When a multinational consumer products company opened a large, state-of-the-art factory in China, it was confident that it would be able to achieve cost competitiveness. Its recipe—combining automation and economies of scale—had worked in Western markets. The company expected to prove the concept in China and replicate it in other fast-growing emerging markets. But things didn’t work out that way.

After a detailed cost benchmarking exercise, the multinational’s executives realized that their products were uncompetitive. The company had focused on optimizing unit costs, underestimating the impact that other factors could have on its bottom line. In particular, the MNC had failed to fully account for transportation and distribution costs—two areas of expense that Chinese companies were in a better position to control thanks to the large number of small factories they had built closer to end-customer markets. As a result, those Chinese competitors had a significant overall cost structure advantage.

If this was a painful learning experience, it was not a unique one. We’ve seen MNCs make similar mistakes in Brazil, India, and Africa. And the competitive environment for MNCs has become even less forgiving this year. The COVID-19 crisis is a powerful new factor (alongside tariffs, trade frictions, and the shortening of lead times) in the regionalization of supply chains.

The way out is for MNCs to rethink their capital expenditure assumptions. Mistakes made early on in emerging markets can be hard to overcome.

The Right Diagnosis

Multinational companies are often quick to attribute their subpar profitability in emerging markets to factor cost differentials, large numbers of expatriate staff, and corporate overhead charges. In fact, the main reason for MNCs’ lower profit margins is their business model, including their commercial and go-to-market approach, product portfolio, and manufacturing and distribution network.

The problem starts with the tendency to use designs optimized for the more mature markets in which MNCs have historically operated. These designs call for factories that are large by emerging-market standards—much larger than a manufacturer in China, India, Latin America, or Africa would normally build. And the designs are often made costlier by MNCs’ desire to “future proof” their emerging-market investments—that is, to start out with the vast capacity they believe they will one day need. For consumer product companies that have a lot of bulky or low-value-density products (such as food and beverage manufacturers), building a few high-capacity plants, rather than a larger number of smaller plants, puts them at a disadvantage in distribution. The problem is particularly acute in geographically dispersed markets such as Brazil, Russia, India, and China. In some of these markets, distribution costs are so high they can permanently impair an MNC’s cost competitiveness.

The problem starts with the tendency to use designs optimized for the more mature markets in which MNCs have historically operated.

How can MNCs miss these problems? After all, most of them use sophisticated network footprint and financial planning models to determine how many factories they should have and how large they should be. Are their models simply wrong?

In our experience, the problem lies with the inputs to the models, starting with the assumption that capital expenses should be as high in emerging markets as they are in developed markets. MNCs tend to make four main mistakes: they overlook local equipment suppliers, default to centerlines and other global standards, accept too much factory underutilization, and overinvest in automation.

Local Equipment Suppliers. If you’ve ever visited an MNC’s factory in an emerging market, you’ve mostly seen equipment from European, Japanese, and North American suppliers. Quality and safety standards are usually given as the reasons for selecting these manufacturers’ more expensive machines, but often the true reason lies elsewhere—in a global supplier agreement or in simple habit. Often the prevailing attitude is, “They’ve always been our supplier. Why change?”

But there may well be reasons to change. Chinese and other emerging-market equipment producers now sell comparable machinery at a fraction of the cost. In China in particular, the quality and precision of factory machines have greatly improved in recent years.

It’s true that plant equipment made in emerging markets often doesn’t have the same control system sophistication, the same data collection capabilities, the same redundancies, or the same energy efficiency guarantees. But all of these features can be added later through local suppliers, often at a much lower price. And in a like-for-like comparison, the cost of the emerging-market machines will be significantly lower than that of comparably equipped machines from suppliers in developed nations.

The rule about not overlooking local sources also applies to labor. Factories can be built more economically if local providers and workers are used. This includes everyone from those who set up the factory’s energy and utility network to the civil engineers who design the factory and oversee its execution to whoever wheels in the plant manager’s chair the night before the factory opens for business.

Centerlines and Other Global Standards. Centerlines are parameters (such as temperature, pressure, time, and tolerances) that manufacturing processes use to ensure that products conform to design specifications (the texture of a packaged dessert, for example, or the viscosity of a shampoo). Centerlines determine not only what raw materials are needed but also what type of equipment to use. A highly demanding manufacturing centerline requires much more expensive equipment than a less demanding one.

Centerlines partly explain why seemingly identical knockoff products are in far less demand than the originals in developed markets. In fact, the knockoff products are not identical and long-time customers immediately know the difference.

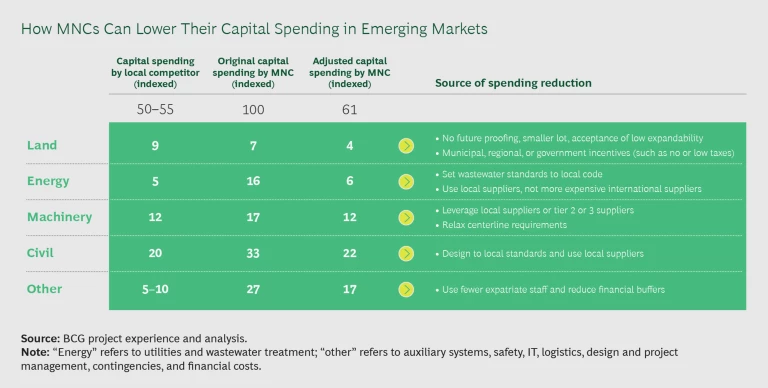

Product specifications are extremely important for MNCs and are inextricably linked to their global brands. So we do not advocate changing centerlines in markets where MNCs have long operated—and where customers could be disappointed by a change. The question is whether some centerline specifications can be relaxed in newer markets if their removal wouldn’t be consequential—and would allow for the use of less expensive equipment. (For additional ways to lower capital spending in emerging markets, see the exhibit.)

