William Kissick, the father of the US Medicare program, once described the economics of health care systems as an iron triangle composed of three competing elements: access, quality, and cost containment. The core challenge: How do you make improvements to one of the elements without compromising the other two? Much of the focus has been on rising costs, which the traditional model of care delivery has tried to address with improvements in operational efficiency—delivering the same level of output with less effort and waste. However, this chase for efficiency has reached its limits. In recent decades, productivity improvement rates in health care in Europe and North America have lagged behind those of almost all other industries. It is time to pivot from a focus on efficiency to a focus on meaningful innovation, and business ecosystems in health care can play a major role in this paradigm shift.

Business ecosystems offer three important benefits.

First, they can provide fast access to a broad range of external capabilities that may be too expensive or time-consuming to build internally. This is particularly relevant for companies that want to reap the benefits of open innovation, an area where ecosystems outperform pipeline models. Second, ecosystems can scale much faster than pipeline models. Their modular setup, with clearly defined interfaces, makes it easy to add partners and expand the network. And finally, ecosystems offer a large degree of flexibility and resilience. They can quickly adapt to changing consumer needs or technological innovation, which makes them particularly advantageous in unpredictable environments and during times of high uncertainty.

In business ecosystems, a dynamic group of largely independent partners work together to deliver integrated products or services. While the health care system meets all requirements of a business ecosystem, it is rarely managed as one. By learning from other industries and harnessing the innovation potential of the ecosystem model, health care could substantially improve all three dimensions of the iron triangle. Like Alibaba for retail, or Airbnb for travel, health care ecosystems could facilitate and improve access at scale for patients and consumers. Like smart farming or smart mining platforms, health care ecosystems could enable new solutions and major improvements in quality by enhancing coordination and effectively using data across partners. Like cloud-computing platforms or e-commerce marketplaces, health care ecosystems could lower cost and tap the efficiency potential currently lost in the fragmented interplay of stakeholders, sectoral boundaries, and limited care coordination, which researchers estimate account for up to 25% of health care spending in Europe and the US. When designed and managed properly, business ecosystems allow health care organizations to break the painful tradeoff between access, quality, and cost.

Why Are There So Few Successful Health Care Ecosystems?

The ecosystem approach is not new to health care. Traditional health care payers, providers, and suppliers, as well as big tech companies, have attempted to establish ecosystems in order to deliver integrated or value-based health care. Some success stories exist, particularly among health maintenance organizations (HMOs), such as Kaiser Permanente, but the broader health care sector has not yet embraced the ecosystem concept.

There are a few reasons for this. First, innovation in care delivery is hampered by structural roadblocks that discourage the most important precondition of an ecosystem: cooperation between partners. In most developed economies, strict legal boundaries between the different health care segments fragment care delivery, and fee-for-service payment structures incentivize single treatments rather than holistic care. Stakeholders lack common outcome measures and shared goals.

Second, the health care sector is resistant to change. While the overall health care system is under considerable pressure from rising costs, many individual actors don’t feel this pressure because their business models are still intact, creating a strong status-quo bias. Many of these actors are well organized and equipped with veto-like powers in political processes, making policy change difficult. Health policy plays an important role in defining common goals, providing a framework for cooperation, and driving long-term improvements. For ecosystem solutions to work, proactive changes in regulation are needed.

Finally, the strategic challenges of moving from a pipeline model to an ecosystem model are considerable, and few health care players have found the right approach.

Research conducted by the BCG Henderson Institute found that fewer than 15% of business ecosystems are sustainable in the long run—and six out of seven failures can be attributed to weaknesses in ecosystem design. To make the transition, business ecosystems must be designed and managed carefully from the outset.

Now Is the Time for Ecosystems in Health Care

Several trends are paving the way for a broader application of ecosystem models in health care. First, new competitors, many equipped with successful platforms and relevant experience in creating business ecosystems, are entering the market. Walmart has launched cost-efficient outpatient clinics, startups like mySugr and Omada Health are disrupting chronic care management, and tech players such as Google, Amazon, Microsoft, and Apple are offering health care solutions such as cloud services for health data and telemedicine. Second, patients are increasingly demanding levels of service and choice in health care that they are used to receiving in other areas of life—often delivered by ecosystems. Third, technology adoption has created new forms of access and interaction. Secure and cost-effective data-sharing solutions, for example, are increasingly available and enable new ecosystem applications. Fourth, we are starting to see momentum in regulatory changes. In Germany, for example, an enabling regulatory framework for telemedicine was recently instituted, digital therapeutics can now be prescribed by doctors, and systemwide electronic health records (EHRs) were launched in January 2021.

