Circularity presents a significant economic and green growth opportunity by creating value with fewer resources. In the Nordics alone, circularity could unlock up to ~€48B annually by 2030 (~3% of

This is the first of three articles on circularity. We begin with how circularity can unlock new opportunities. The following article will cover scaling circularity into a profitable business, including challenges and key enablers. The final article will explore embedding circularity into traditional linear operations to drive long-term sustainable growth.

Circularity: Sustainability and Business Growth

Currently, only 7% of the resources extracted yearly are reused or recycled

Stay ahead with BCG insights on climate change and sustainability

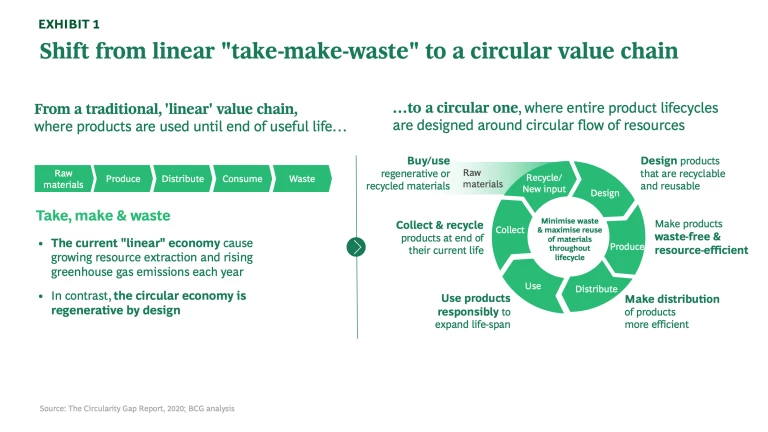

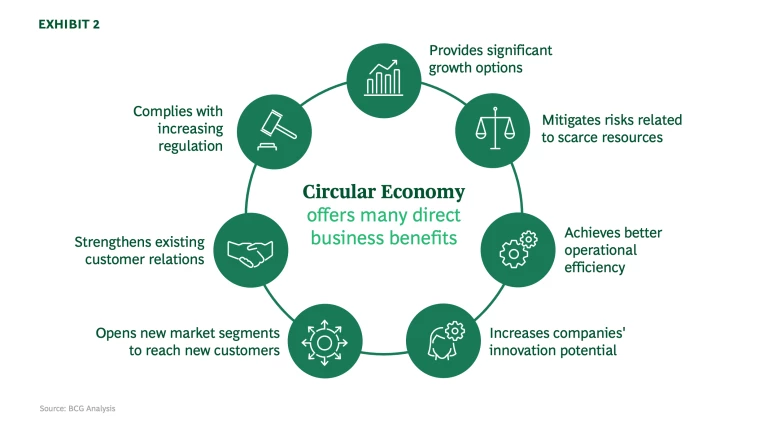

At the same time, circular business models are attractive to those looking for growth, profitability, and resilience in a rapidly changing world. By converting from traditional linear systems to circular business models, companies can unlock several business benefits. (See Exhibit 2.)

Tapping Into Circularity’s €48 Billion Yearly Opportunity in the Nordics by 2030

According to BCG research, approximately 6% of the Nordic economy is circular, meaning 6% of resources used for production comes from recovered materials.

This is significantly behind both the current EU average of 12% and the 2030 target of 24%. If the Nordics reach the current EU average, they could unlock €48 billion in annual economic opportunities by 2030, equivalent to ~3% of the region's GDP.

Across industries—both in the Nordics and globally— we are observing significant growth of circular business models and new value pools for companies to tap into.

Fashion

Sportswear and Equipment

Electronics

Automotive

Industrial Goods

Paper and Packaging

Why Now? Cost Pressure, Regulations, Resilience, Technology, and Consumer Demand

The shift toward circularity is driven by several dynamics, such as stricter regulations, cost pressure, supply chain resilience, technological progress, and consumer demand. Within this context, companies are using circularity both as a driver of innovation and as an opportunity to create and tap into new value pools.

Regulation

Cost pressure

Resilience

Technology

Consumer demand

- Rising awareness and support: According to a report from the Swiss Re Institute, 43% of respondents planned to support the transition to a circular economy within two years from being

asked.23 23 What goes around comes around: Insuring the circular economy, Swiss Re Institute - Positive sentiment, limited action: According to the same report, 74% of people believe recycling should be a top priority, but only about 35%

recycle.24 24 What goes around comes around: Insuring the circular economy, Swiss Re Institute According to our European consumer sentiment report from 2024, consumers continue to prioritize factors like affordability and convenience over sustainability. - High intentions but low willingness to pay: While 37% of consumers often or regularly consider sustainability in their purchase decisions, only ~19% of consumers are willing to pay more for sustainable products. However, case studies have demonstrated that circular consumers have a higher customer lifetime value driven by increased consumer loyalty, more frequent visits (e.g., they go to the store for a repair and end up paying something), and other valuable traits.

