What is the current state of commercial performance in the engineered-product industry, and which practices do leading companies apply to drive commercial excellence?

These questions have become increasingly relevant as the industry’s commercial environment evolves toward greater diversity and globalization. The Boston Consulting Group sought the answers in a recent quantitative and qualitative benchmarking study of Europe-based companies whose operations are global and whose products range from small parts (such as sensors) to project-based offerings (for example, paper production machinery). The BCG Commercial Excellence in Engineered Products Benchmarking Study 2013 reveals critical gaps between current performance and best practices, and it points to opportunities for companies to apply more-sophisticated approaches to sell their products and services.

The engineered-product industry encompasses a wide range of segments and companies, but most players share the need to develop complex high-tech products that are often heavily tailored to or specifically designed for individual customers. They also have a common need to achieve excellence in sales and marketing in order to drive top-line growth, improve pricing and profitability, create competitive advantage, and complement efforts to reduce costs. Many engineered-product companies are missing out on these benefits, however, because their sales forces adhere to the traditional way of selling products and services.

Although engineered-product companies have been leaders in applying technical innovations and advanced analytics to product design and manufacturing, the commercial function at many of these companies has lagged behind in the transition from “art” to “science.” The sales approach is frequently based more on intuition than fact, given that many salespeople tend to rely heavily on relationships and persuasion in pursuing and closing deals. Because top sellers are often rewarded on the basis of volume, they are incentivized to offer price promotions and giveaways and to negotiate informal deals. This traditional approach often results in lower profitability and a higher cost to serve, as well as lost opportunities to improve customer lifetime value and satisfaction.

To be sure, applying “art” in sales to maintain strong customer relationships still has its place. Today’s commercial environment is more complex than in the past, however, which means that to remain competitive, engineered-product companies need to enhance their sales forces’ traditional skills with advanced technical and analytic capabilities.

A More Complex Commercial Environment

The complexity of the commercial environment for engineered-product companies is increasing on several fronts:

- Diverse Markets. Companies now sell their products in multiple markets that are growing at different rates. This “multispeed” world has replaced the “two speed” world in which companies needed to distinguish only between mature and emerging markets when selling products. Customers are also expanding their operations globally and expect their engineered-product suppliers to diversify their offerings to meet the needs of different operating environments.

- Narrowly Defined Customer Segments. Companies must tailor their offerings to “microsegments” of customers with distinct needs for products and services. Emerging-market customers are rapidly becoming more sophisticated and differentiated, and manufacturers must be agile enough to keep pace. For example, manufacturers cannot serve Chinese customers with a single strategy. Customers in the growing market of inland China have very different requirements for products and services than the coastal Chinese customers that are more familiar to manufacturers.

The Rise of Global Challengers. The industry’s traditional leaders must compete with a new generation of challengers based in emerging markets, particularly China. As recently as 2000, the industry’s goods flowed primarily between the U.S. and Europe, with very limited flows to and from China. By the start of the current decade, however, Chinese players had made strong inroads into Western markets. From 2000 through 2011, exports of engineered products from China to the U.S. grew at a compound annual rate of 25 percent (reaching $30 billion annually), and exports from China to Europe grew at a compound annual rate of 28 percent (reaching $33 billion annually). During the same period, exports from the West to China grew as well, albeit at a slower rate. Exports of engineered products from the U.S. to China grew at a compound annual rate of 17 percent (reaching $14 billion annually), and exports from Europe to China grew by a compound annual rate of 19 percent (reaching $51 billion).

For Western companies, the rise of global challengers means that they must defend their home markets while simultaneously pursuing growth in China and other emerging markets—a requirement that creates significant resource-allocation challenges. Further, some European engineered-product companies have been acquired by global challengers. For example, Sany and XCMG, leading Chinese manufacturers, acquired some of their European peers recently, intensifying the competitiveness of Europe’s mature market.

