Global banking has entered a new era in which every region, product, and legal entity is going to be closely regulated.

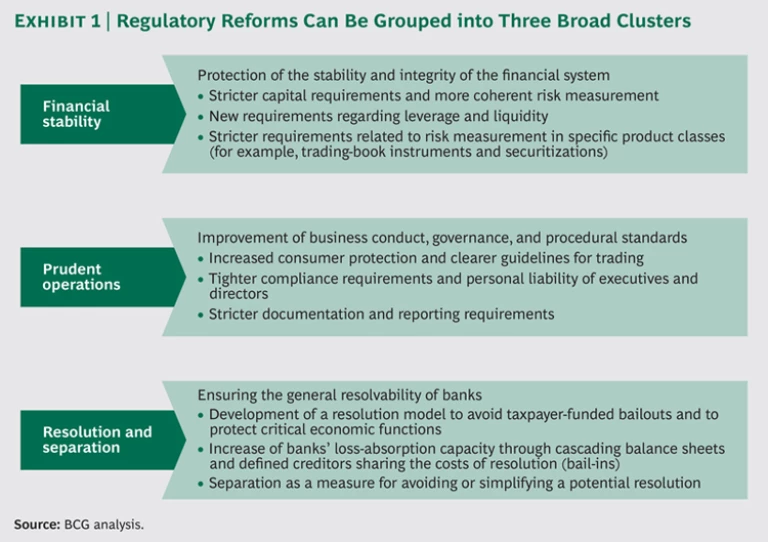

To assess the current status and future effects of regulatory reform, we have classified the entire spectrum of regulatory reforms, grouping them into three clusters: financial stability, prudent operations, and resolution and separation. (See Exhibit 1.)

Financial Stability: Expectations Exceed Regulators’ Intent

Since the crisis began, establishing and safeguarding global and local financial stability have been regulators’ highest priorities. As a result, financial stability is the most developed area of reform. Fundamental requirements have been revised or reinstated, primarily on the basis of Basel III standards. Those requirements now form the global regulatory baseline for capital, leverage, and liquidity.

Many banks already fulfill or even exceed the heightened requirements for capital and liquidity, yet both remain top priorities for banks. This is because investors increasingly require additional cushions above and beyond the regulatory minimums. Fulfilling these market expectations for capital and liquidity will become more of a competitive factor for banks.

Already, investors expect banks to comply with Basel III fully loaded Common Equity Tier 1 ratios of at least 10 to 12 percent, even though regulators require a minimum ratio of only 7 percent by 2019. Furthermore, investor focus has now shifted to compliance with leverage ratios. Minimum requirements in the range of 5 to 6 percent are expected, clearly driven by the U.S. and the UK, raising the bar in terms of capital levels.

We anticipate a similar development for liquidity ratios. Owing to central-bank intervention, investors have not yet considered this issue critical. While liquidity-coverage-ratio requirements have been finalized, the net stable funding ratio (NSFR) is still in debate. Despite doubts among some banks, we believe regulatory intent to oversee long-term bank liquidity is sufficiently strong to push implementation of the NSFR.

Financial-stability efforts will focus on global harmonization of diverse regulatory standards, such as leverage ratio rules, and on defining additional capital-related technical measures to deal with current regulations that are insufficient. As a start, market risk measurement of trading-book positions will be revised under the fundamental review of the trading book. Risk measurement of securitizations will also be revamped on the basis of the regulations for implementing Basel III’s securitization framework.

Finally, it remains to be seen how global harmonization will be enforced. (See “Demystifying the Transatlantic Debate”) There are also questions related to the further development of Pillar 1 and Pillar 2 liquidity requirements and the degree to which they will match the development of capital standards.

Prudent Operations: Entering a New Game

In addition to establishing financial stability after the crisis, regulators have also focused on episodes of apparent misconduct. Abusive sales tactics, opaque fee structures, index rigging, and conflicts of interest have been among the most prominent targets of regulatory countermeasures to ensure prudent operations. Regulators have emphasized consumer protection and provided clear guidelines for trading, heightened compliance requirements, and tightened documentation and reporting requirements.

The most prominent regulations already in place include the markets in financial instruments directive and regulation (MiFID II/MiFIR) in the EU as well as the Dodd-Frank Act’s Title VII in the U.S. The European rules aim to harmonize the European financial markets and improve consumer protection. Among other requirements, they have defined transparency of electronic markets, including “

In addition, the drastic enforcement of sanctions, the increased personal liability of “acting persons” (those actively involved in the business), and the partial criminal liability of executives and top management represent strong tightening of regulations. This part of the reform reflects regulators’ intent to trigger a cultural change in banking, making banks more willing to act much more transparently and proactively vis-à-vis supervisory authorities and the market.

In summary, we believe that the target picture for prudent operations is clear from the viewpoint of regulators, and it is now up to the banks to implement it and especially to control themselves.

Resolution and Separation: First Steps Toward Resolvability

Although regulations governing financial stability and prudent operations are largely established, resolution and separation re-forms are still on the table and yet to be implemented.

Among the central goals of postcrisis reforms are achieving ways to protect functions critical to the real economy and avoiding any need for future taxpayer-funded bailouts. But if a bank were to fail today, taxpayers’ money would be at risk: the regulatory intent has not yet been achieved.

However, some elements of resolution have progressed, especially in the U.S. and Europe.

