The popularity of joint ventures (JVs) and alliances sharply declined during the global financial crisis, but they are making a comeback—especially among multinational corporations (MNCs) and Asian companies seeking to make inroads into new markets. Given the regulatory constraints in many parts of Asia, as well as the prevalence of family businesses and state-owned enterprises, JVs and alliances are often more attractive than mergers or acquisitions, which typically involve some degree of takeover or control and can lead to negative publicity.

Despite their resurgence and a few high-profile successes, JVs and alliances are challenging, and many participants are disappointed with the value the partnerships deliver. What are the key obstacles, and what do successful ventures do differently?

To find out, BCG surveyed executives from more than 70 companies in ten industries: real estate; health care; oil and gas; financial services; infrastructure and transportation; industrial goods; energy and utilities; mining; technology, media, and telecommunications; and consumer goods. The survey respondents included MNCs with JVs in Asia, as well as companies from developing Asian economies with JVs in the U.S. or Europe. We also analyzed JV best practices in Asia to gain further insights. (See “Survey Methodology.”) Our goals were to gain a better understanding of how different companies approach and manage joint ventures and alliances and to determine which approaches are most effective.

Survey Methodology

As illustrated in the exhibit below, BCG’s findings on joint ventures (JVs) and alliances are based on a quantitative survey of executives from more than 70 companies involved in such partnerships, as well as extensive analytical research and face-to-face and telephone interviews. The research drew on the rich Thomson Reuters database covering ten years of JVs and alliances in a wide range of sectors, locations, and outcomes. The goal of our quantitative survey was to gain a better understanding of how companies use JVs and alliances for corporate development, the sources of success and failure, and key value levers.

The JV Landscape and Inherent Challenges

Our research revealed a growing interest in JVs and alliances. From 2009 through 2013, the number of announced JV transactions grew at a compound annual rate of 4 percent (compared with only 3 percent for M&As) and accounted for 9 percent of all global deals in 2012. Companies typically pursue a JV for one of four reasons: to gain faster entry into a new market; to acquire expertise in, for example, products or technology; to increase production scale, efficiencies, or coverage; or to expand business development by gaining access to distributor networks. The inherent challenges in some countries can also make JVs appealing. In China, for instance, regulatory restrictions on foreign ownership make JVs the only viable option for gaining access to certain markets. Other markets, such as India and Indonesia, are too complex for foreign owners to navigate alone, and a strong local partner can pave the way. We recommend that, before they embark on a JV, companies perform a self-assessment, using a diagnostic tool such as that shown in the sidebar “Call to Action: For Executives Leading Joint Ventures and Alliances.” Such a tool is helpful not only for companies starting a JV but also for those already in a partnership.

CALL TO ACTION

For Executives Leading Joint Ventures and Alliances

Whether your company is considering a JV or is already in a partnership, a self-assessment is critical. The diagnostic tool below is a good place to start.

- Is the strategic objective crystal clear?

- Have you scanned the universe to find the best partner?

- Have you chosen the best format for your JV?

- Are you evaluating nontraditional formats such as nonequity alliances, JVs with competitors and customers, multiple competing JVs, and R&D JVs (not all intellectual property is lost).

- Have you assigned the best internal and external teams to consideration of this venture?

If your company already has at least one JV, to what extent are you satisfied with its performance and value creation? How would you answer the following questions?

- Do you systematically pull all value-creation levers?

- Do you react to external changes effectively?

- Do you know how to solve the growth-versus-profit trade-off?

- Do you have the right governance in place?

- Do you have the right people?

- Do you give up? Do you accept the status quo? Should you conduct a constructive and systematic intervention?

On the basis of your answers to these questions, you can gain insight into how well prepared your company is to move forward. It’s important to realize that an underperforming partnership can be salvaged. A thoughtful and systematic intervention can rejuvenate a JV and turn it around. Reach out to the BCG author team to discuss how to navigate successfully through the challenges that can get in the way of value creation. We can do a baseline assessment to understand your partnership’s core issues, conduct workshops to improve collaboration, and help support needed changes to the operating model.

