It’s been decades since hydrogen was first proposed as a primary source of clean energy. Thanks to advances in a variety of key technologies, the moment when the abundant gas can begin contributing to the fight against climate change may finally be upon us. But the hype level is high, and many technological, economic, and policy challenges remain before hydrogen can offer a truly cost-effective way to lower greenhouse gas (GHG) emissions. If hydrogen is to achieve its full potential, it must become less expensive and more efficient to produce, distribute, and use. Getting there will require two trends to come together.

First, government policymakers and regulators must continue to support, through direct subsidies and policy changes, the production and use of low-carbon hydrogen for applications where hydrogen offers the greatest potential for abating GHG

Second, the hydrogen economy needs to become a reality, and stakeholders throughout the ecosystem need to contribute. In particular, machinery makers (the companies that develop and manufacture the necessary machinery, equipment, and components) and their investors must do their part. With the proper support throughout the hydrogen value chain—and assuming that the global effort to reduce GHG emissions increases in keeping with the goals of the Paris Agreement—the market for hydrogen-related machinery, equipment, and components could rise to an annual $200 billion or more by

At present, the nascent market for low-carbon hydrogen is both highly complex and highly fragmented, but it holds real promise. Money from governments and private investors is beginning to flow into the sector, and large companies, small and midsize enterprises, and startups are rapidly entering the field. Yet uncertainties—about the market, the right business models, the best technologies, and ongoing government support—remain high. Navigating the market will take a great deal of expertise and a consistent, carefully considered strategy.

The nascent market for low-carbon hydrogen is both highly complex and highly fragmented, but it holds real promise.

In this report, we consider the structure of the low-carbon hydrogen market—along with its opportunities, benefits, and challenges—and offer a roadmap for machinery makers to capture their fair share of the value inherent in the hydrogen ecosystem. Their efforts to research, develop, and produce the technologies needed will be instrumental in reducing the cost and increasing the efficiency of hydrogen applications—and making a real contribution to the fight to reduce global warming.

THE HYDROGEN VALUE CHAIN

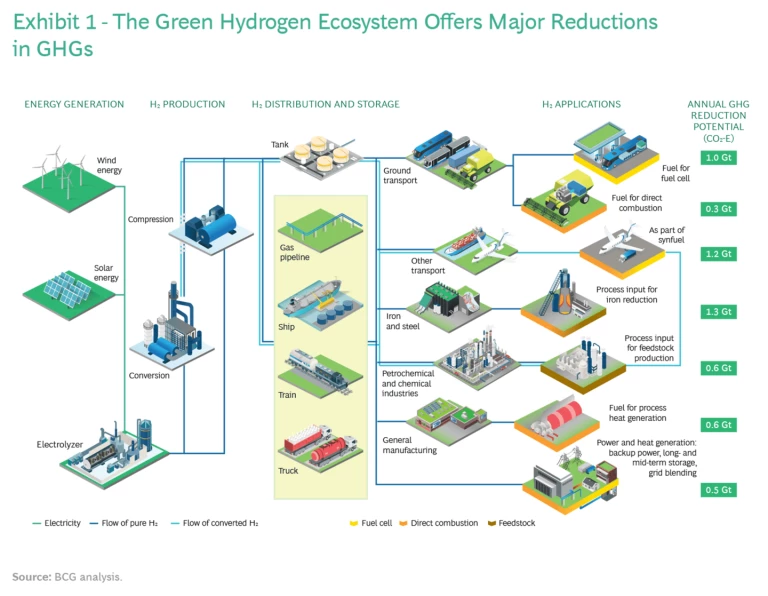

Hydrogen’s potential for decreasing GHG emissions is high. By 2050, GHG emissions could be reduced by 5 to 6 gigatons annually through applications such as the substitution of clean H2 for base chemical production and refinery, the use of fuel cells in heavy vehicles, and as a reduction agent in the iron and steel industry. Altogether, those changes would eliminate about 15% of the 35-gigaton total that we included in our earlier analysis of

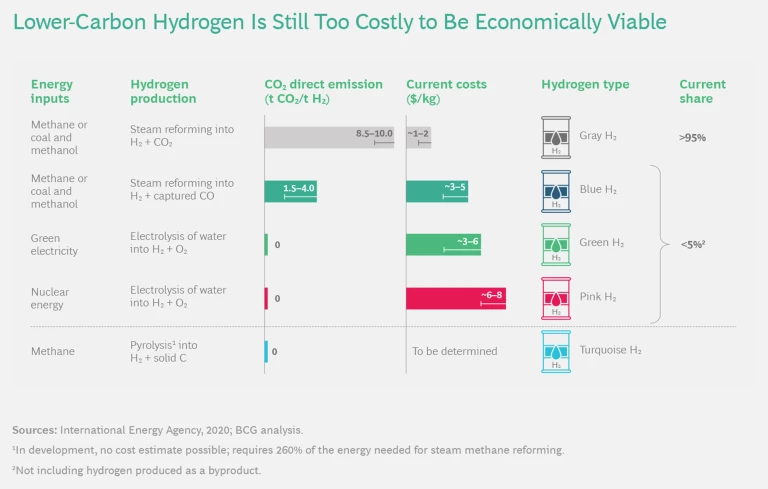

Hydrogen can be produced in a variety of ways, some of them “cleaner” than others. (See “Making Low-Carbon Hydrogen.”) To maximize the environmental gains, H2 must be produced without emitting GHGs. The cleanest method of producing H2 involves breaking water down into its constituent parts through electrolysis, using electricity from renewable-energy sources. It is this so-called “green” H2 that we focus on here.

