trucking, rail volume is likely to come under pressure—although railroads will probably not feel the full impact of these trends within the next ten years.

Operational Realities

Railroads must come to terms with the realities of an exacting operating environment.

The Challenges of Long-Term Cost Reduction. As noted, railroad companies have not been able to sustain PSR’s financial benefits for very long after implementation and through freight and business cycles. Companies can, however, pursue additional cost reduction opportunities, particularly through new technology—though the capital-intensive nature of the industry, the need to employ a skilled labor force, and the push to meet high safety expectations will limit how aggressively railroads can reduce some cost drivers. Changing the industry’s margin structure will increasingly involve addressing the other part of the margin calculation: revenue.

Inevitability of Service Disruptions. Across all T&L industries, including rail, several factors working in concert will likely result in more numerous service issues. For example, extreme weather events (such as floods, tropical storms, blizzards, and heat waves) are increasingly likely as climate change generates more frequent and intense events. Several railroads have already faced service delays during heat waves as tracks became warped. Additionally, in the course of implementing PSR, railroads have reduced staffing levels. This lack of extra capacity weakens their ability to respond to service issues. Moreover, the PSR-related job losses could promote dissatisfaction among employees, leading to further disruptions.

Financial Structure

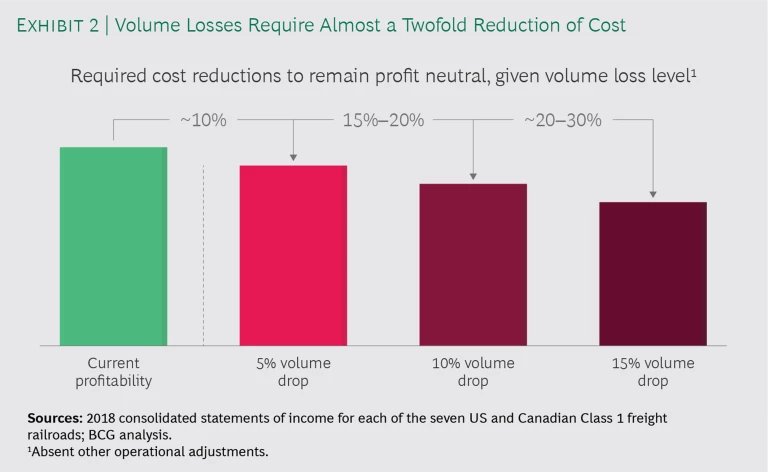

The railroad industry’s slow revenue growth makes profitability vulnerable to volume shocks. Because railroad operations entail high fixed costs, a 5% to 10% drop in volume requires, absent other operational adjustments, a 10% to 20% reduction in cost to maintain profitability—a significant move in the short term. (See Exhibit 2.)

With PSR, some railway companies have successfully variabilized portions of these fixed costs. And while railroads have shown resilience through previous downturns, including the Great Recession, one-time actions were required to ride them out. From 2008 through 2009, Class 1 railroads reduced capital expenditures by 15%. But these actions are not easily replicable.

Thus, railroads must focus on revenue growth to supplement cost reduction initiatives. Growth is the major driver of sustained total shareholder return across industries and over the long run. However, pivoting to growth is not easy for most companies. Revenue growth across Class 1 railroads from 2014 through 2018 averaged 3.3% per year, with substantial volatility year-over-year. Furthermore, market analysts expect similar average annual growth over the next three years. PSR is intended to promote growth by improving the customer experience through greater reliability. However, results have shown that this indirect approach has not been able to move the needle. As a result, there is a clear need for railroads to add growth-related elements to the management playbook.

Beyond PSR: The Next Wave of Improvements

Despite these looming challenges, railroads have reasons to be hopeful. Unless the tech revolution in trucking is more substantial than described above, rail transport will continue to hold competitive advantages over other transportation modes because it is less expensive and more environmentally friendly. Greener transport may become an increasingly important selling point and promote rail’s competitiveness as more end customers and consumers make decisions on the basis of environmental concerns. Although many companies have committed to improving the sustainability of their operations, most are just beginning to implement changes to their supply chains. What’s more, railroads will be able to leverage their new cost advantages and expanded margins to take more creative approaches when investing in growth and competing for new categories of business.

