Agreement among United Nations member countries on the Sustainable Development Goals in 2015 was a major accomplishment. But while establishing a shared aspiration for a better world was a significant step, moving from vision to reality requires large-scale projects—expanding access to energy, for example, or revolutionizing irrigation in Africa. Unfortunately, progress on developing such projects and mobilizing the capital to fund them has been far too slow.

A main reason for this frustratingly sluggish pace is quite simple: ambitious and transformative projects are not being conceived. The organizations best positioned to originate such projects—development finance institutions (DFIs), multilateral and national development banks, and government aid agencies—are not doing so at the scale required, nor are they effectively mobilizing private investors.

The lack of progress on this front by DFIs and development banks is particularly problematic. These institutions have extensive insight on where projects are needed and the financing required; indeed, many of them have a mandate to present SDG-advancing projects and solicit private investment. However, they remain overly focused on investing their own limited capital.

Changing the approaches and processes of these well-established institutions is understandably challenging. But in the absence of viable projects, there’s also an absence of innovation in the capital markets. This is a key reason that spending to advance the SDGs is well below what is needed, despite investments by governments and development organizations. The gap: about $2.5 trillion annually. As World Bank President Jim Yong Kim pointed out in a 2015 speech, meeting the SDGs requires us to “leverage the billions of dollars in official development assistance to trillions in investment of all kinds, whether public or private, national or global.”

In the absence of viable projects, there’s also an absence of innovation in the capital markets.

While some may see the aim of moving from billions to trillions in investment as fanciful, the pool of private capital looking to invest in a way that generates both financial returns and a positive impact on society has grown significantly in recent years. What is missing is a robust mechanism for linking those private dollars to viable, large-scale, SDG-advancing projects. DFIs and development banks—with their expertise, connections, and passion—can step boldly into the void, aligning with external partners to identify the best projects and shopping them to institutional investors. The imperative is clear: Put the projects on the table. The capital will follow.

Put the projects on the table. The capital will follow.

A Dearth of Projects, Not Capital

Social impact entrepreneurs and the philanthropists and investors that support them are making valuable societal contributions. But their projects and associated investments are not at the scale required to close the SDG investment gap. To understand how to close that gap, it is important to look at both sides of the equation: the projects being put forward and the capital available to fund them.

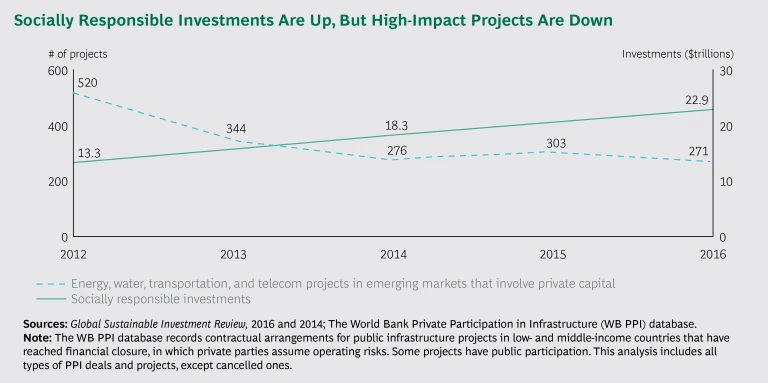

In 2016, there was about $23 trillion in so-called socially responsible investments, up 25% from just two years earlier. These investments allocate capital to entities likely to create positive social and environmental outcomes—however, they often have limited connection to large-scale development projects in emerging economies. Still, the data highlights an important trend: investors increasingly seek to deploy their capital in ways that do more than offer a financial return. Additionally, there is almost $1 trillion in private-equity capital waiting for attractive investment opportunities—capital that in many cases could be well suited to SDG-related projects.

The pool of projects that would advance progress toward the SDGs, however, is not growing. Consider major energy, water, transportation, and telecommunications projects in developing markets. These projects, which typically involve predictable revenue streams and significant assets as collateral, are among the most potentially attractive to institutional investors. Yet in recent years the total number of such new projects involving the private sector has been flat, following a decline from 2012 through 2014. (See the exhibit.)

That trend also holds for the total dollars invested annually in developing-world energy, water, transportation, and telecommunications projects that involve private capital. This figure declined from $123 billion in 2012 to $74 billion in 2016. That is barely 3% of the new funds moving into socially responsible investing each year.

The bottom line: the appetite for investing in developing-world infrastructure projects exceeds the supply of projects. In 2014, 100% of pension funds surveyed by the OECD were not able to meet their target for infrastructure investments. And our interviews with large institutional investors revealed a real sense of frustration. “The banks and insurance companies have identified infrastructure project finance as a place to get better yields than the public bond markets,” one global power investor at a major insurance company told us. “So there is a flood of capital chasing deals right now."

The appetite for investing in developing-world infrastructure projects exceeds the supply of projects.

Of course there are investments beyond infrastructure that are also critical to advancing the SDGs, such as those that support industrial and agricultural ecosystems. All too often, however, private capital is not able to find viable projects in these areas either.

