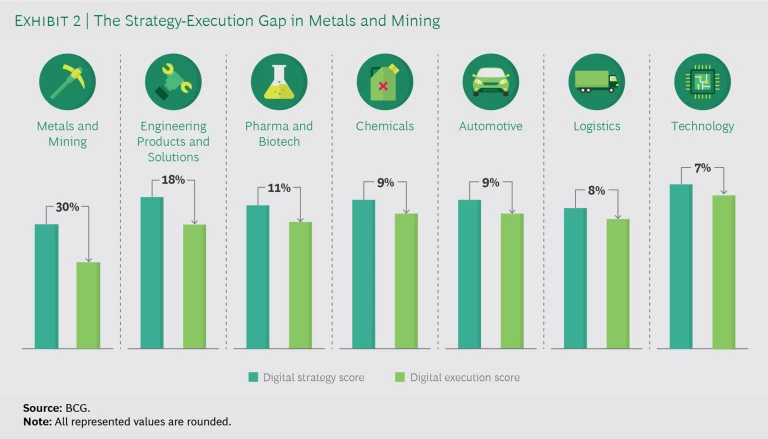

Metals and mining companies are investing in digital technologies across the value chain, from operations to procurement to sales and marketing. Unfortunately, many of these investments have fallen far short of their potential: according to BCG’s Digital Acceleration Index (DAI), the metals and mining industry is roughly 30% to 40% less digitally mature than comparable industries, such as automotive or chemicals.

Digital Acceleration Index (DAI): Methodology

As part of our global Metals and Mining DAI survey, we asked executives at 75 companies to rate their organizations on the DAI scale. Our sample was representative across types of commodities (ferrous metals, base metals, precious metals), geographies, and company size. We further conducted qualitative interviews to better understand companies’ areas of digital investment, the impact they achieve from digital, and the challenges they face.

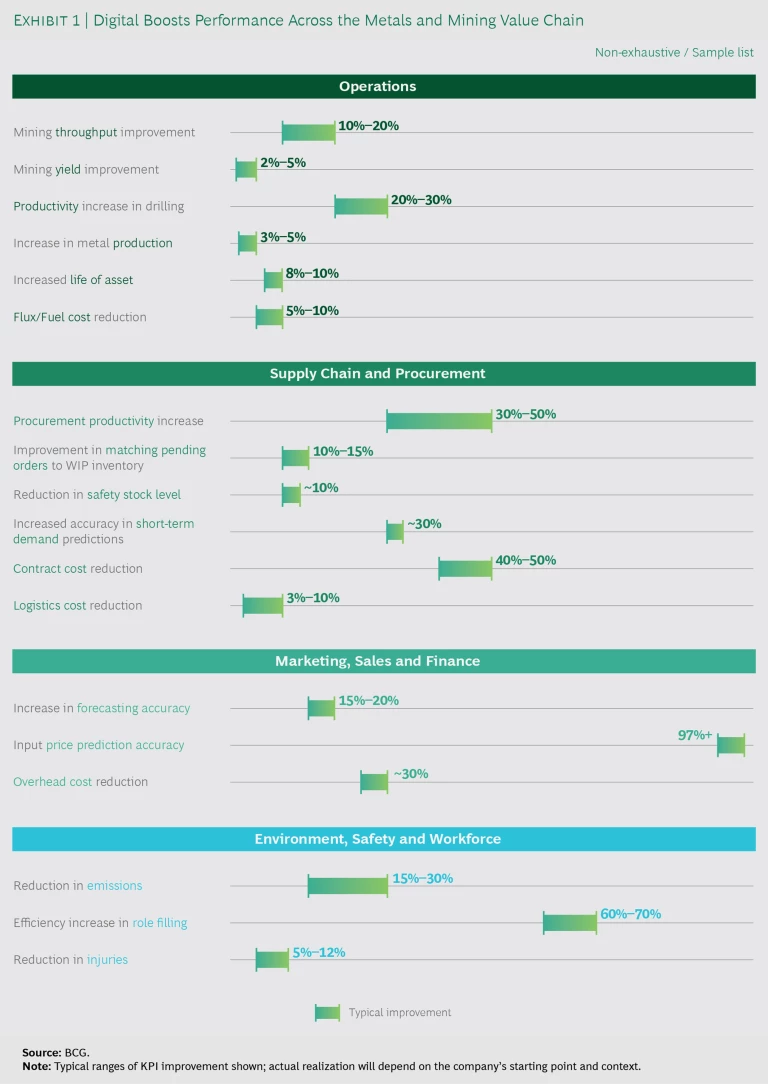

That’s a huge deficit, especially considering the enormous benefits digital technology can bring to the sector. By accelerating digital transformation, metals and mining players can boost throughput, simplify processes, lower costs, improve metal recovery and yield, and reduce supply chain complexity. It’s not easy to pull off, but a handful of companies have done it—and after a closer look at the various players in our survey, we have identified the digital accelerators that set those industry leaders apart.

