It may have taken well over a century for the new science to morph into a disruptive technology, but having done so, synthetic biology (syn-bio) is evolving faster than life itself. Just as chip design altered computing in the last century, syn-bio is transforming biology into the manufacturing paradigm of the future. Consequently, business is having to crawl and run at the same time, trying to come to grips with the technology even as it figures out how to develop syn-bio applications and craft the right strategies to compete in a fast-changing industry. (See the sidebar, “The Drivers of the Synthetic Biology Age.”)

The Drivers of the Synthetic Biology Age

The Drivers of the Synthetic Biology Age

The rise of new syn-bio tools and techniques has transformed the field. Technological advances—such as nanoliter scale screening and microfluidic technologies—have helped create new DNA combinations, reduced DNA-editing costs, and increased the lengths of DNA strands that can be built. Cell-free biology too has advanced, allowing companies to use metabolic cell processes that don’t need live cells and make testing faster.

Syn-bio hardware has become faster. As a result, the cost of reading DNA has fallen by over 300% since 2007, outpacing even Moore’s Law of computing power. The cost of writing DNA too has shrunk, from about $4 in 2004 to between 5 and 10 cents per base pair in 2021. Moreover, the new technologies are becoming widely available. A 2019 Nature paper projected that by 2030, new syn-bio technologies are likely to become available to even organizations with low technical skills and limited financial resources.

As syn-bio becomes more granular, its convergence with digital technologies, such as AI, has provided a fillip to its evolution. By using AI, syn-bio scientists have been able to develop a better understanding of the relationships between biomolecular structures and their functions, enabling them to design novel biomolecules.

Because of advances in precision fermentation, syn-bio is moving out of labs into the world of business. As companies step up the use of syn-bio to create novel products, the technology is helping to develop new raw materials, new products, and new processes. In the next ten years, syn-bio could affect sectors that will account for as much as $30 trillion, or nearly a third, of global GDP, according to our studies, especially in sectors such as chemicals, cosmetics, dyes, food grains, foods, leather, pharmaceuticals, and textiles. An industry of science-based startups has sprung up globally, each trying to alter conventional products and processes to transform the world sustainably.

Naturally, investors have realized the lucrative prospects of investing in syn-bio startups. A recent report by SynBioBeta, a global industry organization, estimated that syn-bio startups raised nearly $18 billion in 2021—almost as much as they did in the 11 years between 2009 and 2020

Syn-bio’s swift evolution may bode well for the science, but it increasingly presents a challenge for incumbent companies’ CEOs, many of whose industries are likely to be disrupted and are only slowly waking up to the challenges they face. By 2030, syn-bio applications are poised to transform industries that contribute as much as a third of global GDP today.

Excited by the possibilities but anxious about the competition, several incumbents have been trying to invest in syn-bio. However, without understanding the industry’s structure and the competitive landscape, it’s tough for them to know if they’re making the right decisions. To tackle this challenge, it’s useful to use the conceptual device of an industry stack—that is, to think of the syn-bio industry as a set of technologies that can be combined and scaled to build applications.

Syn-bio’s swift evolution presents a challenge for incumbent companies’ CEOs, many of whose industries are likely to be disrupted.

A syn-bio industry stack provides a deeper understanding of the context in which incumbents have to frame strategies. It also enables business leaders to better understand the types of syn-bio firms that have emerged either as potential rivals or partners and to anticipate the ones that will do so in the future. That will help business leaders craft strategies that will allow them to reap the most benefits and avoid many risks. By using a decision tree that we’ve created, incumbents will also be able to identify how to develop the capabilities they will need and develop dynamic strategies that will align with the emergent shifts in the industry.

Doing so is more important than many assume. Consider, for example, the fact that by April 2022, the German pharmaceuticals and chemicals giant Bayer AG had sold its West Sacramento (California) biologics research facility to the Boston-based syn-bio firm Ginkgo Bioworks. Just five years earlier, the incumbent and the startup had entered into a joint venture to develop nitrogen-replenishing microbes that would substitute nitrogenous fertilizers. However, as Bayer grappled with the changes in the syn-bio industry, it decided to shift strategies instead of persisting with one that had outlived its usefulness.

