Innovation is a leading priority for CEOs: more than 70% list it as one of their top three areas of focus. Yet only 16% of companies we’ve surveyed believe that they’re better innovators than their peers.

What’s holding them back? In our experience, innovators typically fall short for one of two reasons. Either they pursue the wrong innovation model for their business and competitive context, or they don’t support a good model with the capabilities it requires.

BCG recently studied more than 100 of the world’s most innovative companies—industry leaders in TSR and fixtures in BCG’s annual innovation report. (See, for example, The Most Innovative Companies 2016: Getting Past “Not Invented Here,” BCG report, January 2017.) Our goal was to determine which types of innovation models the leaders use, which models are most successful in which industries, and which underlying capabilities are necessary to deliver on each model.

Six Innovation Models

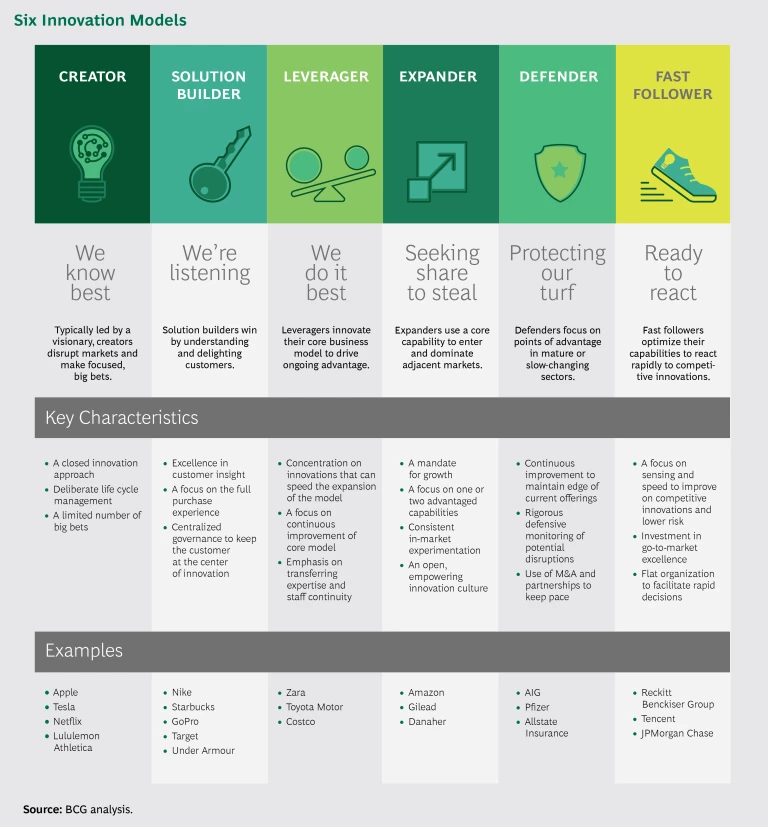

Our research revealed six distinct innovation models: creator, solution builder, leverager, expander, defender, and fast follower. (See the exhibit.)

Let’s take a quick look at these models and the types of companies that embody them:

- Creators fit the popular notion of highly innovative companies. Typically led by a strong, bold, visionary leader, they disrupt their core markets, protect their intellectual property, and make highly focused big bets that become the stuff of industry lore. Apple, which had a TSR of 21.2% from 2008 through 2017, is the classic example.

1 1 All TSR percentages in this article are for the period 2008 through 2017. - Solution builders look to the market for inspiration, drawing on observations and deep insight to address customer priorities and problems. Nike (16.5% TSR) typifies this model, combining customer insights with cutting-edge design and technology. For instance, shoe-based sensors link to web-based platforms offering highly personalized feedback that customers value.

- Leveragers create a superior business model and then capitalize on it to sustain their industry leadership. Zara (whose parent company had a TSR of 16.8%) is a Spanish retailer whose fast-cycle innovation and fashion-forward designs changed the industry. At the heart of Zara’s success are its breakthrough design, manufacturing, and distribution processes, which dramatically shorten the time it takes for new items to reach stores.

- Expanders apply their core capabilities in new ways to take over adjacent markets and spur growth. Pharmaceutical innovator Gilead (14.4% TSR) continually enters new disease categories and markets in search of growth, achieving success through strong management, repeatable R&D and manufacturing processes, and a tolerance for risk that enables a long-term view. By acquiring Pharmasset in 2011, for instance, Gilead was able to develop two best-in-class treatments for hepatitis C and gain access to that promising market.

- Defenders tend to win in mature or slow-changing industries and to innovate defensively in order to protect their advantage. As technology transforms more and more industries, adhering to this model becomes increasingly risky. The key to success is the ability to monitor the landscape for potentially disruptive innovations and to defend against them using tactics such as partnerships and acquisitions. When Allstate Insurance (6.4% TSR) used this approach, it was able to identify the shift to online and app-based products—and to acquire pioneer Esurance to keep from falling behind.