Making Low-Carbon Hydrogen

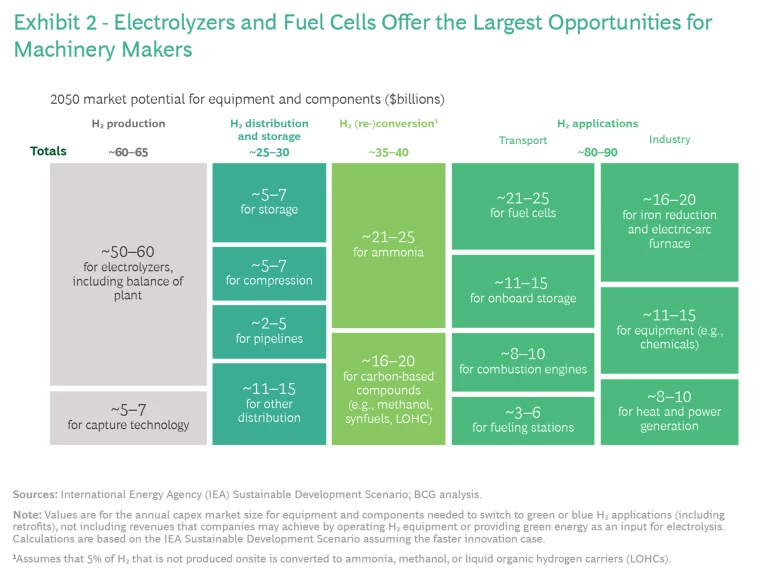

Exhibit 2 breaks down the potential market in 2050—$200 billion in annual capital spending—for the equipment and components needed at each link in the hydrogen value chain:

- Production of H2, primarily via electrolyzer systems

- Distribution, including compression, pipelines, and storage

- Conversion of H2 to transportable forms, mostly components and materials-handling equipment

- Transport and industry applications, including fuel cells, combustion, and use as a feedstock

These market segments will not mature at the same time. While production and distribution will need to develop independently of where and how H2 is to be used, the conversion of H2 into transportable forms and its specific uses depend on their economic competitiveness with current technologies and other green alternatives, as well as government policies and customer preferences.

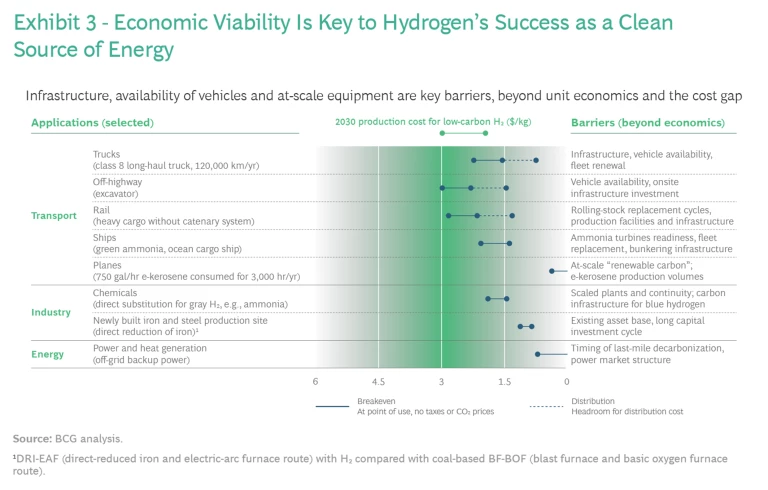

Our scenario analysis shows that at $2 per kilogram of hydrogen, several applications will likely be economically competitive in Europe by 2030. For heavy-duty transport, unit economics will be favorable comparatively early. Direct electrification using battery-electric systems is another green alternative for transport applications, but in the heavy-duty segments, fuel cells and hydrogen-based fuels have operational advantages compared with battery-electric options owing to their higher power density and faster refueling times. We expect battery-electric power to dominate the passenger car and light-commercial-vehicle segments because of its generally higher round-trip efficiency.

In addition to unit economics, handling and distribution costs will need to be considered in order to make hydrogen competitive for those heavy-duty applications. This will require either lowering hydrogen production costs even further or developing decentralized production and distribution networks. Either way, companies need to overcome barriers related to the high capital intensity of providing the required infrastructure and to the availability of hydrogen-powered vehicles and equipment at industrial scale. (See Exhibit 3.)

Applications in the chemical sector and the iron and steel industry could also become economically viable by 2030, as hydrogen production costs decline. The main barriers will be the high investments required to switch to low-carbon hydrogen production, the need to maintain operational continuity in chemical and steel production, and the long investment cycles and planning periods required.