Financial-Stability Reforms Related to Resolution. Capital surcharges as well as cascading balance sheets through bail-in rules are about to go into effect despite continuing discussion regarding the absolute level of minimum requirements (such as potential Pillar 1 total-loss-absorption capacity). The issue of interconnectedness has also been addressed. Large exposure limits for intragroup lending will reduce interconnectedness among legal entities of one and the same banking group. Interconnectedness with other banks stems mainly from derivatives and interbank lending. The former has been addressed by the adoption of clearing obligations for standardized derivatives through central counterparties and the capital disincentives for noncleared derivatives. Capital disincentives also constitute the main step toward reducing interdependencies with the latter.

Resolving interconnectedness with nonbanks has, so far, made the least progress, but it remains high on regulators’ monitoring list, with the intention to use limits as the potential means of resolving this issue.

Prudent Reforms in Operations Related to Resolution. The BCBS 239 principles for risk data aggregation and reporting, when complete, will, from a regulatory standpoint, constitute a major contribution to enhancing banks’ resolvability, because the principles increase transparency of individual portfolios. Transparency is achieved by improving banks’ ability to aggregate and report risk data accurately, comprehensively, and in a timely fashion.

A complex regulatory landscape is not the only hurdle to creating and harmonizing resolution measures. The diversity of the global banking industry also imposes substantial difficulties. Resolution mechanisms must be designed to function in emergency circumstances while taking into account a multitude of business models and fundamentally different yield-risk profiles and refinancing costs.

While banks have already been required to design their own recovery and resolution plans, these “living wills” have, in many cases, been part of the problem rather than the solution. To date, they have largely failed to provide regulators with the transparency and trustworthiness required to resolve large cross-border banks and protect crucial economic functions. Instead, they have been plagued by unrealistic and inadequately supported assumptions, regarding, for example, the behavior of counterparties, investors, and central counterparties. Living wills have also failed to identify the changes in bank structure and practices that would be needed to enhance prospects for orderly resolution.

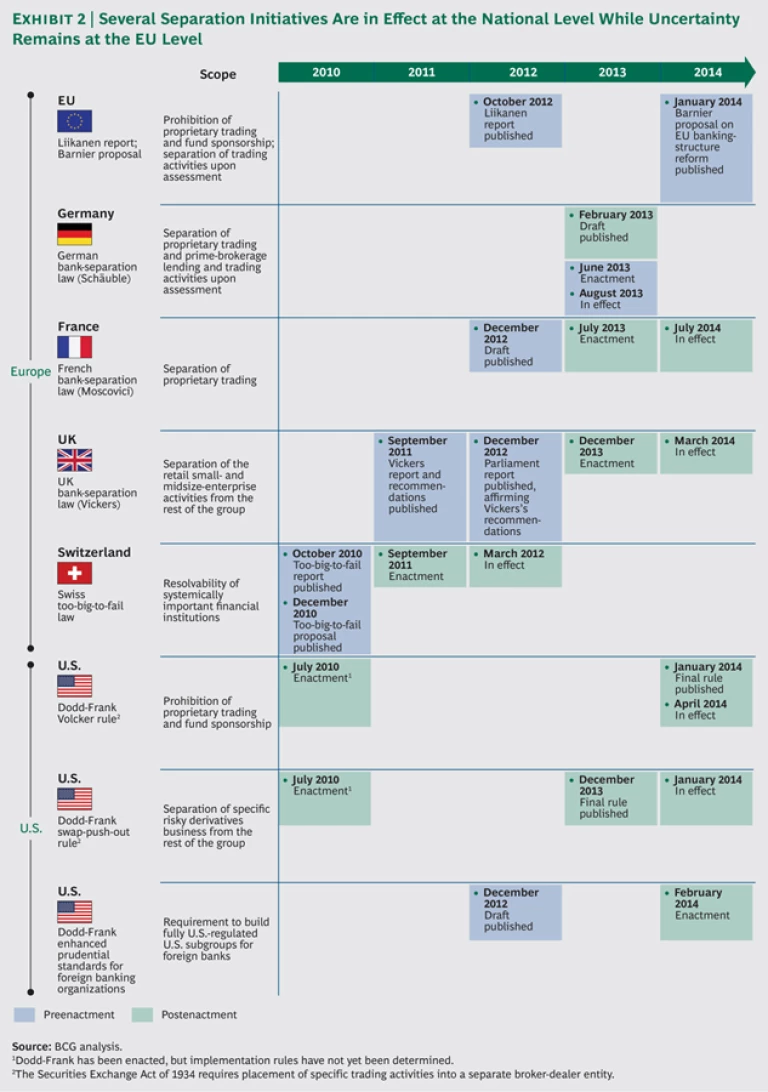

As a consequence, the discussion of structural bank reforms as a means of reducing complexity and protecting the economy is a growing priority. On the national level, an array of initiatives has already come into effect, with the U.S., the UK, and Switzerland being the most advanced. (See Exhibit 2.)

Next steps by U.S. regulators—which allowed the living wills of several major banks to fail—are eagerly awaited, as are changes to the EU’s separation proposal and G20 endorsements from the leaders’ summit in Brisbane.

There is still a long way to go to achieve regulators’ intents for resolution and separation. First, the implementation of all measures created to date must be ensured and their effectiveness monitored. Many of the measures exist only on paper, thus the effectiveness of their incentives has yet to be proved in practice. Furthermore, there are outstanding cross-border issues yet to be addressed. These include selective collaboration agreements, as well as the alignment of regulators on a global resolution frame-work and global standards, such as for derivatives contracts.

In day-to-day commerce and transactions, regulators face the task of monitoring the effectiveness of the changes in culture and incentives that they have imposed on banks. And, finally, the topic of separation as a means of complexity reduction is likely to persist. Further progress toward that goal, both regional and global, remains to be seen.