- Fast followers optimize their capabilities across all dimensions in order to quickly respond to—and often improve upon—competitive innovations. Reckitt Benckiser Group (14.7% TSR) is a best-in-class fast follower in the consumer products industry, which is characterized by low consumer-switching costs and short product development cycles. To minimize risk and maximize speed, the company focuses technical capability and resource investment downstream, in product testing, with minimal energy spent up front, in consumer insight and ideation.

Context Is Critical

Choosing the right innovation model for your company is all about context. Industry context matters because only a subset of models can succeed in most industries. Some models are better suited to—and increase shareholder value in—certain industries and sectors than others. For example, four models drive TSR premiums in consumer retail:

- Creators take on more risk but can achieve dramatic success. Lululemon Athletica (15.6% TSR), for example, capitalized on the growing yoga movement by offering a distinctive life style brand that encompasses everything from the actual products to the in-store customer experience to corporate philanthropy.

- Solution builders create loyalty by understanding specific shopper segments and meeting their needs. For instance, Target (8.1% TSR) delivers a “cheap but chic” set of offerings that meet the needs of its young, often trendy customers.

- Leveragers create a superior business model and then capitalize on it to sustain a position of industry leadership. Costco (13.4% TSR), for example, combines everyday low prices, a lean supplier network, and a members-only approach to stand out from the retail pack.

- Expanders achieve rapid share growth by moving into adjacent markets. For instance, Amazon (30.3% TSR) brings its consumer data analytics, logistics capabilities, and exceptional customer service to an ever-expanding number of retail sectors, including fashion, luxury apparel, and—with the company’s recent purchase of Whole Foods—brick-and-mortar grocery.

Companies struggle when they pursue an innovation model that their industry doesn’t reward. For instance, retailer Sears (–23.6% TSR) used the defender model, counting on its brand recognition and network of brick-and-mortar stores to stay ahead. But when agile online players upended the retail industry, Sears lost its edge.

A company’s individual context is also critical when choosing the best innovation model: How important is innovation to the company’s strategy, its competitive position in the larger market, and the capabilities and advantages that set it apart? As the examples above show, companies in the same industry can succeed with different models—but the chosen model must align with a company’s strategy, strengths, and capabilities. For example, Amazon and Costco both have advantaged—but different—business models. The expander model is a better choice for Amazon because it reaches a much broader pool of consumers and drives more rapid top-line growth, both of which align closely with the company’s strategy and ambition.

Answering a set of common questions can reveal your company’s context. Is innovation seen as a growth engine or a defensive tool in your overall corporate strategy? How strong is your company’s competitive position, and how durable is the source of your competitive advantage? How important is brand, and what is the relative strength of your brand equity? How robust are your innovation-related capabilities compared with others in your industry? How much are you willing and able to invest in innovation? And, most important, how quickly does your sector change—and what value can be gained if your organization stays ahead of the curve?

When choosing a model, look for one that competitors either aren’t using at all or are using poorly. Consider the investment required in terms of dollars, time, and the cost of upgraded capabilities, and then filter the options through the lens of your ambition and resources.

When choosing a model, look for one that competitors either aren’t using at all or are using poorly.

Making It Work

Migrating to a new model or better aligning your capabilities with an existing one are the most challenging aspects of transforming a company’s innovation capability. The six innovation models are not abstract ideas. Each has a set of design principles and characteristics that govern the whole.

It helps to have an innovation blueprint clearly laying out all the interconnecting pieces that must align with and support the model. These include the company’s organizational structure and culture; tools and processes for idea generation, commercialization, and portfolio management; and metrics and incentives to drive, track, and measure results. Such a blueprint can help companies commit to and reinforce their models through the design decisions that flow through their organizations. Consider the following:

- The fast-follower model adopted by Reckitt Benckiser has potential for success in the consumer products industry, but the company’s individual success is enabled by other factors as well, such as a flat organizational structure that maximizes speed to market.

- Under Armour is a solution builder. To build more targeted solutions, the company invests in advanced analytics to better understand what the data reveals about the behaviors and needs of its fitness community.

- Amazon’s best-in-class expander model would not work without the company’s high tolerance for risk, which is reflected in its internal metrics and people incentives.

In our experience, the six innovation models offer a powerful way for organizations to evaluate and refine their innovation strategies. They also help executive teams grapple with critical questions, such as, Which model are we pursuing and why? Are our processes and organization aligned with that model? Does the model confer advantage in our industry? Which models are rivals pursuing—and how well are they doing? Should we reconsider our innovation strategy and model? What investments and capabilities would a shift in those areas require?

Working through these questions will help companies choose the right model, develop the supporting engine to drive it forward, and reap the growth dividends that accrue from innovation success.