Unique Barriers to Digital Adoption—and Unique Opportunities

On one level, it isn’t surprising that so many metals and mining companies struggle to implement digital transformations. Their workforces tend to be blue collar and are often less familiar with digital solutions than in other industries; they frequently operate in remote locations with poor network bandwidth and where the rugged terrain makes deploying digital sensors difficult. There also can be cultural resistance to incorporating digital into processes that have been established for more than a century—automation that could lead to workforce redundancies.

These are not insignificant challenges. But during our DAI research, we worked with several metals and mining companies that overcame these barriers in innovative ways—and, in turn, reaped significant rewards. Some improved their mining throughput by 10% to 20% and their procurement productivity by up to 50%, and reduced emissions by 15% to 30%. (See Exhibit 1.)

The scale and variety of these benefits spurred us to dig deeper into the DAI survey findings, and to draw on our global experience in metals and mining, to identify the key practices that digital leaders follow—five accelerators, specific to the industry, that can help fast-track sustainable and value-creating digital adoption.

Focus on operators’ needs to close the digital strategy-execution gap. Most metals and mining companies have ambitious digital strategies in place, but the gap between strategy and execution is significant—especially relative to other industries. (See Exhibit 2.) Leaders cite three reasons for this: a lack of customized solutions, the use of traditional waterfall models instead of agile methods to deploy digital products, and an inadequate focus on a solution’s sustainability.

To solve these problems, digital leaders have embraced an operator-centric approach based on the following attributes:

- Customized Solutions. Each plant or mine has unique characteristics: the ore body, the manufacturing process and related technical capabilities, the quality of raw materials, and even the skill of the operators themselves, to name a few. Yet, according to the DAI survey, only 25% of metals and mining companies use customized digital solutions. The rest deploy far less effective off-the-shelf products. Operators at a large Russian mining company, for example, did not fully adopt an off-the-shelf fleet management system because it had not been customized for day-to-day operations. However, once the system was customized—to normalize the algorithm for changing mine faces, to display granular mining KPIs, and to simplify the front-end design—the operators embraced it. The result was a 20% improvement in the utilization of the company’s mining equipment.

- Agile Implementation. Another reason for the execution gap is that large digital systems are typically deployed using a traditional waterfall methodology, which doesn’t regularly incorporate user input. As a result, products sometimes don’t match users’ expectations and timelines are delayed. One global flat-steel producer that implemented a new software system found that users’ requirements changed so frequently, and caused so many delays, that the project’s value was eroding by 30% to 50%. After pivoting to an agile approach, users and developers began meeting every week to incorporate design changes, thus getting the digital program back on track.

- Sustainability. Finally, companies must sustain these digital solutions over time, even as operating regimes change, raw material quality varies, and external requirements—such as emissions laws—shift. Some digital leaders have established digital Centers of Excellence and are upskilling shop floor operators to help design and maintain solutions over the long term. At one large coal miner, not only did operators provide inputs to build the models, but they were also trained to change key parameters and refine sections of the code, if necessary. As a result, the operators maintain the solution and have deployed the models in other units within the company, helping establish a strong, operator-centric digital culture.

Value data assets as much as physical assets. The value of data in digitally advanced industries such as banking and retail is obvious. But for many metals and mining companies, investments in data-capture technologies are still viewed as little more than an additional cost. According to the DAI survey, only around 10% of the industry views data as a corporate asset.

Metals and mining executives argue—often rightfully so—that the cost of sensors to gather data is prohibitive, that installation is difficult and time consuming, and that it’s hard to quantify the data’s value. But there are ways to overcome these challenges. Many of our clients are installing low-cost alternatives, such as sensor boxes, in less than two hours. For maintenance purposes, these no-frill sensors capture only vital information—temperature, vibration, and noise levels, for example—and link to smart AI-based functionalities to provide predictive maintenance alerts.

A single mine or plant can potentially generate huge volumes and varieties of data every second.

Even if players solve data capture challenges, they must still address storage and network infrastructure issues. A single mine or plant can potentially generate huge volumes and varieties of data every second. Storing all this data would be expensive and unnecessary, since only a limited amount of data is truly useful—anomalous data related to machine breakdowns, for instance. What’s more, the network infrastructure in many remote operations is not strong enough for real-time storage.

Given these constraints, about half the companies in our DAI survey are combining traditional data warehousing models with new data and digital platforms, such as edge computing and the cloud, to lessen the cost of storing data and to increase the speed of accessing it. Some are hosting complex analytics models on a secured, cloud-based platform, which allows them to use multiple digital models without needing additional storage or software for processing.

Finally, given the value of data, its security and governance are critical. Lapses can have dire consequences. Half of the companies in our survey are instituting new data strategy and governance designs, which involve setting up data governing bodies and identifying specific data-owner roles within their organizations.

