An age-old chemical process may be a major missing link in the solution to one of our most persistent modern problems, plastic waste.

Plastics are essential to modern life, though environmentalists and NGOs have also long warned of the impact that plastic waste has on land, water, and air. Today, regulators, industries, and society alike recognize the need to limit waste and identify solutions. Recent years have seen heightened interest in the potential of circular technologies to break, or at least mitigate, the adverse effects of the make-use-dispose model. But these solutions can’t handle all types of plastic waste (especially plastics blended with other materials such as adhesives). And in many markets, the economics favor new-use or single-use plastics over recycling, while others lack the necessary collection and sorting systems. As a result, single-use flexible plastics (such as bags and packaging), which account for about 50% of all plastics consumption and half of total ocean litter, mostly end up being incinerated, landfilled, or just thrown away.

Flexible packaging accounts for about 50% of all plastics consumption.

Chemical recycling of plastics to fuel (PTF), or plastics regeneration—which is similar to the natural process that creates fossil fuels—can fill a big gap on the disposal-reuse spectrum. The ultimate solutions will involve a combination of judicious consumption and disposal measures as well as the development of cost-competitive and environmentally friendly alternatives. Most observers would agree, however, that these changes are years away. In the meantime—over the next decade or two—we can implement circular solutions to reuse or repurpose plastic waste in the most efficient way.

BCG recently completed several comprehensive analyses of global waste markets, collection systems, and recycling regulations, including the business cases for mechanical recycling and conversion technologies. We examined the PTF value chain, including an in-depth analysis of the most common PTF technology, pyrolysis, which uses heat in an oxygen-starved environment to covert plastic waste into synthetic oil and gas (without emitting a lot of greenhouse gases). We examined the costs of the pyrolysis process and its market potential as well as its environmental impact and shortcomings. We studied how various factors and trends play out in three types of markets common around the world, ranging from those that are largely unregulated and immature with respect to plastics collection to those that are highly regulated with well-developed collection chains. The analysis was reviewed with experts from the chemical industry, waste management companies, circular-economy organizations, and academia. (“Our Thanks to the Experts.”)

Our Thanks to the Experts

Our Thanks to the Experts

The authors are very grateful for the support they received in producing the report on plastics regeneration. Their special thanks go to the following experts, who provided invaluable insight and expertise:

Brendan Edgerton, director circular economy, WBCSD

Craig Halgreen, director sustainability and public affairs, Borealis

Harald Friedl, CEO, Circle Economy

Ladeja Godina Kosir, executive director, Circular Change

Lars Krejberg Petersen, CEO and administrative director, Dansk Retursystem

Marc de Wit, CFO, Circle Economy

Maria Mendiluce, managing director climate and energy, WBCSD

Niko Kopar, circular-economy expert, Circular Change

Nien-Hwa Linda Wang, Maxine Spencer Nichols professor of chemical engineering, Purdue University

The authors also thank the chemical companies from across the world, global waste management companies, consumer industry companies, and environmental NGOs that contributed invaluable input without wanting to be referenced by name.

Our main conclusion is that while the economics and business challenges vary, conversion technologies such as pyrolysis are economically viable in all the market types described above. In some, pyrolysis can have an immediate and substantial impact—it has the potential to treat up to two-thirds of the plastic waste generated in Jakarta, for example. In others, the business case is feasible only if governments act to make inexpensive and environmentally detrimental means of disposal—principally landfills—less financially attractive.

The full report is available here. This article presents a summary of our key findings and conclusions.

No Easy Solutions

While plastics have myriad benefits, they also create a vast, global, and complex waste problem. Some estimates say that humans have manufactured more than 9 billion tons of plastics in the past century, and almost 7 billion tons have become waste. In recent decades, the rising middle class in emerging markets has sent production soaring; half of history’s plastics have been produced in the past 15 years. The UN predicts that under current consumption rates and waste management practices, approximately 12 billion tons of plastic waste will be dumped into landfills and leaked into the environment by 2050.

Many countries—some 60 so far, according to the UN—have responded with steps to constrain plastics consumption and environmentally detrimental means of disposal. Policymakers are increasingly restricting, and in some cases banning, single-use and flexible plastic products, such as shopping bags. They are also limiting plastic waste disposal in landfills. Consumer companies, including restaurants and airlines, are cutting back on, or entirely abandoning, the use of plastic straws, plates, and cutlery. While these actions have yet to materially reduce the volume of waste, they have sent a clear signal that the status quo can shift rapidly.

There are seven different major types of plastic, each with its own chemical composition. The various types and their uses are:

- PET. Water bottles, food containers.