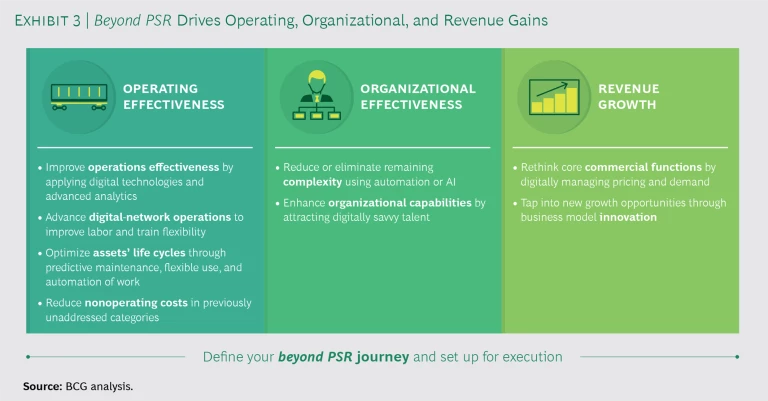

Together, the nine principles of the expanded management playbook enhance the common PSR principles, address operating and organizational effectiveness, add growth-related components, and strengthen change management and execution capabilities.

To make that happen, railroads need an expanded set of management principles that allow them to build upon their gains from PSR. Beyond PSR, our recommendation for an expanded management playbook, comprises nine principles. (See Exhibit 3.) The first three address operating effectiveness and the second three address organizational effectiveness, in all cases enhancing the common PSR principles described above. Two principles add growth-related components to the playbook. The final one, cutting across categories, strengthens change management and execution capabilities. Several principles aim to realize the vision of a digitally driven rail system.

Improve operations effectiveness by applying digital technologies and advanced analytics. Railroads can use digital technology—such as Internet of Things applications—to enhance the reliability and traceability of goods and railcars and to integrate their traceability and tracking with other transport modes. They can also combine the potential of newly connected devices and the power of predictive analytics to reroute assets more dynamically and increase speed. In the US, mandated investments for positive train control (PTC) can enable ongoing improvement in this area. By enhancing the effectiveness of conductors, initiatives such as PTC can reduce fuel consumption. Advanced scenario modeling via advanced analytics can support efforts to optimize infrastructure and routing.

Advance digital-network operations to improve labor and train flexibility. By improving the effectiveness of train scheduling, a railroad can reduce cost, increase responsiveness, and minimize disruption. Similarly, improvements to labor scheduling promote cost reduction and create flexibility. Railroads can look to the airline industry for a model to follow—specifically, KLM’s innovative use of technology to improve aircraft scheduling. For airlines, as for railroads, scheduling and asset utilization—particularly when there are unplanned changes—are of paramount importance to optimize operational performance and minimize cost. KLM developed digital tools powered by artificial intelligence (AI) and advanced analytics that help schedule aircraft and personnel and that respond to changes, thereby minimizing service disruptions. The impact has included a reduction of 10% in delay minutes and a reduction of 10% to 20% in aircraft and personnel costs related to delays.

Optimize assets’ life cycles through predictive maintenance, flexible use, and automation of work. Railroads can use AI and automation to enable predictive maintenance on locomotives, cars, and tracks, as well as to reduce the labor necessary for carrying out those maintenance tasks and positioning spare parts optimally. They can also develop platform and sharing models to improve asset utilization and minimize the risk of investments. Additionally, as technologies that enable the detection and testing of asset conditions continue to improve, it will be increasingly possible to further automate many maintenance tasks.

Reduce nonoperating costs in previously unaddressed categories. Railroads should examine procurement costs, particularly in often-neglected categories, such as nonoperating assets. By managing these categories with the same level of rigor they use for other procurement categories, and applying learnings from adjacent industries, railroads can often achieve savings of 5% to 15%.