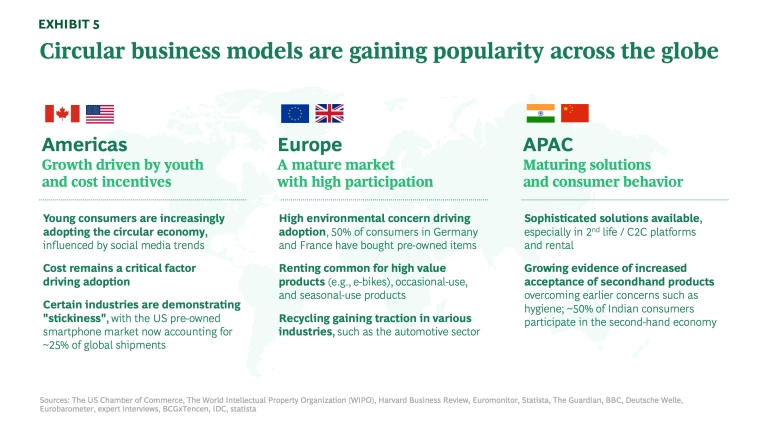

While consumer sentiment for circular models is rising globally, maturity for circular offerings varies by region. Nordic companies that are present in other geographies should be aware of the following regional trends. (See Exhibit 5.)

Start the Journey Towards Circularity Today

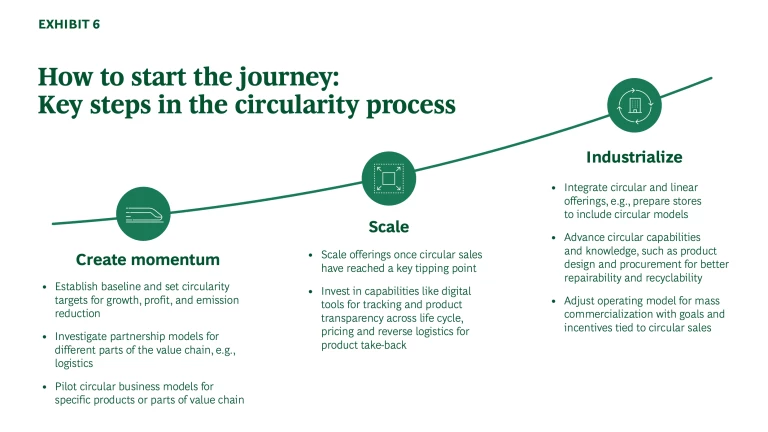

Building a circular business model is often simpler when starting from scratch than transitioning from an existing linear operation. This is because circularity requires a different approach to many aspects of a company’s operations when scaled. As a result, many companies launch circularity separately from traditional operations. Circular initiatives may begin by accounting for only a small share of revenue, with linear operations remaining the primary income source. However, for an established company to fully unlock the potential of circularity, it must eventually scale and integrate circular practices into its core business and strategy—a topic explored further in this series.

Launching a pilot project is a practical way to explore circularity by focusing on a single product, service line, or specific part of the value chain. Key approaches include:

- Single product or business line: High-value products and products designed for periodic usage are often ideal for circular models. Decathlon, for example, began with bicycles for their rental schemes.

- Targeted value chain interventions: Circularity can also begin with specific processes, such as switching to recyclable or biodegradable materials, reducing waste, or introducing take-back programs. For instance,

Renault25 25 “Decarbonized mobility: focus on Renault Group’s trajectory,” Renault Group andStellantis26 26 “Stellantis and Galloo to Form Joint Venture for End-of-Life Vehicle Recycling,” Stellantis aim to use 33% and 40% recycled or green materials per vehicle by 2030, respectively.

Treating pilot projects as isolated initiatives—even when successful—can lead to conflicts with traditional operations and a greater reliance on ad-hoc solutions, such as costly logistics for product returns. So, while beginning with a pilot project can be a practical first step, the full benefits of circularity are realized at scale. Scaling and industrializing circularity across business lines requires integration with traditional operations. It involves investing in circular capabilities and tools, such as pricing engines capable of handling diverse sales models, combining circular and traditional product offerings, and aligning organizational goals and incentives to ensure seamless execution. (See Exhibit 6.)

In summary, circularity offers a transformative opportunity for businesses to achieve sustainability goals while driving innovation and growth in response to evolving consumer demands and regulatory changes. Though the journey requires strategic investments and shifts, the benefits are compelling: reducing emissions, unlocking a €48 billion market opportunity, and decreasing dependence on finite resources.

In the next article, Scaling Circularity into Profitable Business, we will dive deeper into how companies can practically capture the circularity opportunity and scale it into a profitable business model.

This article is written by the Nordic Circularity Team, a group of professionals dedicated to advancing circular economy solutions in the region. The team includes: Nanna Gelebo (Managing Director and Partner, Stockholm), Peter Jameson (Managing Director and Partner, Stockholm, Copenhagen), Davide Urani (Managing Director and Partner, Stockholm, Milan), Elina Ibounig (Partner, Helsinki), Trine Filtenborg de Nully (Principal, Copenhagen), Marcus Bruns (Project Leader, Oslo), Marie Holtorf (Consultant, Copenhagen) and Johanna Ihrfelt (Associate, Stockholm).