Reinsurers’ average annual total shareholder return has generally exceeded that of primary insurers over ten- and five-year horizons.

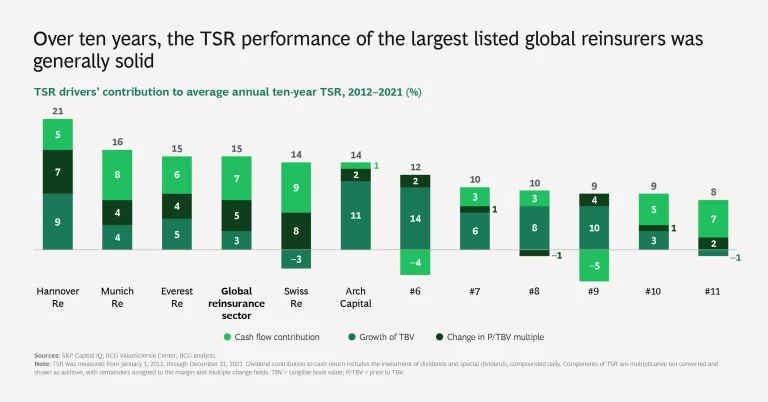

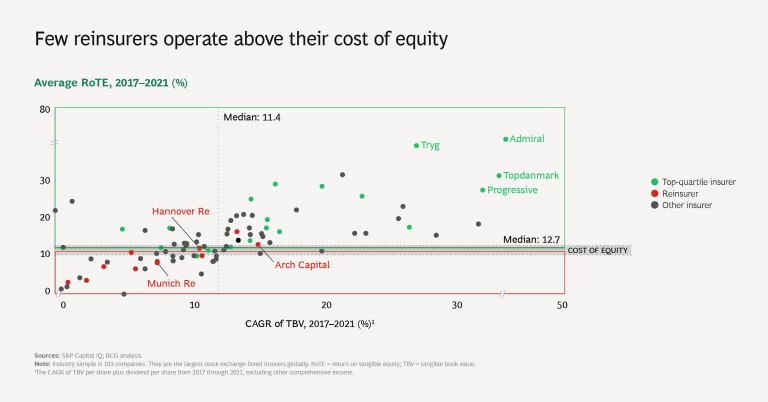

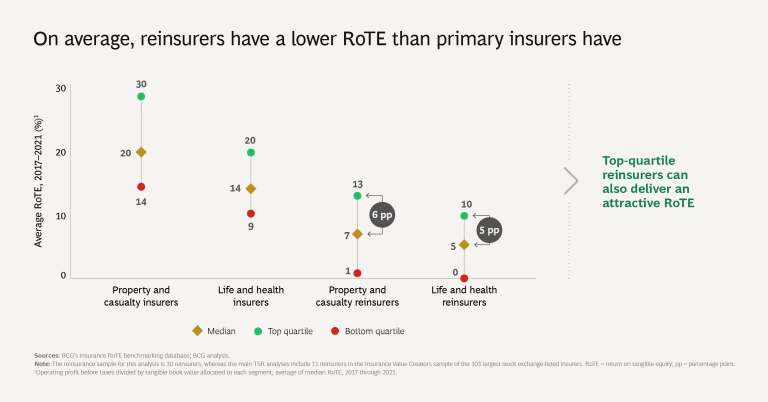

The global reinsurance industry’s total shareholder return (TSR) has, on average, remained below the cost of equity in recent years. Although the average is disappointing, it conceals an encouraging fact: strong TSR performance is possible regardless of a reinsurer’s location or business mix. Indeed, some players have consistently outperformed. Profitable growth is what sets apart the leaders from the laggards. Because profitable growth makes an important contribution to each TSR component, it is crucial to promoting sustained long-term value creation .