BCG Henderson Institute: Discover new thinking shaping the business landscape

Rather than staying Gingko Bioworks’ R&D partner, Bayer has chosen to become the anchor customer that will take to market all the agriculture-related syn-bio applications that Ginkgo Bioworks develops tomorrow in areas such as crop protection, nitrogen fixation, and carbon sequestration. This new relationship will allow Bayer, which operates in a variety of industries, to reduce risk and engage with other syn-bio firms without worrying Gingko Bioworks. Such forward-thinking and flexible strategies are critical if incumbents aren’t to be left behind in the industry, which is likely to change time and again in the future. Only by deciphering the syn-bio industry stack and decrypting its dynamics can business win the syn-bio future.

Building a Synthetic-Biology Technology Stack

Syn-bio technology will have an impact on business that could be equally disruptive than that of digital technology. Just as digital technologies use a common language of zeros and ones to capture and communicate data, genetic code can be regarded as a language made up of the four nucleotides that form DNA: adenine, thymine, cytosine, and guanine. Changing the digital code alters the type of content; modifying the genetic code changes the very nature of matter.

Syn-bio industry’s structure is best portrayed as a stack of technologies that can be combined and scaled to build a variety of applications.

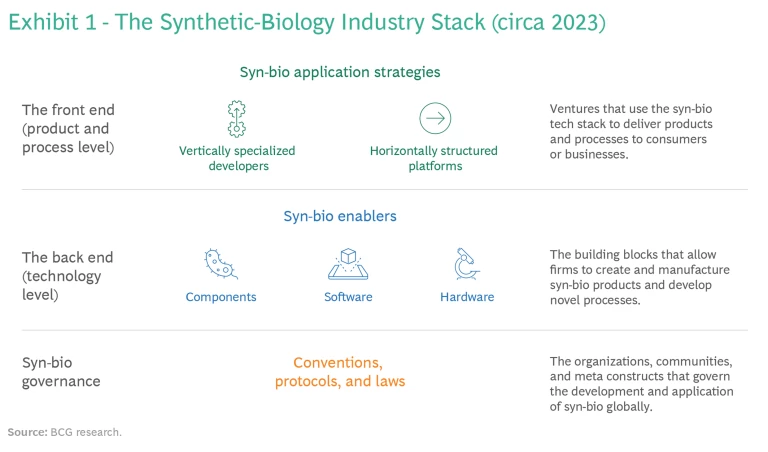

From this perspective, all industries that work with organic matter share a common language. Because of advances in syn-bio, companies in all those sectors will soon find themselves in related businesses, and every corporation will turn into everyone else’s rival. Anticipating that, the syn-bio industry is developing along similar lines to that of the information technology sector. As a result, its structure is best portrayed as a stack of technologies that can be combined and scaled to build a variety of applications. (See Exhibit 1.)

Helpful as the analogy to a tech stack may be, it’s important to keep its limitations in mind. Not only does the analog-and-physical nature of the syn-bio industry present challenges that are different from those of the purely virtual digital world, business’ understanding of syn-bio today is at a different stage than its knowledge of information technology. Consequently, the manner in which the syn-bio technology stack changes over time; the roles that companies can play in the stack; and, above all, how incumbents will gain competitive advantage will differ from the manner in which business responded to digital disruption.

The syn-bio industry stack is currently constituted of two operational levels, according to our research: the back end (or the technology level) and the front end (or the product and process level). Underlying them are meta-level conventions, protocols, and laws that govern scientific research and applications development in syn-bio the world over. (See the sidebar, “The Global Governance of Synthetic Biology.”)

The Global Governance of Synthetic Biology

The Global Governance of Synthetic Biology

Other UN forums are discussing the creation of archives for biological samples as well as genetic data, which could affect the syn-bio industry tomorrow. While several countries, such as India, Malaysia, and Kenya, currently regulate access to genetic sequences from biological samples drawn in their countries, their attitudes could change over time.