- Pressure on Prices. Competition from emerging-market players has also created downward pressure on prices in all regions. Price erosion has been further driven by the need to negotiate with more-sophisticated purchasing departments and the low growth rates in mature markets, among other factors. Moreover, many engineered-product customers are seeking less expensive, “good enough” equipment to meet their needs rather than purchasing high-end equipment as their default approach.

To meet distinct customer needs in highly competitive markets, companies have developed increasingly complex offerings that integrate products and services. For example, manufacturers of medical-imaging equipment provide diagnostic software as well as scanners, and manufacturers of material-handling equipment provide software for logistics and supply-chain management. This greater complexity means that sales and marketing teams need to build the competencies required to understand the new offerings and communicate their benefits to customers. These teams also must be able to gain insights into each customer’s business and its value drivers and proactively apply this knowledge to provide better pricing and services. Moreover, volume is no longer the key metric for sales performance given the importance of profitability and other key measures of performance in the competitive market.

Assessing Commercial Performance Today

To find out how engineered-product companies are performing in this complex commercial environment, BCG studied 25 Europe-based companies with a total of 40 distinct business units representing a wide range of industry sectors. The companies have operations in Europe; the U.S.; Brazil, Russia, India, and China (the emerging-market BRIC countries); and beyond.

We surveyed approximately 1,000 managers at these companies to understand their definitions of commercial best practices and the extent to which their companies have implemented these practices. Managers also completed approximately 250 quantitative data sheets, thus providing key sales-productivity figures. Separate data sheets were used to gather information on operations globally (including headquarters operations) as well as for countries in mature markets (France, Germany, Italy, the UK, and the U.S.) and each of the BRIC countries. To obtain qualitative insights, we interviewed 70 executives. The quantitative and qualitative information we gathered allowed us to benchmark all aspects of commercial performance and develop detailed insights into the drivers of commercial excellence.

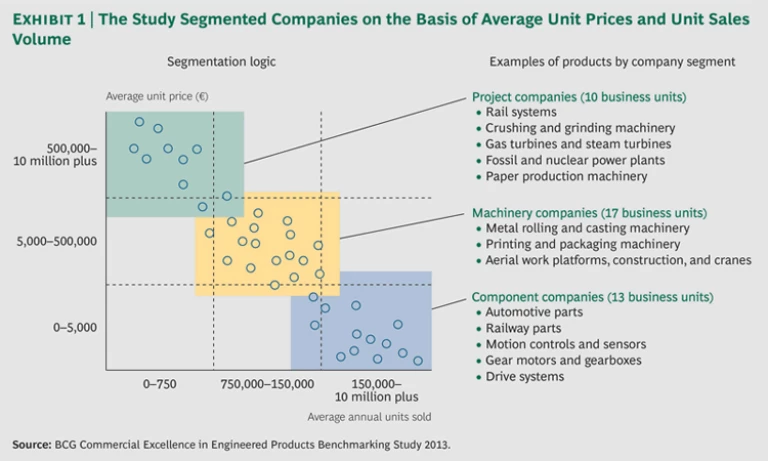

Given the industry’s diverse products and service offerings, we segmented companies into three groups on the basis of the average unit price of their products and the average number of units sold annually. (See Exhibit 1.)

- Project Companies. Companies in the project segment offer engineered products and services for power plants and rail systems, for example, or manufacture and install large equipment such as turbines. These companies, which include only a few large global players, have high-cost offerings but low volume. A large share of their sales comes from offerings customized for specific projects. Service offerings also represent a large share of the business, often 50 percent of sales.

- Machinery Companies. Manufacturers of complex machinery—used in construction and metal rolling and casting, for example—fall within an intermediate range in terms of both price and volume. The machinery segment is highly fragmented and specialized, and many participants are global companies that operate in relatively small niches. Products can generally be designed using common platforms, with limited customization. Service is essential to the offering and is provided directly or through dealers.

