Road freight incumbents may not like it, but disruption from digital challengers is on their doorstep.

Having transformed consumer-oriented industries such as retail, entertainment, and travel, digital startups are beginning to make inroads in commercial-oriented industries. Road freight, which is highly fragmented and dominated by manual processes, is seen by digital challengers as overdue for change.

At the same time, new digital freight players are benefiting from a remarkable increase in funding. Venture capital funds invested more than $3.3 billion in digital shipping and logistics startups from January 2012 through September 2017. A significant proportion of that funding is going to road freight startups. The beneficiaries include companies such as Convoy, a US online freight-shipping platform that has raised $80 million; Freightex, a UK virtual logistics provider that was recently acquired by UPS; and EasyPost, an online logistics provider backed by Google.

For incumbents, road freight has been a competitive, low-margin business. Digital startups could make life even tougher by introducing new business models and tackling perennial inefficiencies. Companies must act now and seize digital opportunities or face eroding margins and declining volumes.

Traditional Practices Are Under Fire

Digital startups are targeting the road freight industry because several pain points present an opportunity to transform the market. These problems can be seen most clearly in the Western European market.

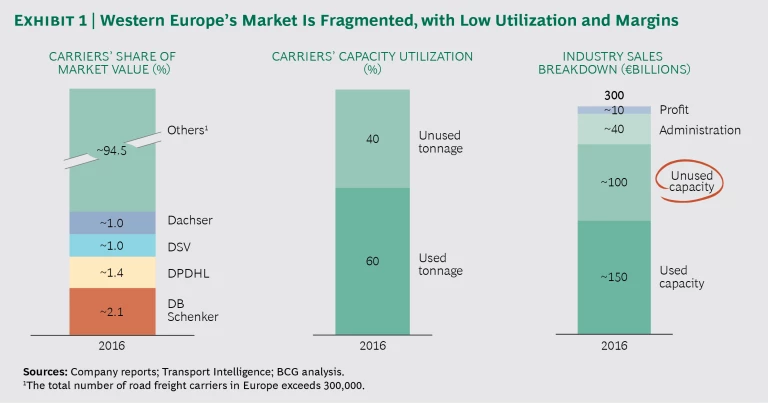

- High Fragmentation, Low Transparency. In Western Europe, the road freight industry has more than 300,000 carriers that range in size from multibillion-euro companies to small owner-driver operations; the share of market value of the biggest player, DB Schenker, is only about 2.1%. (See Exhibit 1.) Such market fragmentation often spurs competitors to work together to gain economies of scale and offer customers better value propositions. But an industrywide culture of distrust has prevented road freight companies from collaborating and reaping the benefits. Companies compete largely on price, which is driven by the supply of and demand for freight capacity, with customers having only limited insight into rates, capacity, and the quality and reliability of carriers.

- Underutilization of Assets. In 2016, the utilization of Western European road freight capacity was 60% (similar to the percentage of assets that were employed in the US) due to trucks returning from journeys empty or only partly full. This unused capacity cost the Western European industry about €100 billion, a significant amount considering that industry sales were €300 billion and its profit was approximately €10 billion.

- Costly Manual Processes. Limited automation and digitization of core processes (such as dispatching, order management, and load consolidation) have added to the industry’s high costs. What’s more, relying on paper-based processes has typically resulted in a significant loss of information.

- Outdated Customer Interfaces. In many industries, companies’ web-based customer interfaces enable seamless, efficient, and fast transactions. But in road freight, such interfaces are generally outdated. This is often due to legacy IT systems. Customers have to put up with lengthy procedures to obtain a quote, cumbersome documentation processes, and a lack of real-time cargo tracking.

Western European road freight incumbents are facing other significant pressures as well. Industry margins remain at historic lows: margins on earnings before interest and taxes are, on average, 2% to 3%, with larger carriers generating margins below 5%. Meanwhile, weak barriers to entry and limited cross-border regulation make road freight players vulnerable to losing market share to Eastern European carriers with cheaper prices.

In the US, some companies that are active in road freight are more profitable than their European counterparts, but they generally face similar challenges: The market is highly fragmented, and individual players lack the scale to improve asset utilization. In addition, paper- and phone-based processes are still common, and the spot market is dominated by thousands of brokers who manually match shippers with carriers.

