The US can build a durable competitive advantage in clean technologies and generate significant economic benefits in the process—creating jobs, achieving national energy security and sustainability goals, and catalyzing the global adoption of key green solutions. The opportunities and challenges differ from one set of technologies to the next, however, and they will require different approaches, according to Two Paths to US Competitiveness in Clean Technologies , a new BCG report which expands upon a previous study into US competitiveness in clean tech. Both reports were commissioned by Breakthrough Energy and Third Way.

Here’s what our latest report found:

- Two mature clean technologies—solar photovoltaic (solar PV) and offshore wind—are key to decarbonizing energy systems worldwide. In the US, they will account for more than 40% of power generation by 2050, according to the International Energy Agency (IEA). Unfortunately, the US has already ceded leadership in these technologies to foreign companies in both the international and domestic markets. Even so, a narrow path still exists for US players to recapture the domestic market—strengthening US energy security, boosting domestic manufacturing capabilities, and making supply chains more resilient.

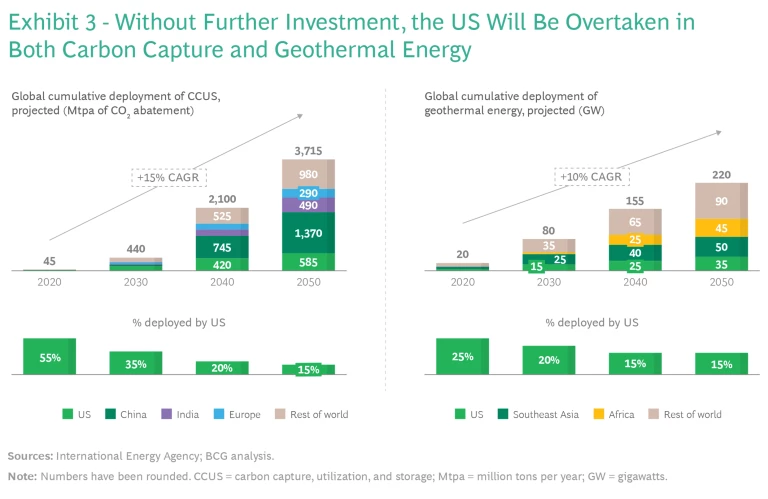

- Geothermal energy and carbon capture, utilization, and storage (CCUS), in contrast, are emerging technologies with huge growth potential. Geothermal technology can be an important source of clean, dispatchable power that can be used to balance supplies from variable renewable energy sources. It can also enable the domestic production of critical minerals, such as lithium, and provide zero-carbon heat for industrial processes. Meanwhile, CCUS is emerging as a vital solution for decarbonizing hard-to-abate sectors. The US is a global leader in these two technologies; still, it needs to take steps to unlock domestic deployment to ensure it stays ahead of foreign competition and both catalyzes and captures global demand.

Tax credits and other financial incentives in the Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act (IIJA) have provided significant support for US investment in these technologies—in some cases making domestically manufactured systems substantially cheaper than imports.

However, for the US to achieve strong market positions across all four technologies, policymakers and companies must build on this recent legislation. They should take targeted actions that support the varying needs of these technologies, including tackling infrastructure bottlenecks, streamlining permitting processes, and accelerating investment plans.