Finally, while the COVID-19 pandemic has exposed many structural weaknesses of existing health care systems, it has also demonstrated the potential of digital ecosystems. Companies responding to the COVID crisis were required to rethink many existing rules, regulations, and routines, which enabled them to innovate and collaborate like never before. Virtually overnight, a contactless health care system became a necessity, fostering a plethora of new digital applications, including advances in telehealth, innovative distribution of medical supplies (via drones, for example), and coordinated care across broad geographical regions.

Of course, business ecosystems are not a panacea; for many business opportunities and situations a hierarchical supply chain or an open-market model will perform better. But ecosystems are the optimal governance model when a high level of modularity (offerings of different players can be flexibly combined) meets a significant need for coordination in order to align stakeholder activities. And these are exactly the conditions that we typically find in the health care sector. The entire health care system can be considered a large ecosystem made up of providers (hospitals, doctors, therapists, and others), payers (health insurers), suppliers (pharmaceutical and medtech companies, pharmacies, and others), and regulators. All of these partners offer complementary modules that need to be coordinated in order to provide coherent diagnostic, therapeutic, or care solutions for patients.

How to Put Ecosystems Into Practice

Health care companies that want to build or participate in a business ecosystem have much to gain, but they must first understand why some ecosystems work, and others do not. Based on our analysis of health care ecosystems around the world, we have found that the most successful, sustainable ecosystems embrace the following principles:

- Focus on a big enough problem to solve.

- Ensure that all essential partners are on board.

- Select the right orchestrator.

- Achieve critical mass by first increasing scale, not scope.

- Create and harness data flywheel effects.

Focus on a Big Enough Problem to Solve

Many health care ecosystems have failed because they did not address a large enough problem. Establishing an ecosystem requires a considerable upfront investment to build the platform and incentivize partners to join. These investments can only be justified if the ecosystem, once fully established, creates sufficient value by addressing and solving a sizable problem.

Consider HealthSpot, a US telemedicine provider that allowed patients to video chat with doctors via walk-in kiosks equipped with videoconferencing tools and a suite of interactive medical devices. Despite significant funding of $44 million, and strong strategic partners, including Rite Aid (to pilot the kiosks at selected pharmacies) and Xerox (to provide IT infrastructure), HealthSpot, founded in 2010, shut down in 2016. A key reason for its demise was built right into its business model. In the US, access to care is broadly available, and an online doctor’s visit does not remove a significant source of friction. Rather than creating value, HealthSpot just shifted value from one channel to another (offline to online), and from one doctor to another, in a zero-sum game.

But value propositions can be context dependent. In China, unlike the US, access to health care in rural areas is a major challenge, and this paved the way for integrated care offerings at scale, such as Ping An Good Doctor. Ping An reports that Good Doctor, which was founded in 2014, now facilitates more than 830,000 daily consultations and provides a network of 111,000 pharmacies, 1,800 in-house medical doctors, and approximately 10,000 external medical experts who can remotely diagnose more than 60% of common diseases.

Remote access to health care became an enormous problem that needed to be solved during the COVID-19 pandemic.

In the US, online consultations increased from less than 0.01% of total ambulatory visits before the pandemic to nearly 70% in April 2020. By July 2020, the share of online visits dropped to 21%, according to analysis from Epic Health Research Network, and while it is unclear how big the share will be in the long run, many telehealth providers are profiting. In September 2020, Google-backed telehealth company Amwell raised $742 million in its IPO, with its stock price rising 28% in its first day of trading. As of September 2020, Amwell had provided 5.6 million consultations since its 2006 launch, with half of those coming in the six months from April through September of last year. Teladoc, a direct competitor, saw its share price jump from $84 in December 2019 to $208 in December 2020, an increase of approximately 150%.