Despite the challenges, the economic viability of H2 applications will increase over the next decade. The higher that taxes or GHG emissions costs rise, and the faster the barriers in infrastructure and availability of equipment at industrial scale are removed, the sooner each application will become economically viable.

The task of developing and scaling up the equipment and processes needed to reduce the costs of producing, distributing, and developing uses for hydrogen will fall primarily to the world’s machinery makers. In what follows, we analyze the four segments of the hydrogen market—production, distribution, conversion, and applications—and the opportunities each segment offers to machinery makers.

PRODUCING HYDROGEN

In the future, most of the hydrogen produced will be low-carbon—either green or blue. In this report, we focus on the production of green hydrogen through electrolysis. Although blue H2 will also likely account for a considerable amount of the total hydrogen supply, the market for the carbon capture membrane technologies needed to produce it will remain considerably smaller than the electrolyzer market.

Under its Sustainable Development Scenario, the International Energy Agency expects installed electrolysis capacity for producing H2 to rise to 130 gigawatts in 2030, with the EU accounting for 80 gigawatts of the total, including production for import. Powering all these electrolyzers to produce green hydrogen will require the production of about 600 terawatt hours of renewable energy, providing a huge new market for the renewable-power generation industry (not considered in this analysis). But to meet the expected demand for low-carbon H2, the cost of electrolysis must decline, and its efficiency must rise.

Several different types of electrolyzers are in use. The most common are polymer electrolyte or proton exchange membrane (PEM) electrolyzers, which use stacks of solid polymer membranes between the electrolyzer’s anode and cathode, and alkaline electrolysis cells (AECs), which use a liquid alkaline solution as the electrolyte. Solid oxide electrolysis cells (SOECs) use a solid electrolyte to produce H2 from steam; the technology is less mature but offers the potential for efficiency levels of up to 80%.

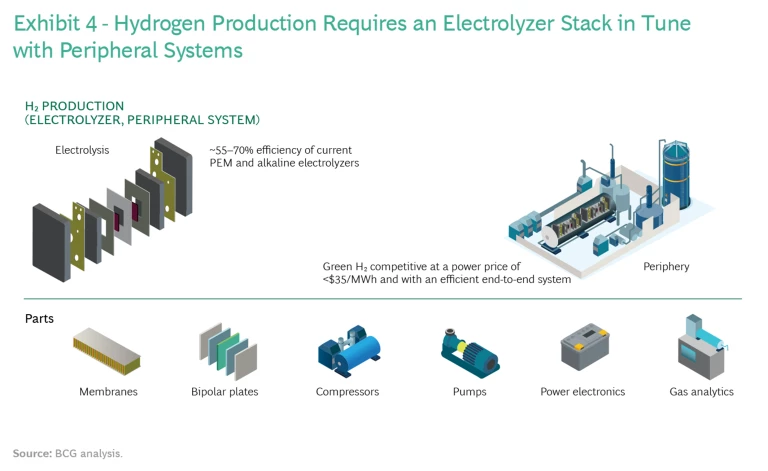

The cost both to produce and to operate electrolyzers is high, owing largely to the inefficiency of current electrolyzer technology and the end-to-end support systems they require. (See Exhibit 4.) Increasing overall efficiency offers a major opportunity for machinery makers. For example, boosting the system efficiency of PEM electrolyzers from 60% to 70% seems possible, primarily by improving the materials used in the stack.

At present, building out the required electrolyzer capacity is far too costly to be practical. These capital cost are high for several reasons. For one, electrolyzers require a large amount of pricey material, such as precious metals. This holds true especially for PEM electrolyzer stacks that mostly use a membrane with platinum on the cathode and iridium or ruthenium on the anode side of it. R&D is ongoing to explore ways of reducing the amount of precious metal needed without risking durability.

Other factors also contribute to the high capex. One issue is that only a small number of electrolyzers are being produced. And manufacturing costs are high owing to a lack of production automation. Electrolyzers typically contain as many as 150 cells, in ten very thin layers; given the precision needed to make them, automating the process is extremely difficult and requires considerable expertise. Quality standards, too, are lacking, forcing operators to ensure the quality of each individual electrolyzer, further increasing costs. Finally, the largest operational electrolyzer has a capacity of just 10 megawatts. At today’s relatively small capacities, the cost of setting up the peripheral components for each electrolyzer is high.

Reducing the cost of materials and increasing automation and standardization could bring down the capex needed for AEC stacks by 30% to 40%, if production can be scaled up from 50 units to 1,000 units a year. At that scale, the capex needed for the balance of plant (BOP) would decrease by 20% to 30%, bringing the overall system cost to about $280 to $350 per kilowatt (not including margins, overhead, and SG&A). For PEM electrolyzers, the capex required for the stacks would need to fall by 40% to 50% and for BOP by 20% to 30%, bringing overall system costs down to $320 to $400 per kilowatt.