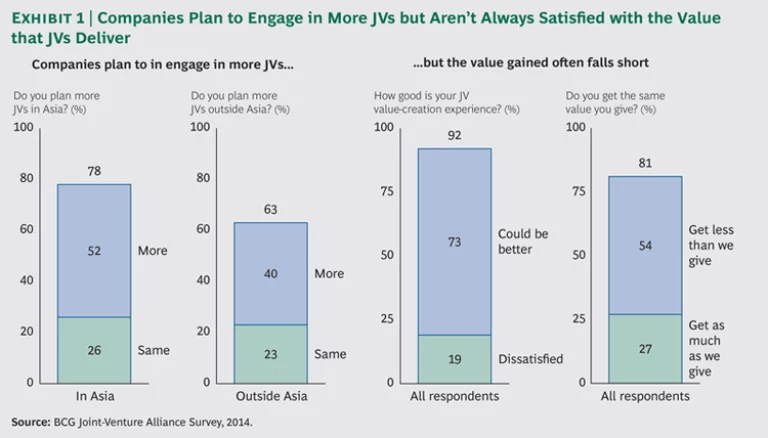

Among our survey respondents, 78 percent said that they plan to maintain or increase their JV activity in Asia—compared with 63 percent outside Asia—even though they’re not always satisfied with the value the partnerships deliver. (See Exhibit 1.)

MNCs are particularly interested in China and India. In China, 20 percent of all foreign direct investment, $23 billion, came from JVs in 2011, and 26 percent of foreign companies operating in that country have JVs there. The importance of JVs in emerging markets is, in many cases, related to the prevalent ownership structures. Because state-owned enterprises and family-owned conglomerates generate 10 to 40 percent of GDP in Asian countries, they are logical JV partners.

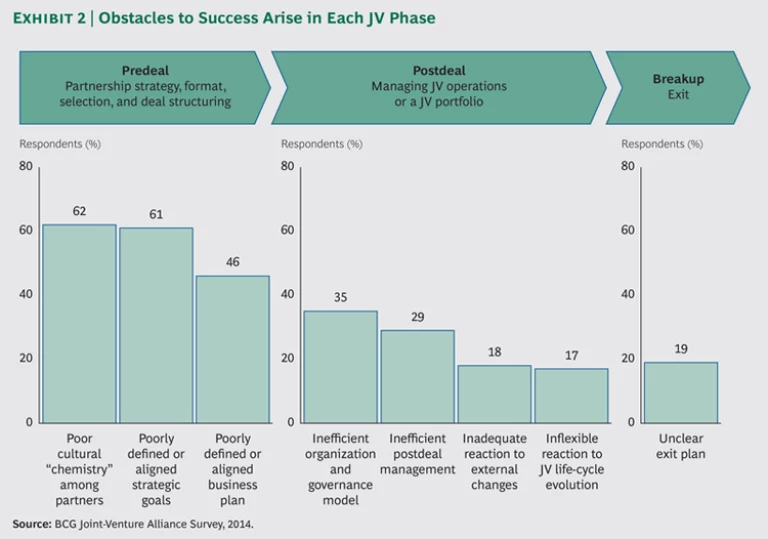

Despite their enthusiasm for JVs, 92 percent of our respondents believe that they could have gained more value from the partnerships, and 54 percent said that they gave more value than they got. The obstacles to success arise in each phase of the venture: predeal, postdeal, and breakup. (See Exhibit 2.)

- Predeal. The predeal challenges involved partnership strategy, format selection, and deal structuring. The most important problems were poor cultural “chemistry” between partners (cited by 62 percent of respondents), poorly defined or misaligned strategic goals (61 percent), and a lack of definition or alignment on the business plan (46 percent).

- Postdeal. The main postdeal challenges were associated with managing JV operations or a portfolio of JVs. Among the most critical issues were problems with organization structure and governance (35 percent), management problems (29 percent), inadequate response to external changes (18 percent), and a lack of flexibility in responding to the evolving JV life cycle (17 percent).

- Breakup. The major problem in the final phase of ventures was the lack of a clear exit plan. This was cited by 19 percent of respondents.

But the successful partnerships in both emerging and developed economies are evidence that many JVs are able to overcome these challenges and do deliver significant value. What can we learn from these high-value JVs?

Eight Lessons from Successful JVs

Our research shows that the challenges in all three phases of the deal can be overcome with careful planning and strong management. Successful JVs adhere to the following guidelines.

Be sure that your strategic objectives are clear. It is critical to articulate all objectives, expected contributions, and concerns up front. Any advantage gained from a lack of transparency will be short-lived and could damage the alliance. A partner that is marginalized can put a JV’s future at risk—and result in an angry competitor. Your best bet is to enter JV negotiations in good faith and with a win-win mentality. If you find that this is difficult, you might be negotiating with the wrong partners.