Similarly, Grand Rounds identified a substantial friction in the health care system and developed an ecosystem solution with a clearly defined value proposition. When his son was diagnosed with a rare disease, Dr. Lawrence Hofmann, a professor at Stanford University Medical Center, reached out to his personal network to ensure the best possible care for his son. Hofmann knew that most people do not have the benefit of such a specialized network, and building on this idea, he helped found Grand Rounds in 2011. Grand Rounds offers not only a telemedicine solution but AI-based algorithms to match people with trusted specialists and top-rated medical facilities in their network when a second opinion is needed. In this way, the ecosystem creates value not only for the affected patient but also reduces health care costs overall by preventing expensive mistakes and identifying the most efficient treatments. Grand Rounds has since grown to become a care coordinator for large employers, with corporate clients that include Walmart and Home Depot. The company was last valued at $1.34 billion in a financing round in mid-2020 and recently announced a merger with the telehealth company Doctor on Demand.

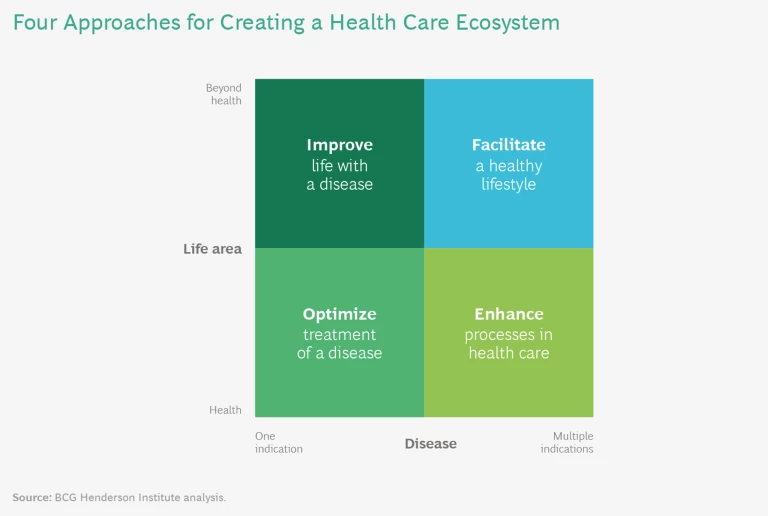

For companies looking to remove existing frictions in health care with the help of an ecosystem model, we have identified four fundamental value propositions: optimize treatment of a disease, improve life with a disease, enhance processes in health care, and facilitate a healthy lifestyle. (See “The Four Fundamental Value Propositions of Health Care Ecosystems.”)

The Four Fundamental Value Propositions of Health Care Ecosystems

Optimize treatment of a disease. Ecosystem strategies can focus on the treatment and prevention of specific indications, such as heart disease or cancer. This can be done through traditional disease-management programs as well as emerging solutions, such as optimizing COVID-19 treatment in hospitals. For example, the World Economic Forum launched the Atlanta Heart Failure Pilot in 2017. The pilot built an ecosystem of approximately 40 health care stakeholders and aimed to “make Atlanta a national leader in the heart failure survival rate by 2022 while significantly improving quality of life and reducing the average cost per capita.”

Improve life with a disease. Ecosystem strategies can also move beyond the narrow health care focus and include other life areas such as nutrition, housing, mobility, or wellness in order to improve the lives of patients with a specific indication. Payers, care-management organizations, and startups are well-positioned to offer this value proposition. For example, mySugr, the Austrian diabetes-management startup (acquired by Roche in 2017), built an open ecosystem that brings together diabetes-focused partners like Novo Nordisk, specialized physicians, coaching, and other services to improve the lives of patients with diabetes. The company crisply captures its mission in the tagline: “make diabetes suck less.”

Enhance processes in health care. Ecosystem strategies that can be leveraged to make health care processes more efficient and effective include EHRs and comprehensive telehealth offerings. Some solutions, like EHRs, need systemwide scale to be successful, while others focus on specific segments or services. Chicago-based primary-care provider Oak Street Health, for example, offers population health management for care-intensive seniors, dramatically improving patient outcomes by using advanced data analytics to gain deep customer insights and constantly expand its offerings.

Facilitate a healthy lifestyle. The broadest value proposition of a health care ecosystem is to span different life areas such as mobility or education to promote a healthy lifestyle—with or without a disease—including prevention and general health. Some traditional health care players have started to expand their offerings to address social determinants of health (SDH). RWJBarnabas Health, a US-based integrated-care provider, recently launched a tech-enabled SDH platform that includes assistance on housing, safety, nutrition, and access to transportation.

Ensure That All Essential Partners are on Board

Once you have found a big enough problem to solve, the next challenge is to identify all essential partners needed to make an ecosystem work—and convince them to join the ecosystem. Start by creating a blueprint of your ecosystem that outlines the various activities, actors, and responsibilities, along with a clear view of the ways that information, goods or services, and money will flow through the ecosystem.