As production of H2 electrolyzers ramps up, established system makers may have an advantage because they are more likely to be able to establish large-scale electrolysis plants at the required quality standards. In time, however, this is expected to change, as increasing specialization opens up opportunities for suppliers of components such as membranes and bipolar plates for the electrolysis stack, as well as the compressors, pumps, power electronics, and gas analytics for entire electrolysis systems.

Hydrogen production offers a variety of opportunities for machinery makers, worth a total of $60 billion to $65 billion annually by 2050.

Taken together, the production end of the hydrogen value chain offers a variety of opportunities for machinery makers, worth a total of $60 billion to $65 billion annually by 2050. Building and improving the efficiency of the electrolyzers that will be needed is only part of the equation. More R&D will be required to improve the reaction and startup times of electrolyzers and the methods for running them under different conditions.

DISTRIBUTING AND STORING HYDROGEN

If the market for hydrogen is to reach its full potential, companies must overcome several significant hurdles in distribution and storage. Unlike the current oil and gas industry, the low-carbon hydrogen ecosystem will require a mix of centralized and decentralized production, distribution, and storage, depending on the availability of renewable energy, the existing infrastructure, and the locations for efficiently using the H2.

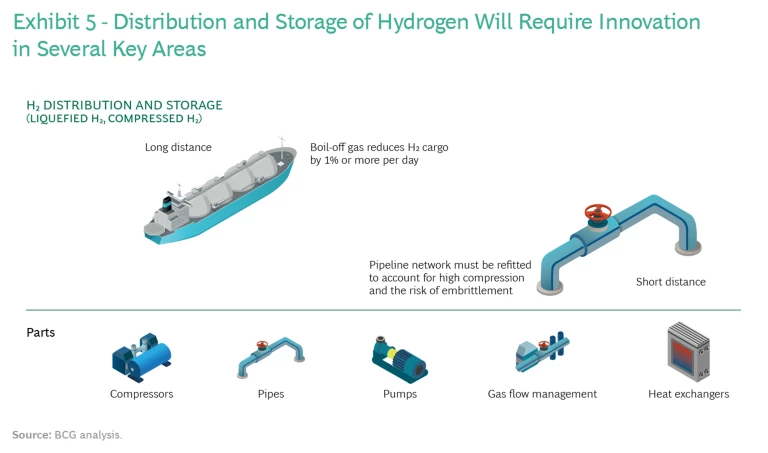

Unlike hydrocarbons, hydrogen is highly volatile and lighter than air, making transportation and storage tricky. Thus it makes sense, in the near term, to locate hydrogen production near where it will be used. Over time, however, as demand for low-carbon hydrogen increases, the cost advantages of producing large volumes of H2 in the Southern Hemisphere, near major sources of renewable energy (especially solar energy), will drive further growth of international markets for H2. Long-distance transportation networks must be developed, most likely using ships. For shorter distances, large amounts can be sent through pipelines, while a combination of trains and trucks can deliver smaller amounts. (See Exhibit 5.)

H2 is highly flammable and explosive, escapes easily, and has a relatively low density. Transporting it in one of its higher-density forms is preferable but requires compression, liquefaction, or conversion. H2 also reacts with many metals, causing them to become brittle.

These considerations open up a number of potential markets for machinery manufacturers, especially those that specialize in hazardous materials, and for suppliers that can adapt their products for use with hydrogen.

Because of its low density, H2 must be highly compressed in order to store it efficiently and ship it to its destination. Several technologies are under consideration. H2 becomes a liquid at a temperature of –252°C, but transporting liquid hydrogen over long distances is only 70% efficient; the efficiency is limited by the need for super-cold cryogenic tanks and constant active cooling to prevent rising pressure and the associated risk of explosion. And still, some of the liquid will inevitably return to its gaseous state and escape as boil-off gas. Improved liquefaction methods and insulation materials need to be developed in order to make shipping liquefied H2 over longer distances economically competitive. New ships that can keep the H2 cold must also be designed and built; and regulatory hurdles must fall: transporting liquid H2 is currently not allowed.

Another option for long-distance transportation is converting hydrogen to a different form. (See the next section.) Converted hydrogen can be handled through existing transport infrastructure in use by the gas industry. But if the converted hydrogen needs to be reconverted at its destination, efficiency losses are even higher than for liquid hydrogen.

The most economical way to transport H2 across distances of up to a few thousand kilometers is through pipelines, opening up a further opportunity in pipeline construction and repurposing. As of 2018, for example, Europe had just 2,000 kilometers of pipelines carrying H2 but had almost 23,000 kilometers of methane gas pipelines that could be refitted for H2 by 2040. New pipes designed for H2 could also be installed inside current pipelines, making it unnecessary to recoat and reseal the existing pipes.

Either way, there will be high demand for pipeline materials that can withstand H2 for decades and for the equipment required to keep the H2 under compression as it moves through the pipelines. Leak-proof seals, pumps, gas flow management systems, and heat exchangers, as well as smaller parts like valves, will also be needed.

Opportunities in the storage of H2 for future transport and use differ depending on the amount being stored. Solutions vary from gas cylinders for small amounts of compressed hydrogen up to salt caverns and rock cavities for large amounts. Medium amounts will most likely be stored in larger vessels or tanks, in compressed, liquefied, or converted forms.