Seizing the Digital Opportunity

Despite a difficult environment, incumbents have an advantage, thanks to their assets, industry know-how, and customer and supplier relationships and networks. However, if incumbents fail to digitize their offerings, then the digital startups’ business models, along with their transparency about rates and capacity, will increase pressure on incumbents’ margins. Some current players will lose market share to cheaper, more agile digital rivals. For instance, traditional forwarders may forfeit business to virtual forwarders.

Incumbents have an advantage, thanks to their assets, know-how, and networks.

By proactively responding to the startup challenge, incumbents have the opportunity to replace their manual processes with more efficient digital ones, adopt digital business models, and identify innovative ways to gain market share and exit the industry’s low-margin trap. Digitization can help existing players differentiate themselves from the competition, reach new customers, and retain current customers in an otherwise commoditized industry. By acting now, incumbents will be emulating the success of a handful of digital players, such as TimoCom and Transporeon. The sales of these two companies are still relatively small, but they have had strong growth, and their margins significantly exceed those of incumbents.

Our research shows that many existing players have been reluctant to make significant digital investments. Those companies are in danger of falling behind challengers, particularly the ones funded by venture capital firms and technology players. However, other incumbents stand out for taking the following steps:

- Automating and Digitizing Processes. Some players are automating core internal processes and upgrading their customer interfaces by adding digital front ends in order to reduce transaction costs and improve the customer experience. An example is Kuehne + Nagel’s online portal, KN FreightNet.

- Collaborating with Startups. Some companies are partnering with newcomers to gain insight into and benefits from technology developments and next-generation business models, while supporting their core businesses. Examples include DB Schenker, which is developing its Drive4Schenker platform with uShip, and Panalpina World Transport, which is cooperating with digital startup Colo21.

- Building Digital Businesses. A small number of players are creating digital startups. For instance, DPDHL’s Saloodo! matches shippers’ load requirements to carriers’ availability.

The New Digital Landscape

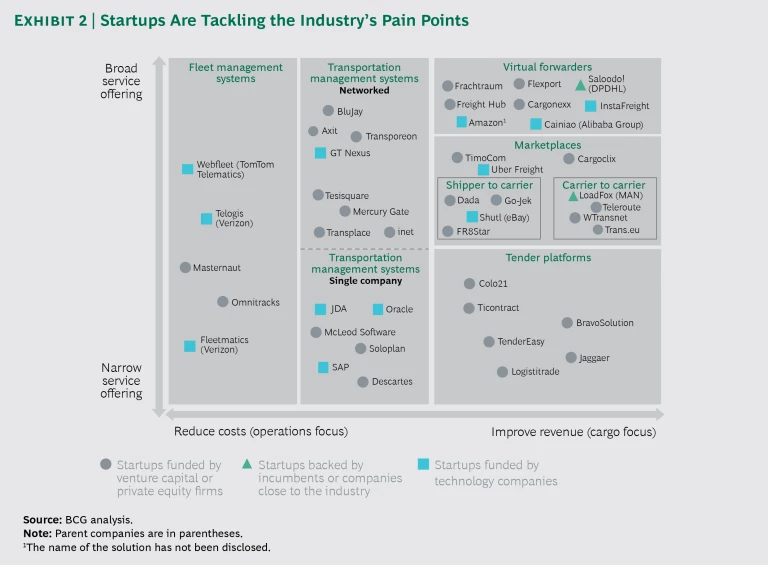

To help incumbents understand the myriad of digital startups and identify a good market entry point, we classified the companies by their principal investor. (See Exhibit 2.) We included startups that are often funded by venture capital or private equity firms; startups that are backed by incumbents or companies close to the road freight industry; and startups funded by large technology corporations, including e-commerce giants Alibaba and Amazon, for which road freight is not a core business today.

