Indonesia is in the midst of an historic shift, as incomes rise and living standards improve for a large component of the population. Like most emerging Asian markets, Indonesia has experienced significant turbulence throughout much of 2015, caused largely by the slowdown in China, which has affected Indonesia’s exports and weakened its currency. Yet the country’s long-term economic prospects are still positive. For many companies in the consumer durables sector, an expanding base of middle-class consumers will create an extremely favorable market.

Indonesian Consumer Series

- Consumer Durables

- Fast-Moving Consumer Goods

- Financial Services

To gauge the scope of the opportunity, The Boston Consulting Group recently surveyed Indonesian consumers regarding their savings habits, spending levels, and overall sentiment, and we used the results to analyze their behavior regarding durable goods. (For details on the research, see “Methodology.”) We performed similar analyses of Indonesia’s fast-moving consumer goods and financial services sectors, which are discussed in separate publications.

METHODOLOGY

We conducted face-to-face interviews with more than 3,000 consumers across all socioeconomic groups in 19 locations—both cities and regencies—throughout Indonesia. Respondents were between the ages of 15 and 55, evenly split between men and women in each socioeconomic group. We define socioeconomic groups according to a combination of criteria, including monthly expenditures and ownership of household assets, in order to provide a more accurate indication of household wealth.

We conducted a deep-dive analysis of consumers’ shopping attitudes, spending levels, channel preferences, and experiences with several brands in order to better understand how they assess products and make purchasing decisions, giving us an in-depth understanding of the path to purchase (that is, the process by which customers make buying decisions). We analyzed the path to purchase for 63 product categories across three consumer categories: consumer durables (18 categories), fast-moving consumer goods (23 categories), and financial services (22 categories). Additionally, we captured a wide range of profiling variables, including demographics, household expenditure, and overall consumer sentiment in Indonesia.

Growth in the Durables Category

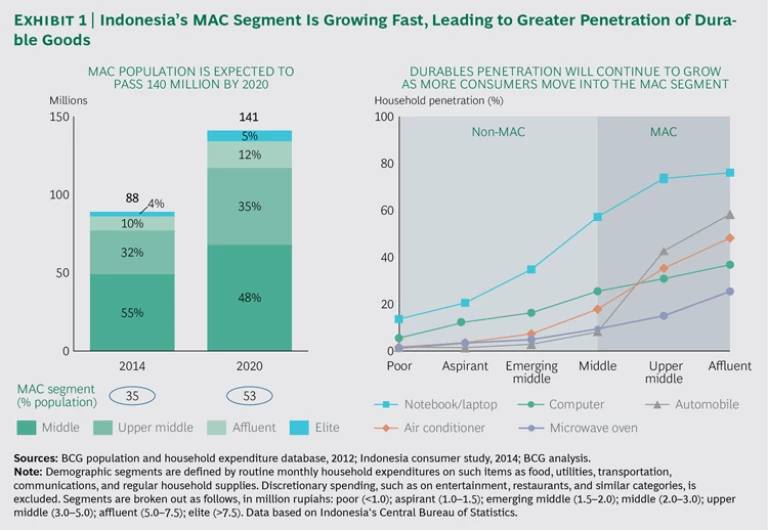

Indonesia’s consumer durables market is poised for sizable growth in the foreseeable future, for several reasons. First, the country’s

Societal shifts, too, are driving durables sales, as single young professionals and young couples increasingly seek to live independently. In the past, these people would likely have continued to live in their parents’ households, but because of urbanization and other factors, they are now starting to live independently and to purchase durable goods for themselves.

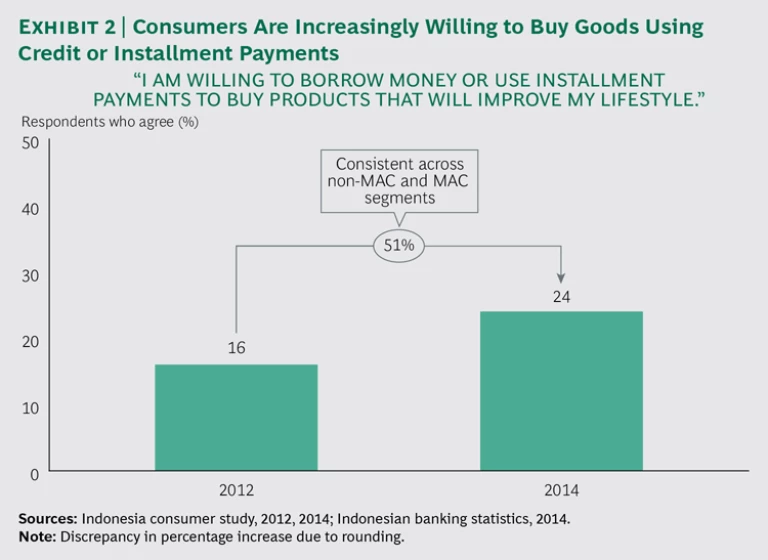

Third, durable goods are increasingly seen as an important consumer need, far more so than in the past. Accordingly, Indonesians are more willing to borrow money to finance the purchase of such products. In 2014, 50% more consumers than in 2012 were willing to finance a durable product with credit, and this growth was consistent across MAC and non-MAC segments. (See Exhibit 2.)