For machinery makers, the potential hydrogen distribution market opportunity will total an annual $25 billion to $30 billion by 2050.

CONVERTING HYDROGEN

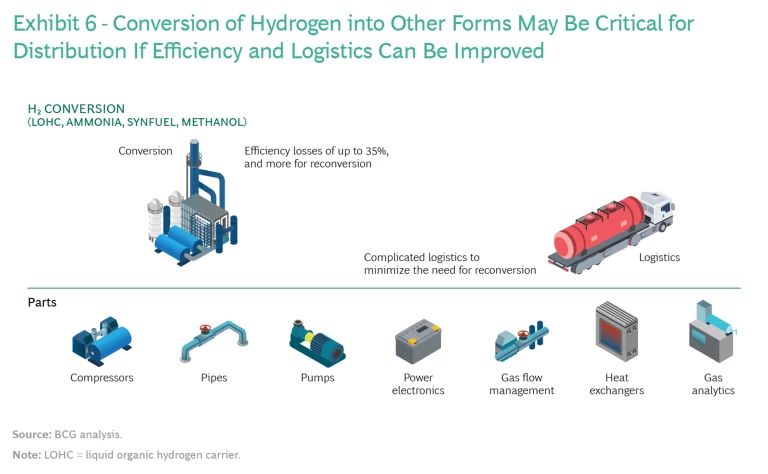

As mentioned above, once H2 is produced, it can be converted into other forms, such as ammonia and synthetic hydrocarbons like methanol, or bound to a liquid organic carrier such as toluene. This allows it to be stored and transported through the existing commodity infrastructure, including storage tanks, ships, and pipelines. (See Exhibit 6.) Japan, for example, expects to import 300,000 tons of H2 annually by 2030. Ships capable of transporting 50 tons of liquefied H2 are in development, and that would require 5,000 to 6,000 shiploads. But transporting H2 converted into ammonia, for example, could reduce the number of shiploads required by a factor of 100.

Energy efficiency losses vary from about 12% when converting H2 to ammonia, to more than 20% when converting it to methanol or binding it to a carrier, and up to about 35% when converting it to a synthetic hydrocarbon. In the latter case, the added carbon required must be derived from sources other than fossil fuels—through a process called direct air capture, for example.

Depending on its application, the converted H2 does not necessarily need to be reconverted to pure H2. For example, ammonia can be used directly as a feedstock in the chemical industry and to make fertilizers, and methanol can be converted to power and heat for the steel industry through combustion. Both processes offer considerable potential as soon as producing green H2 becomes competitive with other production methods. Ammonia, as well as synthetic hydrocarbon, could eventually be used for direct combustion in other applications, but this depends on replacing traditional combustion engines and turbines with ones fit for ammonia or synfuels, which isn’t likely to happen at scale until well after 2030.

A further possibility is to link H2 to a liquid organic carrier that is less toxic than ammonia (such as toluene), ship it, and then return it to gaseous form once it reaches the destination. At present, the conversion and reconversion or dehydrogenation process results in a 50% loss of H2, far less efficient than other conversion processes. And the dehydrogenated liquid organic carrier must be shipped back to where the H2 was originally converted so that it can be reused. But technological advances in conversion and transport could make this method more energy efficient.

The development of improved conversion and recapture technologies presents a considerable opportunity for machinery makers—$35 billion to $40 billion a year by 2050.

USING HYDROGEN

Hydrogen will be put to a wide variety of uses. The applications with the greatest opportunity for machinery makers are fuel cells for transport and feedstock for the iron and steel industry. (See Exhibit 7.) In the longer term, H2 is also expected to be used in direct combustion to produce power and heat. Together, these add up to potential revenue for machinery makers of $80 billion to $90 billion annually by 2050. Hydrogen, however, is not nearly as cost-effective as current applications yet and must compete with other low-carbon technologies for some applications.

Transport. As a fuel for trucks, trains, and ships, hydrogen has many advantages. Given its higher energy density, it offers considerable advantages in range and refueling time compared with direct electrification through battery-electric systems. But the abatement cost of replacing the industry’s current GHG emissions can be high, depending on the form of transportation.

Because of the considerable efficiency losses inevitable in both the electrolysis process and the use of fuel cells, direct electrification has a much higher round-trip efficiency. Although the total cost of ownership of battery-electric vehicles is lower, their long recharging times and heavy batteries give vehicles powered with fuel cells operational advantages in applications such as heavy-duty trucks, off-highway vehicles such as mining trucks and excavators, and long-haul buses, given their heavy loads, long ranges, high fuel consumption, and the need for fast refueling.

The first trains powered by hydrogen are already in passenger operation in Europe today.

In rail transport, fuel cells provide a green alternative in situations where an overhead catenary system providing electric power can’t be used, and they will likely become competitive with diesel in the next ten years. The infrastructure challenge is smaller than in road transport since fewer refueling stations are required. The first trains powered by hydrogen are already in passenger operation in Europe today.

