When travel declined sharply and smog cleared over big cities around the world, people saw that when emissions decline the benefits come remarkably fast. This is a valuable lesson from the pandemic, and it’s one reason that the issue of environmental sustainability will emerge even stronger once COVID-19 no longer tops global business agendas.

For telecommunications network operators specifically, the issue of sustainability has become urgent. The unprecedented demand for digital communications during the pandemic has forced telco infrastructures to consume more energy than ever, expanding their carbon footprint. This demand likely will continue or increase as companies not only rush to adopt remote work during the pandemic but make these tools a permanent part of the workplace.

Until recently, telco CEOs have been reluctant to make sustainability a top strategic priority, seeing it as a cost topic best left to internal sustainability departments. But in fact, sustainability is a strategic topic with substantial potential returns in terms of savings and new product offerings that CEOs need to own. To gain insight into these issues, BCG launched its Telco Sustainability Index, which zeroes in on how to measure sustainability and what steps are necessary to implement a sustainability approach for the entire business.

The Scope of Emission Reductions

For many years, the ICT industry’s impact on the environment went relatively unnoticed. But its effect is consequential and gaining attention. The industry accounts for 3 to 4% of global CO2 emissions, about twice that of civil aviation. And with global data traffic expected to grow around 60% per year, the industry’s share will grow further unless investments in energy efficiency and renewables can offset the effect.

As a specific segment within the ICT industry, telco operators have a sizeable impact on both CO2 emissions and waste. To assess the CO2 impact, companies need to take into account all three “scopes” of emissions. Telcos generate few so-called scope 1 emissions—those generated from directly burning fossil fuels. Scope 2 emissions result from purchasing energy and heat (so what is in scope 2 for a telco is in scope 1 for the energy supplier).

Finally, scope 3 emissions are caused by downstream and upstream activities, such as the energy consumption of suppliers. This is by far the biggest impact area, typically making up more than two-thirds of a telco’s total carbon emissions, and sometimes more than 90%. In the past few years, most telcos have begun to acknowledge that they should assume responsibility for their scope 3 emissions, for example by demanding transparency into their suppliers’ footprint, engaging with them to improve, and factoring this into the selection process.

In addition to lowering their own end-to-end emissions, telcos have a historic opportunity to help other industries become more energy efficient.

In addition to lowering their own end-to-end emissions, telcos have a historic opportunity to help other industries become more energy efficient. Smart products and solutions from telcos—e.g., smart agriculture and smart logistics—are already available that can help other industries reduce their carbon emissions by an amount up to 10 times the telco industry’s own emissions. This “customer enablement” is becoming a key measure of a telco’s environmental performance and a major avenue for boosting its B2B business.

Besides energy efficiency, telcos could help companies save energy by replacing high carbon physical products and activities with virtual low carbon equivalents (a.k.a. dematerialization). Also, telcos with IT activities could play a big role in helping companies use so-called digital twins to simulate the performance of physical assets, processes, people, places, systems, and devices. For example, a company could create a digital simulation of an aircraft engine and feed in data so that the simulation behaves like the real thing. This way a company can learn how the engine performs in various circumstances and also discover opportunities for reducing emission intensity.

Measuring Sustainability Progress

In reaction to all these dynamics, most telco companies have begun to put environmental sustainability policies in place. However, common standards for comparing and qualifying those policies do not account for the specifics of the telco industry, and are either too narrow (e.g., not considering customer enablement) or too wide (e.g., focusing on the United Nations’ 17 Sustainable Development Goals but not being specific on environmental issues).