- Component Companies. Component manufacturers provide parts (such as for automobiles) as well as small equipment (such as sensors and gear boxes). These companies have low-price, high-volume businesses. There are many of them, and they compete in a highly fragmented market. They generally offer standardized products with low unit value, and service offerings play only a small role. Nonetheless, many of these companies sell highly sophisticated products—including high-end, high-tech products, such as an advanced sensor priced at a few euros.

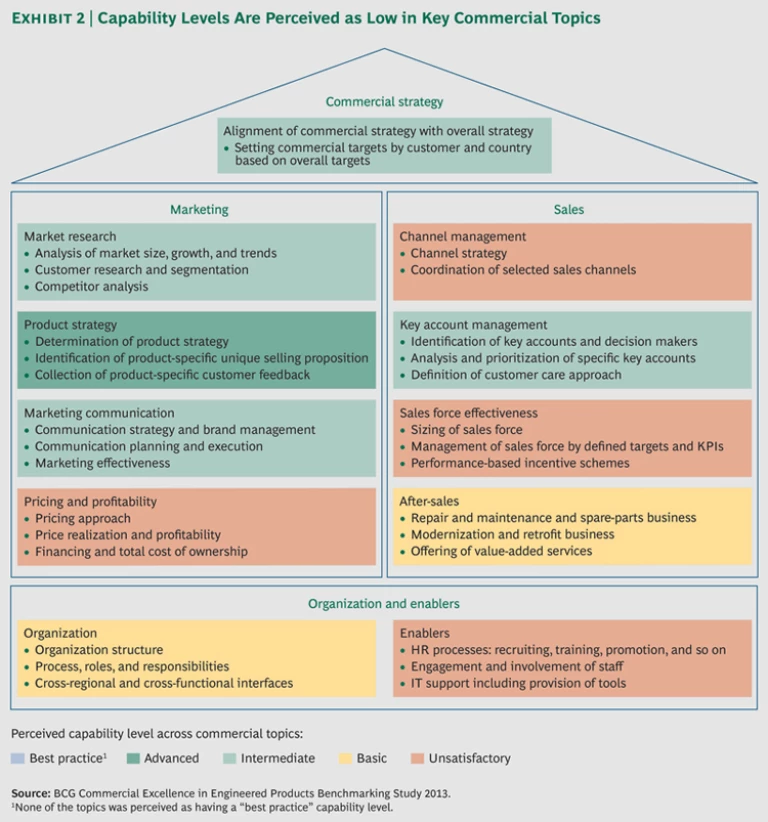

The insights and data collected in the study allowed us to understand how companies perceive their own commercial capabilities relative to best practices and to identify the areas that offer the greatest improvement opportunities. (See Exhibit 2.) Generally, capabilities in product strategy are perceived as advanced, reflecting the fact that most surveyed companies have highly sophisticated technical and engineering competence. Perceived performance levels in other commercial capabilities range from intermediate to unsatisfactory, however. The greatest perceived shortfalls in capabilities relative to best practice were in sales force effectiveness, channel management, pricing and profitability, and human resources and IT enablers. Additionally, capabilities in after-sales, although they are critically important now, are perceived as being only basic.

These findings indicate that the traditional sales approach is no longer sufficient to win in today’s more complex commercial environment. Success requires a new commercial model in which companies apply systematic and analytic approaches and tools to sell integrated product-and-service solutions. The “art” of sales must be enhanced by the more systematic “science” of sales.

Next, we highlight the study’s findings for five commercial topics that offer companies the greatest opportunities to differentiate themselves in the new environment. Because capabilities relating to product strategy are already high throughout the industry, engineered-product companies must pursue excellence in other commercial topics to distinguish themselves from their competitors. That means high performance in these five areas will likely determine the winners in this highly competitive market.

Sales Force Effectiveness

Although sales force effectiveness is considered among the most important commercial topics across all three company segments, most companies perceive themselves to be performing at a low level. The quantitative study did not reveal differences in sales force effectiveness by segment or region, but some interviewees noted greater opportunities for improvement in emerging markets than in mature markets.

