The coronavirus pandemic has hampered companies’ go-to-market strategies everywhere, but nowhere has the disruption been more severe than in emerging markets.

Even in good times, selling in many markets in Africa, Asia, and Latin America can be challenging—and these aren’t good times. The requirements of social distancing have introduced a new complication in markets that already had low visibility (because of data limitations), fragmented front ends, and last-mile execution issues (because of talent and attrition challenges).

Once the crisis has receded enough for businesses to start bouncing back, emerging markets will experience a reset in demand. However, in our view, there will also be a dramatic change in the shape of demand on the front line. COVID-19 has already significantly disrupted sales teams’ traditional activities. There are many unknowns ahead, but one certainty is that go-to-market approaches must fundamentally change.

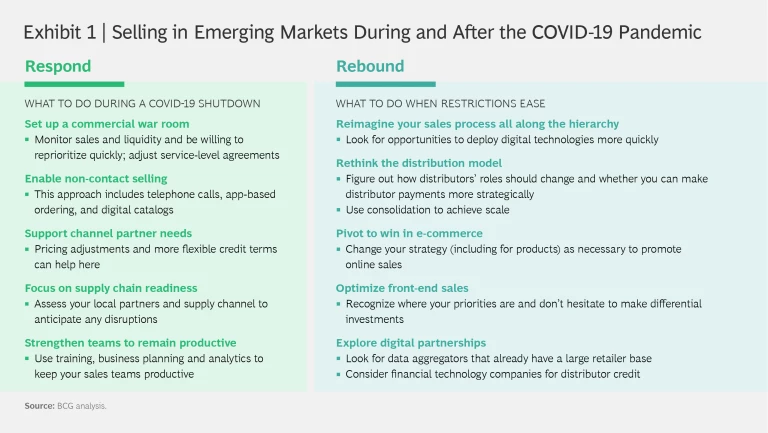

We recommend that companies rethinking their go-to-market plans in emerging markets adopt a two-phase approach. The first involves the immediate response—what to do now, with lockdowns persisting in many places. The second is what to do once the new reality sets in and businesses start to rebound.

As part of their immediate response, most B2C and B2B companies that sell through retailers have already set up commercial war rooms with dedicated cross-functional teams headed by senior leadership. In addition, they have taken steps to help their channel partners rebound quickly. But in providing such support, companies have had to make some tough decisions on the basis of their own liquidity positions, appetites for risk, and competitive positions. Companies have also created minimum viable products that use digital technology to make their underlying processes more efficient and effective.

Imperatives for the Rebound Phase

Preparing for the rebound requires a different mindset. We see five imperatives in the rebound phase. (See Exhibit 1.)

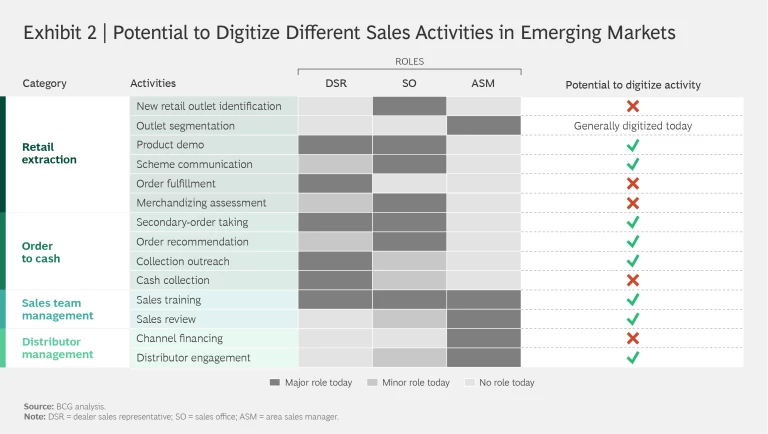

Reimagine the sales process. COVID-19 has accelerated the ongoing process of the digitization of sales. At this point, we advocate a zero-based approach—looking at every sales role and activity to find opportunities for digital automation or augmentation. BCG’s recent global survey of companies in a variety of industries found that roughly 80% of companies are actively exploring ways to shift their go-to-market strategies away from in-person channels and toward digital ones.

Companies must reimagine the entire sales process and answer the following questions:

- Are these activities really needed?

- Is there a way to handle them digitally so they become more efficient and effective?

- Could existing solutions or partners help with the reimagination process?