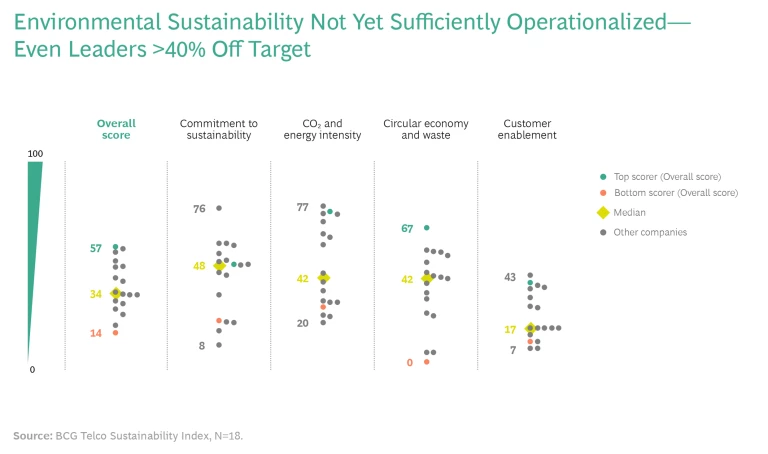

To fill this gap, BCG has launched its Telco Sustainability Index. The index captures the four dimensions most relevant to a telco’s environmental sustainability: commitment to sustainability, CO2 and energy intensity, circular economy and waste, and customer enablement (see Exhibit for our initial, high-level results). What we’ve learned so far is that good practices are isolated, and no telco has created a comprehensive, effective sustainability strategy.

Commitment to Sustainability. This index dimension has four components: targets (e.g., a specific year the company wants to achieve net zero-carbon emissions, and specific waste reduction targets); culture (e.g., having management’s compensation tied to environmental targets up to the CEO); transparency and reporting (e.g., detailed and recent data, and external assurance of data); and sustainable sourcing (e.g., using sustainability principles to select suppliers, and monitoring the supply chain’s impact on the environment).

Basically, all major telcos have said they want to become net carbon neutral by 2050, a goal supported by the GSMA. In addition, most major telcos have defined specific 2030 targets for emissions, waste and the share of renewable energy (e.g., reduce energy consumption per unit of traffic by 70% or more, and get 100% of electricity from renewable sources). Meanwhile, leading players in Europe have already reached their net carbon neutral goals, coupling low emissions with carbon-offsetting investments.

Leading players in Europe have already reached their net carbon neutral goals, coupling low emissions with carbon-offsetting investments.

Energy and CO2 Intensity. This dimension measures scope 1, 2 and 3 emissions in terms of energy intensity, e.g., comparing emission totals to IP data traffic (gigajoule/exabyte). The telco industry has a significant opportunity to reduce its energy intensity by upgrading to 5G. According to BCG analysis, this upgrade will eventually reduce energy consumption of its mobile networks by 70% per gigabyte. CO2 intensity depends heavily on energy sourcing, most importantly the share of renewable energy sources as a percentage of total energy sources. Due to the sometimes limited supply of renewable energy, only a few telcos operate their networks with 100% renewable energy. Most generate some scope 1 and 2 emissions. Today, leading telcos are working with all suppliers to put plans in place to reduce scope 3 emissions to zero by 2030.

Customer Enablement. Once a telco has an environmental sustainability approach in place to address its own footprint, it can begin to help other industries cut down their emissions. Many offerings of the ICT industry (of which telco infrastructure is always a part) can enable business customers to cut down energy consumption. These offerings include digitization and dematerialization, data processing, and process, activity and functional optimization.

This index dimension is measured using a “customer enablement factor,” which quantifies customers’ carbon emission reductions relative to a telco’s own footprint. While most telcos don’t report a standard carbon abatement factor yet, many say this is a goal. One global industry leader, for example, wants to help business clients cut their carbon emissions by nearly 10 times its own scope 1 and 2 emissions.

Circular Economy and Waste. Besides carbon emissions, waste is the second major factor contributing to any telco’s environmental footprint. This index dimension measures direct waste, using metrics such as waste totals compared to IP data traffic (kt/exabyte), and the amount of waste recycled as a percentage of total waste. The other component is consumer behavior, measured by mobile phone collection for refurbishment and recycling relative to group (mobile) revenue.

In terms of emissions, a carbon-neutral economy is the goal. In terms of waste, the goal is a “circular economy.” This is based on the principles of designing out waste and pollution, keeping products and materials in use, and regenerating natural systems. Most telcos still don’t calculate their waste impact across the value chain (one Asian player is an exception, estimating 3.7 kg per customer). And only a few set comprehensive targets, e.g., a zero-waste target for the facilities.

Most targets that do exist are confined to isolated segments such as paper. In Western countries, for example, e-waste per capita is more than 20 kg, with telco and IT equipment being a major share. About 80% of e-waste is discarded in landfills, burned or illegally traded every year, according to Global E-waste Monitor. However, a few companies are excelling at circular economy principles. One Asian telco has launched a nationwide e-waste recycling program. It takes back all e-waste, not only electronic materials from its own operations.

Implementing a Sustainability Approach

To become green, a telco must align its organizational goals with those of a low-carbon economy and implement a sustainability approach that can deliver on those goals. To this end, telcos should consider the following five steps.

