“Many leaders of big organizations, I think, don’t believe that change is possible. But if you look at history, things do change; and if your business is static, you’re likely to have issues.”

—Larry Page, CEO and cofounder, Google

Over the past decade, business has witnessed the rise of a new aristocracy: the new technology giants. Their growth has been stellar: Google, Amazon.com, Facebook, and eBay, for example, all surpassed $1 billion in annual sales within roughly 5 years of launch. Procter & Gamble, by contrast, took more than 20 years to reach $1 million in yearly sales and more than 100 years to pass the $1 billion mark.

Furthermore, many of these new leaders are highly profitable, with margins often exceeding 25 percent. This is true of behemoths such as Google (which had a margin of approximately 26 percent in 2012) as well as smaller players such as Baidu (more than 40 percent). Few other industries can match such margins: on average, margins of Fortune 500 companies are lower than 10 percent.

Evolvable Strategy

Is the emergence of these companies driven solely by the rise of a new set of technologies? Unlikely. In fact, several of these companies compete in a fundamentally new way. They leverage evolvable algorithms, which self-tune to accumulated knowledge and changing circumstances. These are the algorithms that, for example, select ads when a customer books a flight online and create offers for similar flights and for related destinations, hotels, and cars. The algorithms’ recommendations are seamlessly updated when the customer researches alternatives. And the algorithms learn from established patterns for future reference. In essence, evolvable algorithms allow these companies to balance broad, economical, and fast exploration of new opportunities with the exploitation of existing known ones, helping the companies thrive under conditions of high uncertainty and rapid change in their online businesses.

At a more fundamental level, these players apply the same principles of evolvability recursively to both their strategy and their organization, areas usually guided by managerial experience, intuition, and “common sense.” Evolvable strategy is a better, more calibrated alternative: it allows organizations to adapt to changing circumstances and avoid both frivolous exploration and insufficient exploitation of existing opportunities.

Consider three companies with seemingly diverse business models: Google, Amazon, and Netflix. Their core evolvable algorithms perform essentially the same tasks. They exploit proven “winners” by displaying previously high-ranking search results, high click-through ads, and recommendations to blockbusters. Simultaneously, they explore a continuous stream of new search entries, ads, and newly released movies for which prospective popularity is unknowable.

Evolvable algorithms deal with such tradeoffs under uncertain and changing conditions by doing the following:

- Defining a very broad option space

- Modeling expected payoffs from options leveraging all available information

- Testing promising options quickly and cheaply

- Rapidly updating option assessments in light of new information and reallocating resources by scaling up, stopping, or repurposing investments

- Quickly iterating the above steps in a self-tuning manner, thereby overcoming the information complexity and speed constraints of “managerial” decision making

- Measuring outcomes and optimizing the algorithm itself in response to changing circumstances

It is perhaps not surprising that, in many cases, these companies also apply the same evolvability principles to their organization and strategy, because their entire business needs to support rapid adaptive learning to stay ahead of competitors that could, over time, replicate their core algorithms.

Evolvable Organizations

Google, for example, embodies these key features in its organization and strategy, exploring a broad range of options both close to and distant from its core. Its efforts range from incrementally improving its core ad products and making exploratory venture-capital investments through Google Ventures to embarking on speculative projects such as Google Glass. To prevent narrowing its options prematurely, Google requires that project specs be no longer than one page, minimizing constraints on changing course as projects progress.

And Google wouldn’t be Google if the company didn’t collect and leverage all possible information for evaluating options. Google Ventures, for instance, relies heavily on predictive analytics to calibrate investment decisions in an industry historically dominated by experience and gut feel.

Similarly, Google has developed ways of exploring options quickly and frugally. To contain its risks and costs, the company launched Google Glass among a select group of customers who pay to participate. Even if Google Glass fails, participants will have enjoyed the thrill and cachet of taking part in a high profile, visionary experiment.

Finally, Google calibrates exploration to avoid wasting resources on low-value projects. The company continuously measures outcomes and, on the basis of the results, rapidly reallocates resources among projects. Over the past ten years, Google has both launched and killed roughly 10 to 15 products annually—without creating major customer or organizational resentment. Objective data—rather than disputable gut feel—govern each decision. And consider Google’s highly celebrated “20 percent time”—time employees can freely allocate to unofficial initiatives. This is also calibrated: Google allows more time for exploratory and speculative projects that require creativity than for existing product categories in which the direction is clear and broad exploration would be superfluous.

Evolvability Beyond High-Tech Industries

So is self-tuning strategy reserved for technology whiz kids? Not at all. Similar principles are being applied by more “traditional” businesses to tackle tough operational challenges—such as dynamic pricing, securities trading, and pharmaceutical clinical trials—that entail decision making in situations of high complexity, dynamism, and uncertainty.

Strategically, almost all companies face similar exploration-exploitation tradeoffs in portfolio management, R&D strategy, and product development. Few companies, however, outside of a handful of technology players, apply evolvability principles systematically to their strategy or organization. But companies in many industries now face increasingly uncertain and dynamic environments and would benefit from doing so, because dynamism and uncertainty increase the value of acquiring new knowledge. At the same time, however, exploring new areas without a calibrated, balanced approach is costly and risky.

