We all know that marketing is changing fast, but think for a nanosecond about just how fast. The five FAANG companies—Facebook, Amazon, Apple, Netflix, and Google (Alphabet), whose combined market cap is approximately $3 trillion—have an average age of 23 years, the equivalent of one human generation. They are consumer companies as well as tech giants, and in those 23 years, they (and others) have redrawn the customer buying journey and redefined how companies and consumers interact.

And that is only the beginning. Technologies and tools continue to advance and digital channels to fragment. Just a few years ago, marketing was about digital, mobile, and social. Today, social alone segments into multiple platforms—Facebook, Instagram, Snapchat, Pinterest, and YouTube, to name a few. In China, WeChat, Douyin, and Youku are popular.

New channels and types of channels, including vision ambience, voice ambience, and ever more precise and interactive geolocation, are entering the mainstream. Artificial intelligence (AI) is automating internal processes and enabling new forms of consumer engagement. Measurement and ROI tools are better than ever—for those that can harness them and the relevant data. And, of course, consumer expectations keep rising.

Measurement and ROI tools are better than ever—for companies that can harness them and the relevant data.

These are just some of the changes that marketers need to stay current on today. Tomorrow will be different—and even more complicated. The question is, how can CMOs and their companies keep up? At some point, hiring more data scientists and software engineers is neither practical nor a solution. Leaders are taking a page from the digital natives’ playbook and turning to technology for the answer.

Can Marketers Keep Current?

In our work with clients, we see three areas of fast-paced change that challenge marketers’ ability to stay current: rising consumer expectations, evolving channels of customer engagement, and the ascendancy of data as a driver of strategy. Here’s a quick tour.

Consumer Expectations. Digital natives taught consumers to expect more, from companies as well as their products and services, and consumers learned their lesson well. According to salesforce.com’s 2018 State of the Connected Consumer report, four in five customers say that the experience a company provides is as important as its products or services, and almost 60% have switched to a competitor because it provided a better experience. Consumers today expect an unprecedented degree of relevance, and increasingly personalized customization, in the products and services that companies offer. Salesforce found that 60% of customers look for “tailored engagement based on past experience.” More than 70% “expect vendors to personalize engagement to my needs,” and almost 70% “expect an Amazon-like buying experience.”

Plenty of companies are responding. For example, Singapore Airlines personalizes its in-flight entertainment offerings. U.S. Bank provides personalized recommendations for day-to-day financial decisions with customers’ financial health in mind. At Walt Disney’s Orlando resort, visitors use MagicBands to reserve rides, unlock hotel rooms, and make purchases; guests at Disney’s new Shanghai resort can do the same things with their smartphones. Disney gathers data from every interaction and uses it to serve up targeted offerings to guests. Carnival is introducing “smart medallions” that use similar technology on its hundred-plus cruise ships.

Already, brands that create personalized experiences are seeing revenue increase by 6% to 10%, according to our research—two to three times faster than those that don’t. As a result, personalization leaders stand to capture a disproportionate share of category profits in the new age of individualized brands, while slow movers will lose customers, share, and profits. Over the next five years in three sectors alone—retail, health care, and financial services—we expect personalization to push a revenue shift of some $800 billion to the 15% of companies that get it right. (See “Profiting from Personalization,” BCG article, May 2017.)

Personalization leaders stand to capture a disproportionate share of the profits, while slow movers will lose customers, share, and profits.

But meeting these rising expectations requires new capabilities. Tracking a customer through the purchase journey may be a one-time, a one-hundred-time, or a one-thousand-time experience, and customers want to be remembered as they crisscross channels. Companies must reinvent their operating models to act at speed. They need a data strategy that they can execute at scale and campaign-tracking abilities across channels that can adapt in real time and enable a self-reinforcing cycle of tailored experiences. They must manage new complexities around permission marketing and growing concerns around data privacy and security. They also need to provide 24-7 access and service because customers want to decide when and where they interact with a brand.

That’s today. Tomorrow’s customer journeys and personalization programs will be run by AI algorithms and software applications, or bots. Are you ready?