In our view, the answer to all three is a resounding yes. Beyond the digitization of sales roles, companies may look to directly engage with their retailers—allowing retailers to directly place their own orders online, for instance. (See Exhibit 2.)

Rethink the distribution model. The pandemic is compounding subscale distributors’ growth challenges with higher costs of working capital and unfavorable economics. Data clearly shows that bigger distributors grow faster and invest more in their businesses than smaller ones do.

Once they get through this period of short-term distributor support, companies need to evaluate the scale, architecture, and profile of these partners. They also need to critically evaluate the role of the traditional distributor.

Companies need to reassess how well their distributors are handling multiple activities—such as servicing and breaking bulk, secondary execution, retailer credit, collections, and local compliance—and whether other players in the ecosystem could do the work more effectively. There are clearly many inefficiencies in the way distributors carry out their business today—often relating to deliveries or order-taking at the fragmented front end. Companies also need to completely rethink the payout structures for distributors, taking into account the role they want each distributor to play and linking payouts to performance.

The rise of B2B e-commerce players in emerging markets has been driven by the belief that technology can make some aspects of distribution more efficient for both the companies trying to sell products and their retailers. This is undoubtedly true. However, the use of B2B e-commerce platforms will force companies to think through a number of business model issues, such as:

- How do we manage the inevitable conflicts with distributors?

- Should we create our own B2B e-commerce platform or should we partner?

- How do we change our team and functions (including trade marketing and sales) once we start using such platforms?

- Who handles the jobs of core activation and demand generation?

Pivot to win in e-commerce. BCG’s recent consumer research shows a systemic shift toward e-commerce. This shift isn’t surprising, given the highly transmissible nature of COVID-19, and it isn’t the first time that a health crisis has caused consumers to shop differently: there was significant and sustained growth in e-commerce after the SARS outbreak in China.

Companies should use this opportunity to develop their e-commerce 2.0 business strategies. Many leading companies are already planning to grow their e-commerce businesses, including for products such as building materials and tires, which retailers used to sell to in-store customers directly. Product assortment and packaging, digital marketing, merchandising, and customer service are among the areas in which companies must develop capabilities to succeed in e-commerce in emerging markets. (See Exhibit 3.)

Optimize front-end sales spending. Companies have traditionally devoted a high share (from 20% to 30%) of the gap between consumer price and net revenue to channel trade spend. COVID-19 creates an imperative for companies to optimize their highly fragmented, often mismanaged, trade investments. They can do this by taking the following actions:

- Allocate trade investments differentially to win in priority spaces. The idea here is to prioritize spends across SKUs and to analyze affordability, brand strength, market share, and competition on the basis of location.

- Enhance effectiveness of trade spends. Companies must take a granular view of trade spend benchmarks across their industry in order to both define their starting points and identify areas of opportunity. Companies must clearly define output measures for their spend objectives—an increase in market share, absolute sales, or weighted reach. The effectiveness of these spends should be clearly tracked with a dashboard; returns on investments should be measured and enhanced through analytics.

- Plug leakages. Our analysis across multiple clients suggests that as much as 20% of trade spends is wasted through leakages. These leakages can be plugged by the effective use of technology including analytical rules to ensure the correct classification of different retail segments.

A structured approach can help companies reduce the cost to serve by 200 to 300 basis points and free up capital for investments in disruptive opportunities.

Explore digital partnerships. To address customers’ expectations and new behaviors in the aftermath of the pandemic, a go-to-market approach that leverages digital technology is critical. Companies should creatively and carefully assess partnerships with logistics and delivery providers, with B2C and B2B e-commerce businesses, with technology providers, and with companies in the broader ecosystem to unlock value through disruptive ideas. (In a recent effort, we identified 20 use cases that could unlock significant value; many of them would require partnerships with traditional and unconventional players.) With reduced budgets and increasing cost pressures, strategic partnerships with other companies can be beneficial to all parties. Companies should be asking themselves what to build, what to partner on, and what to acquire.

Preparing for an Uncertain Future

There is limited certainty about the immediate economic future in emerging markets. The recovery, when it comes, will likely proceed at different speeds in different places.

Responding quickly to unique and unusual market demands, building momentum early through quick wins, and demonstrating early success will be critical for sustained performance. The crisis is forcing companies to make structural changes in their go-to-market plans. They must, therefore, become more effective in how they respond to evolving consumer and customer needs, in navigating the competitive landscape, and in controlling the costs of doing business. Nimble organizations that can innovate and adapt digitally will be the ones that shape the new reality.