Several not-for-profit organizations are designing, developing, and disseminating guidelines for the application of syn-bio by business. Institutions such as the International Genetically Engineered Machines (iGEM) Foundation, BioBricks, and MIT’s Registry of Standard Biological Parts have jointly developed standards for syn-bio parts, or bio bricks, which serve as the infrastructure for an open, commons-based approach. iGEM, for instance, was set up in 2001, and fosters education, boosts competition, and helps cultivate a collaborative and cooperative community. Similarly, the BioBricks Foundation, founded in 2006, supports the open and ethical development of biotechnology, and manages several open-source projects. And the MIT Registry has grown rapidly since its inception in 2003, with the number of parts in its catalog rising from fewer than 1,000 in 2004 to more than 20,000 in early 2023.

Skeptics fear that as business interest in syn-bio grows, startups scale, and investments increase, the current push to democratize syn-bio will change. If the rise of open source in software is any indication, though, these qualms may be misplaced. Digital technologies have successfully developed along two different paths: The closed-source route of proprietary software (exemplified by Microsoft Office) and the open-source world (symbolized by Linux). Similarly, business’ push for a syn-bio commons could be an opportunity, allowing it to access the expertise of a global syn-bio community, gain early access to emerging technologies, and develop value by sharing knowledge.

Still, many consumers will view syn-bio products and processes with suspicion. Business has no option but to participate in the discussions at the global, national, and industry levels about the conventions and protocols that will shape the syn-bio industry’s future as well as the critical role of the syn-bio commons.

Dominating the Back End of the Synthetic-Biology Industry Stack

The back end of the syn-bio industry stack is in a state of rapid evolution. In July 2022, for example, the London-based DeepMind announced AI-based predictions of the structures of around 200 million proteins. In November 2022, Meta’s researchers unveiled the probable structures of around 600 million proteins from bacteria, viruses, and many unclassified microbes. All that data will be made available for free, so researchers can type the name of any protein on a search engine and learn what its structure could be. This will save years of laboratory work and reduce R&D costs across the industry.

More paradigm-shifting changes of this kind are likely in the syn-bio industry, so it’s important for incumbents to stay abreast of the latest technologies. Operating at the cutting edge will demand specialized expertise, and organizations will be able to create new capabilities only by investing a great deal of time and capital. They must start by analyzing the changing nature of the three building blocks of the back-end stack: components, software, and hardware.

Components. These are the physical sections of biological materials that syn-bio firms create and supply to other firms to make manufacture and testing easier. These biological bricks—the equivalents of transistors in the IT industry—consist of several standard components that can be produced in large volumes. Among them are DNA lengths such as oligos and genes; RNA enzymes used in biosynthesis and protein modification; expression hosts such as model micro-organisms; and restriction and ligation enzymes—such as the popular CRISPR/Cas-9—which help scientists read, write, and edit DNA.

The early movers making syn-bio components in bulk, such as Twist Bioscience, are trying to dominate the components market. Their strategy is to become the largest sources of supply of the major syn-bio parts by using economies of scale to deliver components at prices lower than the costs at which incumbents will be able to produce them in-house. Many syn-bio components, such as DNA oligos and genes, are already close to becoming commodities although only a few ventures are manufacturing them at scale.

Other ventures have created syn-bio platforms that incumbents can use to develop, and even customize, components themselves. For instance, the Colorado-based Inscripta’s Onyx platform provides gene-editing tools that allow academic and commercial customers to create syn-bio components. At the push of a button, companies can design complex, CRISPR-edited cell libraries in two to four days’ time, generating up to 10,000 microbial strain designs per run and making thousands of edits to them.

Software. There’s a pressing need for different types of software solutions in the industry, from in-silico design and simulation to biosecurity tracking. So far, no company has developed off-the-shelf software that can satisfy every customer’s end-to-end requirements. Some ventures have developed software to meet their own needs, but that trend is unlikely to persist.