Affordability, too, is leading to greater penetration of durable goods. In major durables categories, the ratio of a product’s price to overall household expenditures has fallen steadily since 2008. The relative price of household durables has fallen approximately 25%, and the relative price of consumer electronics products has fallen by as much as 50%. As a result, these products are becoming more affordable each year.

Key Insights for Durable Goods Companies

Although the market potential for durables looks promising, manufacturers will need to overcome some challenges, including a tendency to lose consumers along the path to purchase, low brand loyalty, and rising energy costs. (See “Key Challenges for Durables Companies.”) Our experience in this sector, as well as the results of our Indonesian consumer survey, have produced ten insights that can help companies make the most of today’s opportunities in this growing market.

Key Challenges for Durables Companies

Our research highlights three challenges for manufacturers of durable goods in Indonesia:

-

Consumers drop out along the path to purchase. Among consumers who are aware of a specific product category, less than one-third actually end up making a purchase. Purchasing rates are typically higher in nondiscretionary categories such as irons, rice cookers, and blenders, and are far lower in discretionary categories such as digital cameras and air conditioners, where less than 5% of consumers end up making a purchase.

Indonesians value the functional benefits of products, and brands that can create a consumer need and then show how their product best addresses that need will win over more consumers than brands that aim to simply increase awareness. In addition, companies need to find the right marketing mix. Most purchasing decisions are made in the store, so manufacturers must balance their investments between traditional marketing and in-store efforts that can persuade consumers to buy.

- Consumers have low levels of brand loyalty. Across most major durables categories, approximately one-third of the Indonesian consumers we surveyed said that they plan to try a different brand the next time they purchase a given product, even if they are happy with their current brand. Consumers feel that products and technology are getting better all the time, and they believe they will be rewarded for trying a different brand. To address this challenge, manufacturers must reengage their current customers with new products and features, such as through trial offers.

- Energy costs are rising. In the short term, we expect electricity prices to have little impact on purchase planning. Over the longer term, however, rising prices could affect behavior in indirect ways. For example, people may alter the way they use products that consume high levels of electricity (such as air conditioners, TVs, irons, and washing machines). In turn, reduced usage could decrease these products’ importance to consumers and extend their life spans, slowing down repurchasing cycles. For durable goods companies, energy efficiency needs to be part of the innovation agenda.

1. First-time buyers are critical for growth. We estimate that Indonesian consumers making their first purchase of a durables product in a given category will account for more than 65% of total sales volume in 2017. In some categories, initial purchases will account for an even larger share. For example, first-time purchases of tablets and air conditioners will make up more than 80% of sales. To capture this opportunity, companies need to consider their route to market and their product strategy for first-time buyers. Building brand awareness and expanding the distribution network are both crucial. Companies must also create the right portfolio of products for first-time buyers in a given category, along with a pricing strategy to reach them.

2. “Young professionals” and “modern housewives” are increasingly important demographic segments. We define young professionals as people between the ages of 20 and 40 who have earned at least a bachelor’s degree and are relatively new to the workforce. They are comfortable with mobile technology such as smartphones and tablets, and they rely more than older people on digital media for information about new products. Modern housewives are women between the ages of 20 and 35 in the MAC segment. There are approximately 12 million people in these two groups in Indonesia today, and that number is increasing by about 650,000 each year.

Both young professionals and modern housewives are key opinion leaders in their families and communities, and they are crucial drivers of sales by first-time buyers. For manufacturers, the goal is to understand these consumers’ product preferences, which are often different from those of other groups. For example, because their families are typically smaller, first-time buyers may require smaller-capacity models of products such as refrigerators and washing machines. In addition, as their income levels rise over the years, people in these segments will look to upgrade products in certain categories. Thus, they may shift from low-capacity washing machines to bigger models and from entry-level flat-screen TVs to larger versions with more features.

