As we move beyond the immediate response phase for COVID-19, banks should strongly consider the role of transformative M&A in their strategic agendas. Before the crisis, there was a strong case for banks to make consolidation moves, and this case will only grow stronger during the rebound from COVID-19. Pressure on bank economics will increase, and the strategic imperative for investments enabled by scale will increase as well. Some banks will emerge from the crisis stronger than others, because of greater resilience in their existing books and/or better responses to the crisis. After a period of inactivity in which expectations and valuations further stabilize, we expect M&A to rebound yet again. There will be a finite window for banks to maximize the opportunity. Banks with higher relative valuations and/or financial resilience should be ready with clearly articulated strategies and plans.

The Pre-COVID-19 Climate

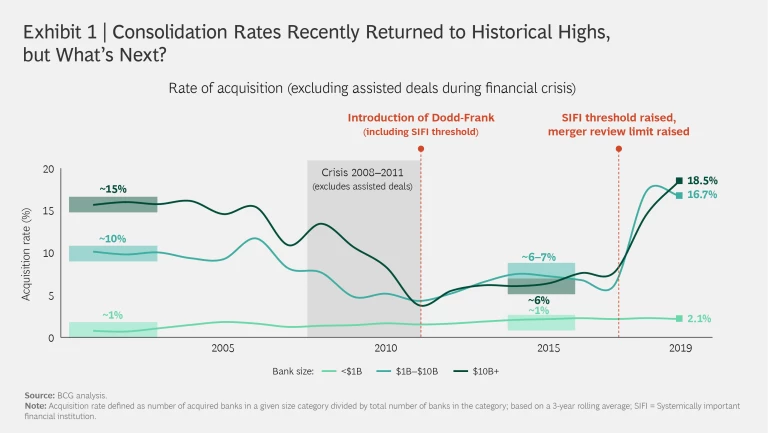

As we argued in our 2019 report “How North American Banks Can Revive Shareholder Value,” there is strong motivation in the banking sector for transformation, including consolidation M&A. Scale has always been a driver of value in banking, but it is more critical than ever because of the need for investment in technology and digital capabilities. Prior to the pandemic, regulatory changes had led to increased consolidation, and transaction volume had recovered to levels not seen since the 2008-2011 financial crisis. (See Exhibit 1.) Additionally, mergers of equals were becoming more frequent.

The Pandemic Temporarily Slows Deal Making

Not surprisingly, the near-term focus of CEOs and boards has been on stabilizing their existing businesses. Valuations and total shareholder return (TSR) have been hit heavily by the crisis, as uncertainty over expected losses and the duration of the pressure on economics has yet to clear up. For many sellers, now may not be the best time to sell, unless there is severe capital pressure or material risk of failure. For buyers, uncertainty over capital flexibility or the quality of target credit portfolios may prevent immediate action. For these reasons, year-to-date deal making has slowed significantly.

Under the surface, however, is a growing need for further consolidation. Significant macroeconomic pressure will affect some banks more than others. Unprecedented credit losses and an extended period of low and potentially negative interest rates will result in significant pressure on all banks, especially those that are more heavily dependent on net interest income or riskier asset books. It remains unclear if there will be a wave of rescue deals like we saw in the last crisis. Government actions have included—and could continue to include—systemic support for the entire banking sector, such as reducing short-term interest rates or providing assistance with liquidity.

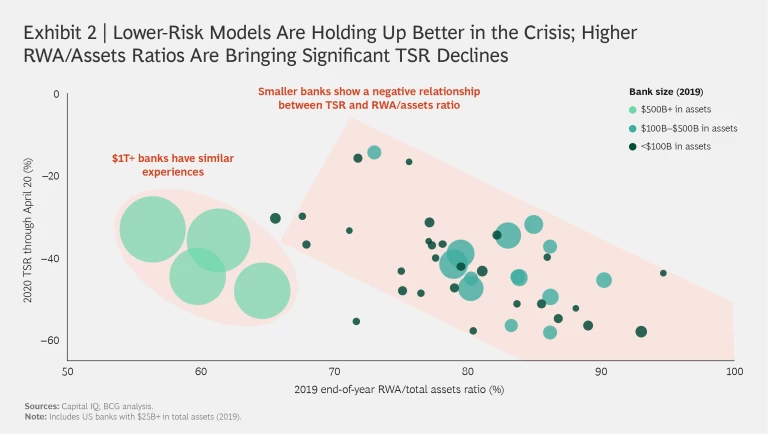

Even with these forms of systemic support, however, some institutions may come under severe pressure as a result of exposure to certain sectors or because of general weakness in pre-crisis capital/liquidity levels. Some banks will no doubt emerge from this crisis stronger than others. As Exhibit 2 shows, year-to-date TSR versus the proportion of risk-weighted assets shows a clear negative correlation. Although there are other factors at play, it is clear that investors are discounting current earnings for banks with riskier asset books.

Coming out of the crisis, we expect the spread between winners and losers to widen.