Since the JV’s purpose will indicate partner choice and deal structure, a good first step is to assess your company’s business portfolio and capabilities, identifying gaps and priorities. For instance, are attractive segments missing from your current portfolio? Do you have high-potential businesses that should be strengthened or lack capabilities that are important for success? If market entry is your purpose, typical partners will be competitors or other companies that are already in the target market. When product, technology, or other know-how is the goal, the typical partner is a competitor or supplier. The same is true when production scale, efficiency, or coverage is the goal. When business development is the JV purpose, look to competitors, distributors, and customers as potential partners. Having the right structure and partners can help you avoid typical predeal pitfalls, such as poor chemistry, misaligned goals, and lack of business plan alignment, as well as concerns over the protection of intellectual property. (See the sidebar “Protecting Intellectual Property.”)

PROTECTING INTELLECTUAL PROPERTY

A common concern associated with joint ventures and alliances is how to protect intellectual property. Some deals require technology transfers or leave companies vulnerable to copycat partners—especially in developing countries that lack strong copyright laws.

By evaluating how critical a capability is today and will likely be in the future, a company can determine the best strategy: should the company protect the intellectual property, share it under certain circumstances, use it as a bargaining chip to gain more value, or share with minimal concern? Airbus, for instance, transferred parts manufacturing for its older aircraft—not new technologies—to its partners in China.

In essence, the intellectual-property contribution is just another element of each deal, and like the other elements, it must be negotiated transparently so that all parties are fully aligned. To this end, be sure to conduct a proper valuation of all intellectual property and include it as a potential contribution and negotiation point. If the parties are aligned on the valuation, then the deal can be structured around it.

Develop a bespoke partnership strategy tailored to your situation. Standard JV templates don’t always work. When you are considering with whom to partner, you must consider a number of factors, including whether to join forces with a market leader or follower and how much control your company desires. Each choice involves strategic considerations. For instance, a market leader with mature capabilities can give you quick market access, but you may have to pay more to play—and end up with less control. A greater number of partners can help diversify risk and confer more bargaining power, but with more partners, there can be conflicts of interest. By contrast, going solo gives your company more control, but it also demands a greater investment of time and money. Long-term ventures are typically the best bet in these cases.

The optimal ownership structure depends on which partner is best suited to control the JV. Which partner has the local contracts, can manage the local team better, and has the expertise needed to maximize shareholder value? Other considerations include how much control your company wants, the size of your appetite for risk, and how much of a financial investment you want to make.

From these starting points, the partners can negotiate specific control and risk-management concerns in good faith. Options include having a controlling share, a 50-50 partnership, a minority share, or a nonequity alliance. With the right management structure, some MNCs are able to exert control even without a controlling stake. For instance, one global automaker with less than 50 percent representation on its JV’s management board maintains management control over R&D, manufacturing, quality assurance, and marketing and sales—critical functions that have substantial impact on the company’s brand.

Consider unconventional alliances. Be open to unconventional approaches, such as partnering with competitors or customers or even running competing JVs simultaneously. For instance, China-based Zhengzhou Coal Mining Machinery Group, the world’s leading provider of hydraulic roof supports for the mining industry, forms JVs with customers throughout China, becoming their exclusive supplier. Significant value can also be created through “coopetition,” an alliance of one or more competitors with similar objectives, such as reducing costs, increasing asset utilization, or improving customer service. Some MNCs are even able to manage more than one competing JV within a single market—typically, having them sell different product models. A leading manufacturer uses this approach in China to diversify risk, gain greater market share, and quickly identify which designs are most suitable for Chinese buyers. The company increases its negotiating power with the JVs by selectively allocating resources among them.