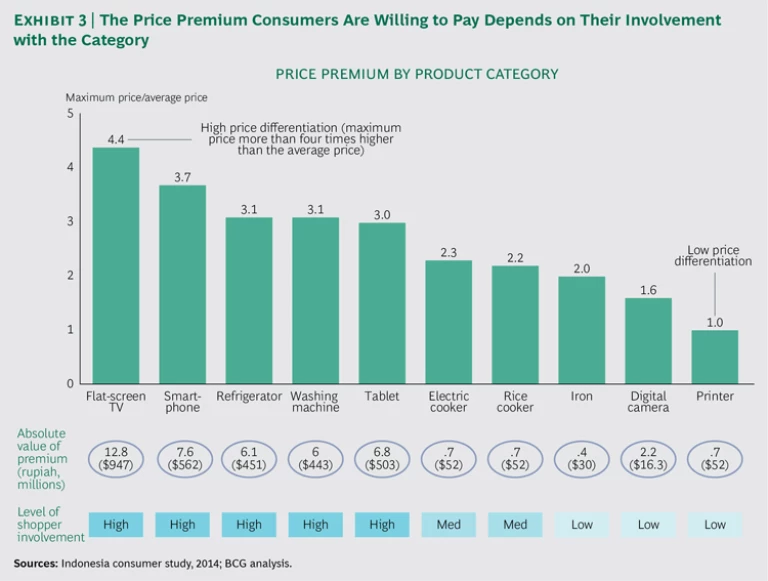

3. Shopper involvement varies significantly by product type. Products such as TVs, smartphones, and tablets are associated with a far higher degree of shopper involvement than basic consumer durable products like rice cookers and irons.

Our survey showed that this involvement depends on the perceived benefits that a product provides compared with other products, and the product’s impact on the consumer’s social image. Critically for manufacturers, the degree of involvement correlates with the price premium that consumers are willing to pay. (See Exhibit 3.)

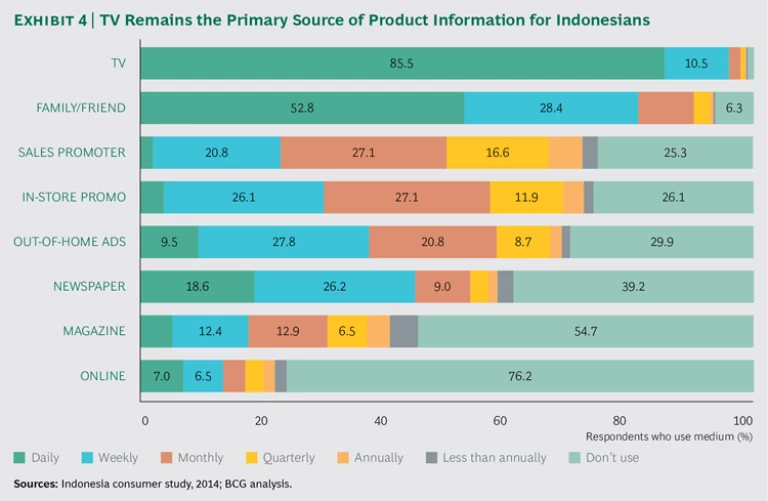

4. Television remains the primary source of product information, but digital is growing fast. Nearly 90% of Indonesia’s population watches TV daily, especially in rural areas. (See Exhibit 4.) By contrast, exposure to digital is limited, but it is growing rapidly and will play an increasingly important role in the future, particularly as the country’s Internet infrastructure improves. The ways in which digital technology has affected other emerging markets give an indication of its likely effects in Indonesia. Initially, consumers begin comparing product features and prices online and start reading and writing reviews of the brand. Later, as the logistics of home delivery get worked out and consumers become more comfortable buying online, e-commerce rises dramatically. (Notably, digital is more effective at engaging the core consumer group of 25- to 35-year-olds.)

Xiaomi, a Chinese manufacturer of smartphones, recently used digital marketing to create buzz and drive awareness in the Indonesian market. It offered one of its phones through a “flash sale” promoted via e-mail. Similarly, when Samsung launched a new smartphone in Indonesia, it used digital technology to stage a bidding event, which caught on in social media and garnered newspaper coverage as well.