Channels of Engagement. Thanks in part to continuing advances in technology, media, entertainment, and commerce, consumers are engaging with all kinds of new devices, tools, and digital channels. Think about voice recognition software. Since Apple launched Siri in 2011, she has been joined by competitors from Amazon, Google, Microsoft, and others. (There go those digital natives again.) Google reported in 2017 that 20% of mobile queries were voice searches; Comscore predicts that half of all searches will be voice activated by 2020. In China, voice is already the primary search method.

There’s little question that voice is the next major consumer interface (at home, at work, and in the car, the home, or any other familiar location). Amazon has started to allow brands to offer voice-only deals through Echo devices, opening the door for paid search opportunities via voice; first movers included Procter & Gamble’s Clorox (in January 2018).

There’s little question that voice is the next major consumer interface.

It’s not just a voice thing. Vision-driven engagement is another powerful channel for marketers. BCG estimates that more than 80 million people in the US, or roughly one-third of all smartphone users, engage with augmented reality (AR) at least monthly, on the basis of 2017 data from Snapchat, Pokémon Go, and other AR applications. The consumers using AR applications are a particularly attractive segment for advertisers: most are millennials (aged 19 to 34) or Generation Z consumers (aged 18 or younger). (See Augmented Reality: Is the Camera the Next Big Thing in Advertising?, BCG Focus, April 2018.)

Virtual reality (VR), another form of vision-driven engagement, enables consumers to experience products before purchasing them, without ever leaving their couch. VR and AI are an especially potent combo. Think about simulated interactions with products and assistance from virtual tours of a home a thousand miles away. Or remotely test-driving a car. Or a contact lens that records and stores video in the blink of an eye. The Japanese retailer Start Today offers a combination of the Zozosuit and the Zozo app, which together develop detailed measurements of a customer’s body. Start Today has expanded its sizing solution to more than 70 countries.

Plenty of companies have already successfully experimented with AR and VR. Nissan drove a 15-percentage-point improvement in brand favorability with its See the Unseen campaign, which showcased advanced vehicle safety technologies through interaction with Star Wars movie characters. Ikea uses VR to allow consumers to “walk” around a 3D kitchen and interact with objects, adjusting the features in real time. Caterpillar created an app that takes users inside a bulldozer so that they can experience its capabilities and features from behind the wheel. Alibaba’s VR shopping experience allows customers to virtually visit stores around the world, learn about products, and purchase them through the platform.

Vision ambience will forever alter the prepurchase interactions that consumers have with brands. Customers will be drawn to pertinent content in relevant formats (with different ones resonating with each individual) across various points in the consumer journey.

A long-standing digital marketing capability—geolocation—is enjoying increased prominence as predictive analytics demonstrate the power of location data. To track each stage of a delivery, Uber Eats uses motion sensor data from drivers’ phones to indicate when the driver is on the road, walking, or stuck and not moving. A health care company boosts profits by geotargeting its marketing spending in real time to focus on high-pollen areas during peak seasons; it aligns media spending with consumers’ locations and activities. Japanese retailer Ryohin Keikaku, or Muji, has implemented a location-based loyalty program: when members enter a Muji store, they receive points that they can use for discounts or services.

All of these new and more complex channels of consumer engagement mean that brands must rethink their data-processing norms and search engine optimization tactics. They must also identify measurable precursors to sales and determine how to market at those moments and locations. In time, software applications will be capable of ingesting, processing, creating, and deciding which content to push (and to whom) at relevant moments.

Data Ascendancy. Data is the fuel that runs the modern marketing engine. It facilitates improved targeting and customer insights, enables more complex personalization functions, provides the ability to link on-line and offline consumption habits, and leads to smarter business decisions and greater business insights.