As the number of software tools needed increases; the sharing of standard parts rises; and more startups enter the market, syn-bio firms will increasingly rely on outsourced software such as ThreatSEQ’s biosecurity DNA screening software. And because of the network effects that software platforms generate, integrated solutions that connect easily and effectively with IoT-equipped laboratory devices will, probably, dominate the industry. (See the sidebar, “Software for the Synthetic Biology Industry.”)

Software for the Synthetic Biology Industry

Software for the Synthetic Biology Industry

- Design and workflow automation software for different parts of the design-build-test-and-learn cycle.

- Lab design software to conduct experiments in silico rather than in vitro. The programs simulate complex reactions and pathways, and startups can avoid the time and expense needed to carry them out in wet labs. The development of syn-bio CAD/CAM software, which can run through millions of permutations before suggesting physical experiments, is well under way. It will enable computer aided design for the discovery of new genes as well as the statistical optimization of component design, data inference, and pattern recognition. Databases such as KEGG (for metabolic pathways) and GenBank (for genetic sequences) can codify biological processes in machine terms while DNA can be printed, put into living cells, and the physical experiments can run alongside virtual ones.

- Biomolecular visualization software enables researchers to picture synthesized molecules in three dimensions to facilitate design. They are a great way of raising awareness about biological processes. For instance, PyMOL by Schrodinger is an open-source visualization software that provides a comprehensive solution to render and animate biological structures, such as proteins, in 3D.

- Laboratory information management systems to track samples and workflows. For instance, Moderna used Dassault Systemes’ Medi Data suite to accelerate clinical trials when it was developing its COVID-19 vaccine.

- DNA-screening software that preemptively assess the creation of dangerous biomolecules, such as pathogens and allergens, through gene synthesis. This will grow in importance as syn-bio products come under more scrutiny. ThreatSEQ’s DNA screening software, built on a compilation of more than 10,000 sequences of concern, claims to provide actionable information to developers about the threat level of any sequence.

- Web portals for interacting with customers.

Hardware. Companies will need many kinds of hardware depending on the syn-bio technique and process they use to automate processes in laboratories as well as bio-industrial facilities. They will include micro-fluidic growth kits and fluid-moving robotics, for instance. Much of this hardware can be controlled through digital interfaces and integrated into automatized workflows.

Companies will require equipment to manufacture products at scale. They may be able to use the same hardware for more than one process in the future, but doing so today requires customization and retrofitting, which will add to costs. Meanwhile, the rise of cell-free biology—which entails using a cell’s processes, rather than the entire cell, to minimize complexity and increase precision—will catalyze the creation of tools for cell miniaturization, integration, and tracking.

The hardware market is likely to be extremely competitive, the extent of which will depend on the technology, the degree of precision customers need, and the capital costs of manufacturing hardware. However, a few leaders, such as Thermo Fisher Scientific and Beckman Coulter in automatized robotic laboratory systems, are likely to emerge in specialized niches. These firms enable lab optimization, scheduling, and testing, and make experimentation easier, less expensive, and reproducible.

Some back-end pioneers offer innovation-as-a-service to help incumbents create syn-bio applications and processes. The London-based Synthace’s software, for instance, allows scientists to communicate with its lab hardware, so they can design, run, analyze, and repeat experiments effectively and efficiently. Similarly, the San Francisco-based Strateos has developed cloud labs— remotely accessible labs with lab control software—where companies can conduct experiments in facilities they may never see.

Because they need to provide turnkey solutions, the innovation-as-a-service companies are being compelled to enter into alliances, licensing arrangements, and collaborations with each other and with incumbents. That will make vertical integration between different back-end players, and incumbents, possible and inevitable.

