For telecom operators, the cloud does double duty, sparking both efficiencies and opportunities for growth. But will it also be a double-edged sword? By shifting their data and processes to the cloud, telcos open the door to faster, more flexible ways of working. By developing cloud-based products, they can pursue—and seize—new revenue streams. But as the cloud’s role grows, cloud providers become better positioned to get in on the action. How can telcos unleash rewards, not rivals?

This year’s telco IT benchmarking (TeBIT) study, jointly developed by ETIS—The Community for Telecom Professionals—and Boston Consulting Group, looks at the path telcos are taking as they embrace the cloud and deepen relationships with cloud providers. It finds telcos in wide agreement that they have landed on an enabler for growth. What they haven’t landed on—yet—is the optimal strategy: both to speed their cloud journey and to ensure that today’s partners aren’t tomorrow’s competitors. (See “About the TeBIT Benchmark”)

About the TeBIT Benchmark

Collaboration is a key component of TeBIT; the goal—as it is with ETIS working groups and community gatherings—is to identify, and even shape, the best practices that can help telcos better serve customers in a rapidly changing world. In return for allowing themselves to be compared with other telcos, participants can access a full set of benchmark results, along with further trend analysis.

Accelerating Transformation

Telcos played a crucial role in helping the world adapt—and stay connected—during the pandemic. Video conferencing, online transactions, digital ecosystems: they kept businesses and society resilient. And as new ways of interacting have grown into standard ways, telecom services have grown, too. On average, ETIS members saw a 2.6% increase in revenues in 2021, a turn north from the 0.8% drop the group recorded in 2020. Yet EBITDA margin—an indicator of how well telcos are managing costs and efficiency—has not grown in step. A prime culprit: legacy technology.

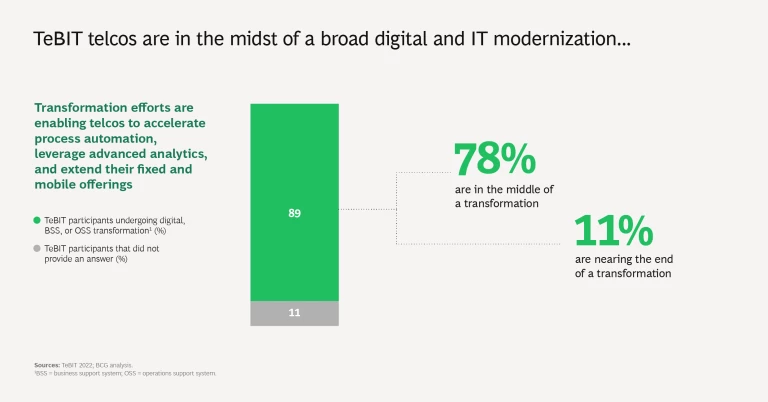

For telcos, this isn’t a news flash. One of the key motivators for transformation has been to shift to more flexible, scalable, and efficient ways of working. By modernizing their IT, telcos can accelerate process automation, better leverage data and analytics, and take advantage of emerging technologies and business models. And they’re well on their way: 78% of TeBIT participants are in the middle of a digital transformation, business support system transformation, or operations support system transformation. Another 11% are even further along, nearing the end of their transformations. If these efforts pay off, telcos can hit the trifecta of boosting revenues, lowering costs, and improving efficiency.