Data has taken on its own version of Moore’s law: the sheer amount of available data is predicted to at least double every two years into the future. At the same time, the types of data—and its sources—continue to expand. The Internet of Things (IoT) is leading to an explosion in data as mobile connections rise from 7.5 billion in 2017 to 25.1 billion in 2025, and sensors, monitors, cameras, and gauges provide an ever-larger plethora of information. The long-awaited deployment of 5G mobile technology—which will vastly increase the speed, capacity, and quality of mobile networks—will enable the generation, collection, and consumption of more data than ever.

Digital natives, which grew up feeding on data, have long demonstrated the benefits of the “data flywheel effect,” in which digital ecosystems enable unprecedented data accumulation and analysis, fueling improvements to products and business processes and stimulating further growth and data access. These ecosystems can provide seamless and comprehensive digital experiences for customers by organizing business partners on a single platform to satisfy multiple customer needs. They thereby lock in customers and capture a greater portion of their attention, time, and value. (See “How IoT Data Ecosystems Will Transform B2B Competition,” BCG article, July 2018.)

But, as with the capabilities described above, harnessing, cleaning, sorting, and storing data—and assembling the insights that count—require new technology and analytics capabilities. Platforms must talk to one another. Software must be embedded in, or support, most products and services. All marketing divisions (as well as others) need access to real-time modeling and analytics—and the skills to use them. Data security becomes a heightened concern. (See “Bridging the Trust Gap in Personal Data,” BCG article, March 2018.)

Internal Company Considerations

In the past, marketing departments typically set brand strategy and outsourced campaign development and execution. Even as digital technologies reshaped campaign content and delivery in recent years, companies relied heavily on agencies and outsiders to handle the increasingly automated aspects of media buying and campaign execution. The internal-external pendulum is swinging back inside now as companies realize the rising importance of speed, control, and data ownership. Insourcing execution accelerates output, which is particularly relevant as digital channels increase in number and importance and require ever-faster content turnout. Internal execution also facilitates the ability to test, learn, and make adjustments to campaigns on the fly. In addition, many companies are finding that in-house execution allows for greater control and reins in costs, in some cases saving as much as 50% of current agency and content development expense.

Perhaps most important, companies that own their data own the customer. Data kept in-house and pulled directly remains unfiltered and can be used in many ways to inform content development, test campaigns, make media-buying decisions, personalize outreach, and measure results.

The proliferation of channels and the importance of managing the customer journey put a rising premium on measurement, which is rapidly becoming as much an exercise in the microattribution of spending and impact as in the tracking of broad results. Data availability, connections, and processing power are critical to the ability to employ a test-and-learn approach and to link marketing spending and ROI—specifically how individual marketing channels and tactics drive impact within the stages of the consumer journey. CMOs also have an opportunity for an expanded voice in the C-suite if they put the proper tools in place to prove marketing impact.

Data and Software to the Fore

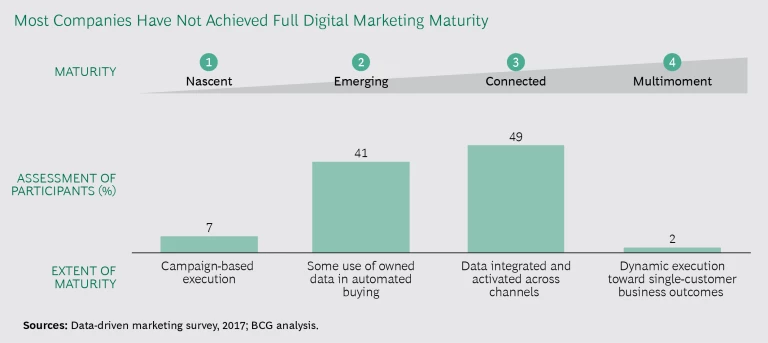

CMOs and their marketing colleagues have the potential to do more to affect corporate results than ever before. Most companies aren’t there yet. Our research into 40 leading international marketers found that though companies are trying to climb the digital curve, the curve gets steeper as it rises, increasing the difficulty of moving to the next level. (See the exhibit.) We rated companies from one to four on their digital maturity with four being “multimoment maturity”—the ability to deliver personalized content to consumers at multiple moments across the purchase journey. Only a few companies have achieved that level. Most cluster around two and three.

