Autonomous vehicle (AV) technology has the potential to transform how people and goods move through the world. Personal autonomous cars get most of the media attention, but long-haul trucks actually offer one of the most appealing use cases for full self-driving vehicles. A critical factor is the ability of AV providers and fleet operators to identify the most appropriate routes on which to trial and ultimately operate their autonomous commercial vehicles.

In early 2022, BCG collaborated with Kodiak, one of the leading players in autonomous trucking, to identify the most promising routes between major metropolitan areas (MAs) in the continental United States. BCG’s data analytics group BCG GAMMA developed an interactive dashboard that applies a prioritization algorithm to define optimal routes according to filters chosen by the user.

In this article, we explain how Kodiak used the tool to validate strategic decisions and guide its expansion plans. We also invite readers to experiment with the tool to generate custom maps of ranked routes well-suited for autonomous trucking.

The Business Benefits and Technical Advantages of Autonomous Trucks

A key aspect of the artificial intelligence (AI) technology behind autonomous vehicles is that it tends to have an easier time handling traffic situations that occur frequently. This makes it well-suited for interstate highways, which are built to the same general standards and typically have fewer obstacles and hazards, such as pedestrians, bicyclists, and children at play that could befuddle an AV navigating an urban or suburban street. Autonomous vehicles also tend to perform better on highways due to the fact that the other vehicles around them are moving in the same direction and within a narrow band of speeds, with oncoming traffic separated by a clearly defined median barrier.

For these reasons, solving the technical hurdles for autonomous trucks could be easier than for passenger cars or taxis—with human-driven trucks handling the first and last miles of the journey on surface streets.

Autonomous trucks also hold the potential to solve one of the biggest problems plaguing the trucking industry today—a massive labor shortage. In 2021, the American Trucking Associations estimated that the industry faced a historic shortfall of 80,000 drivers, with expectations that the shortage could exceed 160,000 drivers by 2030 given current driver demographics and expected growth in freight volumes. The Financial Times reports that the situation is much the same in Europe, where in 2021 the EU faced a shortage of 400,000 heavy-goods vehicle drivers.

According to a US Department of Transportation study, while autonomous vehicles could eventually lead to job losses in the trucking industry, human drivers will still be needed for the foreseeable future to operate trucks on the first and last miles of routes. Long-haul trucking jobs in particular are challenging to fill since many drivers are reluctant to be away from home on jobs that often involve being on the road for three to six weeks at a time. Drivers handling first-mile and last-mile routes in autonomous trucks could work close to home, which could make it easier for trucking companies to hire and retain the staff they need.

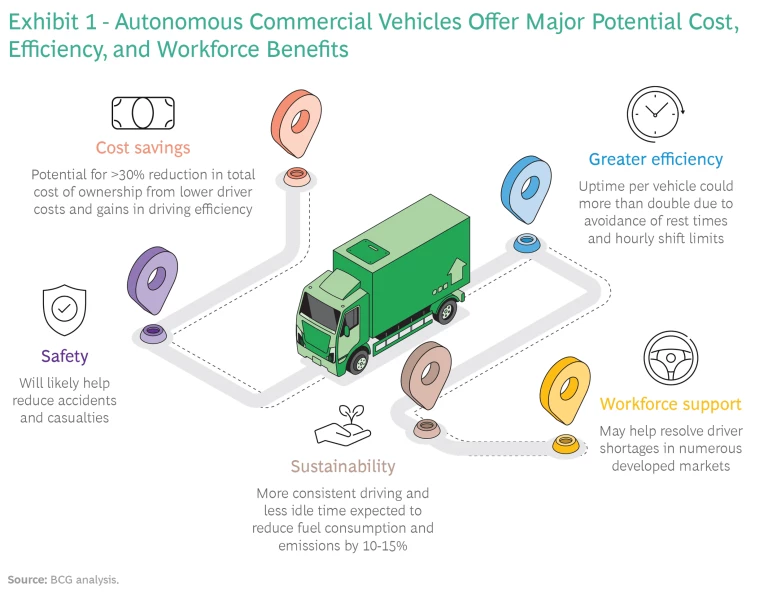

The financial case for autonomous trucking is also compelling. Autonomous driving technologies could reduce the total cost of ownership (TCO) of long-haul trucking by more than 30% through labor savings and driving efficiency gains. Because trucks would no longer have to sit idle while their drivers rest due to shift limits, vehicle utilization could more than double, dramatically increasing productivity. (See Exhibit 1.)