A blueprint can also uncover technological risks. Bold value propositions frequently require multiple innovations from different partners, and if just one of the components is not ready, the entire ecosystem may fail. Consider the example of remote robotic surgery, which promised access to state-of-the-art surgery everywhere. The technical proof of concept was established in 2001 when a group of surgeons in New York City used telesurgery to remove the gall bladder of a patient in France. Twenty years later, telesurgery is still rare. Innovations addressing latency (the lag between the operator and the remote system), reliability, and security have not been fully addressed. As a result, telesurgery has not taken off. But there is an important lesson here: timing matters. With recent advances in 5G, encryption, authentication, and robotics, telesurgery may finally be poised to bring high-level care to underserved populations.

Even if the technological problems are solved, convincing all participants to join and commit to the ecosystem can be a critical roadblock and a key reason for ecosystem failure. In health care, misaligned incentives are a chronic problem and the source of many inefficiencies. The German health care system has long struggled with systemwide adoption of digital infrastructure (“telematic infrastructure”) because of low participation among health care providers. Neither positive incentives, such as investment subsidies, nor punitive measures, including fines of up to 2.5% of revenue, convinced a critical mass of providers to join, as many still perceived the net effects of adoption as negative.

To understand which players are ready, willing, and able to participate and invest in an ecosystem, you must first understand their specific incentives.

Partners are more likely to commit if the following conditions are in place: participants can expect meaningful net benefits; there is a high competitive risk associated with not participating; limited investment is required; the probability and/or cost of failure is low; participants can build on existing capabilities rather than having to develop new ones.

An ecosystem can only be sustained if all required partners benefit. Strong incentives can be built into its design—and not just monetary incentives, but access to services or information. Consider the example of HERE Technologies. The mapping and location-data company has established mutually beneficial partnerships with transport and logistics companies, automakers, and traffic management centers. In exchange for receiving traffic or location data, HERE provides data and services to its partners, so all participants in the ecosystem benefit from the collaboration. Additionally, some partners are also paid for data sharing. By aligning all of the partners’ goals, HERE has created a thriving business ecosystem.

It’s critical to convince health care providers and patients to participate in an ecosystem. Patients can be incentivized with free products, free services, or bonus programs. The situation is more complex for providers, who often face high investment costs and limited benefits, and orchestrators must think carefully about how to get them on board. The HMO Kaiser Permanente solved this dilemma by merging payer and provider, which has allowed it to ensure that providers participate and enabled the company to successfully implement EHRs at scale. More generally, health care players must find ways to encourage participation by establishing an aligned vision and generously sharing the benefits of the ecosystem.

Select the Right Orchestrator

In business ecosystems, an “orchestrator” offers a platform, defines the basic ecosystem governance, and encourages others to join (think of Google in its smart-home ecosystem). “Realizers” contribute complementary products or services (such as manufacturers of lighting, security, or entertainment devices in the smart-home ecosystem). “Enablers” supply more generic products or services to the ecosystem participants (such as manufacturers of sensors or displays).

The orchestrator bears the bulk of responsibility for the ecosystem’s success and will shoulder the significant investments required to make it work. In return, the orchestrator typically claims the residual income of the ecosystem, which can be very high (as in the case of Amazon or Apple), though it may take years to achieve profitability (as in the case of Uber or Airbnb).

Some health care ecosystems have failed because they had the wrong orchestrator. Two massive efforts to create EHRs offer a clear example of this. In 2007, Microsoft launched HealthVault, a web-based personal health record system. In 2008, Google launched Google Health, which was originally an attempt to create a repository of health records and data. Neither company managed to build a sustainable EHR ecosystem: Google Health was shut down in 2012, and Microsoft closed HealthVault in 2019. These big tech companies were not accepted as the orchestrator of an EHR ecosystem by providers and patients. Accordingly, many providers started to implement their own in-house EHRs, limited to their respective organizations, forgoing the full potential of the ecosystem model.