Fuel cells can also be used in other forms of transport. In certain kinds of shipping, such as ferries, they are likely to become a green alternative to biofuels, given potential restrictions on emissions close to some coastlines. For other forms of shipping, ammonia and methanol derived from green H2 will likely become the favored green alternative to battery-electric power, though such applications will probably not be developed at scale by 2030.

For transport applications, fuel cell technology is already well advanced, and both policymakers and vehicle manufacturers are beginning to promote it heavily. We expect the use of hydrogen in the transport sector to grow rapidly over the next ten years—albeit from a low base—eventually offering a market opportunity for machinery companies of some $45 billion to $50 billion annually by 2050. The opportunity can be broken down into three areas:

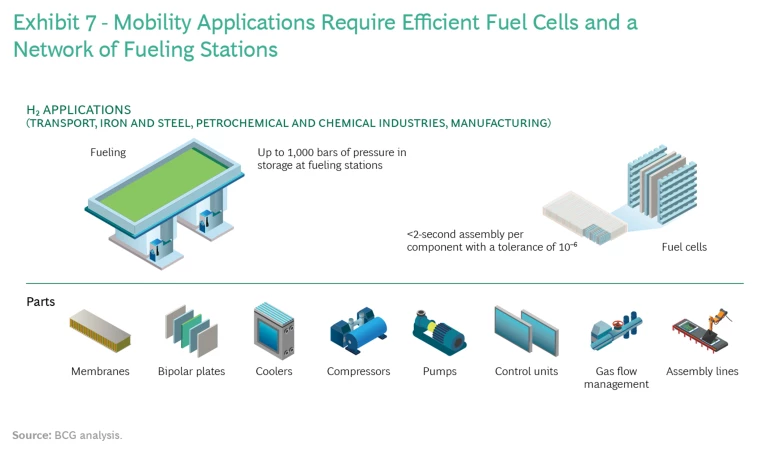

- Refueling Stations. If the demand for H2 for heavy on-road vehicles rises to as much as 40 megatons to 45 megatons a year, more than 50,000 H2 refueling stations will be needed around the world by 2050, up from just 450 in 2019. On average, each station will need to supply 800 tons to 900 tons of H2 per year—by providing a consistent supply of hydrogen to the station via pipelines or other means, by storing enough H2 at the station, and perhaps by producing the H2 at the station itself, conceivably with onsite solar panels or wind turbines. To ensure short refueling times comparable to the refueling of diesel or gasoline, the H2 must also be precooled and compressed.

- Fuel Tanks. Powering vehicles with H2 can be done in three ways: through direct combustion of H2 in an engine, conversion of H2 in a fuel cell to generate electricity to power electric engines, and conversion into a synthetic fuel or e-fuel to run a combustion engine. The first two require the ability to store H2 onboard the vehicle compactly, safely, and inexpensively. Tanks must be able to withstand high pressure and be sealed perfectly. Opportunities for machinery companies will also include improving and lowering the cost of the production processes for both the tanks and the carbon fibers used to make them.

- Fuel Cells. Perhaps the greatest challenge lies in developing and producing the high-quality, efficient, and affordable fuel cells used to provide power for electric vehicles. Fuel cells are made from hundreds of individual cell membranes that generate electricity. These are combined into stacks and equipped with cooling systems, compressors, pumps, control units, and gas flow management systems to form a complete fuel system.

Altogether, fuel cells offer many opportunities for machinery makers. The efficiency, durability, longevity, and cost of the cells must be improved, and the amount of precious metals, such as platinum, that are used to make them must be reduced. It will also be necessary to develop a method of recycling these metals so that they can be reused.

Currently, fuel cells are crafted mostly by hand, a time-consuming method. The process must become fully automated at rapid speeds of less than 2 seconds each, allowing factories to produce as many as 1 million a year within high tolerances and under extreme pressure. Different kinds of fuel cell stacks and systems will need to be manufactured for specific applications. This will increase the demand for very complex assembly line equipment and for the equipment needed to manufacture the many components that go into the full fuel system.

Industrial Processes. H2 can be used in a variety of industrial applications. In the chemical industry, H2 is already used to produce feedstock, significantly decreasing the market potential for equipment in this industry. The use of green or blue H2, however, will significantly reduce the GHG emissions generated as a result of the process.

If blue H2 is used for these processes, it could be produced onsite by refitting steam methane reformers and installing carbon capture and compression equipment to produce clean blue H2. Providing the carbon capture equipment and membrane technology for filtering out the GHGs released should provide a business opportunity for machinery makers of $5 billion to $7 billion per year by 2050.

The iron and steel industry is the second-most-promising industrial application, where H2 can replace methane gas as a reduction agent for producing direct-reduced iron that can then be used in an electric-arc furnace to produce steel. Assuming that countries around the world comply with the Paris Agreement, this market could reach an annual $16 billion to $20 billion by 2050, including the equipment needed for cooling, heat recuperation and compression, as well as humidifiers and gas-drying systems. To reach that potential, however, several challenges must be overcome. These include boosting the quality of the steel made using H2, dynamically managing the supply of H2 from onsite electrolyzers, and optimizing H2-based furnace design and reduction processes to improve the system’s overall efficiency—not to mention the need to replace all the existing traditional blast furnaces.