Recognizing the strong business case for self-driving trucks, a number of autonomous driving companies—including Aurora, Einride, Embark, Kodiak, Plus, Torc, TuSimple, and Waymo—have been building the technology to bring solutions to market while forging partnerships with (or in the case of Torc, being acquired by) OEM trucking companies and fleet operators.

AV companies are starting pilot programs to put autonomous trucks on highways. So far, these self-driving vehicles mostly have a “safety driver” behind the wheel, ready to take control at a moment’s notice if the AI needs help. As they look to expand their roadway networks beyond the pilot phase, companies need to identify which trucking hubs are best suited to AV fleets and determine which point-to-point routes and multi-hop corridors should be prioritized.

Filtering and Prioritizing Autonomous Trucking Routes

Kodiak, headquartered in Mountain View, California, set up its commercial operations hub in Texas—where the warm weather, dense freight volume, friendly legislative environment, and lengthy limited-access highway shipping corridors are all conducive to autonomous trucking operations.

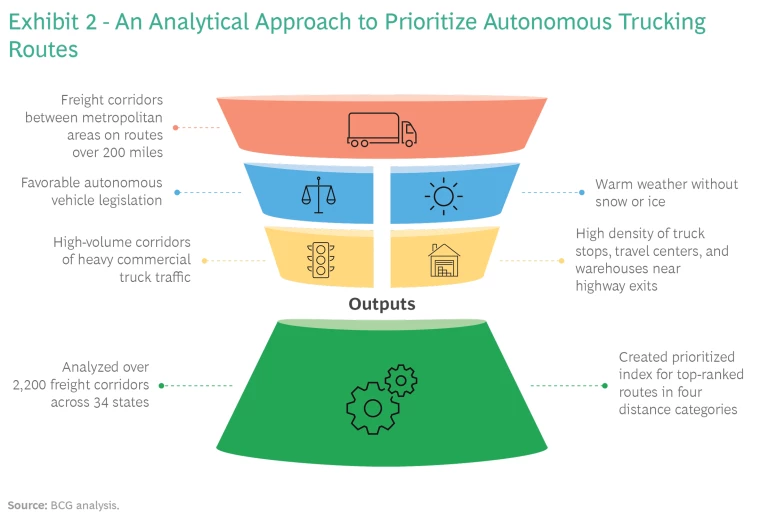

BCG GAMMA and Kodiak worked together to identify the most promising potential autonomous trucking routes between major metropolitan areas in the continental United States. We ultimately settled on five main criteria for evaluating such routes. (See Exhibit 2.)

Distance. We grouped routes into four distance categories: 200 to 350 miles, 350 to 600 miles, 600 to 1,200 miles, and 1,200 + miles. The shortest category represents the number of miles that an AV trucking company could handle now with a shift-limited safety driver in the vehicle. The longer categories (especially the 600+ mile categories) represent future driverless routes that a human driver could not cover in a single shift.

AV Legislation. We added a legislation-related segmentation for routes, to be able to filter from the list of all potential routes those that could be categorized as “driverless ready” or “testing ready and above” according to state-level AV laws at both origin and destination.

Weather. We classified MAs based on whether they were in the “Sun Belt” to account for the fact that current AV technology has an easier time navigating areas where ice and snow rarely impact travel conditions.

Freight Density. We leveraged the 2017 Commodity Flow Survey (CFS) for data on the round-trip freight volume transported by trucks between MA pairs. This survey, a joint effort of the US Bureau of Transportation Statistics, the US Department of Transportation, and the US Census Bureau, is conducted every five years as part of the Economic Census.

Density of Truck Stops and Warehouses. We calculated the density of truck stops and warehouses near highways within each MA. This is important for AV companies as they develop long-term plans for a route network, because even when completely autonomous trucks are deployed on highways, they will initially still need to stop at waypoints near highways so that drivers can complete the last few miles of the off-highway route to their destinations. In fact, Kodiak recently announced a partnership with travel center operator Pilot Co. to collaborate on development of autonomous truck services at Pilot and Flying J travel centers across North America. The companies will start by developing an autonomous truckport in the Atlanta region, where vehicles could have special designated spaces to pick up and drop off loads, transfer data, and undergo inspection, maintenance, and refueling.

