Companies that historically have focused on oil and gas production can evolve their businesses to meet net-zero challenges.

As the race to net zero accelerates, low-carbon solutions (LCS) are quickly becoming the primary new growth opportunity for companies that historically have focused on oil and gas (O&G) production. According to the International Energy Agency, remaining on track for net zero will require $21 trillion in capital investment by 2030 . Companies that have the right capabilities in place stand to benefit greatly.

LCS are products, services, and technologies that have a limited carbon footprint and can serve as alternative energy sources or tools for decarbonizing operations and consumption. These offerings fall into six categories: hydrogen and ammonia; carbon capture, utilization, and storage (CCUS); bioenergy; green mobility and battery electric storage; decarbonization technologies; and renewable power.

The opportunity has not escaped O&G companies, which are increasingly developing LCS to diversify their operations and ensure future revenue generation. BCG’s analysis of the largest players found that integrated energy companies (IECs), supermajors, international oil companies (IOCs), and national oil companies (NOCs) are all getting into the game.

Low-carbon solutions are the key to future revenue generation.

As competition in the LCS space heats up, the most advanced players are standing apart from their peers both commercially and organizationally. Companies that focus on developing the organizational capabilities of their LCS businesses will position themselves to take full advantage of the opportunity. Those that don’t are at risk of falling behind.

Shifting Gears

In 2022, to understand this rapidly evolving sector, BCG assessed 17 companies in the O&G industry. Our analysis covered the LCS ambition, portfolio choices, technology access, and organization models of six IECs/supermajors, eight NOCs, and three IOCs, with the goal of analyzing how these companies are setting themselves up for success in the low-carbon space.

Accelerating Pace of LCS Investment

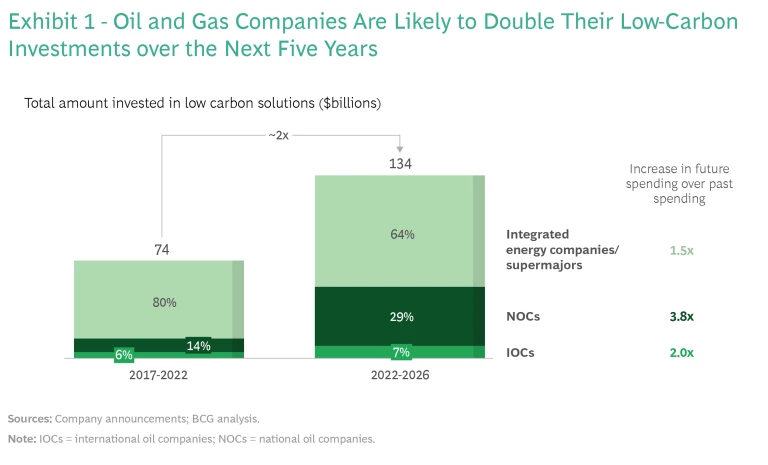

Except for a temporary slowdown during the height of the COVID-19 pandemic in 2020 and 2021, O&G investments in LCS have increased rapidly over the past five years, and all signs indicate that the pace of investment will continue to accelerate. From 2017 to 2022, 17 companies invested approximately $74 billion. Of that amount, 55% went to inorganic growth, which suggests that O&G players are actively acquiring external capabilities to accelerate their transition to net zero. Extrapolating from companies’ public statements of commitment, we estimate that investments will reach $134 billion over the next five years, an increase of nearly 80%. (See Exhibit 1.)

Together, the six largest publicly traded energy companies—including BP, Chevron, Eni, ExxonMobil, Shell, and TotalEnergies—contributed about 80% of investments. These companies will continue to dominate investment activity. Their share of low-carbon capital expenditures averaged 5% over the past five years, and analysts predict that it will soon surpass 15%. Some IOCs, along with some NOCs, plan to increase their spending, on average, by 3.2 times during the same period.