The Market Opportunity for US Players

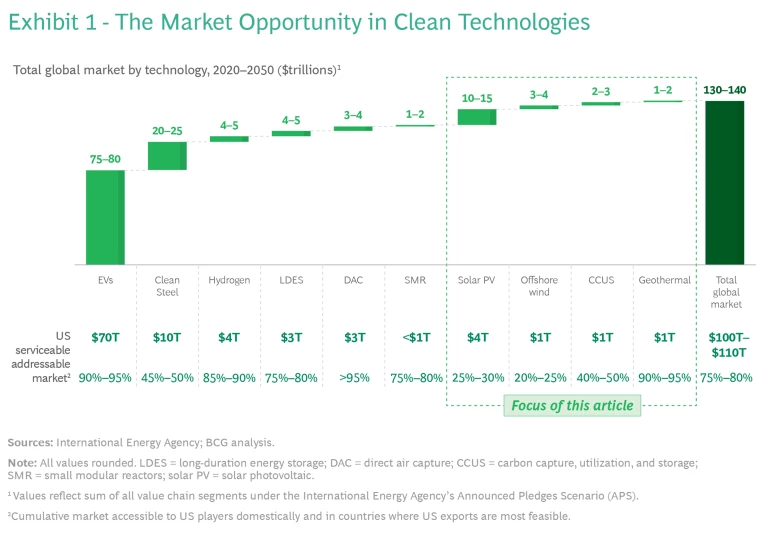

Our analysis of these four technologies builds on our previous report, which examined the market opportunity for US companies in six complementary technologies : electric vehicles, clean steel, low-carbon hydrogen, long-duration energy storage, direct air capture, and advanced nuclear small modular reactors. For each of the ten technologies, we examined the market opportunity available to the US and its current competitive position at a value-chain level. This allowed us to identify specific areas where the US would benefit most from building a strong presence.

We estimate that the global market for all ten technologies could total $130 to $140 trillion between now and 2050. Of this figure, the serviceable addressable market (SAM) for US companies—in other words, the cumulative market for these technologies domestically and in countries where US exports are most feasible—could be worth $100 to $110 trillion over the same time period. The ten technologies could also avoid or capture about 30 gigatons per year of greenhouse gas emissions by 2050, equivalent to nearly 60% of total annual emissions worldwide. (See Exhibit 1.)

Our market projections are based on the IEA’s Announced Pledges Scenario (APS), which assumes that governments will meet their current emission reduction commitments in full and on time. This scenario is the most likely of three IEA emission reduction outlooks (the other two being stated policies and net-zero emissions).

Within the US, we estimate that the domestic market for US companies in solar PV, offshore wind, geothermal and CCUS—the focus of this report—could be worth a combined $3 to $4 trillion between now and 2050 and create up to 800,000 new US jobs, roughly equal to the chemical manufacturing industry’s current US workforce. They could also generate $25 to $30 billion for the US in annual export revenues in 2050, which is about the size of US grain exports in 2020. Because the opportunities and challenges of these four technologies differ, we have divided them into two separate groupings.

Solar PV and Offshore Wind

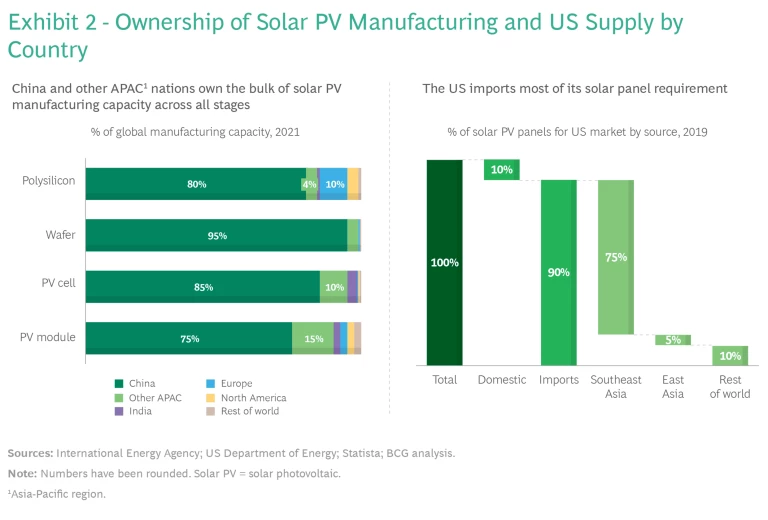

Today, foreign companies dominate global solar PV and offshore wind markets, including that of the US. Over 85% of solar PV manufacturing capacity belongs to lower-cost competitors in China and Southeast Asia; while in offshore wind, the European Union, the UK, and China are responsible for over 95% of manufacture and installations. The US, by comparison, imports around 90% of solar panels and its domestic offshore wind capacity is negligible compared to Europe and China. (See Exhibit 2.)

Increased political will in the US and recent legislation are set to change that. Provisions in the IRA will make domestically produced solar panels up to 30% to 40% cheaper than imported ones, reducing the costs of generating solar energy and supporting a significant expansion in deployment. Similarly, IRA provisions support the domestic manufacturing of offshore wind components and address supply chain bottlenecks through funding for port upgrades and installation vessels. These measures are designed to help the US achieve the Biden administration’s goal of creating 30 gigawatts of offshore wind capacity by 2030, putting the US on par with leading countries.