A successful orchestrator needs to meet four requirements. It must:

- Serve as an essential member of the ecosystem and contribute key resources, such as access to users or a strong brand

- Occupy a central position in the ecosystem network, with strong connections to many other players, allowing for close coordination

- Stand to gain significantly from the ecosystem and thus have the incentive and ability to take on the required large up-front investments

- Be perceived as a fair or neutral partner by the other ecosystem members, not as a competitive threat

The challenge in health care is that the natural orchestrator is not always obvious. That said, in some scenarios a particular organization is in a privileged position to take the orchestrator role, depending on the ecosystem’s value proposition and the player’s capabilities. For example, in ecosystems that focus on optimizing treatment of a disease or improving life with a disease, the point of care and medical expertise is critical; therefore, providers are in a good position to orchestrate these types of ecosystems. As geographic scope expands, larger health care players are often best positioned to become orchestrators, as we’ve seen with Novo Nordisk and its nationwide diabetes ecosystem in China.

If the ecosystem aims at improving processes in health care, it’s more important for orchestrators to have a broad operational scope, putting health insurers and governments in a central position. In Europe, most systemwide EHR solutions are orchestrated by the government (as in Denmark and Estonia) or by payers (as in Germany). For more local applications, providers can take a central role, as we’ve seen with the integrated-care ecosystems of Kaiser Permanente and Mayo Clinic.

In ecosystems that aim to facilitate a healthy lifestyle, digital capabilities are frequently at the core of the value proposition, which means tech players are in a good position to take on the orchestrator role. In China, tech companies such as Tencent, Alibaba, and Baidu are demonstrating their ability to manage extensive health care ecosystems (both in terms of scale and scope).

Because they play such a crucial role in health care ecosystems, it’s critical for orchestrators to be aware of and actively manage their potential shortcomings.

For example, a tech company with limited experience in health care, or a health insurer with a track record of ruthless cost cutting at the expense of providers will first need to build trust with partners in order to be accepted as a fair ecosystem orchestrator.

However, it’s not just the orchestrators that benefit from an ecosystem. In many cases, serving as a realizer or enabler can be highly attractive, because they typically have lower investment requirements and can select the most attractive ecosystem to join—or they can even hedge their bets by participating in more than one competing ecosystem. In particular, if they provide important components in an area that can become a bottleneck in the ecosystem, they are in a good position to claim a substantial share of the profits. Microsoft followed this path after the failure of its HealthVault platform by pivoting to an enabler role in digital health. In 2020 the company launched a health care cloud solution that combines Microsoft’s existing services, like chatbots (which enabled more than 1,500 COVID-related bots), Teams (enabling provider-to-patient virtual visits), and Azure IoT (enabling remote health monitoring).

Achieve Critical Mass By First Increasing Scale, Not Scope

A key challenge during the launch phase is to achieve critical mass so the ecosystem can take off. To this end, the ecosystem must quickly increase its scale to achieve network effects, whereby additional partners and users make the ecosystem more valuable for existing participants, which in turn attracts further partners and users.

Increasing scale requires focus. A common failure is to broaden the scope of the ecosystem beyond its core value proposition before achieving critical mass. A number of health care ecosystems have fallen into this trap by adding too many services and products, only to find that they have diluted their value proposition, added complexity, and struggled to grow.

Consider Driver, a platform designed to match cancer patients with clinical trials. Instead of focusing on its core value proposition, Driver quickly broadened its scope. The company not only collected patients’ medical records and tumor samples to be sequenced, but also opened two pathology labs (one in China, one in the US) and ran multiple apps for doctors and patients. Driver failed in 2018, just months after its launch, despite funding of $80 million. In an interview with MedCity News, co-founder William Polkinghorn concluded: “One of the biggest things we got wrong is we tried to do too much.”

The scale and size of an ecosystem should not be measured by vanity metrics, such as the number of registered patients, but by the number of interactions or transactions, because this is how the ecosystem creates value for its participants. In many cases, it is not just about the quantity of members but about attracting the right members (just as an online booking platform like OpenTable must work with the most in-demand restaurants) in the right proportions (just as a ride-hailing ecosystem like Uber must balance the number of drivers and riders). Moreover, network effects are often local, so network density may be more important than network size.

In health care, ecosystems that are built on physical supplier networks, such as accountable care organizations or patient booking platforms, require local density. They can learn from the launch strategies of mobility and food-delivery platforms that built their network clusters country by country or even city by city. Other health care ecosystems, such as those focused on EHRs, can only demonstrate their strength when they operate across sectors and geographies and thus require supraregional or even system-wide density to take off. For more specialized health care ecosystems, such as the online patient network PatientsLikeMe, which connects patients with peers facing the same rare disease to share their experiences, relevant scale is defined as high penetration of the global population of patients with a specific indication.