Moving from Renewable Power to Hydrogen, CCUS, and Bioenergy

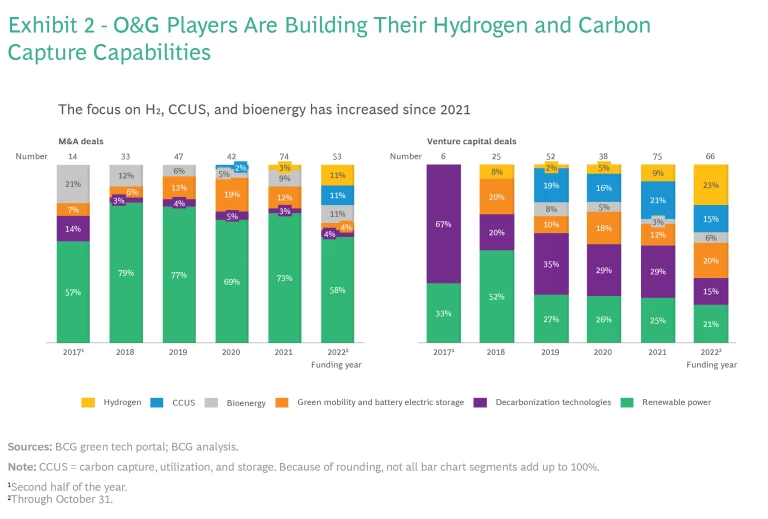

During the period from 2017 to October 2022, O&G companies focused on building renewable power capabilities: solar and wind accounted for 75% of their low-carbon investments, and bioenergy approximately 10%. But the situation is changing rapidly. Both M&A activity and venturing activity indicate that hydrogen , CCUS, and bioenergy are rapidly taking center stage. (See Exhibit 2.)

In 2018, renewables accounted for 80% of M&As; in 2022, that percentage has dropped to 60%. There were no hydrogen or CCUS transactions prior to 2020; these two domains now account for 22% of transactions, with 16 transactions so far in 2022. The shift is even more visible in the venture capital space. Renewable power deals dropped from 52% in 2018 to 21% in 2022, while hydrogen, CCUS, and bioenergy together rose from 8% to 44%. Bioenergy is enjoying strong interest, receiving $7 billion in investments over the past two years.

O&G players are positioning themselves to become market leaders in these emerging low-carbon technologies. They will likely hold a large amount of green hydrogen capacity by 2040—second only to the pure-play hydrogen companies—and more than 45% of global capture capacity by 2030. The shift to hydrogen and CCUS reflects the importance of these solutions for reaching net-zero goals and achieving synergies with existing O&G assets and operations. However, we see a different situation in the solar photovoltaic subsector. O&G players account for only 15% of solar photovoltaic asset ownership in 2022, while independent power players and institutional investors combined own over 60%.

Accommodating New Organizational Models

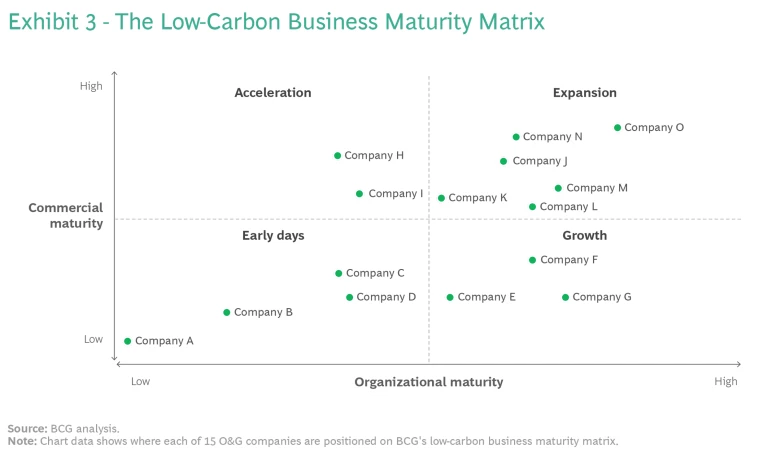

O&G companies are adjusting their organizational structures to support their LCS strategies. This is evident from our analysis of players across two dimensions: commercial maturity, which reflects an LCS business’s ability to generate positive cash flow at scale; and organizational maturity, which reflects its reporting lines and degree of business autonomy.

LCS businesses fall into four main categories that encompass a wide range of commercial and organizational maturity. (See Exhibit 3.) Those categories are as follows:

- Early Days. Companies in this cohort are beginning to develop low-carbon businesses. Mostly NOCs and upstream independents, Early Days players usually incubate an LCS group within their technology or sustainability segment without granting P&L ownership. Despite placing prudent bets, these companies are not likely to generate revenues over the next few years.

- Growth. The companies in this quadrant, which include US majors and some NOCs, have set up or are investing in low-carbon business units—a few of which have their own P&L and generate cash flow but are not yet at scale. Growth companies are developing in-house capabilities and accelerating the scaling up of their low-carbon businesses via selected mergers and acquisitions, partnerships, and strategic investments.

- Acceleration. Companies in this category rely primarily on inorganic moves to speed up their progress toward commercial maturity in selected low-carbon businesses. Although they may generate cash flow through these acquisitions, Acceleration companies often lack the organizational maturity needed to fully integrate the acquired companies.

- Expansion. The players that fall into the Expansion quadrant have at least one commercially mature low-carbon business unit in place and are scaling up others. Most of these companies, which tend to be based in Europe, aim to become integrated energy companies.

A higher degree of autonomy and separation from the core business typically translates into higher commercial maturity. In the companies we observed, LCS activities are moving toward becoming independent business entities driven by their agenda rather than being incubated by core segments.