By developing its own domestic capabilities in these two areas, the US can meet growing demand at home and serve a small number of nearby export markets. (As shown in Exhibit 1, we estimate that the proportion of the global market accessible to US players is 25% to 30% for solar PV and 20% to 25% for offshore wind, below other clean technologies.) To seize this opportunity, US players should start by targeting those areas that offer the greatest potential.

Areas to Prioritize for Solar PV. According to our analysis of the solar PV market, solar manufacturing, polysilicon production, and project development should be priority areas for the US, based on the possible market size of these areas and the competitive advantages they offer.

- Solar PV Manufacturing. Building domestic manufacturing capabilities is essential if the US is to avoid disruption from shocks to highly concentrated overseas supply chains. It also gives the US an opportunity to regain a leadership position in intellectual property (IP) and technical innovation.

- Polysilicon Production. Chinese tariffs on US polysilicon exports have caused US companies to mothball plants, cutting the US’s share of global production capacity to just 5%. As the US creates its own manufacturing capabilities in solar PV, domestic demand for polysilicon will grow rapidly, enabling players to restart plants, add new capacity, and create resilient domestic supply chains for key inputs.

- Project Development. Owing to supportive policies and the US’s favorable natural conditions, domestic developers have built significant experience in utility-scale solar projects and control about 75% of the domestic market. US developers can use that expertise to develop projects in fast-growing overseas markets.

Areas to Prioritize for Offshore Wind. In offshore wind, we believe the US should prioritize component manufacturing, engineering, procurement, and construction (EPC) and operations and maintenance (O&M). Each area offers a sizeable market opportunity where the US can develop a durable competitive advantage.

- Component Manufacturing. The US has no plants making offshore wind components today because of high upfront capital costs. Despite this, the expense of importing monopiles (foundations) and similar large components incentivizes the US to produce components domestically and potentially export to regional markets. Further, new floating turbine technology gives the US an opportunity to gain a technical leadership position in a nascent area with significant domestic and global potential.

- EPC. The US’s significant experience in offshore oil and gas projects provides it with transferrable skills for building wind turbines for domestic developers and players in nearby markets.

- O&M. Access to skilled localized labor and IRA support for constructing specialized equipment provide US O&M players with an advantage in delivering traditional services domestically. But by developing automated solutions and advanced software applications, they could make O&M more cost effective and capture additional export sales.

Key Steps for Building Competitive Advantage. IRA and IIJA incentives help to tackle the significant cost issues that have prevented US companies from competing effectively against foreign competitors in solar PV and offshore wind markets. But policymakers and companies need to address structural challenges to maximize the potential benefit from these incentives and improve long-term competitiveness. Here are our top measures for urgent action in these markets:

- Offset high domestic manufacturing costs. By rapidly capturing economies of scale, by innovating, and by increasing automation in legacy manufacturing processes, companies can help offset the US’s high energy and labor costs.

- Tackle shortages of skilled labor and expertise. Both companies and policymakers can improve the availability of skilled labor by developing workforce training programs, introducing supportive immigration policies, and retraining workers who have relevant traditional skill sets.

- Improve transmission interconnection and planning processes. To enable deployment, new solar PV and offshore wind farms need to be connected to the grid in a timely manner; sufficient grid capacity is required, and the cost of infrastructure updates must be allocated fairly and transparently. To achieve these goals, regulators must urgently reform connection-related processes, including cost allocation, and streamline permitting for electricity transmission.

Geothermal Energy and CCUS

The US is currently a global leader in geothermal energy and CCUS. While global deployment of these two solutions is limited today, technical innovations, cost reductions, and favorable policies are likely to accelerate the use of both technologies. The US can build on the impetus created by IRA and IIJA legislation, using techniques from the domestic oil and gas industry and its own technological prowess, to strengthen its leadership position in geothermal energy and CCUS, catalyze demand, and capture export revenues.

Geothermal energy stands at an inflection point, with new technical developments set to transform it from a niche to a central decarbonization solution. As well as providing clean heat and power, geothermal wells could be an important source of lithium and other valuable minerals, creating additional opportunities for US players. However, the US will need to invest in new geothermal approaches to maintain its lead over competitors in East and Southeast Asia.

The US faces similar challenges in CCUS. Domestic deployment in China and other large economies is expected to overtake that of the US unless it builds on its first-mover advantage by investing in next-generation capture techniques and strengthening access to foreign markets. (See Exhibit 3.)