Having said that, bringing together cutting-edge hardware and software tools to build an integrated bio-foundry—a facility which designs, builds, and tests genetic constructs for syn-bio strains as well as discovery pathways for applications—will be quite expensive. All the data shows that the capital required to set up a modern bio-foundry is an entry barrier, and increases in speed, scale, scope, and precision will only demand more investment. One telling indicator: in 2022, Schmidt Futures estimated that biotechnology facilities would require a capital investment of between $150 million and $200 million while earlier, in 2014, Berkeley Lab projected that Berkeley Open BioFoundry’s maintenance expenses would be around 15% of the capital investment.

Only a few large corporations and startups therefore possess the ability to raise the resources needed to build integrated bio-foundries and develop the capabilities to operate them 24x7. Incumbents that already employ some syn-bio talent and see syn-bio applications disrupting their futures will, most likely, invest in bio-foundries. Others will find different ways of engaging with firms that have already invested in setting up bio-foundries.

Distinguishing Between the Front-End Players of the Synthetic-Biology Industry Stack

That shifts the spotlight to the front end of the syn-bio industry stack. By deploying the stack’s back end, companies can create syn-bio applications, which constitute the consumer-facing end. Those may be syn-bio products such as cell-based meats; syn-bio processes such as those that can leach minerals or manufacture chemicals; and all-new materials such as mycelium-based leather.

Two different kinds of syn-bio application firms have emerged: vertically specialized developers and horizontally structured platforms.

Interestingly, a company can use the same raw materials and technology to manufacture different syn-bio products, albeit with some modifications, so, over time, the front end of the syn-bio stack is likely to become more fragmented than the back end. Our studies show that two different kinds of syn-bio application firms have emerged and are likely to play a key role tomorrow: vertically specialized developers and horizontally structured platforms.

Vertically specialized syn-bio application developers focus on making syn-bio products or processes and bringing them to market. They include, for example, syn-bio food companies such as Impossible Foods and Beyond Meat; leather-makers such as Modern Meadow and Myco Works; dye makers such as PILI; and collagen and elastin makers such as Geltor.

Most syn-bio product makers are vertically focused and product oriented even though they use different raw materials and technologies. These firms have built relatively small bio-foundries whose scope is limited, and, over time, they are likely to scale. This approach was pioneered in the pharmaceuticals industry, with one of the most prominent examples being BioNTech, a startup which is using Messenger RNA to develop a range of therapies.

Learning from pharmaceutical startups, several syn-bio startups are experimenting with using related processes to make different products. For instance, Mosa Meat specializes in manufacturing meat from cow cells, but it has also diversified into making bio-leather because the mammalian cell-based processes for meat and leather are quite similar. Likewise, companies such as Amyris and Geltor have started producing specialty chemicals as well as other industrial raw materials because of the economies of scope they’ve realized by studying microbial chasses and their metabolic pathways.

The trouble is that the development of syn-bio products is expensive and time-consuming. In 2000, for instance, DuPont worked with a syn-bio startup, Genencor, to develop a process to create 1,3-propanediol (an organic compound used mainly as a building block in the production of industrial polymers such as adhesives, laminates, coatings, and moldings) from a plant-derived starch instead of a petroleum-based derivative. However, it took six years before DuPont and Tate & Lyle Bio Products were able to kick off the commercial production of the bio-engineered propanediol at a newly built $100-million facility. Incumbents must be prepared to manage many surprises when scaling syn-bio technologies.

Horizontally structured application platforms use continuous process technology stacks to develop syn-bio applications but don’t market the applications themselves. Bio-foundry platforms such as Ginkgo Bioworks and Arzeda keep development costs attractive for partners in different industries by continuously finetuning research processes; refining foundries; and training AI/ML models on data, theory, and research from different industries. By investing human and financial capital up front, the bio-foundry platforms hope to stay ahead, especially in tomorrow’s cell-free environment.