The companies in our study wrestled with both technical and organizational issues:

- 83% could not link data across consumer touch points.

- 68% lacked automation, relying instead on manual processes.

- 78% could not attribute value to their individual touch points with consumers.

- 80% suffered from inadequate cross-functional coordination.

We also found that companies that do climb the digital maturity curve can achieve impressive results: they report cost savings of up to 30% and revenue increases of as much as 20%.

But even digitally mature marketers face a greater challenge: positioning themselves to stay current with the fast—and accelerating—pace of change. This is a different type of organizational test. Companies can boost digital maturity by adding skills and technology and developing new capabilities. But it’s not practical to keep adding more technical talent or building out new systems for every new digital need that develops. The process is too slow, and the inevitable side effect is organizational bloat.

Instead, marketing functions need to find ways for their current staff to manage multiplying channels, advancing technologies, and rising consumer demands. The answer, we believe, lies in combining new software platforms with advanced training so that any marketer can access and use the full array of data, capabilities, and tools available today—and tomorrow—whatever his or her area of responsibility.

Consider, for example, a business unit marketing manager for a coffee brand in Sweden and that person’s dotted-line boss, the regional marketing manager for packaged goods in the Nordic countries. Suppose both individuals (and anyone else in the global marketing function) could tap into a software platform—using a laptop, tablet, or smartphone—that provided access to, and the ability to manipulate, two types of real-time data.

The first data sphere is strategic. It helps both managers create value by finding the best allocations of marketing resources for the coffee brand in Sweden and for all CPG products in the Nordic countries. It combines relevant company data (such as sales volume, revenue, profit, share of market, share of voice, relative pricing, and distribution) with market research results (category trends, consumer demand trends, and brand health data) and analytics outputs (return on marketing investment within the units of allocation estimated by econometrics, digital attribution, AB testing, and ad hoc research).

The second data sphere is tactical. It helps users create superior marketing plans for short- and long-term brand growth and profit generation—taking into account the potential impact of all tools and channels available. It provides brand teams with full visibility and integrated planning capability for the entire brand’s marketing plan including media and below-the-line activities such as those in the store and at the point of sale. It covers the complete planning scope, from the role of brands in the portfolio to individual market activities. It supports the design of a brand’s marketing plan with instant estimates of impact on sales, profit, and ROI. It helps brand managers to track actual sales during the execution year and use real-time results to estimate sales performance for the remainder of the year.

Taken together, the two spheres of information provide the user—whatever his or her level of responsibility—with a full view of the tasks, goals, and resources. Moreover, software enables teams of users to design, test, and execute multifaceted campaigns at unprecedented speed and to make adjustments across media and across individual media platforms (Facebook versus Instagram, for example, or voice recognition versus AR). And it can do all this almost regardless of the number of components or the future complexity of the media and technology landscape.

A few leading companies are starting to build out their data capabilities—using an agile and minimum-viable-product approach.

This technology exists today. A few leading companies are starting to build out their capabilities—using an agile and minimum-viable-product approach. They are organizing ecosystems to gain access to the internal and external data and expertise that they need. The processing power and storage capabilities can be found in the cloud, which makes the new platform readily accessible to users globally as soon as it’s ready for testing. These companies are not striving for perfection. They are looking to improve with a step change in capability—and then to progress even further over time.

If You Are Not Moving Forward…

Picture three airplane passengers disembarking at a gate far from the main terminal. Two decide to walk the distance to baggage claim. The other makes use of the moving walkways that speed the journey. At the end of the first walkway, the fast mover has opened a lead of 20 yards; at the end of the second, the lead has more than doubled; and at the end of the third, the lead is approaching the length of a football field.

So it is with digital technologies. If the three passengers were actually three companies, the early adopter would have established both a lead and critical competitive advantages that would be hard for the others to close or counter. Technologies continue to advance, often at breakneck speed, and companies that allow themselves to fall behind find it more and more difficult to narrow the gap.