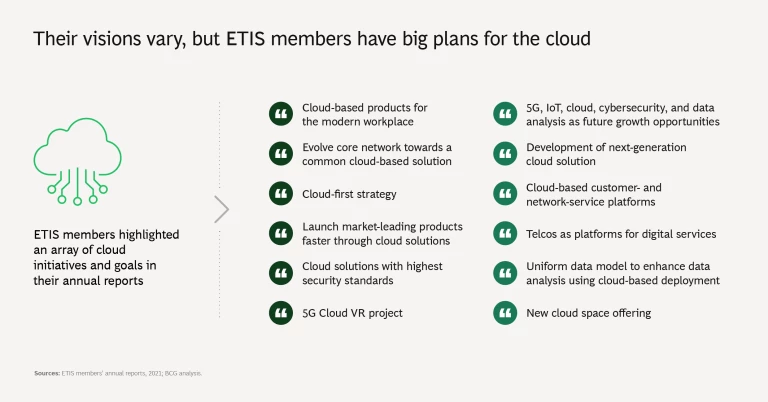

Increasingly, telcos see the cloud as the special sauce that makes their transformations come together. ETIS members’ annual reports spotlight an array of cloud initiatives and goals: new cloud products, cloud-based customer- and network-service platforms, cloud-first strategies—the list goes on. The cloud lets telcos more easily access their data, scale the services they use (or sell), and put advanced analytics and automation to use—for example, to predict and prevent service incidents and to support customers as they choose from, and use, the telco’s offerings.

Telcos see the cloud as the special sauce that makes their transformations come together.

With success stories spanning industries, there is no question about the efficiency and effectiveness of the cloud. The question is how efficiently and effectively telcos are embracing it. This year’s TeBIT analysis uncovered some surprises, some potential pitfalls, and some ways, perhaps, to smooth the journey.

A Slow Migration

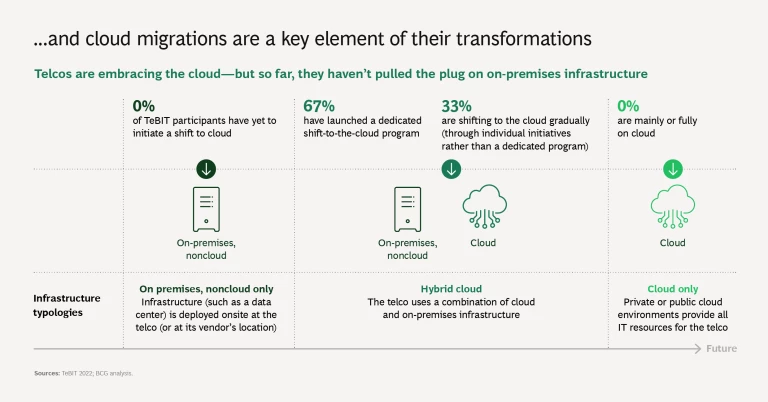

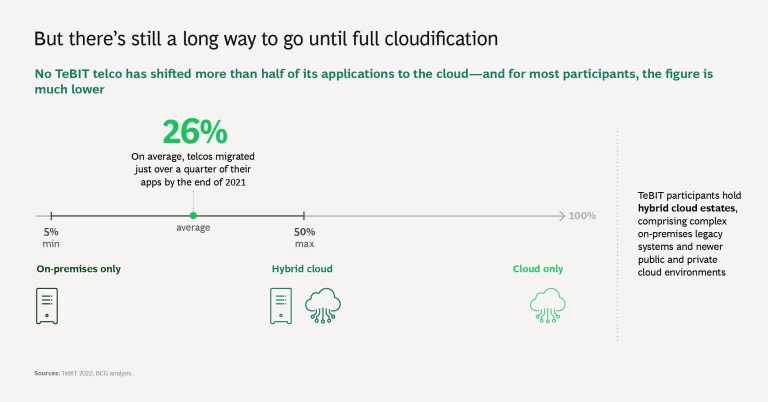

One surprise is where telcos are in their cloud journey. While 75% of TeBIT participants have initiated a shift to the cloud since 2019, most are still, in practical terms, in the early stages. On average, telcos migrated just 26% of their applications by the end of 2021, and no participant crossed the 50% mark. Why the holdup? One explanation is—again— telcos’ legacy IT landscape. With a broad variety of interdependencies and often layers of customization added over the years, it‘s a natural bottleneck. Moving applications from a legacy environment to a cloud platform is taking time.