Reduce or eliminate remaining complexity using automation and AI. Railroads can use AI to eliminate the non-value-added work that drives complexity. They can then use automation to partially digitize the remaining manual work. Common target areas for these efforts are repeatable processes in noncommercial support functions, such as finance and HR. For example, to help drive efficiency, a railroad can automate employee hiring and termination processes or use AI to manage accounts receivable and payable. Many rail companies are also seeking opportunities to streamline commercial functions with automation and AI. Examples include more sophisticated price recommendation engines, automated postcontract compliance, and next-generation sales tools to improve the efficiency of customer relationship management.

Enhance organizational capabilities by attracting digitally savvy talent. Railroads can enhance their organizational capabilities by recruiting and retaining digitally savvy talent. A clear definition of organizational purpose helps attract talent. In key functions, railroads can learn from other industries and develop new ways of working that enable them to quickly respond to changing needs. For example, the agile approach, which has been effective in many industries, may well apply to areas of railroad business process modernization.

Tech talent is becoming increasingly hard to attract. This is particularly true for companies, such as railroads, that have not traditionally been thought of as tech players. To attract top talent, a global aerospace company set up a digital center of excellence. The company laid the groundwork by defining its overall digital strategy and articulating how the center would support the strategy. Within a year, it built a new physical site, hired 50 full-time-equivalent employees, and launched a dozen digital projects.

Rethink core commercial functions by digitally managing pricing and demand. Across the value chain, logistics players are radically changing their go-to-market strategies. In part, they are being pushed to do so by highly innovative players such as Amazon, eBay, and Walmart. These innovative companies use more sophisticated buying practices that require faster quote turnarounds, more granular pricing, and more solutions-oriented sales engagements. Technology also plays a key role, enabling commercial functions to be more dynamic and leverage data more thoroughly.

Railroads can adopt these practices and more thoroughly apply advanced analytics to pricing decisions and quoting. Examples include establishing dynamic pricing on the basis of cost-to-serve and customer value, modeling customer alternatives, and optimizing network loads. By building the required capabilities—such as granular demand forecasting, lead and shipment scoring, and automated postcontract revenue assurance—railroads can boost sustained OR levels.

In addition, railroads have a unique opportunity to apply the visibility and predictability gains of PSR commercially. Shippers of some product classes, such as consumer goods, have historically relied more on trucking because it gives them greater options to take action to mitigate the impact of a delay (such as taking alternative routes). However, trucking is also more expensive than rail. Because PSR can improve service levels, railroads can tout the dependability of their service to win part of the business that shippers currently give to rail. To do so, they must develop commercial offers and pricing models that appeal to those companies that prioritize dependability.

Tap into new growth opportunities through business model innovation. Railroad companies should focus on innovations beyond rail that leverage their inherent strengths or existing intellectual property. It may be especially valuable, for example, to develop new business models that help companies collect additional data to enhance visibility into demand and performance. Railroads are as well positioned as any player in the value chain to own this data and offer new products and services.

The most traditional industries are often the most fruitful for innovation. An example from the T&L industry is Maersk’s launch of Twill, a digital logistics provider that offers a digital freight-forwarding platform by the same name. The company was founded to address customer pain points and lower the cost to serve in ways that current business processes could not do effectively. Services offerings include instant price quotes from a network of suppliers, document management, and tracking that provides transparency throughout the shipping process.

Define your beyond PSR journey and set up for execution. To drive implementation forward, it is essential for a company to set up an activist program management office that is responsible for ensuring accountability and tracking results. Depending on the level of ambition, implementing beyond PSR may require a significant change for an organization, as was probably the case for the initial adoption of PSR. To ensure buy-in and participation at all levels of the organization, a railroad company will need to address its change management capabilities.

Confronted by diminishing returns from the traditional PSR playbook and a harsher business environment, railway companies must act quickly to implement beyond PSR. Those that follow the lead of other industries and do so will be well positioned to sustain their strong performance in the years ahead.