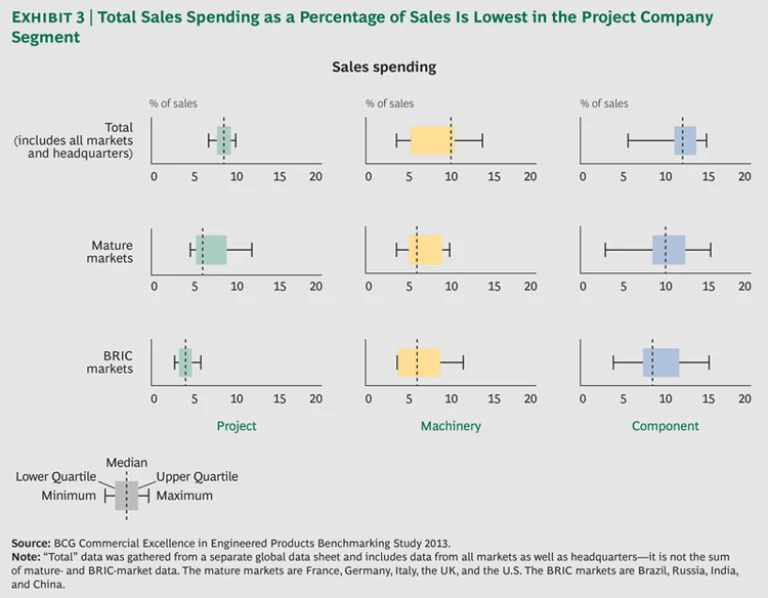

Global sales spending as a percentage of sales was lowest in the project company segment (indicating the highest level of sales force effectiveness) and highest in the component company segment. Sales spending as a percentage of sales is higher in mature markets than in the BRIC countries across all three company segments, although the difference is not significant. The higher spending in mature markets could indicate that many European companies still rely heavily on their headquarters for overseas sales and that sales structures are changing less quickly than customer demand. (See Exhibit 3.) The largest portion of sales spending is allocated to personnel costs. Trade fair participation, travel, and product samples are examples of other sales expenses.

Interviewees raised concerns about not having adequate sales KPIs—for example, they lacked information about the profitability of specific products and client relationships. Most also said that incentive schemes are still based on volume as the only performance indicator. Although engineered-product companies have experience managing production with a high degree of accuracy, it appears that most have yet to exploit the huge amount of sales data available to effectively steer the sales force to promote the appropriate product mix and pricing.

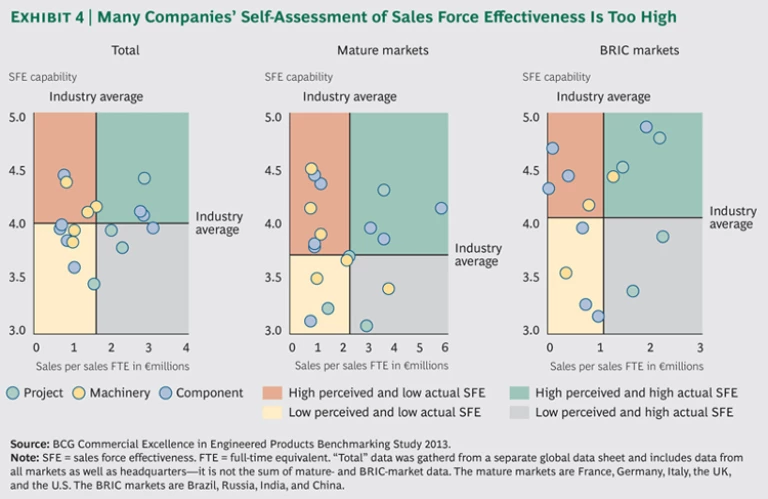

Notably, we also found that companies often overestimate their sales capabilities. Many companies consider their sales-force effectiveness capabilities to be high despite having low sales-force effectiveness as measured by sales revenues per sales FTE. This overestimation of capabilities is most evident in the machinery and component segments, where sales force effectiveness is often below the industry average even though capabilities are perceived to be above average. (See Exhibit 4.) This disparity holds true for both mature and BRIC markets.