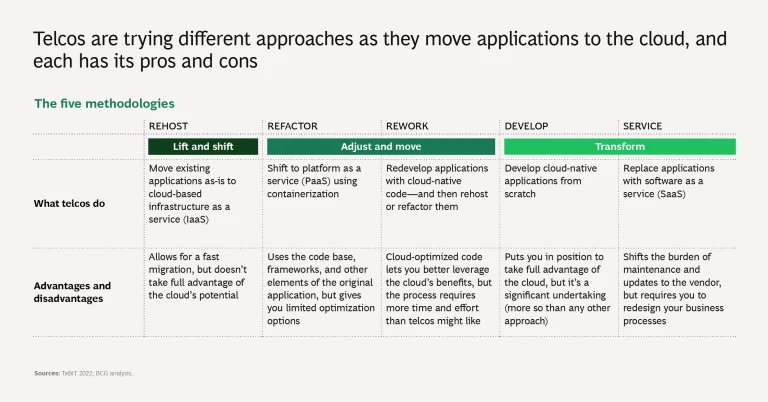

But maybe telcos could pick up the pace. Typically, there are five ways to shift a legacy application to the cloud: rehosting (lifting an application “as is” and deploying it on the cloud); refactoring (adjusting and then moving the application); reworking (redeveloping the application with cloud-native code and then rehosting or refactoring); developing cloud-native applications from scratch; and replacing a legacy application entirely with a software-as-a-service (SaaS) solution. Each of these approaches has its pros and cons. Rehosting, for example, means a fast migration, but it typically leaves you with software that doesn’t take full advantage of the cloud’s potential. Developing from scratch, by contrast, can realize that potential but it’s a significant undertaking.

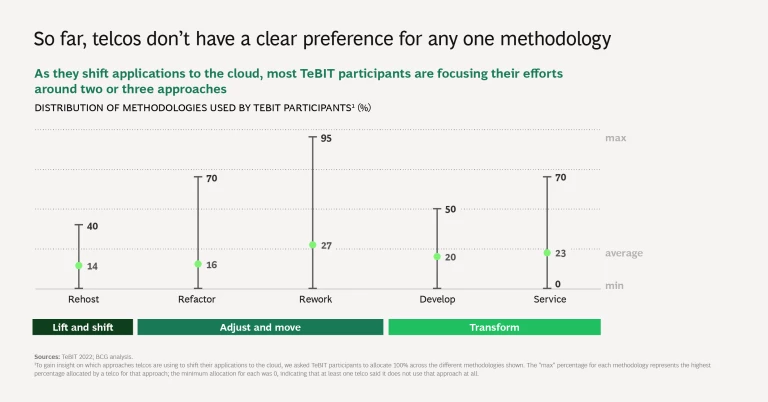

Overall, telcos don’t seem to have a clear preference for any one method. Yet we did see some patterns. The participants that are most advanced in their cloud migrations tend to rework their existing applications or develop all-new ones. Telcos that are just beginning their migrations, meanwhile, typically employ the full range of methodologies—in effect, trying them all. This suggests that telcos just starting their migrations might want to follow a more focused playbook—centered around the methodologies favored by the early adopters.

A Shift but Not a Strategy

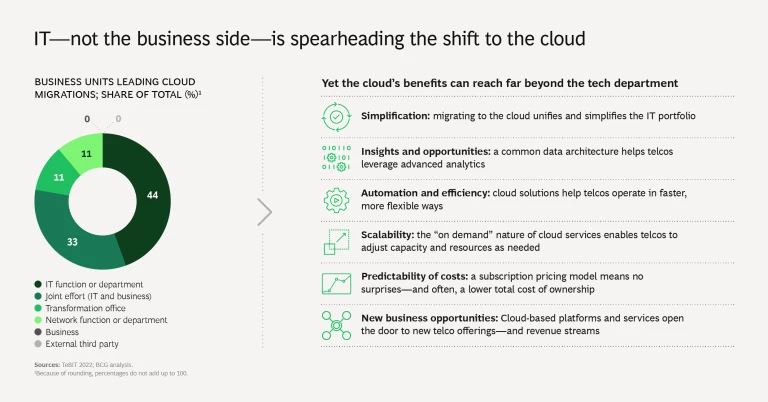

App migration is important, but telcos also need to think about where, and how, the cloud can trigger growth. That means applying a strategic mindset to the cloud. Throughout the study, we saw evidence of participants taking more of an ad hoc approach rather than looking at the big picture. Case in point: while 44% of cloud migrations have been led by telco IT departments, just 33% percent have been spearheaded jointly by IT and the business side. One could argue that it makes sense that IT is leading the charge: the cloud can simplify the IT landscape and trigger greater efficiency in operations. But those benefits are just part of what the cloud offers.

