Agencies must harness the human touch, while embracing technology.

Insurance agencies have a long, storied history in the industry as the place where agents made calls, met clients, and drank coffee before pounding the pavement in search of new business. But this sales channel is under pressure from customer demand for digital, seamless, and hybrid support along with external forces such as original equipment manufacturers embedding insurance into their products.

In many markets, the agency channel is still dominant, but it won’t be for long unless insurers massively embrace technology and more effective ways of working. The path forward for agencies blends both the old and new, the physical and digital. Their future is tied to their ability to harness the human touch and customer intimacy while welcoming technology.

Tomorrow’s Insurance Agent

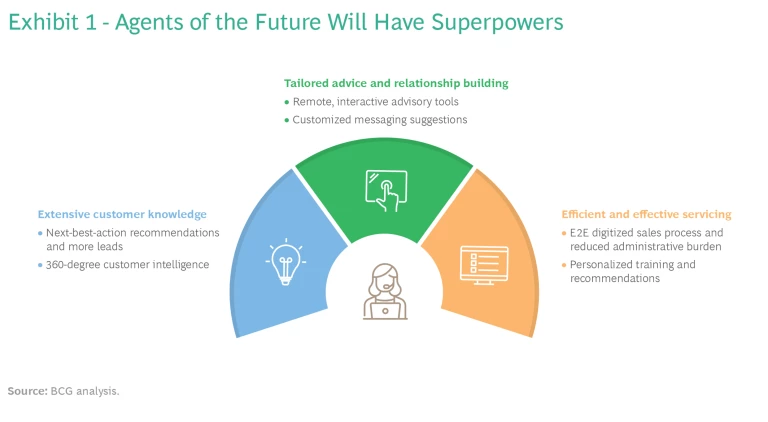

Insurance agents of the future will have superpowers, a complement of people skills and technology. They will know their customers better than ever, service and support them at key moments, and provide them with a rich digital experience. Their conversations with them will be influenced by the AI-generated insights of choices made by other customers in similar life and work situations. In short, insurance agents will be more effective. (See Exhibit 1.)

This is what customers want: the capacity to move fluidly across digital and personal channels in their sales journey; speedy and convenient access to basic questions and more thorough research; and the ability to buy simple products, like motor insurance, hassle-free. They would also like live digital and physical interactions with agents for complex offers.

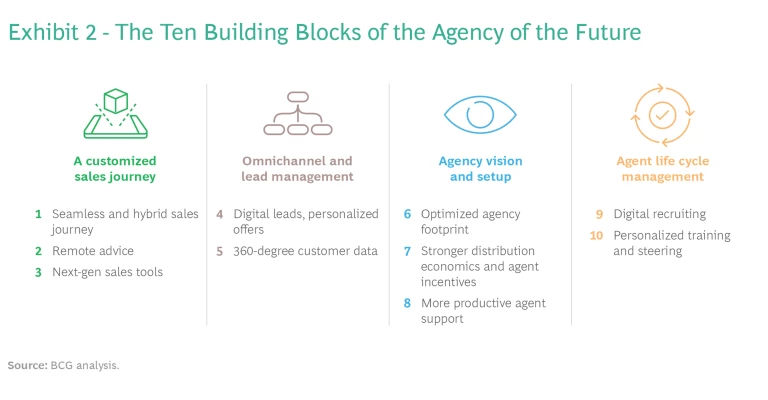

The forces are in place for transformative change in insurance distribution. BCG has generated four themes and ten building blocks that support this transformation. These ideas will shape the agency of the future. (See Exhibit 2.)

A Customized Sales Journey

Digital will increasingly be the primary channel for most customers on most interactions. But direct, personal conversations will be the main medium for closing complex offers in many markets. Agencies need to know how and when digital or human contact makes the most sense and respond with the right approach for that customer at that moment. Living in two worlds will be hard and necessary.

Seamless and Hybrid Sales Journey. Customers often want to switch channels along the sales journey. Insurers should be able to anticipate a customer’s specific journey and offer self-service platforms, digital tools, remote interactions, or face-to-face meetings at the right time. Tools such as QR codes and online offers ought to permit switches between channels.

Remote Advice. The pandemic showed that many traditional physical transactions—simple meetings and basic account servicing—do not need to be conducted face-to-face. Other activities, such as research, are often better suited for a digital experience. And yet customers still selectively want to meet with agents for advice, consultation, and finishing touches.

Next-Gen Sales Tools. Insurance agents who get by on charm and connection are a vanishing breed. Their successors will need new skills and digital tools. They will reach customers more frequently, increasingly through digital channels, and serve them more effectively with AI-based insights.

Many agents are wary of technology. Introducing digital tools without training and a change management program is malpractice. The agency cannot be transformed unless agents are transformed.