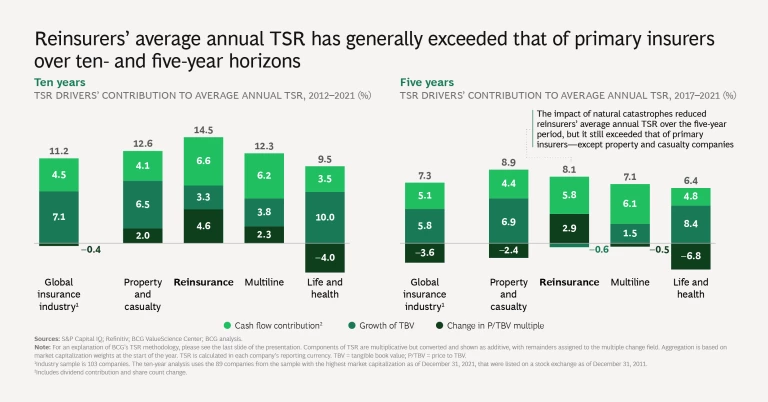

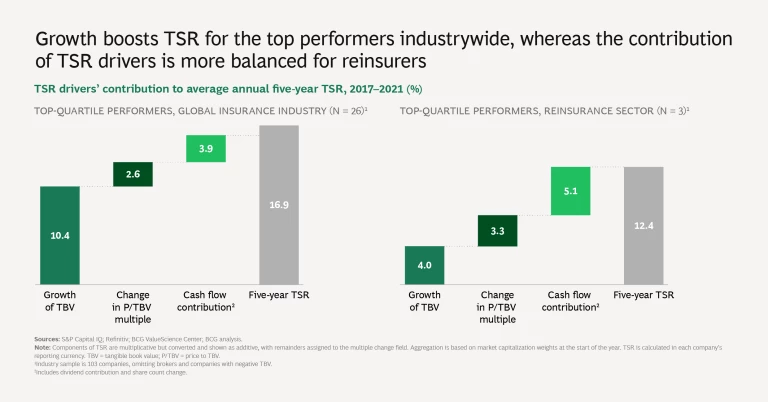

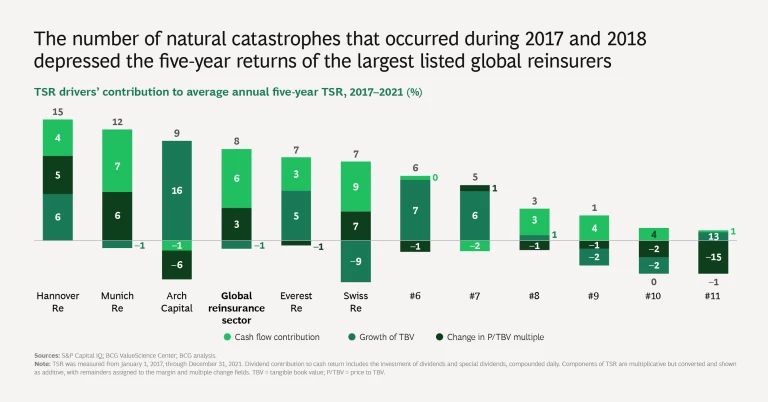

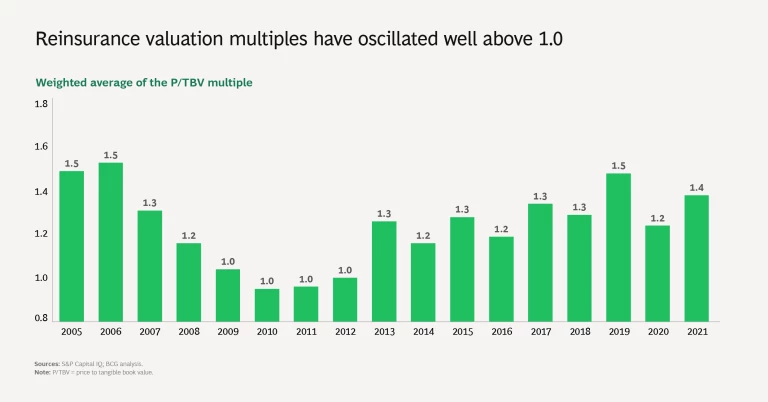

Over the ten years from 2012 through 2021, reinsurers’ average annual TSR of 14.5% eclipsed that of all sectors of primary insurance (property and casualty, multiline, and life and health). In recent years, the impact of natural catastrophes has put pressure on reinsurers’ TSR. Even so, their average annual TSR of 8.1% over the five years from 2017 through 2021 still surpassed that of all primary insurance sectors—except for property and casualty. However, comparing the top-quartile performers in reinsurance with those in the global insurance industry , we found that reinsurers’ outperformance was driven by cash flow contributions (dividends and share buybacks) and favorable multiples, not growth in tangible book value (TBV).

Reinsurers’ ten-year average annual TSR of 14.5% eclipsed that of all primary insurance sectors.