The syn-bio platforms have ambitious visions; they believe that incumbents in many industries will have to use their services. They plan to map a large number of metabolic processes; become the biggest sources of syn-bio discovery; and emerge as the innovation layer that bridges the back and front ends of the syn-bio stack. Their business models include entering into revenue-sharing agreements, charging R&D fees, and even taking equity stakes in the ventures that will make the products and processes they develop—all without their having to manufacture or market them. As Jason Kelly, Ginkgo Bioworks’ CEO, told Bloomberg Businessweek Debrief in a recent interview, “. . . You’ve got to build a lab. [. . .] (That’s) an enormous upfront expense [. . .] So, what we’re saying is: Just use our platform. We’ve already built all that. We have those huge, fixed costs and you get a low marginal cost. And I will program that cell for you . . .”

Despite the potential that syn-bio application-development platforms have displayed, the strategy remains relatively untested. Not only is it tough for the bio-foundry platforms to keep costs competitive, large customers are often reluctant to partner with them. That’s partly because the scalability of output isn’t a given and because the platforms insist on retaining the rights to the intellectual property they create. Until the syn-bio platforms figure out how to become commercially viable, they will continue to be in a state of flux.

Some are hence looking for new approaches. For instance, the California-based Zymergen pivoted from its original strategy of creating a general syn-bio innovation platform to becoming a creator of applications only for the chemicals and plastics industries (before Ginkgo Bioworks acquired it). Much of its revenues came from helping companies re-engineer microbes they were already using to increase production, reduce costs, or both. Similarly, Checkerspot, a syn-bio material innovation platform based on algae, is also showing signs of shifting strategies. It is integrating its operations vertically by making bio-sourced polyurethane and has spun out firms such as WNDR Alpine, which markets snowboards made from green plastic, to manufacture the novel products it has developed.

Paradoxically, incumbents, which possess many tangible and intangible assets as well as well-honed technical capabilities and talent, may be best positioned to help syn-bio startups persist with their strategies. The latter face many challenges, in addition to discovery and development, such as capital requirements, manufacturing expertise, market access, and especially regulatory knowhow, which can prove to be a major hurdle. For instance, startups such as Impossible Foods, Mosa Meat, and Meati all use syn-bio techniques to cultivate meat substitutes, but their processes are based on, respectively, microbes, cells, and fungi. Governments will regulate them differently, depending on their processing methods and raw materials, so these firms will need different regulatory approvals to get through each stage of their processes. That’s why striking partnerships with seasoned incumbents will help.

Incumbents may be best positioned to help syn-bio startups persist with their strategies.

Going it alone in syn-bio is a challenge for incumbents too, even those that have technological expertise such as pharmaceutical manufacturers. The knowledge barriers are too high for incumbents to orchestrate the development of new genetic strains, so it’s likely they will prefer to partner with other firms to develop new products and processes. Many will team up with, or acquire, startups that have developed applications that fit into their existing product pipelines. That will allow the incumbents to move up the syn-bio learning curve and profit from the new opportunities that syn-bio brings to their industries—a strategy the pharmaceutical majors have honed for two decades now.

Synthetic Biology Strategies for Success

Few incumbents will be able to execute a successful syn-bio strategy unless they engage with the right players and use the right partnership approach. Moreover, syn-bio technologies and firms at both the front and back ends are changing rapidly, so engaging with an emergent stack demands a shift in the incumbents’ approach.

Instead of instinctively entering into transactional (buyer-seller) relationships, as they are prone to, established companies would do well to fashion a strategy of codevelopment and partnering with several companies. In other words, they must learn to create syn-bio ecosystems (or actively participate in emerging ones), which are ideal to tackle new opportunities that extend across traditional sectoral boundaries as well as fast-changing businesses that require the acquisition of novel capabilities.