Once the ecosystem has achieved critical mass, the scope can be broadened in a series of staged expansions.

For example, LinkedIn was launched as a social network, allowing users to connect with other professionals based on simple profiles. Only after having achieved a leading market position did the company begin to add further services, such as a marketplace for online recruiting and a content-publishing platform.

Doctolib, an online and mobile booking platform, followed this path of strategic expansion to become one of the few health care unicorns in Europe. Founded in 2013, Doctolib focused on a clear and simple value proposition: launching a booking platform that helps patients find a specialist and make an appointment. With this clear goal, the platform aimed to quickly achieve scale by prioritizing local density. Doctolib conquered the French market, city by city, and became the leading booking platform for doctor appointments in the country. When the company expanded to Germany, it followed the same strategy of creating local clusters, starting in Berlin and expanding to other major cities. To promote network effects, Doctolib charged doctors for its services (€129 per month per physician), but not patients. Building on its leading position in France and Germany, Doctolib began to expand its service from primary care physicians to hospitals. At the same time, the scope of the platform was expanded step by step, with new solutions for doctor-patient communication, marketing offerings for providers, consulting services, digital referrals of patients, and telemedicine. Eight years after launch, the company is worth more than $1 billion.

Create and Harness Data Flywheel Effects

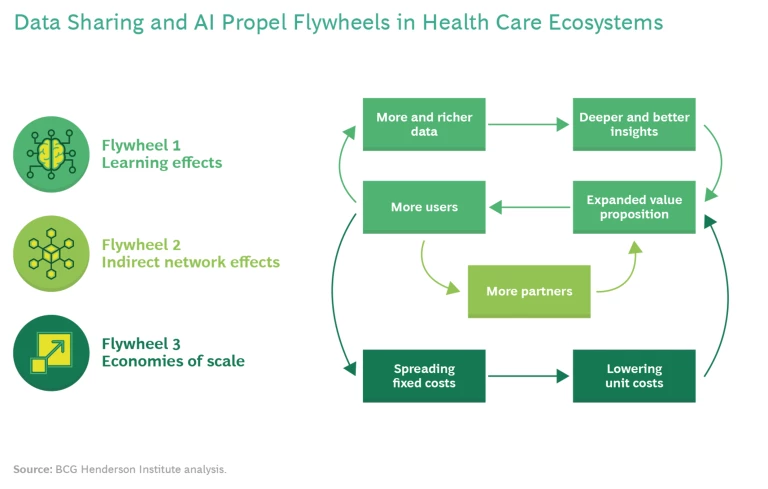

Data can be a key source of network effects in health care ecosystems. Sharing data among ecosystem participants can not only remove existing frictions and enable a seamless patient journey, but also enable new insights and innovation, such as preventive and predictive interventions, faster drug development, improved clinical decision making, and customized treatments. Take the example of Moderna. For years, the company has invested in data and artificial intelligence to improve its chances of success with drug development. During the coronavirus crisis, the company leveraged its digital and AI capabilities to gain an edge over many vaccine makers.

Data sharing can also amplify flywheel effects. (See Exhibit 1.) As more users join the ecosystem, more and richer data are available, which enables deeper and better insights, which expands the value proposition of the ecosystem and encourages even more users to join. When the data flywheel gains speed, it can propel two additional flywheels in a health care ecosystem. A growing number of users will attract more partners to the ecosystem, which further increases the breadth and improves the quality of the offering and thus attracts more users. Such indirect network effects are well-known from ecosystems in other sectors (from video games to online food-delivery platforms) and can lead to a dominant market position. In addition, a growing number of users will also enable economies of scale by spreading the fixed costs of the ecosystem over more users, while lowering unit costs, further increasing the attractiveness of the ecosystem for additional users and partners.

Ping An’s Good Doctor exemplifies this flywheel effect. The platform was initially designed by 200 AI specialists using a data set of 400 million consultations. By integrating a range of online and offline services and digitizing most processes, Ping An was able to build a comprehensive ecosystem based on data analytics. The insights provided by Ping An’s data set increase with every new user and every additional interaction on the platform, and the company uses this data to constantly improve its offerings. Its AI system has grown to incorporate 3,000 diseases and cover the entire consultation process. As a result, Ping An has doubled the efficiency of consultations, greatly reduced the risk of misdiagnosis or missed diagnosis, and constantly improved patients’ experiences. The platform nearly doubled its number of registered users from approximately 193 million in 2017 to 346 million in 2020, according to company reports, and became the first AI health care system to reach the highest level of certification of the World Organization of Family Doctors (the world’s largest family physician organization and a World Health Organization partner).