Next, we categorized companies on the basis of their focus. Specifically, we considered whether companies are focused primarily on reducing costs or improving revenue for carriers and forwarders. (Marketplaces, for example, are revenue focused because they enable participants to acquire supplementary loads or dispose of unattractive ones.) Additionally, we determined whether companies have a broad or narrow service offering. A broad offering spans more of the overall value chain and provides more services than a narrow one does. The latter typically focuses on one or a few specific elements in the value chain (for instance, road freight tenders).

We found that digital startups are mainly pursuing five types of solutions in the road freight industry and tackling specific pain points.

Digital startups are mainly pursuing five types of solutions.

Fleet Management Systems. An FMS helps carriers improve fleet efficiencies by analyzing operational data; road freight companies often collect fleet and driving data using telematics units onboard trucks. FMS products and services include vehicle management solutions that diagnose potential issues, enabling companies to take action (such as performing preventive maintenance); driver management solutions that monitor driving performance, ensuring safety and preempting unnecessary costs; operations management solutions that focus on route planning and optimization as well as mobile workforce scheduling; and network solutions that support the integration of enterprise resource planning software. In 2017, US communications giant Verizon acquired US FMS players Telogis and Fleetmatics to expand its own networked-fleet’s capabilities—a potential sign of consolidation.

Transportation Management Systems. A TMS enables the digital integration of all transportation-related activities and participants in the logistics process. Such a system uses the data generated by an FMS to facilitate multiple functions, including dispatching loads onto vehicles, managing intermodal transportation, tracking shipments, and achieving KPIs. A TMS also acts as an onboard digital operating system that hosts various in-truck applications, such as telematics.

A TMS can be one of two types. The first type is a networked or cloud-based system that provides software-as-a-service solutions for multiple players. A few examples of such providers include Transporeon in Europe and BluJay and Transplace in the US.

The second type is an on-premises solution for a single company. Providers of single-company solutions include Soloplan in Europe and McLeod Software in the US. The TMS segment is already seeing the beginnings of consolidation. For example, financial investor TPG has acquired Transporeon and Transplace.

Marketplaces. These websites help improve transparency and efficiency in the market by bringing together shippers and carriers and matching the supply of road freight capacity to the demand. Marketplaces broadly split into two types:

- Shipper to Carrier. These marketplaces help shippers locate available freight capacity for full or partial truckloads and, at the same time, help carriers or forwarders increase capacity utilization.

- Carrier to Carrier. These marketplaces enable carriers and forwarders to exchange truck capacity and loads among each other, including less-than-truckload shipments.

Some marketplaces facilitate shipper-to-carrier and carrier-to-carrier transactions at the same time. A European example is TimoCom; Uber Freight is a new entrant in the US. Marketplaces create value by building a critical mass of participants so that users can find the appropriate business partners. Marketplaces generally provide few or no services in addition to their matching and booking functions; marketplaces provide users with a platform for purchasing freight capacity, but they are not directly involved in negotiating shipper-carrier contracts or providing freight capacity.

Virtual Forwarders. Virtual end-to-end forwarders typically contract with carriers and function as a one-stop shop for shippers for all transportation-related services, including contracting and payments. Thus, these startups are challenging traditional forwarders. Virtual forwarders guarantee delivery fulfillment and may purchase capacity, though this is less common in the road freight industry than in the air and sea freight industries, since the latter have more standardized delivery routes. Examples of virtual forwarders include Flexport in the US and Saloodo! in Europe.

Tender Platforms. These platforms help shippers and carriers directly negotiate longer-term transportation contracts. Such platforms also provide innovative approaches to reducing carriers’ network imbalances by optimizing partners’ networks. In Europe, Ticontract and Colo21 are examples of tender platforms.

What the Future Could Look Like

Incumbents must respond to the digital challengers, or they risk being left behind. Consolidation will produce only a handful of winners, as it has in other digitally disrupted industries. Incumbents need to take action now so that they have a place at the starting gate, can benefit from greater differentiation, and can attract new customers. The record of digital freight players demonstrates how companies can buck the industry trend and generate reasonable margins. All of the digital solutions outlined above have the potential for sustained success, albeit some may end up as niche offerings.

Companies can buck the industry trend and generate reasonable margins.