Many factors contribute to the lack of viable, SDG-advancing projects. Two in particular stand out. The first is that private investors have limited visibility into potential projects, so they may not hear about scalable projects that could have a large impact if backed by sufficient capital. The second is that many high-impact projects require creative structuring, including government funding or first-loss capital from DFIs and development banks, in order to be attractive to private investors. But such deal structuring remains the exception rather than the rule.

Certainly, all the main DFIs list the promotion of private-sector investment in developing countries as a fundamental part of their mission or goals. Yet in practice they have not made the leveraging of private capital a priority. For example, many key performance indicators (KPIs) for DFIs and development banks are focused on fully deploying internal capital—not on maximizing total investment, including private capital, in important projects. In fact, when DFIs do draw outside capital into projects, that capital often comes not from private investors but from other DFIs. In addition, DFIs and development banks often spread their efforts across many countries and project types. This makes it difficult for them to put the necessary internal resources behind big, complex projects and to build the geographic or sector expertise they need to market opportunities to private investors.

Further, DFIs and development banks often lack the full suite of sophisticated financing and risk management tools to structure large, complex deals. And with few viable projects on the table, private investors have not put money behind building big teams that can assess those projects and make investment decisions.

Closing the Gap

DFIs and development banks are clearly committed to advancing development around the world. We have identified actions they can take in six areas to accelerate the flow of private capital into SDG-advancing projects.

Start with the current book and project pipeline. There is no better starting point to challenge mindsets and begin driving change than within the current investment portfolio. Leadership should task the organization with a rapid assessment of the potential scalability and impact of the book of current investments and projects in the pipeline. Which projects could offer greater development impact if more investment were brought in or if complementary skills, such as the supply chain expertise of large corporations, were brought to the table?

Expand relationships with institutional investors and private equity firms. Most DFIs and development banks will benefit by cultivating a far broader network of potential investment partners. They need to discover what expertise and resources private-sector investors can bring to project development and finance, which areas are of highest interest to those players, how those investors think about and manage risk, and how they would like to help structure and package deals. DFIs and development banks should then identify which investors offer the strongest complementary skills in financial innovation and risk management, and access to a broad network in the investment world. Doing so will help DFIs and development banks break away from their historical boundaries and mindsets.

Redesign the investment process to welcome the private sector. Most of the processes DFIs and development banks use today evolved during a period with very different development and funding dynamics in donor governments. The economic and development challenges in target countries were different as well. And institutional investors paid far less attention to issues like the SDGs or corporate environmental, social, and governance (ESG) performance. In light of these fundamental shifts, it is time to re-examine the investment process end-to-end, from project origination through deal structuring, investment allocation, approval, and tracking. Institutions must rethink each step and, in particular, identify where and how the private sector could contribute more fully to upfront origination, project design, deal structuring, and brokering.

Structure deals to attract private capital. As private capital increasingly aims for both balanced returns and societal impact, DFIs and development banks should identify where and how their financial capacity can be deployed to help achieve those objectives. They might consider shifts in the degree to which they provide high-risk capital to increase the attractiveness of deals, the financial instruments they use, and the length of their investment horizon. To make this happen, these organizations should work with the most innovative institutional investors and development partners to test their traditional approaches against today’s most innovative investment thinking and instruments. Properly done, this will spur changes in attitudes, processes, and even products. Most important, it will help DFIs and development banks identify the approaches that will get the most out of government development capital.

Embrace the roles of convener and broker. Achieving the SDGs will require organizations across sectors to devise innovative approaches to leveraging private-sector capital and corporate expertise and resources. DFIs and development banks are positioned to convene the meetings and broker the deals to make that happen. In addition to involving private players early and throughout the project design process, these institutions also need to adapt the tools that commercial investment houses employ to promote deals, including full-fledged roadshows. DFIs and development banks should also freely share information on what is working, financial innovations, and novel tools and approaches.

Build new internal capabilities and incentives. It will take new skills and incentives and agile organizational structures and ways of working for DFIs and development banks to put themselves at the center of larger projects with private investors. Project teams need a deeper understanding of how to identify and structure deals that support advancement of the SDGs as well as insight on the goals of large institutional investors, social impact investors, and progressive foundations. DFIs and development banks will need to test whether and how to specialize in particular regions, development areas, or project types. In this way, they can build the expertise and track record to help them establish credibility among larger investors. They should also adjust their KPIs to create incentives and rewards for reaching their core goal: building a development finance institution fit for the challenge of the SDGs.

Achieving the SDGs will require a major investment of resources from many actors, particularly from the private sector. The capital is available. What’s needed is for that capital to find a home in well-designed, viable projects.

DFIs and development banks are in a unique position to make that happen. But they need to shift their mindset, direction, and operating incentives toward attracting and mobilizing private investment. Ultimately, the extent to which DFIs and development institutions engage effectively with the private sector will determine whether we move from billions to trillions.