Of course, there are significant barriers to data sharing and analytics in health care. Existing data often lack precision and are difficult to analyze, data from different sources are not compatible, and integrating data analytics into existing workflows is complex and challenging for many incumbent health care players. At the same time, the stakes are high because health decisions can be life or death, and mistakes are costly. What’s more, patients and regulators are rightfully concerned about data privacy and security.

To overcome these barriers, health care can learn from ecosystems in other sectors that face similar challenges. Two ingredients are essential. First, it’s important to have an operating model that enables an effective data workflow among ecosystem participants, with clear data standards and application programming interfaces (APIs). Second, you need a data governance framework that strikes a balance between value creation and privacy risks by providing clear answers to the following three questions: Who owns the data? Who decides about access to the data? Who can use the data for which applications? For example, in many EHR systems ownership lies with the patient who can make decisions about access and whether to share data with partners in the ecosystem. However, ownership and decision rights can also be separated, as in Google’s smart home ecosystem, where the user owns the data, but Google broadly shares it with third parties, based on clearly defined rules and standards.

Beyond these concerns, effective data sharing requires a change of mindset. Providers, payers, and suppliers to the health care system need to stop guarding their data to protect their share of the pie and seek out innovative ways to share their (anonymized or aggregated) data in order to create new value and thus increase the overall size of the pie. The potential benefits are enormous. With over a quarter of US health care spending attributable to conditions related to modifiable risk factors, according to research published in the journal The Lancet Public Health, data-driven prevention alone could substantially improve the health of large parts of the population and reduce costs for the entire system.

Taking Action, Jointly and Individually

Payers, providers, and suppliers, as well as startups, tech companies, and regulators, all have a unique role to play in navigating, managing, and leading a successful ecosystem.

All stakeholders must act now to seize the opportunities ahead. Several trends are fueling the emergence of health care ecosystems, providing huge opportunities for new and enhanced value propositions. As new ecosystems emerge, the established roles in today’s health care landscape will be unbundled, so it’s critical to have a strategic vision of what the future might hold and what your role in it might be. Don’t wait for regulators to provide all required conditions and incentives. Embrace a collaborative mindset, build trust, and forge positive relationships with partners. Put yourself in the shoes of the other ecosystem participants and be sure every partner has an incentive to join and contribute.

Payers, providers, and suppliers must be active, not reactive. Too many incumbents have yet to develop an ecosystem strategy or establish clear positioning. New players threaten to disrupt the industry, and the time to build competitive advantage is now. Actively screen the market and expand your network to include new partners, such as startups and tech players, while leveraging your strong central position and deep expertise in the health care sector. Set up pilot projects focused on a clear value proposition for a specific population or region, then scale up. Organize this value proposition around the customer, not the service you deliver. Invest in new capabilities to gain a competitive advantage by strengthening digital competencies, digitizing processes, building interoperable data lakes, and developing a data (and data-sharing) strategy.

Startups and tech companies should focus on cooperation rather than a “move fast and break things” approach. Health care is a sensitive and highly regulated sector, with many inherent challenges; it’s important to learn the specifics of the industry and build on existing expertise. Clearly define the position you want to secure, whether it’s as an enabler providing infrastructure or analytical services, a realizer offering specific solutions, or an orchestrator offering broad services or solutions. To thrive in this space, tech companies must deliver services that are interoperable, seamless, and modular. Trust is also key—and plays a crucial role in building relationships with patients as well as ecosystem partners.

Regulators should encourage pilot projects and use cases that enable ecosystems and new care delivery models, such as integrated, remote health offerings that provide telemedicine and digital therapeutics as not just standalone offerings, but as integrated, value-adding services. Over the long term, regulators should facilitate cooperation by enabling outcome-based or value-based payment structures and easing the boundaries between sectors. They should also encourage digitization to facilitate data sharing and data use cases.

Incumbent and new health care players that follow the five principles embraced by the most successful and sustainable next-generation health care ecosystems will do more than just optimize operational efficiency. They will finally overcome the traditional tradeoff of the iron triangle in health care by improving quality, enhancing access, and lowering costs—all at the same time.

BCG Henderson Institute

HTW Berlin

https://www.htw-berlin.de/en/