Omnichannel and Lead Management

In a digital world, lead management is more important than ever. With far less physical traffic in agencies and fewer face-to-face customer calls, insurers must find new ways to generate leads. And they need to think about the best way to serve customers whose first interaction is digital—the right channel may vary depending on the customer and the circumstances.

With far less physical traffic in agencies and fewer face-to-face customer calls, insurers must find new ways to generate leads.

Digital Leads, Personalized Offers. Leads will increasingly come from new sources such as ecosystem partnerships and digital marketing channels or be generated through data and analytics. Partnerships can give insurers access to proprietary data, allowing them to deepen existing relationships and win new customers. Insurers can offer customers a better experience with more personalized product offers, rewards, and service, delivered in the right channel at the right time. Offers for simple products will be delivered digitally. Agents, armed with digital tools, will step in on complex, high-margin activities.

360-Degree Customer Data. To serve customers effectively, agencies will need a 360-degree view of their customers across channels and business lines. This will inform the next-best-action algorithms that suggest sales approaches and offers to agents. Agents will play a hands-on role in collecting, characterizing, and structuring customer data.

Agency Vision and Setup

The economics and operating model of the agency need to change. Operations must become leaner and more productive. Agents will share commissions.

Optimized Agency Footprint. Agencies will be optimized for size, location, and scope on the basis of geoanalytics. Open layouts will become increasingly common as agents spend more of their time working remotely, and locations will likely consolidate. New agency formats, such as shops in shops, will emerge, and the agency will be reserved largely for high-value advisory services and relationship building. The technology to communicate with customers will be state of the art. Agents will be connected to networks of experts who can provide fast, action-oriented advice on traditional and new offerings. These experts may work at ecosystem partner companies, such as a retirement-planning firm.

Stronger Distribution Economics and Agent Incentives. Digital marketing and ecosystem partnerships will increase both the number of leads and the fixed costs associated with attracting them. Commissions will need to be shared according to the effective contributions of various channels and partners. This might be done based on the share of activities performed along the sales journey: lead generation, closing, and servicing. Agents may be superheroes, but they need to share the credit.

More Productive Agent Support. Contribution-based commissions and incentives will encourage agencies to improve productivity and lower costs through self-service, automation, and process simplification. Rather than doing routine administrative work, sales support staff will increasingly play more of a front-office role by offering customers real-time advice. Many of them will develop specialized skills along products lines (such as life insurance or small- and medium-size business products) or channels (broker support, for instance).

Agent Life Cycle Management

This rebooting of the agency will not be easy. The new operating model for the agency needs to become more data driven and human centered. The future lies in the balance between those two extremes.

Digital Recruiting. Agencies can expand the reach of their recruitment through AI and other tools. Digital systems will also help them source new agents, assess candidates efficiently, and improve the onboarding experience.

Personalized Training and Steering. Once agents are onboard, training will become more tailored according to individual developmental needs and career plans, mixing both remote and face-to-face training, and linking training to performance through frequent feedback.

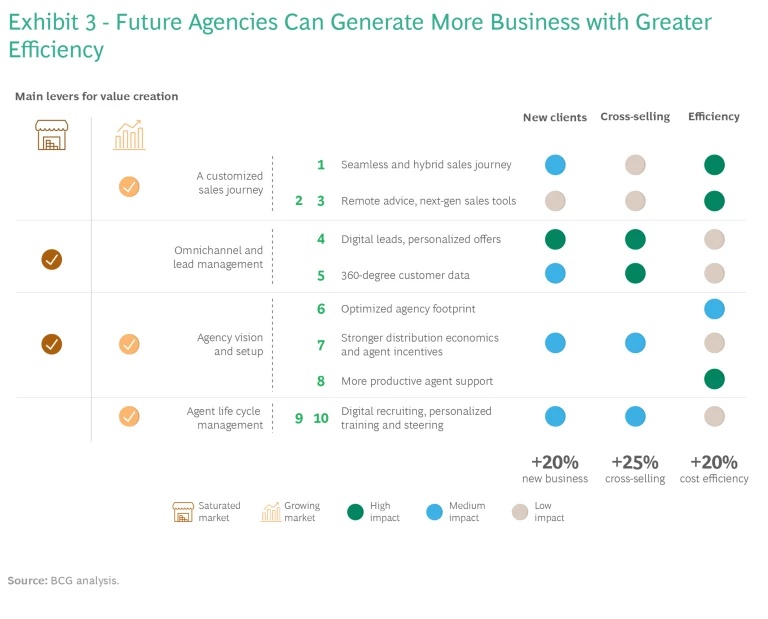

To survive, the agency channel must become more productive. Successful insurance agency transformation will pay off through better conversion of new clients, higher cross-selling rates, and efficiency improvements. (See Exhibit 3.)

But those results will be reserved only for the few that transform their business so that it sits at the crossroads of the physical and digital worlds. The agency model of the future reflects both what customers want and what insurance companies need.