Finally, H2 can be put to use in a variety of power and heat generation applications, a market that could total a yearly $8 billion to $10 billion by 2050. It can be used, for example, as a combustion fuel for large-scale, stationary turbine engines and generators and to produce heat for industrial uses. H2 fuel cells can also be used in decentralized stationary power applications, where they can generate electricity, and the heat created as a byproduct can be captured and used in other industrial applications.

ENTERING THE HYDROGEN ARENA

Like companies moving into any new and rapidly growing sector, machinery makers looking to participate in the hydrogen economy face several challenges and risks, aside from the development of the technologies and the effort to make them cost-competitive. Overcoming these obstacles will require considerable planning as well as support from other players.

Regulatory Uncertainty. Because hydrogen technology is still immature, the market’s continued growth will depend considerably on strong regulatory and policy support. Companies are making significant investments in production and market development, and most are still losing money. The risks involved remain high, and stamina will be needed to stay in the game.

Governments around the world have a critical role to play in creating the hydrogen value chain and a major stake in making it sustainable.

Governments around the world have a critical role to play in creating the hydrogen value chain and a major stake in making it sustainable—through taxes on GHG emissions, cap-and-trade schemes, market regulation, and direct support of the industry. Such efforts would significantly increase the upside potential of the hydrogen market, but whether governments will continue to support hydrogen, and at what level, remains unclear.

Players should therefore consider taking several steps to reduce their risk in the face of uncertain government support. Diversifying geographically will reduce dependence on single markets and exposure to individual regulatory and policy support. Some areas offer favorable local policies and financial support, through public funding of lighthouse projects. Private investors might also help fund such efforts, but this would require stronger business cases backed by greater regulatory support.

Investment Hype. Investors are pouring money into hydrogen-oriented companies, rapidly driving up valuations for pure-play hydrogen companies with little revenue but strong growth prospects. In some cases, the enterprise value-to-sales multiples are heading upward of 50. As a result, incumbent machinery companies looking to grow inorganically will find deals very expensive to make. The money flooding into these companies is enabling their management to invest heavily in R&D and production, making it that much more difficult for private companies without access to that capital to compete.

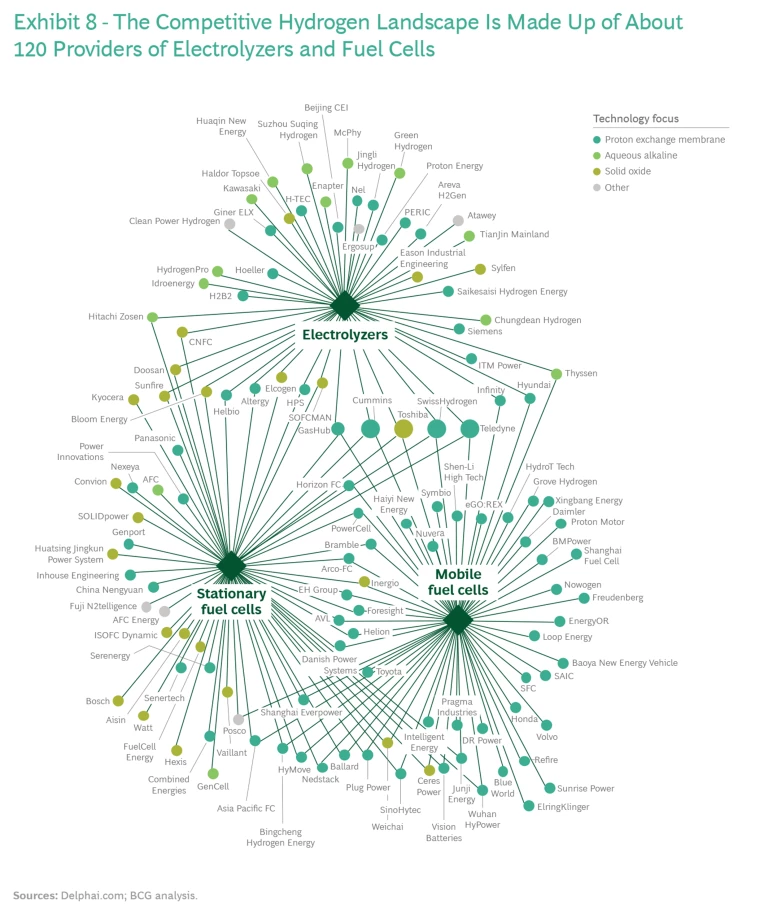

Ecosystem Complexity. Adding to the challenge is the sheer complexity of the hydrogen investment landscape. At present, there are about 120 active providers of electrolyzers and mobile and stationary fuel cells alone, according to analytics provider Delphai, and two-thirds of them entered the market in the past 20 years. As can be seen in Exhibit 8, a large number of companies are focusing on PEM; although it has higher capex than the more mature alkaline technology, PEM is considered the most promising tech for mobility applications.