Our prioritization algorithm calculates optimal routes based on freight density and the density of truck stops and warehouses. Routes with higher density of these factors receive a higher ranking. Users can then apply map overlays—such as distance, weather, and AV legislation—to show route results that meet these criteria. For one of the overlays, we captured congestion information on the metropolitan areas by using data on highway traffic delays from Texas A&M Transportation Institute, adding an additional consideration for fleet operators.

Take Our Route Finder Dashboard for a Spin

Use the tool’s interactive dashboard to generate a list of potential AV trucking routes based on your filter selections. Click below to get started. (For details on tool options, see the sidebar.)

A closer look at the AV truck route tool

For example:

- You can choose to see routes within a specific distance range as well as routes within and outside the Sun Belt.

- You can filter routes according to whether they pass through states with AV legislation in place for testing or driverless-ready operations.

- You can limit the results to metro areas with many highway truck stops and favorable traffic congestion levels.

- You can apply the CFS Area filter to view only those routes that pass through a specific MA.

Various elements on the map offer key details on routes and MAs. For example, the thickness of the lines indicate freight volume along the routes. The size of the dots marking MA end-points indicate the number of truck stops within a 100 highway-mile radius. The color of the MA dots denotes traffic congestion.

You can also zoom in to the map to see more detail and better distinguish overlapping routes. Finally, mousing over a route opens a pop-up window with additional information.

Tool Findings Help Guide Decisions for Kodiak

By ranking routes based on scores generated by the prioritization algorithm, the tool provides interesting insights. In Kodiak’s case, the dashboard helped the company validate its decision to make Dallas/Fort Worth its initial base of commercial operations. (See Exhibit 3.) The tool showed that Dallas/Fort Worth has the highest Class 8 truck volume in the country. Many of the highest-ranking routes identified by the dashboard had Texas as an endpoint, including intra-Texas routes such as Dallas/Fort Worth to Houston, Austin, and San Antonio, as well as interstate routes including Dallas/Fort Worth to Atlanta and to Los Angeles.

The tool also confirmed Kodiak’s belief that Atlanta has strong potential to serve as a future autonomous trucking hub based on scores for routes originating or ending there, as well as the linkages it provides to other important hubs along the eastern seaboard.

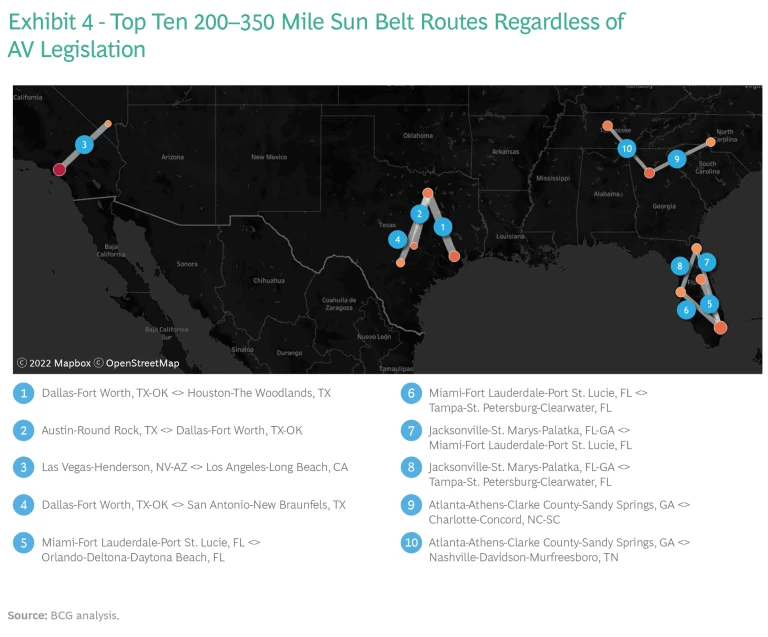

By focusing our analysis on Sun Belt routes that are 200 to 350 miles long (regardless of AV legislation status or congestion), Dallas/Fort Worth–Houston emerges as the top priority route, with Dallas/Fort Worth–Austin and Los Angeles–Las Vegas rounding out the top three. Looking deeper into the ranking, we see Dallas/Fort Worth as an endpoint in the fourth ranked route, connecting to San Antonio, Texas. There are also some clusters of geographic routes in Florida and out of Atlanta among the other top-ten routes in this category. (See Exhibit 4.)