The companies that are the best performers address these issues by applying the same type of fact-based techniques to manage their sales force as they apply to manage their production processes. To guide the sales force, they employ a broad set of sales KPIs and apply incentives such as compensation that varies based on performance. They use a sales-steering dashboard to give visibility to multiple performance indicators in addition to volume—such as margins for each product, purchases by specific customers, and customers’ perceptions of products. For example, monitoring differentiated KPIs allowed an industrial-service company to identify opportunities to increase its sales by refocusing its sales efforts on existing clients rather than trying to acquire new ones.

Leading companies also provide salespeople with nonmonetary rewards tied to targets and KPIs as a part of the incentive system. These rewards can include participation in a university’s leadership-training program, mentoring by senior colleagues, participation in a talent exchange program with other companies, or temporary assignments to projects in other regions. Additionally, managers of the front-line sales force regularly review performance so that they can reward their best employees or take corrective actions promptly. Because emerging markets have high rates of employee turnover, these approaches have been especially critical in those regions for differentiating the top performers from their competitors. For example, a machinery company facing an annual employee-turnover rate exceeding 20 percent in China was able to gain stability and traction in the market by recognizing top performers early in their careers and taking steps to retain them.

Channel Management

Study participants rated their companies as having low maturity in channel management. They ranked channel management capabilities as the weakest among the topics surveyed in the project and component company segments. Those in the machinery segment ranked channel management capabilities above only those relating to marketing communication and HR and IT enablers.

Interviewees cited indirect channels as the main problem, attributing poor capabilities to a lack of proper training and monitoring of the sales force. As expected, we found that the use of indirect sales channels is highest in the component company segment (approximately 30 percent of sales in both mature and BRIC markets). It was also no surprise that the project company segment had the lowest use of the indirect sales channel (approximately 15 percent of sales in both types of markets). The indirect sales channel accounts for nearly 25 percent of sales in the machinery segment.

The best performers determine the optimal mix of direct and indirect channels for each product and region by analyzing the market potential and the cost to serve. For instance, in the security technology market, the role of distributors has recently become significantly more important, and the distributors expect differentiated service—such as greater volumes of more standardized, easy-to-use products. In response to this trend, leading manufacturers are rethinking their sales organizations, and even their product strategies, to gain access to this increasingly relevant channel.

Leading manufacturers also deploy “hybrid” models in which they select some types of customers to serve directly (for example, top accounts or government agencies) and serve other customer groups using both their own sales representatives and wholesalers and distributors. This approach enables companies to maintain a smaller direct sales force. However, companies must manage the hybrid approach carefully to ensure that their wholesalers and distributors still have an opportunity to sell to valuable accounts.

Especially in the component company segment, online sales have evolved as a hybrid of direct and indirect channels to serve a larger customer base. For example, some industrial-crane manufacturers have successfully implemented online configuration tools that allow customers to select the main features of their order—similar to what has become a common practice in the automotive industry. After the customer configures the order online, the deal is closed through the existing direct or indirect sales network. Some companies have gone further and launched full-fledged online shops through which deals can be both configured and closed.

To help ensure channel effectiveness, leading companies actively monitor the performance of their channel mix and change it as necessary. They use KPIs and gather insights into customer satisfaction to monitor indirect channels. They also manage indirect channels using the same rigor they apply to direct channels, including providing training and coaching and deploying other enablers (such as increasing discounts based on performance). Through these efforts, they have become sought-after partners for dealers—establishing long-standing relationships rather than being perceived as opportunistic suppliers simply seeking a onetime sale.