Opting for a less rigorous centerline is often a straightforward decision for emerging-market companies. Their insights into local preferences allow them to develop products tailored to their country’s consumers. Indeed, in large emerging-market countries, some local manufacturers tailor different versions of a product for different regions, instead of making a single version that they sell everywhere. For instance, a leading Chinese snack food company markets seaweed-flavored versions of its products in coastal regions and extra-spicy versions in Sichuan province.

There are other standards that MNCs sometimes go too far in enforcing. One global company, for example, required all its buildings, in all regions, to have flood insurance. That made sense for facilities near rivers or other water sources. It made less sense—but was still a requirement—for factories in bone-dry areas of the Middle East.

Factory Underutilization. Given the high growth in emerging markets, some degree of factory underutilization makes sense—you don’t want to end up with a capacity constraint that keeps you from meeting the market’s demands. But when carried too far, underutilization and future proofing can backfire.

Devoting large amounts of capital to a single factory not only puts the factory at an initial cost disadvantage, it also leaves the company vulnerable to high transport costs.

Devoting large amounts of capital to a single factory not only puts the factory at an initial cost disadvantage, it also leaves the company vulnerable to high transport costs. And it ignores the possibility that a product might flop. An unsuccessful product launch is never good, but it’s worse if a future-proofed, high-capacity plant or production line was custom-built for that one product.

Local manufacturers can experience product failure too, but their insights into a region’s customers make it somewhat less likely. And their highly flexible production lines put them in a position to prototype and test new ideas and products before they invest in large assets. This is an effective model in emerging markets, where local preferences can be quite durable and products developed half a world away don’t always resonate.

Excessive Automation. Technology, automation, and Industry 4.0 manufacturing systems can significantly improve operational effectiveness, but adding technology with a limited payoff is a recipe for lost competitiveness. We have written in the past about how well-intentioned but ill-conceived automation initiatives can lock in bad processes; something similar often happens when MNCs assume that their factories in emerging markets should have the same level of automation as their mature-market factories. Instead, we advocate “right sized” automation and the use of technology, particularly analytics, to improve yield, quality, and safety.

Labor costs in most emerging markets are increasing quickly, so much more automation will eventually be justified. But many MNCs automate before the business case exists, to their detriment. For example, one multinational we worked with implemented robots throughout its manufacturing lines to handle a delicate product. The product kept breaking, leading to high scrap rates, and line efficiency deteriorated because the robots themselves kept breaking down. Moreover, the robots were unable to do product inspections; for that task, human beings were still required.

Instead of overinvesting in automation, many emerging-market factories would be better off implementing lean and other advanced manufacturing practices to simplify their processes and remove waste. This can be accomplished through technology investments aimed at improving quality and safety and by implementing basic automation. More sophisticated automation can be the next step, locking in improved processes a little further down the road.

Emerging-Market Essentials

If multinational companies are to improve their competitive position in emerging markets—whether in Asia, Latin America, or Africa—they will need to do some things differently. Here are three ideas to always keep in mind.

If centerline standards are applied where they aren’t helpful, they can saddle the MNC with uncompetitive products and high costs.

Use localized insights to formulate a fully integrated emerging-markets strategy. Your product portfolio, production system, and commercial system should all be tailored to the market you’re in. And your product portfolio should be aligned not just to local demand but also to the plant and distribution network, to product and packaging specifications, and to the type of capital equipment used. This brings us back to the crucial issue of global centerline standards. If these are applied where they aren’t helpful, the effects can cascade through the entire emerging-market operation, saddling the MNC with uncompetitive products and high costs.

Localized insights should likewise be integrated into your commercial system—the way your company sells, its go-to-market approach, and how it structures its sales force. That doesn’t necessarily mean MNCs should copy the traditional-trade go-to-market model of their local competitors or build smaller and more dispersed production and distribution networks. MNCs bring significant advantages of their own. But they do need to rethink their assumptions in emerging markets—about the products they sell, how to bring those products to market, their level of capital investment, and the costs of their production networks.

Think end to end and pay attention to tradeoffs. You won’t do a good job of integrating your product portfolio and your commercial and production systems if you haven’t done a thorough analysis of the tradeoffs and interdependencies. Decisions involving product centerlines, commercial models, and production networks can’t be separated. Companies that are able to design products with relaxed centerlines and with locally sourced capital equipment are often able to these break those tradeoffs.

Get input from multiple disciplines and diverse experts. At the beginning of this article, we described the disappointing experience of an MNC—one of BCG’s clients—with products manufactured at its state-of-the-art factory in China. Our initial discussions were with the company’s production engineering team, since the plant seemed to be the main source of the company’s high capital expenditures. But when it became clear that the product portfolio and centerline standards were also contributing to the capital spending problem, we expanded the working team to include R&D, procurement, finance, and product management.

Given the number of interdependent functions involved, the capital decisions of multinationals in emerging markets should be informed by discussions that include all your product people as well as your finance, procurement, and marketing and sales functions. Too often, these functions operate in silos.

The Need for Fresh Thinking

It’s understandable that MNCs entering emerging markets would start with the products, practices, and standards that have worked for them elsewhere. It’s easy to assume that the production and distribution systems they rely on in developed markets will give them an immediate advantage in a less mature emerging market. Sometimes this is a sound assumption, and the MNC’s resources and know-how pay off immediately.

Often, however, the specific conditions of an emerging market call for some significant adjustments to an MNC’s business model. That could mean rethinking the product formula; the size, number, and location of plants; the capital expenditures within plants; and the go-to-market approach. To succeed in emerging markets, MNCs must understand these markets as well as they understand their markets back home and invest smartly as well as aggressively.