- HDPE. Milk bottles; shampoo, chemical, and detergent bottles.

- PVC. Cosmetic containers, commercial cling wrap.

- LDPE. Squeeze bottles, other cling wrap, rubbish bags.

- PP. Microwave dishes, potato chip bags.

- EPS/PS. Plastic cutlery, CD and video cases, hot-drink cups, protective packaging.

- Other. Mixed-use plastics.

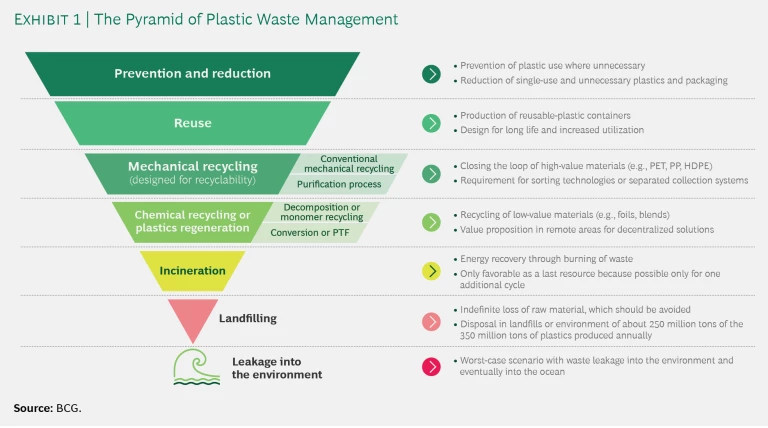

A hierarchy of plastic waste management describes the options for disposing of all this plastic. (See Exhibit 1.) Outside of actually reducing the amount of waste generated, reuse is the best method we have. Leakage of plastic waste into the environment is the least desirable, and disposal in landfills is only marginally better. Various groups and organizations are actively pursuing initiatives to push waste management practices toward the top of the pyramid. An intermediate target is to find ways to reduce the use of landfills and incineration and move toward more recycling and reuse (as well as reduction).

A pillar of the circular economy, mechanical recycling provides both a viable business case for companies and significant societal and environmental benefits by reducing the amount of virgin plastic used and driving greater circularity. But an effective mechanical-recycling system also requires an efficient collection system. The most effective systems separate waste at the source, which reduces requirements for cleaning and saves water and energy. Industrial-sized sorting systems and mechanical-recovery facilities are increasing in efficiency and separating capability. But putting such a system in place takes time, investment, and often a fundamental change in consumer behavior.

Newer technologies, such as purification, that go beyond conventional mechanical recycling are gaining traction. They work by dissolving plastics into solvents and separating the blends to purify the plastics by extracting additives and dyes. These technologies focus on the same materials as the conventional mechanical-recycling methods, such as PET, HD, and PP, but they are still nascent technologies that have yet to see large-scale implementation.

Plastics Regeneration Fills the Gap

Several new chemical-recycling technologies are emerging that address limitations in materials composition as well as the complexity of mechanical-recycling processes. These new methods can be broadly referred to as plastics regeneration. In this process, polymers are converted into smaller molecules, including their constituent monomers, smaller-chain hydrocarbons, and petrochemical feedstocks. Monomer recycling is generally seen as a particularly circular method because it reverses the chemical composition of the plastics into stable monomer molecules that can then be combined to create the same grade and type of plastic from the waste. It is sometimes also referred to as decomposition. Conversion into fuels or petrochemical feedstock is realized through a variety of technologies, the most common of which is pyrolysis.

Pyrolysis has some distinct advantages over other recycling and recovery technologies. It is adept at handling a variety of plastic types that mechanical-recycling centers typically reject. While pyrolysis uses heat, the only carbon dioxide it emits is from the energy source that generates the heat. As a result, its carbon footprint is much lower than that of incineration.

The output from pyrolysis includes 70% to 80% oil and 10% to 15% gas.

Depending on the mix of inputs, the output from pyrolysis is 70% to 80% oil, which can be used for a variety of purposes, and 10% to 15% gas, which is usually recycled to provide the pyrolysis heat. Only about 10% to 15% of the output is char, an inert solid that can be recycled for roads or sent to landfills, although some usage of char as a fuel has also been demonstrated. Using the liquid output from pyrolysis as fuel or inputs for petrochemical plants prolongs the original plastics’ life cycle to at least a second round in case of the former and to potentially several more in the latter, depending on the ultimate usage and disposal.

Like any chemical process, pyrolysis has its challenges. The biggest are scale and operational complexity. Pyrolysis reactors require regular maintenance, and the downtime is costly. A plant typically comprises multiple reactors, with additional units added in parallel to increase capacity. Some players are exploring continuous-process reactors of smaller size to gain scale.