Four Organizational Models

Diving deeper, we identified four distinct organizational models that companies have deployed in support of low-carbon pursuits:

- Incubated. Operating as centers of excellence, the LCS teams are limited to engaging in strategy and business development. Staffed with 20 people at most, teams report to the COO or lower and have no P&L ownership. Companies that follow this model rely heavily on external stakeholders through partnerships or venturing because they have limited in-house capabilities. This is the least-mature organizational model.

- Capability Aligned. The LCS teams are housed with the most relevant existing business entity. For example, CCUS are housed with the geosciences group and biofuels with retail. This approach leverages existing engineering, technology, and project execution capabilities. The LCS teams report at the COO or CFO level and have limited or no P&L ownership. Companies that adopt capability-aligned LCS entities usually don’t yet consider these activities as core.

- Market Aligned. The LCS teams are hosted in standalone entities to ensure that their strategic agenda aligns with their markets and customers. The LCS entities have P&L ownership and often report directly to the CEO. In this structure, the LCS teams have primary responsibility for handling all core activities for the segment, but they may leverage other segments for some functions.

- Independent. In this setup, the LCS teams operate as a separate entity. They may operate under a different CEO and board of directors, and they are fully staffed for operational and support functions. Companies use this model when their goal is to carve out LCS activities for divestment or to attract investors.

Many O&G players adopt a hybrid combination of capability-aligned and market-aligned models. This approach helps accommodate a wide range of LCS technological and commercial maturity.

O&G companies may eventually need to evolve their low-carbon businesses to give them greater operational independence to capture the fair market value of low-carbon opportunities as the technology matures. Such a move follows recent trends in other industries such as automotive, where some players are separating their electric vehicle operations from their traditional business of producing internal combustion engine vehicles. This empowers the new businesses to develop their own business models unhindered by legacy operations, business models, and valuations.

Persistent Challenges

O&G players are making great strides in the LCS space, but none is best in class today. All continue to grapple with various pain points. Four of these are particularly noteworthy:

- Lack of Strategic Focus. Because they may struggle to identify LCS businesses that have a clear right to win, companies can’t allocate capital effectively. Organizations may also lack a well-defined strategy linked to a developed business case and a go-to-market strategy aligned with customer needs.

- Integration of New Businesses. Building new low-carbon businesses within well-established organizations requires innovative operating models, commercial structures, and shifts in cultural paradigms—demands that make creating synergies difficult. This challenge is exacerbated for companies that pursue multiple acquisitions, since they must integrate structures, processes, and systems that are potentially even more diverse.

- Valuation of Acquired Businesses. Valuations of acquired low-carbon businesses are usually higher than those of existing O&G businesses (12 to 15x EV/EBIT for low carbon vs. 6 to 8x for O&G). O&G companies have yet to find efficient ways to avoid value dilutions when acquiring LCS businesses.

- Insufficient Specialized Talent. To date, most O&G players have primarily relied on internal transfers to handle their low-carbon business. But the need for new skill sets in areas such as business development, commercialization, and technology development is forcing them to look outside the organization for talent—and competition is stiff.

Finding Low-Carbon Success

No matter how much progress their companies have made in the journey, CEOs and CSOs should consistently keep three priorities in mind over the next few years:

- Explore new go-to-market strategies via new partnerships and venturing. Entering LCS markets impels companies to explore new types of partnerships across sectors. To be successful, players need to thoroughly define new partnership and commercial models. One example is Northern Lights, a partnership formed by Equinor, Shell, TotalEnergies, and two downstream players—a cement factory and waste-energy facility in Oslo—to capture and store carbon. Another is Houston Hub, a partnership of Air Liquide, BASF, Capine, Chevron, Dow, ExxonMobil, INEOS, Linde, LyondellBasell, Marathon Petroleum, NRG Energy, Phillips66, Shell, and Valero to explore efforts to capture and store 50 million tons of carbon a year by 2030, and twice that amount by 2040.

- Increase organizational flexibility to fit new low-carbon businesses. Scaling up requires companies to change their organizational structures, project development processes, and technology investment decision making to better align with low-carbon businesses. For example, developing a wind farm has different project development timelines and processes than a refinery or reservoir.

- Hire and upskill to scale up the business. Expanding current capabilities and skill sets to achieve commercial success in the low-carbon space entails developing existing resources and attracting new talent with deep technological, partnering, and regulatory expertise. The International Labor Organization predicts that greening the global economy will yield a net increase of 18 million jobs by 2030. O&G companies must act quickly to ensure that their LCS teams have the necessary skill sets.

LCS represent a new frontier, with phenomenal potential for O&G companies seeking growth in the years ahead. Players that focus on building their organizational maturity to accommodate such solutions will be best positioned to capture this opportunity.