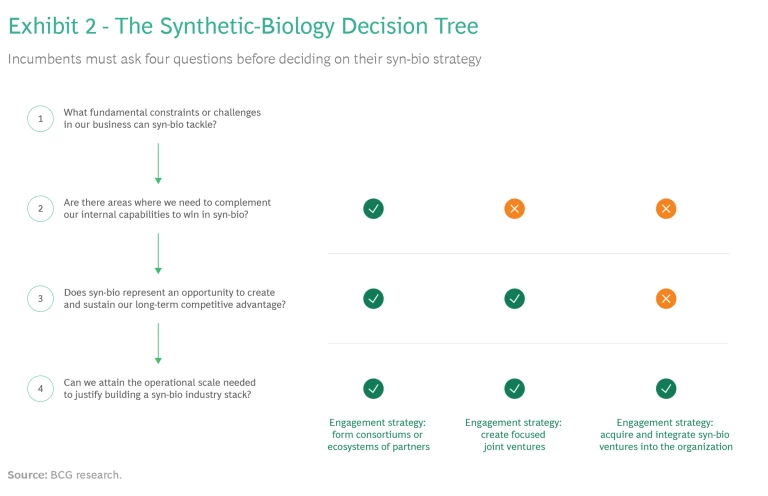

Depending on the context, incumbents can pursue one, or more, of three strategies, asking themselves key questions that will help them make the most effective choices. (See Exhibit 2.)

Create Consortiums. Ask: In which areas does our company need to complement its internal capabilities to win in syn-bio?

Every incumbent should consider forming, or entering, a consortium or ecosystem with other companies to enter the syn-bio industry, such as those that possess required capabilities and skills or have access to specialized assets. The preconditions are that the incumbent should have identified the critical challenges and constraints in the business that syn-bio will help tackle as well as the initial objectives it hopes to achieve by deploying the technology.

Creating syn-bio applications will require incumbents to bring together different but complementary capabilities from both the front and the back ends of the industry stack. That’s why partnering in the syn-bio industry context doesn’t imply striking an agreement with just one syn-bio-focused enterprise; in most cases, incumbents will have to create consortiums if they are to win. A typical consortium will include:

- Research, design, development, and intellectual property partners, such as startups that have capable R&D teams but lack scale and access to markets.

- Sourcing partners, such as manufacturers familiar with creating supply chains for novel feedstocks.

- Manufacturing partners, such as syn-bio contract manufacturers familiar with precision fermentation and engineering.

- Marketing and selling partners, usually established brand-marketers that know how to access the market, engage with regulators, and to grow the demand for syn-bio applications.

Most front-end players in the syn-bio industry have an integrated back end that allows them to develop syn-bio applications. That will make it easier for incumbents that haven’t developed syn-bio capabilities in-house to partner with front-end players rather than trying to work at the same time with several software, hardware, and component-makers from the back end of the stack.

Doing so may enable incumbents to quickly bring to market syn-bio applications, but the sizes, scales, and cultures of the two kinds of organizations are likely to differ—akin to the differences between traditional industrial manufacturers and digital startups. These dissimilarities will test any consortium; its clock speed, especially in terms of design and testing, will have to adapt to the smallest player’s scale and the slowest partner’s speed. That’s likely to be a persistent challenge for all the players in a syn-bio ecosystem.

Form Focused Joint Ventures. Ask: Will entering into a specialized joint venture create an opportunity for us to gain sustained competitive advantage?

A second strategy option is for any incumbent to form a focused joint venture with a syn-bio firm in addition to any other consortiums the incumbent may have created. Being an equal partner in a joint venture will allow the incumbent to exercise greater control over its strategic direction as the technology matures. That’s critical, especially if the syn-bio technology embodies the potential to become one of the incumbent’s main drivers of innovation in the future.

In addition to providing the incumbent the freedom to design a range of syn-bio applications that fit its business portfolio, a joint venture will facilitate the process of licensing the intellectual property the two companies develop to noncompeting companies in other industries. Doing so will help defray the initial costs of developing syn-bio applications and provide the venture with revenues until its products catch on in the marketplace.

Consortiums are usually limited in terms of scope and draw on existing syn-bio industry stacks, but a joint venture offers a different opportunity. Keeping in mind the application they wish to develop, and the underlying feedstock and processes, the partners can join forces to rethink and strengthen the syn-bio stack. That will improve their ability to compete from the start. Nurturing a joint venture isn’t easy, though, and requires time, capital, and capabilities. Before entering into one, incumbents would do well to ask themselves: Does forming a syn-bio joint venture represent an opportunity to create and sustain long-term competitive advantage? Only if the answer is in the affirmative should they go ahead.