Pricing and Profitability

Study participants from all three company segments cited pricing and profitability as a major concern. This topic ranked third in importance among commercial topics overall; component manufacturers ranked it as the most important topic. Because component companies have more standardized offerings than project and machinery companies, they are likely to be hit hardest by pricing pressure. But as elements of offerings in the project and machinery segments become more standardized (such as through modular approaches), pricing pressure is likely to intensify for companies in these segments as well.

Despite the more complex market environment, companies persist in applying outdated approaches to pricing. The study found that companies are not using sophisticated approaches to set prices. Indeed, capabilities in pricing rated among the least mature commercial topics in the study. Additionally, some companies did not apply a consistent approach to pricing across each of the countries in which they operate. By not employing sophisticated approaches to pricing, companies lower their margins and limit their opportunities for profitability.

Interviewees confirmed that inadequate pricing capabilities are harming the bottom line. Many cited concerns about coping with profitability issues, protecting their margins, and no longer knowing how to sustain their high-end price points, either in their home country or globally.

To counter price erosion, leading companies have implemented sophisticated pricing approaches, which are clearly defined and consistently applied across products and regions. These companies use customer segmentation, even down to the level of small groups, as the basis for setting prices—enabling them to tailor their approaches to each segment. Advanced pricing approaches include the following:

- Pricing Mechanisms Based on the Lifetime Value of Customers in the Segment. A customer’s lifetime value to a company is high if, for example, the customer can be expected to buy consumables (such as filters and oil) in addition to the initial purchase of an engineered product. In such cases, the manufacturer should be willing to accept a lower margin for the initial purchase than it would if the customer was expected to buy few, if any, consumables. In contrast, customers expected to require a high level of servicing under a warranty would have a lower lifetime value to the manufacturer—indicating the need to push for higher margins on the initial purchase. Other pricing mechanisms relating to lifetime value can also become central features of a company’s business model. These mechanisms include providing value-added services, bundling and unbundling products and services, and locking in customers to a particular platform or other offering controlled by the company.

- Value Pricing. Leading companies have a deep understanding of how a product or service adds value for a customer. “Total cost of ownership” (TCO) analysis is one of the essential tools for identifying the sources of additional value. A TCO analysis enables a company to build pricing models that take into account the initial investment to purchase a product as well as the customer’s ongoing costs to maintain it. For example, higher-quality products may require lower ongoing costs relating to consumables and servicing, which adds value for the customer by reducing its TCO. Additionally, high-performing companies price and actively promote their products on the basis of the value their customers can generate by using those products. In the printing-machinery industry, for example, machines with Web interfaces and the ability to rapidly switch between jobs have allowed print shops to expand their businesses to serve individuals as well as corporate clients.

- Price Differentiation. Leading companies charge customers different prices on the basis of their willingness to pay and the cost to serve them. To do this successfully, a company needs an in-depth understanding of its relative “pricing power” over customers—assessing which customer segments or transaction types may be more or less sensitive to higher prices. Understanding the costs associated with customers and products is also essential. Many companies have a “long tail” of customer accounts and products that individually contribute low sales but collectively add significant costs arising from complexity. Leading firms use their understanding of complexity costs to establish pricing for the long tail on the basis of product differentiation and the value delivered to customers. The opportunity to capture greater value from a product portfolio by using this approach can be significant. For example, by repricing 20,000 product and service options, one industrial-goods company realized a margin increase of 5 percentage points and increased its market share by 2 percentage points.

To identify additional price potential, top performers regularly analyze their price performance and measure price realization for each product in the portfolio and each customer. To continue to improve the pricing process and optimize margins, they seek to understand where “leakage” (the loss of incremental margin) occurs along the “price waterfall” that runs from the list price down to the realized price. Identifying discounts offered along the price waterfall that are contrary to company policy is especially critical for maintaining healthy margins. A price performance diagnostic can be used to assess when these ad hoc discounts are occurring and determine the key levers for a “scientific” approach to discounts that will yield a positive return. The transparency provided by the diagnostic enables the company to have greater control over pricing decisions and thereby maximize its margins.