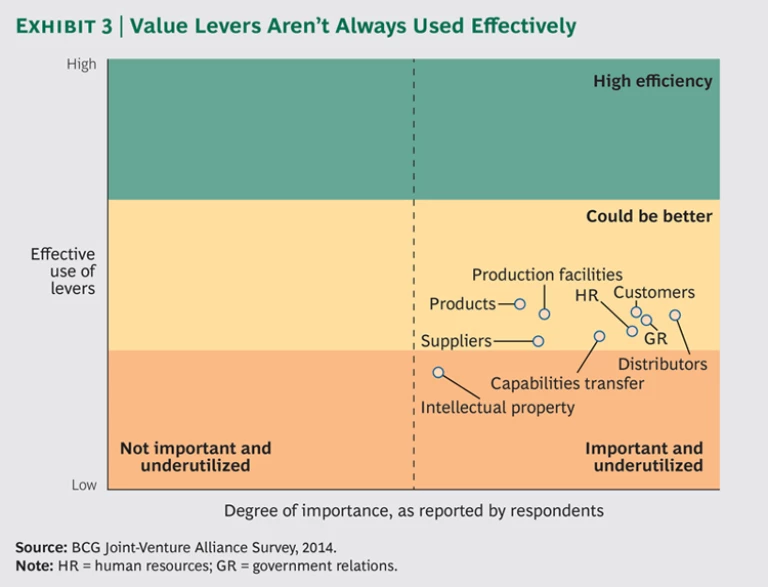

Use all available value levers and use them effectively. In general, value levers include customers, suppliers, distributors, processes, employees, products, production facilities, human resources, intellectual property, technical expertise, capabilities transfer, and government relations. Our survey respondents recognized the importance of these levers but acknowledged that they didn’t always use them effectively. (See Exhibit 3.)

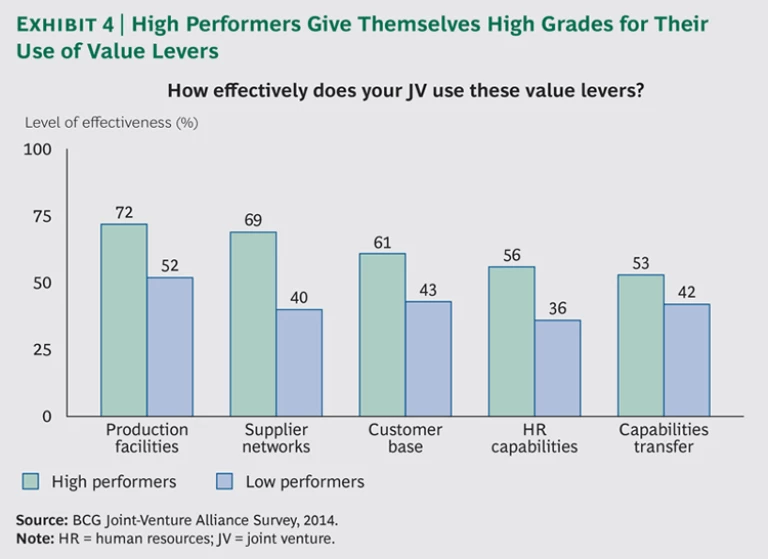

Respondents from developed economies paid a great deal of attention to their partners’ government contacts, but they reported more weakness in the areas of capabilities transfer and leveraging partners’ suppliers and employees. By contrast, respondents from developing economies thought that they could do a better job of leveraging their partners’ government connections, distributors, and suppliers. Overall, high-performing JVs grade the effectiveness of their use of value levers higher than do the low performers. (See Exhibit 4.) Remember that with any complex and interlinked system, the value delivered is only as good as the weakest link.

Tailor the operating model to the partners’ capabilities. No company entering into a JV can control—or should try to control—every aspect of the partnership. A better approach is to design a governance structure that leverages the key capabilities of each partner. Look for strengths and synergies along the value chain among operating and support functions alike. Determine your company’s key capabilities and interests, and seek to control those areas—along with the functions that are most critical to brand image. For instance, ABB’s more than 20 JVs in China manufacture a wide range of products that incorporate the company’s power and automation technologies. The JVs have no sales functions. Instead, ABB uses a centralized platform to coordinate JV sales while maintaining a consistent customer interface and service quality. Similarly, an auto manufacturer or consumer electronics company seeking to enter a developing market might want to focus on areas such as R&D, quality, and production. Control of the most critical functions is an effective substitute for total management control. But you should always keep in mind that although good control and governance are important, they should never hinder effective management.