Companies must gauge the impact that a prospective joint venture’s syn-bio applications are likely to make, in both monetary and sustainability terms. They must figure out if the syn-bio technology will serve as an alternative to an existing product or process or will bring about systemic change by transforming the entire value chain in the industry. If it does, the syn-bio technology could well become the incumbent’s core capability in the future.

In June 2022, for instance, Unilever announced the formation of a $120-million joint venture with syn-bio pioneer Geno to commercialize and scale plant-based alternatives to palm oil as well as the fossil fuel-based ingredients in its cleaning and personal care products. The formation of this focused joint venture signals that both Unilever and Geno are convinced of the enormous potential to market a range of syn-bio applications in the food and personal care products sectors.

Acquire and Integrate. Ask: Can we attain the operational scale needed to justify building an industry stack?

Finally, incumbents should consider using integration as a strategy, building their own syn-bio tech stack, especially in the long run. Companies in sectors such as pharmaceuticals, specialty chemicals, nutrition, and personal care products are well positioned to deploy this strategy. Scale and competitive advantage should push incumbents to integrate their syn-bio acquisitions.

Acquiring science-based startups is an effective way to augment an incumbent’s internal capabilities and exercise more control. It will also speed up internal learning and capability development, enabling the organization to become more knowledge centric. Forced to engage with startups, many incumbents respond by becoming more agile and uncovering untapped synergies among innovation teams and leaders.

However, syn-bio platform development is an investment-intensive, multiyear process that demands long-term commitments. It requires incumbents to move beyond their current focused strategies and engage with a larger number of academic and research institutions, accelerators, and incubators in order to stay at the cutting edge. The capital requirement to build a syn-bio stack may exceed $100 million, so the ability to scale must be a key consideration. Indeed, the stack must be able to operate across all the incumbent’s lines of business and unlock more than one revenue stream.

The French pharmaceuticals giant, Sanofi, for instance, has been pursuing an integration strategy since 2021, when several majors in the industry boosted their R&D pipelines by acquiring cell and gene therapy startups. That year, Sanofi announced six acquisitions—Origimm Biotechnology, Kadmon Holdings, Translate Bio, Tidal Therapeutics, Kymab, and Amunix—making an investment of over $8 billion. Other players have made similar moves. For example, in 2022, Solvay, the Belgium-headquartered materials, solutions, and chemicals company, set up a syn-bio-based materials innovation and production platform. The platform could play a complementary role in the working of three other innovation platforms that Solvay has set up for green hydrogen, battery materials, and thermoplastics.

On Saturday, January 11, 2020, Chinese scientists shared the genetic sequence of the virus that causes COVID-19. Two days later, by Monday, January 13, the American syn-bio startup, Moderna, had designed a mRNA-1273 coronavirus vaccine that was ready for testing—a process that would have taken months, if not years, if the firm hadn’t relied on AI-driven syn-bio processes. Then, Moderna created a consortium—consisting of pharmaceutical majors such as Switzerland’s Lonza, France’s Recipharm, the US’ Baxter International, and Japan’s Takeda to manufacture this vaccine; IBM to oversee its global distribution; and Canada’s National Resilience—to produce genetic components to make and supply this vaccine globally. The weekend miracle of developing a vaccine as well as rapidly tying up with myriad partners to deliver it to consumers epitomizes the speed and the structure by which syn-bio can, and will, transform health care and other industries in the future.

Companies in almost every industry have no choice but to monitor the syn-bio sector, especially the dynamics along the syn-bio stack. Depending on the sector in which they operate, the capabilities they possess, and the potential for competitive advantage, incumbents can create or enter syn-bio consortiums, craft focused joint ventures, or integrate syn-bio firms. Indeed, the fundamental question that every incumbent must ask in this, the Syn-Bio Age, is simple: What’s our syn-bio strategy?