This is an excerpt from The Comeback Kids: Lessons from Successful Turnarounds.

In the early 2010s, the Japanese food, chemical, and pharmaceutical manufacturer Ajinomoto was plagued by challenges in several of its major businesses. Bulk products (including sweeteners, seasonings such as MSG for processed food manufacturers, and amino acids used in animal nutrition) all suffered from intense price competition. Other players added production capacity, pushing prices down even further. Similarly, Ajinomoto’s pharmaceutical business saw revenue decline by 62% from 2009 to 2013, owing to a dearth of new products in the pipeline, competing products, and pricing pressure from the government’s national health system. All of these issues were exacerbated by a weak overall economy in Japan and rising raw material costs.

In 2014, management launched a turnaround aimed at shifting the portfolio away from commodity bulk goods in favor of specialty products in bioscience and chemicals—a move that would allow Ajinomoto to retain pricing power. The company also planned to expand into higher-growth markets across Asia, Africa, and the Americas, and into adjacent channels such as retail and restaurants.

The turnaround aimed to shift the portfolio away from commodity goods in favor of specialty products.

To develop more innovative solutions for customers, the company shifted resources to its R&D function. It also renewed its focus on the core B2B food ingredient business, which is expected to deliver significant revenue growth through 2020. As food service companies require more integrated solutions—rather than basic ingredients—Ajinomoto has positioned itself for success. In addition, Ajinomoto identified some opportunities in the nutrition business, and it expanded beyond food industries with several health care products, which are used in areas such as regenerative medicine.

The company sold some of its bulk business units and expanded into the markets it identified as its Five Stars: Thailand, Vietnam, the Philippines, Indonesia, and Brazil. Ajinomoto also invested in processed food companies in the US and Africa, giving it a base for expansion. The acquisitions will continue. “Over the next three years, we are going to pour over 150 billion yen [nearly $1.4 billion] into M&A,” said president and CEO Takaaki Nishii in early 2017.

Ajinomoto has expanded beyond food ingredients.

Since 2011, domestic food sales have contracted, and international food sales have risen sharply. In all, the company is on track to scale back the percentage of revenue from bulk products across multiple product lines through 2020. And for the bulk products that remain, Ajinomoto is using technology to cut production costs, reducing the raw materials and energy required for some of its processes.

To organize for sustained performance, Ajinomoto supported its global expansion by delegating more authority to local management teams, freeing them to make faster and better decisions based on the needs of their markets. Nearly half of all international operations are now run by executives hired in those markets.

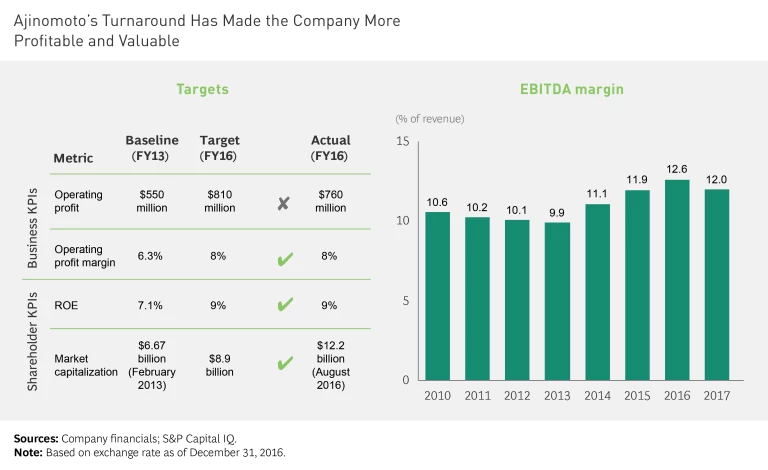

The turnaround has led to a sharp improvement in financial performance. Management set a goal of increasing operating profit from $550 million in 2013 to $810 million in 2016 and fell just short (with profits of $760 million). But the company hit all of its other goals: an operating profit margin of 8%, return on equity of 9%, and a market cap of $8.9 billion (the actual figure was $12.2 billion). Moreover, EBITDA margins have climbed steadily. (See the exhibit.)

The company aims to be a top-ten global food company by 2020 with profits of $1.3 billion. The journey will not be easy, especially with increasing volatility in many markets. That said, Ajinomoto has armed itself through this turnaround with the discipline of greater emphasis on innovation, value-added products, and higher-growth markets and channels.