Develop an ecosystem mindset to leverage internal and external partnerships. The whole is often greater than the sum of its parts, and that’s especially true when it comes to digital. Digital leaders understand the power of leveraging both internal and external ecosystems, and the benefits of building interconnected solutions on the same digital foundation:

- Internal Ecosystems. About 15% of the companies in our DAI survey are applying “systems thinking” to establish smart, interconnected internal ecosystems that capture synergistic benefits across the value chain. Instead of building standalone digital solutions that operate in silos, companies are combining them to create a multiplier effect. For instance, a large copper mine in Chile combined a machine learning (ML) model for optimizing copper recovery at the concentrator plant with its mineral tracking system at the mine. This allows the company to adjust operating parameters according to different types of mineral clusters, boosting recovery yields. Similarly, a leading metals player is developing a solution to track and trace the steel coil across production, logistics, and sales. This improved visibility not only reduces waiting time during dispatch, but also improves the company’s production planning and its understanding of customers’ consumption. Coupled with GPS-based tracking of trucks and wagons, this will give customers real-time visibility on the status of their orders.

- External Ecosystems. There are several ways companies can participate in external ecosystems: they can build a corporate venture capital arm, forge partnerships, or launch new digital businesses. Less than 60% of the companies in our survey have a digital partnership strategy, but those that do can expedite digital adoption and amplify its benefits. For example, as part of its own digital transformation, one of the world’s largest metals and mining companies launched a digital marketplace to connect miners with suppliers providing the latest digital mining solutions.

In digital, the whole is often greater than the sum of its parts.

Build digital talent at all levels to sustain value creation. Most metals and mining companies have adopted traditional operational improvement tools, including overall equipment effectiveness, Six Sigma, and lean business principles. Now leaders need to add digital to this toolbox. Of the organizations we surveyed, 30% had no digital upskilling plan at all, while another 45% had only recently begun training initiatives. Shaping this culture requires time and can be arduous, but the potential payoff is tremendous.

Companies need to design programs and policies that educate and align all levels of the organization with the digital strategy—senior leadership, middle management, and the shop floor. One company, for example, arranged for senior leaders to visit digital centers and industry startups to see firsthand how digital technology is helping to solve problems like their own.

Make digital an essential part of company culture, from senior leadership to the shop floor.

Engaging middle managers is even more critical, since they have the dual responsibility of championing digital while delivering the next quarter’s results. Smart senior leadership teams build incentive structures that allow middle management to take measured risks—and that give them enough time to show results. One company assigned its managers to work closely with the shop-floor teams, identify where digital solutions could solve business problems, and then implement these solutions to become business as usual. This approach allowed middle management to take ownership of the digital transformation, rather than making the transformation a top-down effort.

Many companies say the shop floor is the most difficult domain to introduce digital. The typical approaches—online training programs and classroom-based sessions—are often ineffective because they rarely show how digital tools solve real-world problems. In response, some companies are now using Action Learning certification programs that apply advanced digital tools to various business situations. These programs also give trainees a common language to communicate with developers. The goal is not just to train employees on digital concepts, but also to encourage them to adopt these tools in their day-to-day jobs.

Apply digital tools across the organization. Metals and mining companies have traditionally focused most of their digital efforts on improving operations. As a result, however, digital maturity scores—even among digital leaders—are much lower in areas such as sales and marketing, procurement, and human resources. As the digital opportunities in operations narrow, it’s crucial to begin applying digital to other functions, including:

- Procurement. According to our DAI survey, nearly 75% of companies still rely on manual or disparate systems for procurement. Even digital leaders on the operations side often complain about tiresome procurement processes that lead to stockouts, excess or incorrect inventory, or delays in processing purchase orders. Admittedly, ascribing a specific value to the digitization of procurement processes isn’t easy—but a digital approach surely reduces process overheads and errors. For instance, many of our clients have moved to a QR-based ordering solution, which automates all the standard background processes and reduces the purchase order process to a single click. In more advanced applications, companies have deployed AI-based negotiation coaches to support purchase teams during the procurement process.

- Supply Chains. Nearly 50% of the companies in our DAI survey rely on manual tools for supply chain visibility, and about 40% rely on manual tools to tackle their sales and operations planning problems. Digital leaders, on the other hand, are building integrated operations planning solutions that provide single-click visibility into large, fragmented value chains. One of our clients, which had relied solely on the experience of sales and marketing teams to predict demand, added an ML-based forecasting engine. This improved forecasting accuracy by 20% and, by reducing inventory and integrating more deeply with customers, improved EBITDA by as much as 4%.

- Sales and Marketing. Nearly 50% of the companies in our survey have physical and digital sales channels that are siloed, and have digitized only individual touchpoints along the customer journey. Digital leaders, on the other hand, are moving toward a cross-functional experience across sales, marketing, new product development, and finance.

- Finance. Digital solutions allow CFOs to move away from spreadsheets and improve financial planning. During the COVID-19 pandemic, managers have used these advanced tools to model complex and multivariate scenarios quickly. These models have helped them provide valuable inputs to business strategy as the pandemic has played out.

Charting the Digital Journey

Metals and mining companies fall on a wide digital spectrum. Each has adopted a different approach to digital based on its current state, business context, and external environment. But much remains to be done. The insights from the DAI survey, and our experience working with digital leaders, offer a good starting point, as well as some specific interventions that will help companies accelerate their own digital journeys—and create sustainable value. (See Exhibit 3.)