Areas to Prioritize for Geothermal Energy. According to our analysis, project development, EPC, and advanced equipment manufacturing are priority areas for the US to build a durable competitive advantage in geothermal energy.

- Project Development. Using the transferable expertise of its domestic oil and gas players, the US can build a durable, defendable competitive advantage in project development, the largest value chain segment by potential market value and the one with the most technical complexity.

- EPC. The US is well positioned to be a global leader in EPC because its players are experienced at delivering customized projects that meet specific geological and technological requirements.

- Advanced Equipment Manufacturing. As global demand shifts from mature to emerging techniques needed by developers to drill deeper, tap new kinds of wells, and extract minerals, US players can use their strong R&D capabilities and IP to secure a leadership manufacturing position at home and abroad.

Areas to Prioritize for CCUS. We’ve identified EPC, project development, and equipment and chemical manufacturing as priority areas for the US to build a durable competitive advantage in domestic and export markets for CCUS.

- EPC. Players in the US can build a significant competitive advantage because of their ability to deliver the high levels of quality and reliability needed when deploying CCUS with refineries and power plants, as well as when building large-scale CCUS-related infrastructure such as CO2 pipelines and storage.

- Project Development. Due to the complexity of managing CCUS projects, there is no one business model for developers today. This enables US players to become market leaders by moving first, creating a track record of success, and building relationships across the value chain.

- Manufacturing. The high costs and energy usage currently required to make solvents and sorbents for capturing CO2 emissions give the US an opportunity to use its strong R&D capabilities to create cheaper solutions and win market share.

Subscribe to our Climate Change and Sustainability E-Alert.

Key Steps for Building Competitive Advantage. Recent legislation makes many more CCUS projects commercially viable in the near term. It also marks a significant and positive shift in how policy makers treat geothermal energy. However, additional steps are needed in several areas to prevent other countries from seizing the US’s position as global leader. Here are key areas for urgent action:

- Commercialize and demonstrate innovations. Policymakers should initiate and fund demonstration projects and commercialization initiatives for new game-changing techniques, such as enhanced geothermal systems. Such measures will help improve project economics and encourage faster adoption.

- Share geological data. By sharing information about subsurface formations between government agencies, geothermal companies, and oil and gas players, the US can identify sites for geothermal development and CCUS storage more effectively.

- Reduce regulatory uncertainty. Complex issues relating to subsurface liabilities and ownership of the pore space in geological formations threaten to increase risks and add delays to CCUS projects. Policymakers can help solve these problems by establishing a single agency for resolving disputes, setting liability caps, and creating rules that govern pore-space ownership.

The Importance of Enablers

In addition to the technology-specific actions examined above, several enablers will be important across all four technologies to accelerate deployment, drive down costs, and permit US players to benefit from the lessons learned during development. On the demand side, these include actions that boost demand for green technologies, either through incentives that reduce their cost or disincentives that raise the cost of greenhouse-gas-emitting alternatives. As policymakers address how IRA and IIJA provisions will work in practice, we expect to see greater clarity on the use of both these measures—for example, through more details on which players qualify for various solar-PV or offshore-wind tax incentives.

On the supply side, the enablers include actions that allow US players to boost competitiveness by building economies of scale. By streamlining burdensome permitting processes, for example, policymakers can facilitate the development of CCUS hubs, which allow permitters to reduce the expense of deployment by sharing infrastructure, and geothermal wells on greenfield sites. Similarly, through targeted research, investing in demonstration and commercialization initiatives, and by rebuilding domestic manufacturing capabilities, the US can maintain its global leadership position in IP and innovation—another important supply-side enabler (See Exhibit 4.)

The market opportunities available for the US in solar PV, offshore wind, geothermal energy, and CCUS differ significantly. US players have a chance to reclaim the domestic market in solar PV and offshore wind, while in geothermal and CCUS technologies they can maintain a leadership position not just at home but globally. The incentives included in recent legislation are an essential first step to boost US competitiveness in all four. But policymakers and companies need to go further. They need to focus on those areas of the value chain with the greatest potential and use a mix of targeted actions and more general enablers to fully unlock the opportunities ahead.

Click here to see Third Way’s materials on this effort, along with the complete appendix for the report.