Unlocking the Full Potential of AVs on Longer Routes

Looking ahead, one of the best business cases for autonomous trucking involves the vehicles’ ability to improve asset utilization dramatically and operate on routes that human drivers cannot complete in a single day. Currently, Federal Motor Carrier Safety Administration rules specify that a long-haul truck driver in the US can only drive for 11 hours (and work for 14 consecutive hours after coming on duty) before they have to stop and rest for at least 10 consecutive hours off duty. European Commission rules on mobility and transport are even more strict, with drivers typically capped at a maximum of 9 hours of driving per day and 90 hours total within a 14-day period.

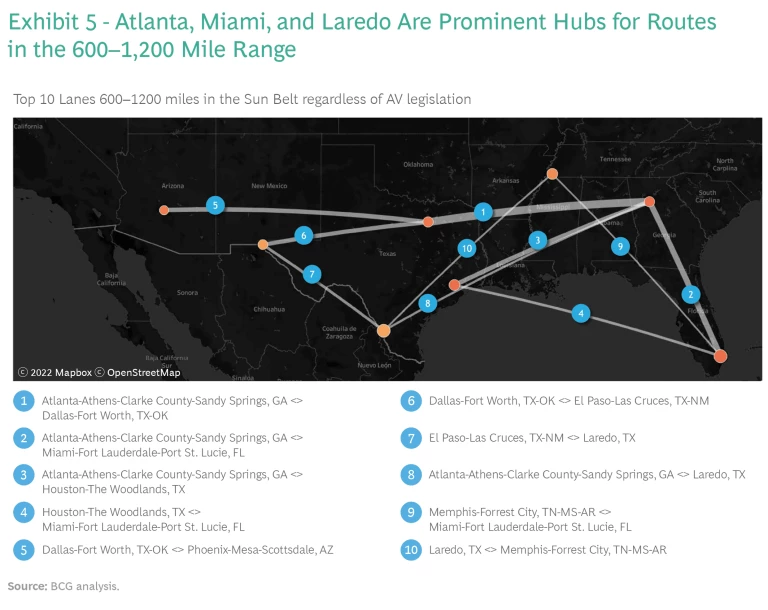

Longer routes that exceed hourly restrictions for human drivers are going to be most relevant for autonomous trucks. Looking at all routes between 600 and 1,200 miles, the dashboard shows that the top three most promising Sun Belt routes regardless of AV legislation or congestion operate through Atlanta (Atlanta–Dallas/Fort Worth, Atlanta–Miami, and Atlanta–Houston). Additional routes in the top ten highlight connections with critical intranational distribution hubs (Dallas/Fort-Worth and Atlanta), international port cities (Miami and Houston), and border cities (Laredo and El Paso). Congestion may be a concern with several of these hubs, but all provide a high density of truck stops and warehouses to support autonomous trucking operations. (See Exhibit 5.)

In addition to driving further than humans can drive without needing to stop and rest, an autonomous truck theoretically can operate around the clock—except for essential stops when human drivers would step in to help with maintenance, refueling, and loading and unloading cargo. Thus, AV trucks not only would allow fleet managers to reduce labor costs and deliver goods faster, but would also enable companies to achieve far more gross tonnage freight miles with the same fleet or potentially fewer trucks.

Indeed, Kodiak has already demonstrated the potential for autonomous trucks to improve utilization by running them on the Dallas to Atlanta route through a partnership with U.S. Xpress, one of the largest truckload carriers in the country.

Exploring Potential Opportunities and Benefits of Autonomous Trucking

While autonomous trucks will not completely replace human drivers anytime soon, they do promise to ease the labor shortage by taking on the grueling job of transporting freight long distances on interstate highways. Human drivers will most likely focus on handling the first and last miles of the route. This will allow drivers to get home every night, which should go a long way toward making it easier to retain current drivers and recruit new ones.

Autonomous vehicle technology has been the subject of much research over the past decade. Studies project that autonomous trucks will offer major benefits, particularly in terms of solving labor shortages and reducing total cost of ownership for long-haul fleet operators.

To realize these benefits and get the most value from AV trucks, it makes sense for companies to start planning which routes make the most sense for expanding their operations. Tools like the BCG GAMMA dashboard can help players identify the top AV trucking routes to prioritize—both in the current pilot phase and when taking the industry to scale—to capitalize fully on the promise and potential of autonomous trucking.