Pyrolysis also requires a sustained and consistent amount of good-quality feedstock to function effectively; this is one of the major challenges of the process because the plastics must be sorted and cleaned in advance to avoid contamination (although the cleaning and processing standards are less stringent than those required for mechanical recycling). These and other issues raise a key question with respect to whether pyrolysis can contribute in a meaningful way to plastic waste solutions: Is it economically viable?

The Economics of Pyrolysis

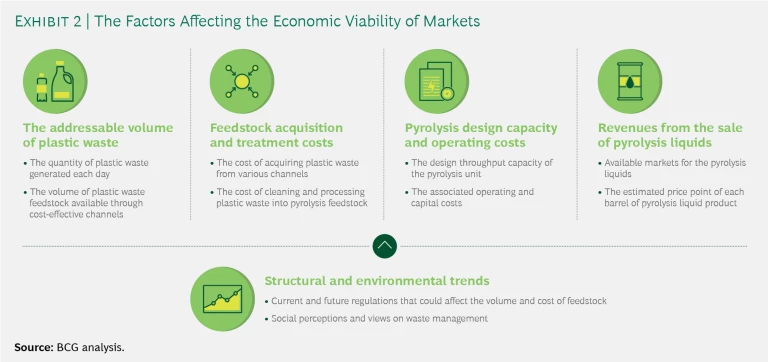

Four factors directly determine the economic viability of pyrolysis, and they can vary considerably by region and market. They include the addressable volume of plastic waste, feedstock acquisition and treatment costs, the capacity and operating expenses of pyrolysis plants, and potential revenues from the sale of pyrolysis gas and liquids.

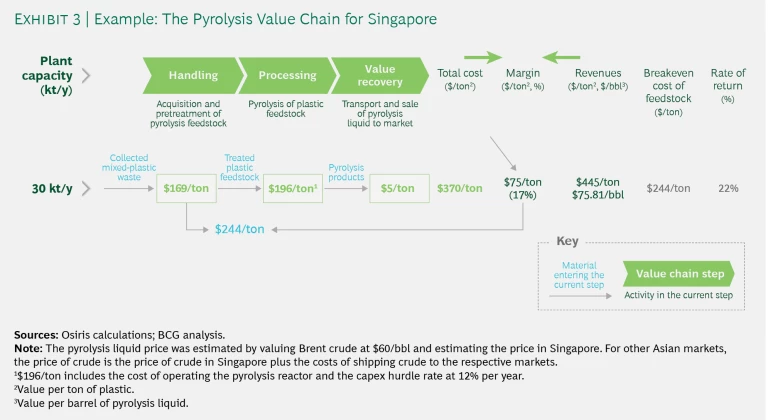

To assess the financial viability of pyrolysis as a business, particularly for energy and chemical companies, BCG researched eight markets, each with its own distinct characteristics. The markets can be divided into three representative categories: mature, moderately regulated, and nascent. For each market, we used two criteria to determine economic viability:

- Margin. The revenues from the sale of pyrolysis liquids minus the costs to acquire feedstock, the cash costs of operation, and capital expenditures.

2 2 During the analysis of the business cases, a broad variation in the quality of the resulting pyrolysis liquids was assumed, given the wide variation of ingoing feedstock. - Volume. The estimated number of 30-kt/y plants that can be run given the addressable volume of plastic waste in the market. (Typically, to obtain a higher throughput, more units are added in parallel.)

We established an arbitrary nominal internal rate of return (IRR) hurdle of 12% as the minimum return that a company would need to justify investment. (See Exhibit 3.) Our analysis indicates that, of the eight markets, six exceed this IRR and four of them do so substantially, including one nascent market: Jakarta.

Mature Markets. These markets have established and mature collection systems, limited landfill use because of regulation or space constraints, near-term recycling targets with stringent monitoring, and near- and medium-term plans to reduce single-use plastics consumption. Our study included Singapore and the Seine-Maritime province of France. Both have attractive IRRs (more than 20% and 25%, respectively), but they are based on very different business cases.

In Singapore, the market offers an ample supply of mixed-plastic feedstock, but the high cost of collection and cleaning could have a big impact on profitability. Singapore generates some 2,200 tons a day of plastic waste, about 50% of it from residential sources. Most of this goes straight to incineration centers. Only approximately 12% to 20% enters recycling sorting centers, and just half of this is actually recycled, with the balance rejected principally because of contamination. Given that it offers the potential to acquire 120 to 300 tons a day of discarded plastic from sorting centers, Singapore could provide the necessary scale for a 30-kT/y pyrolysis plant. (Regulatory changes that favor pyrolysis could divert additional plastic waste from incineration, making an even greater supply available.)