After-Sales

Companies in all three segments consider after-sales to be the most important commercial topic; however, they have not yet tapped into its full profit potential. For example, more than 70 percent of companies do not use their installed product base to generate modernization and retrofitting business. This has contributed to a low maturity score for after-sales across all three segments. After-sales includes repairs, spare parts, and maintenance and sometimes service-oriented offerings such as training, performance checks, and gauging and calibration.

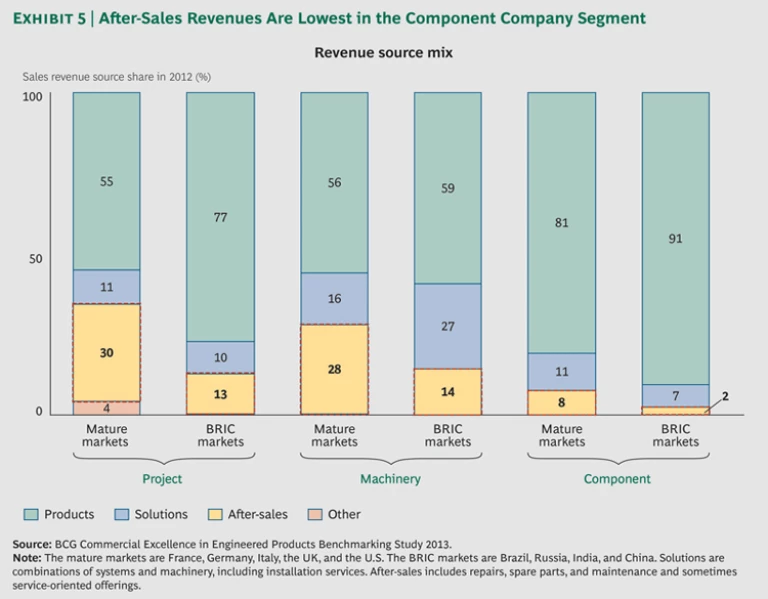

After-sales revenues as a percentage of sales are similar in the project and machinery segments—30 percent and 28 percent in the mature markets and 13 percent and 14 percent, respectively, in the BRIC markets. The component segment lags behind, with after-sales representing 8 percent of sales in mature markets and 2 percent in the BRIC markets. (See Exhibit 5.)

Looking at sales force effectiveness for after-sales, the machinery segment has the highest after-sales revenues per service full-time equivalent (FTE). The project segment’s after-sales revenues per service FTE are significantly lower in both mature and BRIC markets, which should be a concern to companies in this segment given the importance of service offerings related to their customized products.

Rather than having the traditional sales force sell services, advanced companies have established a dedicated sales force for service offerings. Some have set up a separate service division with the goal of building specific expertise and sophistication relating to offerings and business models for services across product segments.

Whether or not they have a unit dedicated to selling services, all companies need to ensure a well-defined linkage between products and after-sales. Because a sales force is traditionally oriented toward selling products, it may miss opportunities for selling services or bundling products and services unless the connection between different types of offerings is clear.

The best performers have recognized that a modernization and retrofitting business combined with value-added services can be stable sales sources and highly profitable, particularly for maturing subsectors (such as paper-production and printing machinery). These companies define a strategy for developing and selling service offerings, establish a dedicated sales team that is closely aligned with the service organization, and foster a culture that emphasizes services as well as products. They offer value-added services for the entire product range (for example, training on the use of products). To develop their service offerings, they perform advanced analyses, such as value chain analyses and sales and cost modeling, and use a TCO approach for pricing. The top companies also use their after-sales business to generate leads for new equipment sales. For example, service technicians inspecting machines in the field give the sales force suggestions relating to new machinery or to upgrades that could improve a machine’s performance.