More generally, banks with a relatively high fixed cost base or those that do not adapt with new capabilities will struggle to respond to the new reality. Following the acute phase of the COVID-19 crisis, scale and the ability to invest and transform to capture advantages from digital, data, and analytics will be even more important than before the crisis. Coming out of the crisis, we expect the spread between winners and losers to widen on the basis of these factors. Which banks will be most effective in managing credit through the cycle or in modernizing collections capabilities? Which will be best equipped to rapidly upgrade their talent and modernize distribution capabilities to reduce their reliance on physical distribution costs?

M&A Resumes and Likely Accelerates

Over the coming months, the effects of economic uncertainty will become clearer, and bank valuations will normalize to reflect a more predictable or narrower set of potential outcomes. At that time, CEOs and boards can more easily resume deal making, likely at an accelerated pace given the window of opportunity and more attractive valuations. Banks that emerge from the crisis with relative strength will be in a position to take advantage.

That being said, in the absence of assisted deals, we should not expect a tsunami of M&A activity. The quantity of available transformational targets with a strong strategic fit for any one bank is limited. Most banks we speak with are less interested in tuck-in deals because of the relative effort of integration compared with benefit. Instead, banks are most focused on material acquisition targets in terms of relative size, and they can readily justify deal premiums only when there is some degree of footprint overlap. A given bank may have only one to three materially sized targets of sufficient footprint overlap to consider. Also, some institutions have been “off the table” as targets owing to strategic ownership by much larger foreign institutions.

Other factors, however, make it possible that we will see some M&A acceleration versus the historic rate. A growing number of banks have expressed a willingness to acquire competitors outside of their current footprint, owing to the increasing criticality of scale and the fact that up to 70% to 80% of typical synergies for large-scale transformational deals are unrelated to branch closures. However, banks are typically willing to pursue such deals only for geographies considered highly strategic—for example, those with a contiguous footprint or a high density of attractive markets. The trend toward mergers of equals may also open the potential for additional deal making, thanks to lower premiums. However, completing a merger of equals relies on strong trust, culture fit, and collaboration between the CEOs and boards. Mergers of equals create a complex set of challenges not faced in a typical bank acquisition. However, if managed effectively, these types of deals can be highly effective in terms of driving transformative impact—as some of the recent mergers of equals have shown.

We expect consolidation to continue and to return to rates seen just before COVID-19.

Considering all of these factors, we expect consolidation to continue and to return to rates seen just before COVID-19, possibly with some acceleration. Attractive targets with strong strategic fit and transformative potential remain reasonably limited—so banks that aspire to participate in M&A need to be proactive and bold.

The COVID-19 crisis has also created funding and valuation challenges for other industry sectors, especially some verticals within fintech. The crisis may provide banks with an opportunity to scan the horizon for complementary technology capabilities that may accelerate the digital transformation of their business. Hence, the M&A strategy should not be limited to banking assets but should also cover technology capabilities and platforms.

The Window of Opportunity Is Open

Banks should focus on maintaining strength and resilience, but they should also be prepared to be opportunistic with a proactive M&A agenda. The window is now open for institutions that are in a position to be bold.

As we have noted in BCG’s M&A research, companies that are opportunistic about strategic M&A during downturns are able to drive more value than companies that conduct M&A only during strong economic times. A recent BCG publication on COVID-19’s impact on global M&A explains that now is a rare moment for consolidators.

Banks that are considering an M&A agenda should take the following steps in preparation:

- Leverage dynamic scenario modeling. Expectations for the financial resilience of your institution and others can change quickly in response to evolving economic conditions. You should have a dynamic, real-time point of view on near-term value creation, as well as on capital, funding, and liquidity levels. Be ready to adapt your strategies quickly.

- Determine the role of strategic M&A in your transformation agenda. Develop a consensus with the full management team and board on your posture toward M&A, along with a set of specific targets. Revisit past decisions in light of current circumstances. Be clear about the bank’s willingness to pursue larger-scale M&A, including merger-of-equals deals. Assess whether there are markets and/or geographies for which you would consider out-of-footprint targets. Revalidate your innovation priorities and determine which subcategories of fintech would be attractive for opportunistic moves.

- Have your wish list ready. Model all expected synergies outside-in for the full set of potential targets. Understand which companies have a strong strategic fit at typical deal premiums—and which could become options if they can be executed at a lower premium (for example, through a merger of equals or downturn-driven deals).

- Monitor the landscape. Track key metrics for all of your targets to periodically update your investment case and assessment for each target. Monitor the landscape for periodically reported data such as valuation, risk-weighted assets, tier 1 capital ratios, net charge-offs, credit default swap spreads, and cost of funding to identify potential opportunities.

- Be prepared to act. Understand which capabilities you may lack to drive a transformational integration. Develop an understanding of what it will take to deliver value. Build your commitment and readiness by learning from others that have been through the journey. Prepare your team by conducting workshops with specific target scenarios to identify key priorities for delivering value.

The COVID-19 pandemic has brought massive disruption to the US banking industry. But viewed in a certain light, it could create an opportunity as well. Banks that have strong financials and take the right preparatory steps—starting today—should be positioned to capitalize.