Tech + Us: Monthly insights for harnessing the full potential of AI and tech.

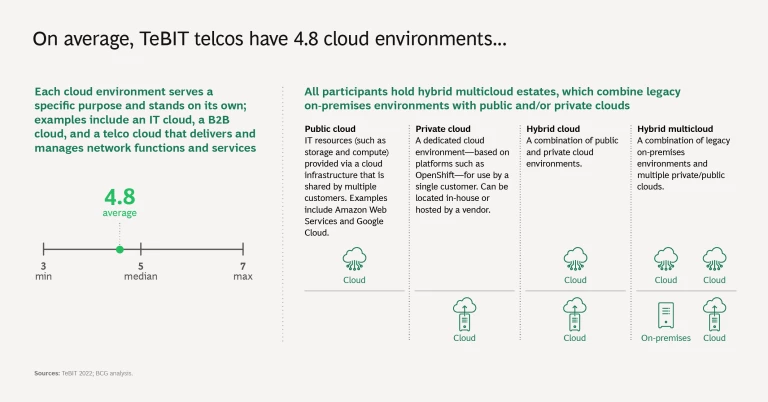

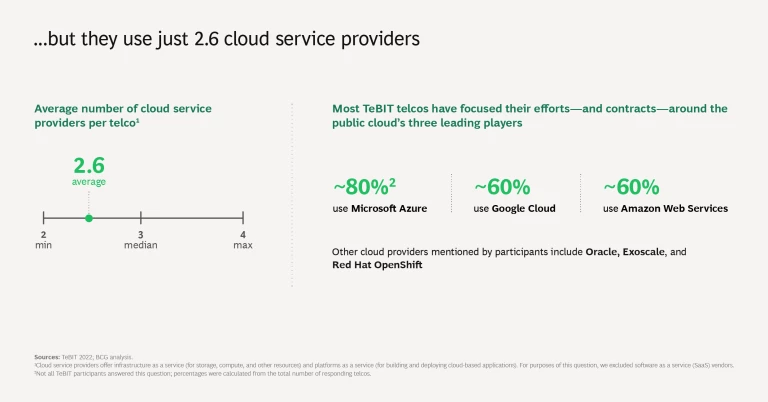

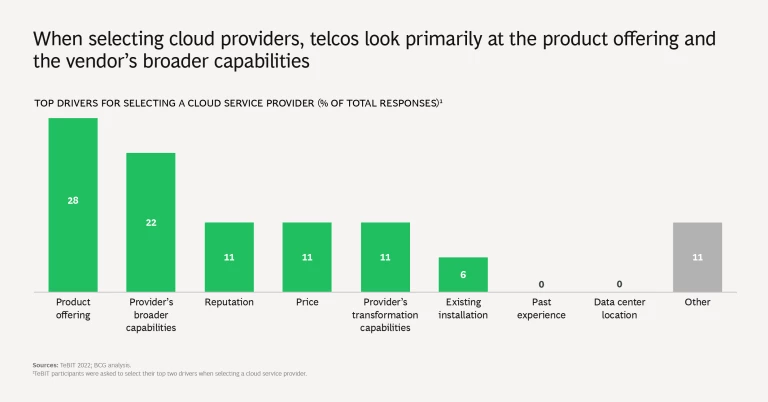

Similarly, telcos appear to be taking an opportunistic approach in how they leverage their cloud partners. On average, TeBIT participants use 2.6 cloud providers (not including SaaS vendors). The most common platforms are Amazon Web Services, Google Cloud, and Microsoft Azure. When selecting a provider, the two main drivers are the product offering (say, the ability to store data, perform analytics, and add other functionality right away) and the provider’s broader capabilities (such as helping with migration, data cleansing, or streamlining processes to boost efficiency).