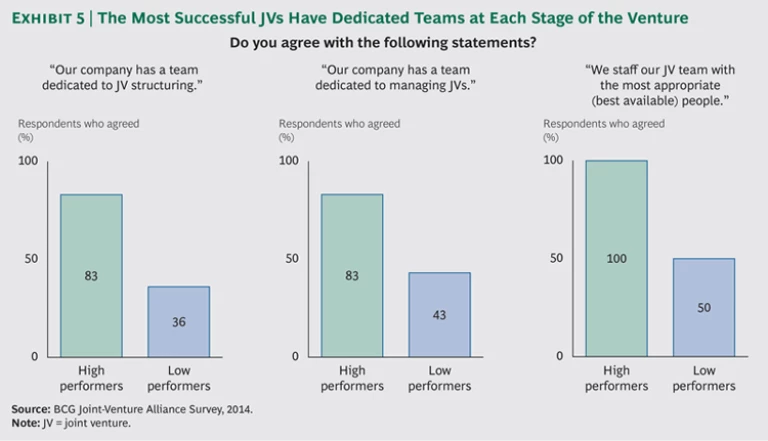

Assign a strong and dedicated team. JVs require a different mind-set and skill set than M&As, and the right people can make an enormous difference. The most successful JVs have strong teams focused on driving value during each stage of the venture’s life cycle. Among our respondents, 83 percent of high performers had a dedicated team in place during the predeal phase, compared with just 36 percent of low performers. Similarly, 83 percent of the high performers had a dedicated team for JV management, compared with 43 percent of low performers. (See Exhibit 5.)

The quality of the people assigned is also critical. Among high performers, a full 100 percent reported that they staff the best people on their JV teams, compared with just 50 percent of low performers. The right incentives must also be in place. The right incentives are those that reward team members for looking after the interests of the JV, not the parent company they come from. Knowing that JVs are rarely long-term ventures, many JV managers, who are understandably concerned about their postpartnership future, remain loyal to the parent company. Sometimes a severance package at the end of the JV can calm anxiety. If not, a new independent management team may be necessary.

Manage the JV’s external ecosystem. To manage a JV partnership effectively, high performers go far beyond the partnership itself, reaching out to the government, available talent pool, and the industry value chain. Most MNCs have a team dedicated to initiating connections with government officials and managing government relationships. Typical responsibilities of these teams include maintaining regular contact, interpreting government policy, and arranging meetings between business leaders and government officials. To further maintain and advance the partnership, successful JVs recruit and cultivate the best talent and innovations, often by partnering with local universities. For instance, one global manufacturer has collaborative relationships with more than 70 institutions in China. Developing relationships across the industry value chain is also critical. To this end, many high-performing JVs foster connections with suppliers, distributors, and customers.

Plan your exit in advance. Although each JV has a shelf life, and all eventually break up, only 19 percent of our respondents had an exit strategy. This is perhaps understandable, given that discussing worst-case scenarios can be difficult at the beginning, when all parties are optimistic and nobody wants to slow down negotiations or scare off a potential partner. For these reasons, we recommend including an independent third party to negotiate the details of the exit strategy. Ideally, this strategy is defined in the predeal stage of the partnership. Factors to consider include the circumstances under which the alliance will be broken, how it will be broken, the time frame for the exit, branding rights, pricing, and the impact on parent operations. The partners must decide on the acceptable reasons for breaking the alliance, such as a breach of agreement only, one party’s unilateral decision to exit, or a bilateral decision only. Moreover, the partners must decide whether the JV will be sold to a partner or third party, or whether the parts will be broken up and returned to the alliance partners. As for the exit time frame, the agreement must stipulate how much time must elapse from the notice of termination to its execution, and it must also describe each partner’s responsibilities during the termination period.

Branding and pricing considerations are also important. Among the critical issues are questions related to whether the JV has the right to sell the brands of a partner that has exited the alliance, whether an exiting partner should be allowed to license the brands to another party, how new brands built by the combined entity should be treated, what principles should be applied to pricing assets and personnel, and how brands—including those that lost market share during the life of the alliance—should be valued.

Finally, the partners should decide what—if any—sourcing obligations will continue to exist among the entities, as well as whether an exiting partner will be allowed to do business in areas covered by the alliance and, if so, under what conditions.

JVs and alliances can be effective approaches for entering new markets, gaining expertise, increasing production capabilities, and expanding distribution. Given the potential benefits—and the appetite for growth among MNCs and ambitious companies from emerging economies—it’s not surprising that these partnerships have regained popularity. Despite their advantages, however, JVs present significant challenges and many fail to deliver the expected value. By following these eight lessons from successful JVs, companies can sharply increase the odds of a high-value outcome.

Acknowledgments

The authors would like to thank Vasudha Mithal and Eva Klement for their contributions to this study.