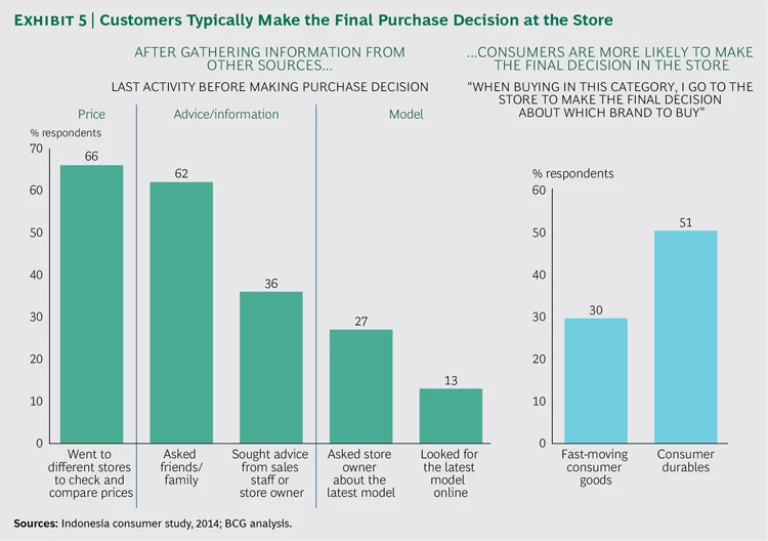

5. The retail store is increasingly important for influencing brand choice in durables. Stores are the second-biggest source of awareness of durable products (after free-to-air TV), and they play a large role in influencing consumers. Across all categories, roughly 50% of final purchasing decisions are made in the store. (See Exhibit 5.) Store owners and employees are the key influencers and sources of information at the point of purchase. Many shoppers also prefer to evaluate products in person before making a purchase, and this preference holds especially true for durable goods.

Accordingly, durables companies need to focus on their in-store strategy, particularly when it comes to determining the right type of stores for trade marketing efforts and the right level of investment for each one. This reinforces the critical role that trade marketing will play.

6. Modern-trade formats are affecting the way consumers shop. Indonesia is in the midst of a shift from traditional trade (neighborhood stores) to modern trade (larger, more organized stores). Our research indicates that consumers are more likely to browse and compare products in modern-trade formats, where they can benefit from a more convenient layout, a wider range of products, and knowledgeable salespeople who can answer questions. Yet when making purchases, they often choose traditional stores, where they can benefit from familiarity with staff and higher levels of trust, and where prices are perceived to be lower. Some 64% of respondents to our survey said that they purchase durables at traditional-trade stores, compared to just 21% at modern-trade stores. Perhaps not surprisingly, younger MAC consumers are more open to switching to modern-trade formats.

However, consumers are more likely to purchase big-ticket items in larger stores, even if the price is slightly higher, because they want to be sure that the product is not a remanufactured version. They also want to see the full range of brands before making a final choice, and they want to review the warranty information. By contrast, they tend to buy smaller items like irons, blenders, and rice cookers at smaller stores, particularly if the prices are significantly lower.

7. Shoppers for consumer durables display a high degree of “repertoire behavior.” Indonesians typically buy different brands within a given product category, and they show limited loyalty to any one brand, even when replacing an item that they like. For market leaders in a given product category, the challenge is to effectively engage current customers in order to encourage repeat purchases of the same brand. This may require a concerted customer relationship management effort to bring customers back to the brand. In particular, brands that are not in the top two or three for a given product line may struggle.

8. The “hero/halo” effect is a powerful tool to influence consumers. Certain products have an especially big influence on consumers’ perceptions of a brand. For example, refrigerators and blenders that consumers favor (heroes) tend to reflect positively on the overall brand (creating haloes). As a result, advertising that highlights hero products puts other products in the company’s portfolio in a more positive light. Thus, Sony continues to sell premium TVs even though the bulk of its business has shifted to other electronics categories. TVs have a strong halo effect, creating a favorable impression of the company’s other products in the minds of consumers.

9. Products’ functional benefits play a large role in shaping purchasing decisions. After efficiency and price, the main drivers of a durables purchase for Indonesian consumers are technical features and the warranty. Surprisingly, design currently holds comparatively little sway among buyers. Manufacturers therefore need to emphasize efficiency, features, and durability in their product designs and marketing messages.

10. Energy efficiency remains a basic concern for durable goods. This is especially true for air conditioners, water dispensers, refrigerators, light bulbs, and kitchen appliances, which either consume large amounts of electricity or are never shut off. Notably, efficiency is important across all demographic segments, even affluent consumers. Companies need to focus on developing energy-efficient products, particularly over the long term.

Questions for Durables Companies

In sum, durables manufacturers that wish to capitalize on the growth opportunity presented by Indonesian consumers should ask themselves some critical questions regarding their current readiness:

- Do we have a program in place to target working professionals and modern housewives—or, at a minimum, do we have a marketing plan that will influence them?

- Do we have a proven hero/halo strategy? Which categories should we emphasize to have the biggest impact on overall brand equity?

- Do we have programs to entice first-time buyers to the category—including the right geographic and channel priorities?

- Are we focusing our digital investments on the right areas (and not simply spending a lot of money on digital marketing campaigns)?

- Are we aware of our performance at key points along the path to purchase? Are we designing the right interventions to improve performance at these junctures?

- Do we have a clear channel strategy that maximizes the role of traditional and modern trade for each product? Can we manage the pricing variation between channels?