There is a danger that a company’s efforts to modernize its installed base may undermine its sales of new products to the same customers. However, we have observed that a modernization business typically helps to generate additional sales and build and sustain long-lasting customer relationships. Such relationships can provide a stable source of recurring after-sales business.

HR and IT as Enablers

In all three company segments, survey respondents ranked recruiting and retention as major issues for engineered-product companies. However, they ranked HR as the least important and least mature topic within the commercial function.

To cope with the challenges of their new environment, companies need to recognize the importance of HR as an enabler for the commercial function. Interviewees told us that they are struggling to attract the right talent, integrate new employees into the corporate culture, and retain them once they have acquired in-depth knowledge of products and services. These challenges are especially prominent in the BRIC markets.

IT is another enabler that warrants greater attention. For example, interviewees said they lacked well-functioning customer-relationship management (CRM) systems to support the commercial function on a daily basis.

Leading companies acknowledge the importance of HR, IT, and other sales-support functions for achieving commercial excellence and actively enhance their capabilities in these fields. They establish strong formal linkages between the sales force and its support functions—for instance, providing reports on sales visits to HR so that personnel can understand what is happening in the field. The sales leadership collaborates with HR to develop training programs (for example, how to negotiate in a multicultural environment) and foster retention, especially in emerging markets. In response to the growing technical complexity of products and solutions and the market’s global scope, sales and HR also work together to foster collaboration between local sales teams and remote technical specialists, which requires appropriate incentives, training, and networking efforts.

The sales leadership at top companies works with IT to implement a sophisticated customer-care model, including a CRM system that is closely aligned with the sales forces’ daily needs. The CRM system should also enable IT and the finance department to upgrade financial reporting so that they can retrieve data on product-specific profitability and other financial KPIs. A basic CRM system provides, for example, an updated view on which products a specific customer has ordered in the past and at what price, as well as identifying key decision makers in the customer’s organization and personal information that might be relevant to maintaining a relationship and closing a sale. The most advanced CRM systems provide account managers with live data streams from clients’ machines and equipment, enabling a real-time assessment of performance and the related sales and service opportunities.

Starting the Journey

Engineered-product companies face a wide range of challenges arising from the industry’s more complex and demanding environment and, in many cases, their own low capability levels in key areas of commercial performance. By addressing the five key commercial topics discussed previously, leading companies have successfully transformed their sales operations to outperform the competition.

To assess their commercial function’s starting point on the journey from art to science, executives can consider their responses to a series of questions that arise from the study’s findings. Examples of these questions include the following, grouped into general categories:

- Overall. How does our commercial function perform relative to the best practices set out in the framework on Exhibit 2? How does our perception of our company’s performance in each dimension of the framework compare with a detailed assessment of its actual performance? Which of the five core topics should we address most urgently?

- Sales Force Effectiveness. Do our incentive systems for the sales force include significant amounts of variable compensation and nonmonetary rewards linked to profitability and other KPIs? Do we have the right set of sales competencies available at the right locations?

- Channel Management. Do we adequately train and coach sales representatives in indirect channels while monitoring their compliance and pricing discipline?

- Pricing and Profitability. Have we successfully implemented consistent pricing approaches, including TCO, value-based pricing, and other advanced pricing methods?

- After-Sales. Do we generate significant business from value-added services as well as modernizing and retrofitting our installed product base?

- HR and IT Enablers. Have we established best-in-class HR processes for the commercial function? Do we use a customer database and CRM system with comprehensive information on customers and relationships?

The answers to questions like these, in the context of the company’s industry and business requirements, will point to the most valuable improvement areas as the company seeks to develop and implement a world-class approach for achieving commercial excellence.

Acknowledgments

The authors would like to thank Mark Freedman, Philipp Gerbert, Ovidiu Petreaca, Amadeus Petzke, Leif Neumann, Jan Holzapfel, Nina Haidinger, and Benjamin Boettger for their support and insights on this topic. The authors would also like to thank David Klein for his writing assistance.