We expect to see waves of consolidation among digital players. This is because there are many similar companies competing in markets where there is limited scope to build significant scale advantages organically. However, some digital challengers may choose to engage in “coopetition”—cooperation with competing companies—before consolidation gathers steam. For example, TimoCom has partnered with multiple providers of telematics and GPS vehicle-tracking solutions so that customers can design routes on the basis of a vehicle’s location and proximity to loads.

We see clear winners emerging among the digital players—specifically, those that have developed a critical mass of users, superior offerings to succeed in a particular market, and the ability to invest in other areas. Adjacent businesses (such as dedicated shipper- and carrier-facing platforms) may decide to partner or merge so that they can cover a larger part of the value chain and offer a better proposition to their users. Mergers may be facilitated by a financial investor; for example, private equity player Castik Capital Partners acquired a marketplace (Teleroute) and a TMS (inet).

Considering that the road freight industry is often regulated along territorial lines, we are also likely to see regional champions emerge.

A Call for Action

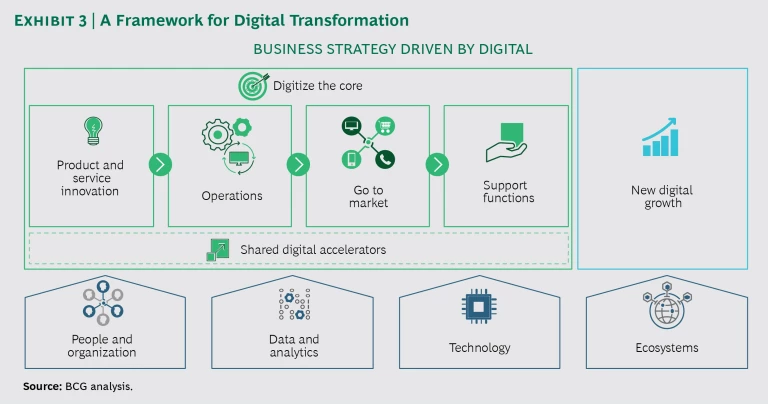

To successfully deal with the digital challenge ahead, incumbents need to act now. (See Exhibit 3.)

Among the measures they need to consider are the following:

- Creating a Business Strategy That’s Driven by Digital. An important first step for companies is to set out a vision for how digitization can transform their businesses. They will need to formulate a clear strategy for achieving this vision, with a roadmap that sets targets along the way and details the practical steps required to meet them. Companies also need to foster a shared understanding across the organization of the digital objectives and priorities. These should be prominently and consistently communicated, both internally and externally. Internal incentives need to be aligned with all goals.

- Digitizing the Core. Digital businesses find new ways to interact with the customer and reinvent the customer experience. These approaches need to be supported by next-generation sales activities, such as automated customer relationship management, to improve sales effectiveness; digitally driven pricing mechanisms, for both personalized and omnichannel pricing; and data-driven marketing for precision targeting. At the same time, internal core processes need to be automated and digitized to greatly reduce transaction and administration costs.

- Fostering New Ecosystems for Digital Growth. The process of building a new digital business can begin with incubating startups, forming partnerships, and making acquisitions. Companies should consider investing in ventures that are close to their core business to gain experience while unlocking benefits for their main operation.

- Tackling People and Organizational Issues and Structures. Large players, in particular, should consider formalizing their vision by making it part of the organization’s structure. For instance, a company could set up a dedicated digital unit or an accelerator center with the responsibility to extend digital initiatives beyond the company’s boundaries in the form of partnerships with suppliers and customers. A clear plan for hiring and training digital talent needs to be developed.

- Upgrading Technology to Improve Data Analytics. Digitization needs to be accompanied by investment in more flexible IT operations and technology across the company’s value chain. On a fundamental level, the IT function needs to be upgraded to support faster product development cycles and improve the analysis and use of data between and across departments and business units.

In the next few years, digital startups are likely to continue their land rush into the road freight industry, as nimble new entrants benefit from the industry’s inefficiencies. A handful of strong players are already emerging from the newcomers and gaining a foothold. Such startups can pose a serious threat to incumbents, at least for parts of their business. Challenged by thin margins and low utilization of assets, existing companies need to react fast to build new digital businesses to improve profitability and avoid being disrupted in the evolving market structure.