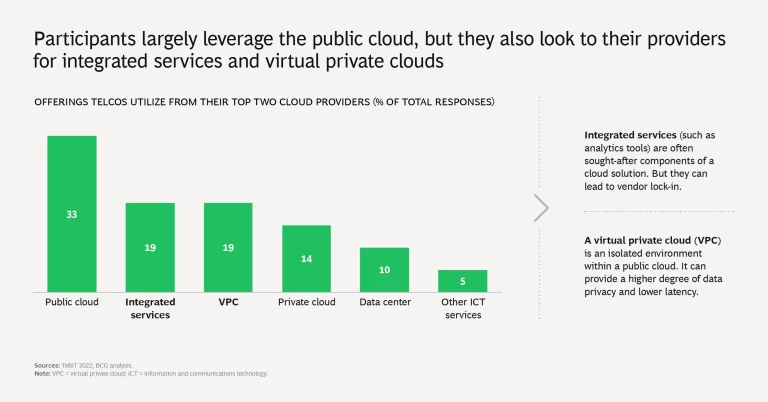

This aligns with the mixed use telcos tend to make of their platforms: on average, participants leverage each of their cloud providers in five ways. But we didn’t see a clear pattern, no “must have” capabilities that everyone is embracing. Instead, the uses—which include infrastructure services (such as compute, storage, and backup), business support systems, data and analytics, and reselling—vary from one telco to another.

All of this supports the notion that telcos are still looking for the optimal way to move to the cloud. There’s no magic bullet, no consensus on what works best. Everyone is taking their own approach. And those approaches—for now, at least—focus more on individual waypoints than the overall journey. This, too, is a familiar theme. In last year’s TeBIT report, we saw that participants were prioritizing and investing in digital transformations but missing an end-to-end view of how to optimize the tools—and the results. Telcos need that holistic perspective when it comes to the cloud as well.

Sparking Growth—or Competition?

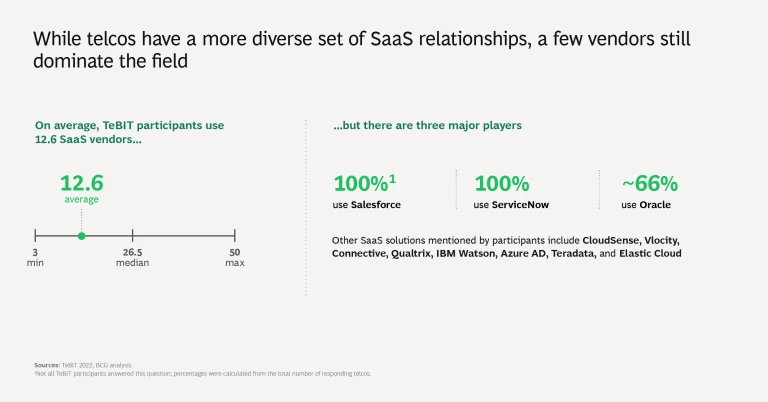

While telcos work with a small number of global cloud service providers, they use a wider array of SaaS vendors: 12.6 on average (though the number ranged widely, from 3 to 50, across TeBIT participants). This finding wasn’t unexpected, as SaaS solutions offer specific functionality and fast migration paths. But two SaaS solutions stand out: 100% of participants use both Salesforce (for customer relationship management as well as marketing and sales) and ServiceNow (for service management).

Subscribe to our Artificial Intelligence E-Alert.