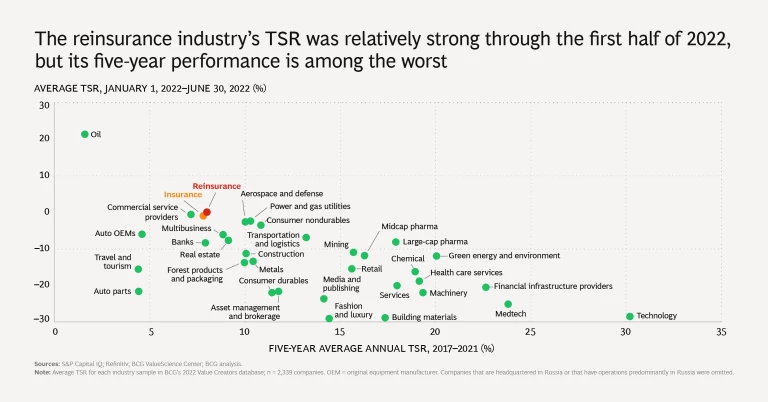

Other comparisons are less favorable. Only one reinsurance company is among the top quartile of insurance value creators by five-year TSR. And looking across industries, reinsurers’ five-year average annual TSR of approximately 8% was well below the average of 15% for the S&P 500 and placed reinsurance 27th among the 34 industries tracked by BCG.

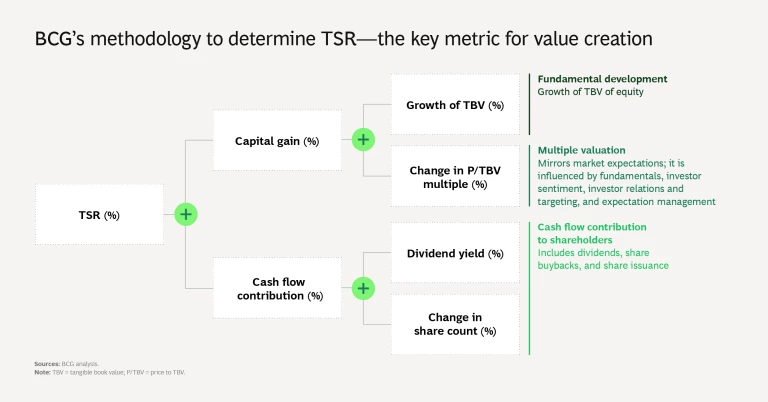

Each year, BCG looks at TSRs on a rolling five-year basis to illuminate long-term value creation. This year’s insurance company sample comprises the largest stock exchange-listed insurers worldwide: 103 players with a market capitalization of more than $4.5 billion at the end of 2021, including 11 reinsurers. These companies’ TSRs are straightforward to measure: we combine share price gains and the impact of dividends and share-count change. What’s more interesting is disaggregating the TSRs into their components.

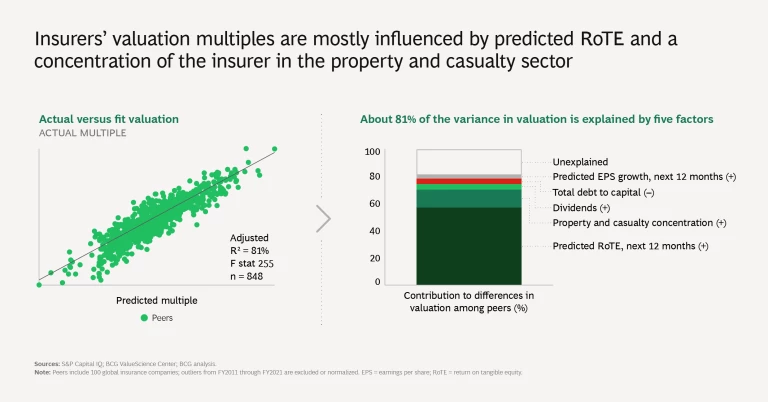

In reinsurance, as in primary insurance, TSR derives from three sources: growth in TBV, change in the price to TBV (P/TBV) multiple, and cash flow contribution (comprising dividend yield and change in share count). Over the long run, TBV growth and cash flow are the major contributors to TSR. Over the short to medium term, changes in the P/TBV multiple matter a lot more.

The most important challenge for management is making the right tradeoffs among increasing TBV, deploying free cash flow, and expanding or protecting valuation multiples. BCG’s TSR methodology helps insurers explore these tradeoffs and make informed decisions about factors such as portfolio focus, capital allocation, and business units’ financial targets.

The slideshow gives an overview of reinsurers’ TSR performance and provides comparisons with the global insurance industry and across primary insurance and reinsurance sectors. It includes the reinsurance results from BCG’s proprietary Insurance Return-on-Tangible-Equity Benchmark. The other publications in this year’s series focus on the global insurance industry, the US property and casualty sector, insurers in Europe, and insurers in Asia-Pacific .

The authors thank their BCG colleagues Kumar Abhinav Anand, Ankit Goel, Sebastian Kindlein, Teresa Schreiber, and Nitish Suddhoo, as well as Martin Link of the BCG ValueScience Center.