In Seine-Maritime, feedstock costs are substantially lower. A pyrolysis operator could expect to achieve a profit margin of almost $130 a ton, or nearly 30%. But Seine-Maritime generates only about 150 to 190 tons of municipal solid waste (MSW) a day, most of which (110 to 160 tons) goes to incinerators or landfills. To ensure sufficient supply for a 30-kT/y plant, an operator would need to either look beyond the Seine-Maritime province for supply or use plastics extracted from landfills, which would require cleaning and sorting.

Moderately Developed Markets. These are markets with established waste collection systems, little pressure on reducing landfill use because of favorable economics, and some long-term recycling goals in place (including data collection to support them) but no firm regulation related to reducing plastics consumption.

The US Gulf of Mexico coast is representative. Plastic waste is both ample (about 25,000 tons a day) and inexpensive (approximately $125 a ton). Of the five states in the region (Alabama, Florida, Georgia, Louisiana, and Texas), only Florida recycles a significant percentage of its MSW (37%); the other states are in the single digits, with 90% or more of their MSW going to landfills. We estimate that pyrolysis plants in the Gulf Coast states could operate with a profit margin of about $135 a ton, or 30%. Continued fallout from China’s decision to restrict imports of recyclables adds to addressable volume and reduces costs for potential operators. Improved sorting efficiency could cut costs further.

Nascent Markets. These markets are characterized by inadequate plastic waste collection systems, few recycling targets, and no firm regulation related to reducing plastics consumption. We looked specifically at a few regions of Indonesia (Jakarta, Ambon, and Batam) and at the Chinese provinces of Guangdong and Zhejiang. Overall, China spans the nascent and moderately developed categories: many cities have developed formal collection systems, and incineration of waste to generate electricity is common.

The regions of Guangdong and Zhejiang share very similar characteristics. A small group of cities in each generates 80% of the plastic waste (nine cities, 25,000 tons a day in Guangdong; six cities, almost 20,000 tons a day in Zhejiang). Private companies manage waste collection and processing, but mechanical recycling depends on an informal network of waste pickers, collectors, and traders. These provinces have the potential to provide ample supply for pyrolysis facilities, but the feedstock acquisition cost is high: more than $200 a ton in both regions. This results in total plant operating costs of more than $400 a ton. Estimated margins would be about $40 a ton, or 8% to 9%.

Achieving Pyrolysis at Scale

In all markets, the biggest single challenge for pyrolysis is achieving the scale necessary to have a significant impact on the plastic waste problem and generate sufficient revenues and profits to justify investment. Some important limitations and risks have to be addressed. The most immediate limitations are the current small scale (a typical plant handles 25 kilotons to 30 kilotons per year) and challenging technical operations. Potential unintended consequences also need to be considered. Several chemical companies are putting major effort into research and development of plastic products that have a greater ability to be mechanically recycled. Promoting pyrolysis, a means of plastics regeneration, could eliminate the incentives for these R&D efforts.

Pyrolysis can have an immediate and significant impact in immature markets such as Jakarta, Guangdong, and Zhejiang.

That said, pyrolysis offers energy and chemical companies the opportunity to explore profitable new business models while they simultaneously improve their environmental, social, and governance performance. Pyrolysis can have an immediate and significant impact in immature markets such as Jakarta (where pyrolysis could handle more than half and potentially up to two-thirds of all plastic waste), Guangdong (a quarter of all plastic waste), and Zhejiang (one-fifth of all plastic waste). Pyrolysis is also economically viable in many mature markets, but in regions such as the US Gulf Coast, where it competes on cost with ample landfill capacity, governments need to decide whether they want to use their legislative and regulatory authority to discourage landfilling and provide incentives for alternatives.

Governments have an important part to play in incentivizing the development of plastic waste solutions. Europe has been a leader in this area through its promotion of and investment in new processes and technologies as well as through its regulation of plastics usage and disposal in general. All governments need to shape policies to create guiding frameworks that help define a clear waste management hierarchy and incentivize recycling to address all plastic types. Such frameworks can aid the development and successful implementation of innovative product design, waste management infrastructure, and mechanical recycling, as well as plastics regeneration technologies. All levels of government can contribute, from local or regional legislative bodies to national assemblies, executives, and agencies.

Within the current hierarchy of solutions, plastics conversion—specifically pyrolysis—can play an important role in mitigating the environmental impact of plastics in the near to medium term. The more companies, governments, and institutions invest in or support conversion technologies, the greater their ability to contribute to solving this global environmental problem.