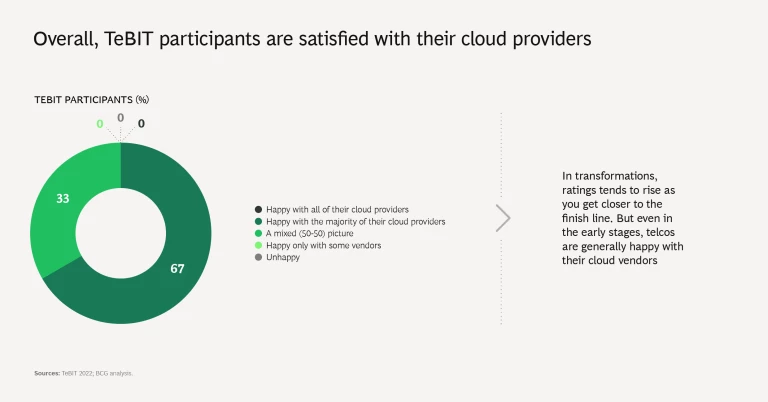

Overall, telcos expressed satisfaction with their cloud providers: 67% said they were happy with the majority of their vendors, while the rest said the picture was mixed, closer to a 50-50 split. Tellingly, no participants said they were happy with just a minority—or none—of their vendors. That’s significant, as one lesson from transformations is that satisfaction tends to rise as you get closer to the goal line. By then, you’ve worked out many issues and are starting to see a payoff. So it bodes well that telcos are generally happy now, when there is still a way to go.

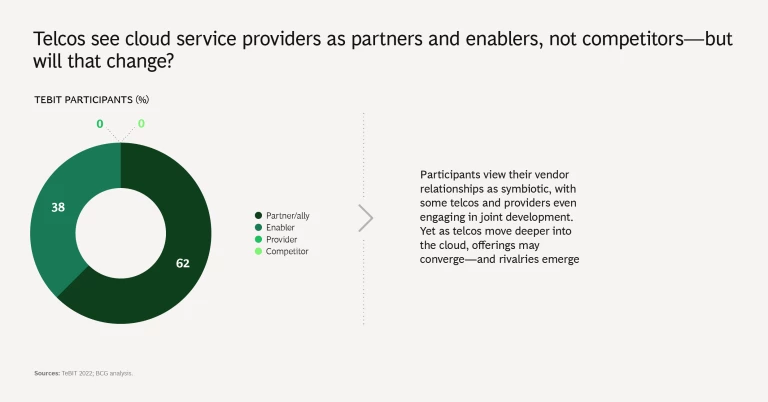

The bigger question is what the future holds for the relationship between telcos and vendors—especially the large global cloud service providers. Right now, telcos tend to view that relationship as symbiotic: 62% of TeBIT participants perceived cloud service providers as partners and allies (involved in decision making, in some cases even jointly developing cloud-based services); the rest saw them as enablers (providing the capabilities and functionality that let telcos harness the power of the cloud). Notably, none viewed their vendors as competitors.

But is this a marriage for the ages, or one of convenience? As telcos simultaneously embrace the cloud and diversify their portfolios, the lines may blur between their offerings and those from cloud providers. (Indeed, some telcos are already reselling products such as cloud storage.) This has the potential to spark competition between telcos and their cloud partners, particularly in emerging areas such as edge computing and the Internet of Things .

A face-off wouldn’t be unprecedented. Cloud providers now dominate data-center services—an area where telcos had made the early inroads. And they’re not likely to cede promising new markets. Cloud providers are agile and, as they’ve proven time and again, can respond quickly to evolving needs and opportunities.

Telcos and their cloud partners could become competitors in areas such as edge computing and IoT.

There’s the potential, too, for competition even in telcos’ traditional business. Increasingly, core network capabilities (such as traffic management) and value-added services (such as industry-specific 5G solutions ) can be handled through software instead of dedicated hardware installed across the telco’s network. This lowers the entry barriers for cloud providers looking to offer similar—or identical—services.

Telcos need to consider these vulnerabilities and take steps to minimize the risk. This starts by making the most of their own strengths: infrastructure ownership and control over the network; end-customer access; and the ability to provide customization and individualized service. Utilizing these advantages, telcos can develop unique capabilities and differentiators. And they can strike the right balance in their cloud partnerships—one that brings growth, not competition.

The authors thank Coralie Ming for her assistance with data assessments, modeling, and analysis.