Given the market’s complexity, companies must first decide which sectors to enter. This decision should be based on several considerations:

- What specific technological know-how does the company bring to the table? Does it expect its technology to become mature enough in the medium term to start or continue to invest in it now?

- Which uses can the company’s technology most effectively be applied to in order to create the most value?

- Which regions are the most promising, considering the company’s technology and the market’s need? How difficult will it be for the player to gain a foothold in the market there, given the region’s competitive landscape?

After prospective players choose their preferred market, they have several options for how to participate (see “Promising Strategic Plays”):

Promising Strategic Plays

- Teaming Up for Scale. Makers of complementary components to power similar applications can partner in order to work out production issues and drive scale.

- EKPO Fuel Cell Technologies is a joint venture between two auto parts makers, ElringKlinger and Plastic Omnium, to produce fuel cell stacks and systems as well as high-pressure tanks.

- Partnering for Capabilities. Players can join together to leverage their complementary capabilities. Established companies in related industries, for example, can join with component suppliers throughout the value chain to gain proprietary know-how and build complete systems.

- Bosch is working with PowerCell to combine its production expertise and existing customer base with the fuel cell maker’s stack technology.

- Building Networks. Two or more players can form a consortium-like partnership to supply a variety of connected products along the value chain. For example, makers of hydrogen-based power systems could promote their products through joint ventures with companies that develop complete hydrogen-based ecosystems.

- Hyundai Hydrogen Mobility (itself a collaboration between Hyundai Motor and H2 Energy) has partnered with Hydrospider (a joint venture of Alpiq, H2 Energy, and Linde for hydropower, electrolysis, and distribution) to make and lease fuel-cell-based trucks and provide them with the necessary refueling infrastructure.

- Creating Local Networks. Makers of equipment such as fuel cells can partner with customers to build independent, local customer-centric networks.

- Plug Power, for example, aims to cross-sell its H2 production, fuel cell, and refueling technology through its diverse customer base.

- Companies targeting organic growth should focus on the most promising link in the hydrogen value chain, depending on their specific expertise. This is true for both suppliers of specific components, such as valves, and those offering complete systems, such as electrolysis, refueling stations, or mobility applications. Canadian fuel cell maker Ballard, for example, has partnered with several mobility players to combine its fuel cell expertise with their know-how in specific transport modes, including Siemens for trains, Van Hool for buses, and Weichai for commercial vehicles.

- Companies first entering the hydrogen market or targeting growth by acquisition must move fast in emerging segments. Given the current high valuations, they should be prepared to pay up or consider very early-stage companies, even though these players typically conform to a lower M&A risk profile.

- Many companies will likely prefer to establish partnerships or joint ventures. Either type of deal can foster the buildup of network effects—and thus the creation of a more complete supply-and-demand ecosystem and swifter, more sustainable growth.

Given the current dynamics of the market, moving quickly would be wise. Valuations will keep climbing, enabling companies to continue investing heavily in R&D and production, and potential partners will be harder to find. Finally, once the COVID-19 pandemic subsides, a considerable amount of public funding intended to stimulate the economy is expected to focus on green technologies.

Companies should consider two approaches to capturing the greatest possible share of the value available in the hydrogen market. On one hand, they could differentiate themselves through superior technology. Opportunities exist for lowering the cost and improving the efficiency of individual components as well as optimizing the systems needed for various H2 applications, for example. Every performance enhancement translates directly into cost savings for customers, a critical factor in making hydrogen economically viable at scale.

On the other hand, companies can also strive to excel in the services they provide and the way they provide them. New business models such as “equipment as a service” are already being explored; Nikola plans to rent out hydrogen-powered trucks by the hour, for example. And Plug Power is developing integrated solutions for its customers, providing fuel cells for forklifts as well as electrolyzers and refueling infrastructure and services to operators of distribution centers.

POWERING UP

Although the hydrogen ecosystem is still nascent, it has the potential to dramatically cut GHG emissions by as much as 6 gigatons a year, contributing significantly to the Paris Agreement goal of keeping the increase in global average temperature to well below 2°C by 2050. It is up to the makers of hydrogen-related machinery, equipment, and components to help meet this objective—an annual revenue opportunity of $200 billion or more by 2050.

Taking advantage of the full potential of hydrogen brings with it significant challenges and risks. Many technological hurdles remain, and the market is highly fragmented, with no clear winners likely to emerge for some time. Further progress will also depend to a significant degree on government subsidies and supportive policies and regulations.

Still, we believe that machinery manufacturers have much to gain by participating in hydrogen’s bright future. Our advice: begin innovating soon, strive for technically superior and cost-efficient products, and find an advantage in ecosystem plays and scale effects.

The authors thank BCG’s Christian Beck, Rajarshi Bhattacharyya, Jorge de Esteban, Joonas Päivärinta, and Filippo Pizzocchero, as well as Delphai’s Jan-Peter Ferdinand for their contributions to this report. They also are grateful to Edward Baker and Siobhan Donovan for writing and editing support, Kim Friedman for design, and Taylor Tinmouth and Mariella von Plessem for marketing assistance.