To become green, a telco must align its organizational goals with those of a low-carbon economy and implement a sustainability approach that can deliver on those goals.

Build the Value Case. First and foremost, telcos must shift away from the all-too-common mindset that sustainability management is about cost and compliance. Better to view it in terms of value generation and investment that can produce cost savings and new revenue through the following:

- Energy efficiency. Energy costs can account for as much as 40% of network OPEX.

- Pricing power. BCG studies have shown, for example, that young consumers are willing to pay a 10% premium for green telco products.

- Loyalty. A focus on sustainability appeals to both customers and employees.

- Market valuation. All industries enjoy a valuation benefit and have lower cost of capital when they are more sustainable and have higher ESG scores.

- Revenue streams. Telcos can add new revenue streams by offering sustainability services that have been successful in the B2B space before.

The value case for each telco will be different depending, for example, on the specifics of the geographic market and the carbon-intensity of the current infrastructure. It’s always necessary to understand the specific business opportunities that sustainability unlocks to create and commit to bold ambition.

Analyze the Baseline. Telcos need to assess their current emissions and circularity to develop solid baseline reference points. They should also assess the current baseline potential of their solutions for customer enablement. In our experience, telcos and tech companies often don’t need to examine every emissions component in detail. Top-down estimates (e.g., using internal P&Ls, ERP reporting and fuel use data) can accurately estimate top-down figures on scope 1 and 2 emissions.

Likewise, of the 15 types of scope 3 emissions, only three or four are usually of much significance. For example, “purchased goods and services” can account for up to half of all scope 3 emissions, while “waste in operations” is typically negligible from a carbon point of view. Areas like “food waste” or paper cup avoidance may serve as a marketing message, but not make much difference to the overall footprint. In BCG’s experience, an eight- to 12-week examination can identify about 95% of a company’s environmental footprint.

As for customer enablement, the baselining exercise involves reviewing the entire B2B product portfolio from a sustainability perspective. This means modeling the carbon abatement effect of each solution in the portfolio. It’s likely that any telco with “smart solutions” (e.g., smart buildings, smart logistics, etc.) will contribute to the carbon abatement of their customers that use the solutions.

Identify Levers. Besides establishing the baseline, telcos need to understand the actual mechanics contributing to that baseline. We have identified 150 emission levers relevant for telcos. As noted earlier, for example, 5G can reduce energy consumption on mobile networks. In addition, telcos can significantly reduce the carbon intensity of data centers they own by consolidating or optimizing cooling, as well as by digital innovation. For example, Google applies machine learning using neural networks to predict and then optimize energy consumption at data centers.

BCG has also identified a comprehensive list of levers influencing circularity all along the lifecycle. For example, telcos can pressure providers to build sustainability into smartphone design. They can also encourage the refurbishment or recycling of phones to capture valuable rare earth elements.

Armed with the value case, current baseline, and improvement levers, a telco should set specific actionable targets for each step in the value chain.

Set Ambitious Targets. Armed with the value case, current baseline, and improvement levers, a telco should then set specific actionable targets for each step in the value chain. For example, in sourcing and procurement, companies can introduce new KPIs such as “share of procurement volume with transparent emission reporting.” They can give product managers targets for scope 3 emissions and waste, give tech and IT targets for energy efficiency of network and data centers, and give customer service operations targets for downstream carbon reduction and for improving the circularity of hardware.

Implement the Plan and Establish Governance. Ambitious targets are no use without an actionable plan. Telcos need to translate targets into individual business unit objectives and assign functional responsibilities and accountability for each. Sustainability targets must also be integrated into the financial planning process and shadow pricing (which adds a hypothetical surcharge to market prices for goods or services that involve carbon emissions in the supply chain). Then telcos should anchor those targets in detailed implementation roadmaps—supervised by tight governance on the corporate level to consolidate the “sustainability accounting.” In short, governance needs to extend much further than sustainability departments. Most important, top management must participate in this oversight, ideally tying the CEO’s variable compensation and those of all other executives to sustainability accomplishments.

Conclusion

As the pressure for environmental sustainability builds, telcos need to begin embedding sustainability issues into their everyday business decisions in a structured, comprehensive way. To this end, CEOs must own these initiatives, not only to reduce the company’s own carbon footprint, but to enable customers and other industries to better manage theirs as well. Far from being merely a cost topic, approaching sustainability from this perspective will open up enormous business opportunities.