Evolvable strategy goes beyond simplistic exhortations for, say, increased experimentation, flexibility, agility, simple rules, or leveraging of big data. Lacking the integrated, self-adjusting mechanism that evolvable strategy offers, such blanket prescriptions are ineffective and add cost and complexity, as well as risk that is not calibrated to potential benefits and a changing environment.

Evolvable strategy not only tells you to explore; it also ensures that you know when, where, and how much to explore, and it self-tunes this guidance to changing circumstances and knowledge.

Creating the Evolvable Organization

“The whole is greater than the sum of the parts.”

—Aristotle

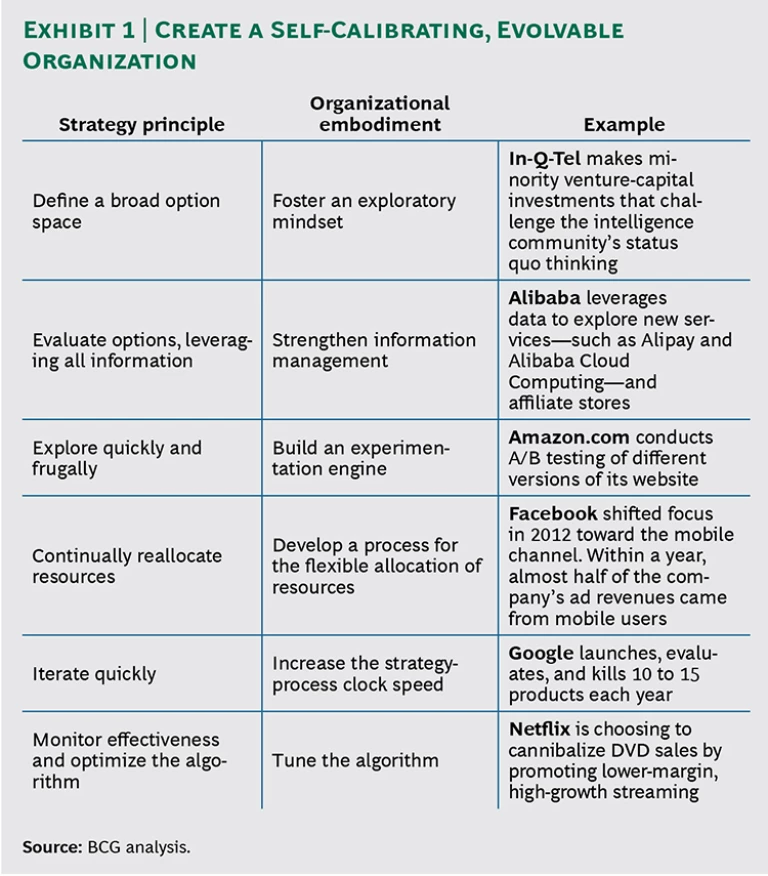

To create a self-calibrating, evolvable organization, companies need to embed the “algorithm” of evolvable strategy into the “software” of their organization. (See Exhibit 1.) To do this, companies need to do all of the following:

- Foster an exploratory mindset. Encourage risk taking, tolerate failure, and challenge the status quo even when the company seems to be successful. Set evolvable goals and methods that allow for changing course as you learn more about environments and investments.

- Strengthen dynamic information management. Leverage a wide range of information sources and develop predictive analytics to measure and manage the exploration process.

- Build an experimentation engine. Use rapid (virtual) testing at a limited scale and minimize the cost of failure. Maximize information extraction from each test and share and leverage the results widely.

- Be flexible in resource acquisition and allocation. Share resources, source externally, and ensure that project leaders will not be penalized for projects that must be aborted. Modularize the organization and continually reallocate resources.

- Increase strategic clock speed. Shorten planning cycles and feedback loops. Simplify approval processes and reduce hierarchy.

- Continually tune your algorithm. Measure the fit between the uncertainty and dynamism of the environment and the parameters of your experimentation engine. Fine-tune your model accordingly.

Combined, these interventions create the integrated, information-enabled learning systems of the type that leading technology companies use to thrive in an increasingly complex world. Conversely, focusing on or omitting individual lines of code will cause a bug that renders the entire system ineffective.

Some high-tech companies excel at evolvable strategy, and now companies from beyond that realm are beginning to follow. Shell, for example, explores options broadly with its external ideation competitions. Wal-Mart continually experiments with store plans and leverages deep analytics to measure outcomes. The 3M Company experiments virtually to speed up innovation. We predict that creating evolvable organizations and strategies will become increasingly important to all enterprises.

Learning to Avoid the Traps

“Success in the past always becomes enshrined in the present by the overvaluation of the policies and attitudes that accompanied that success.”

—Bruce Henderson, founder, The Boston Consulting Group

It is not surprising that evolvable strategy and organization are unfamiliar, challenging to implement, hard to replicate, and, hence, valuable from a competitive standpoint. When embracing evolvability, organizations need to avoid the following common traps that can cause them to veer either toward too little or, alternatively, toward too much exploration.

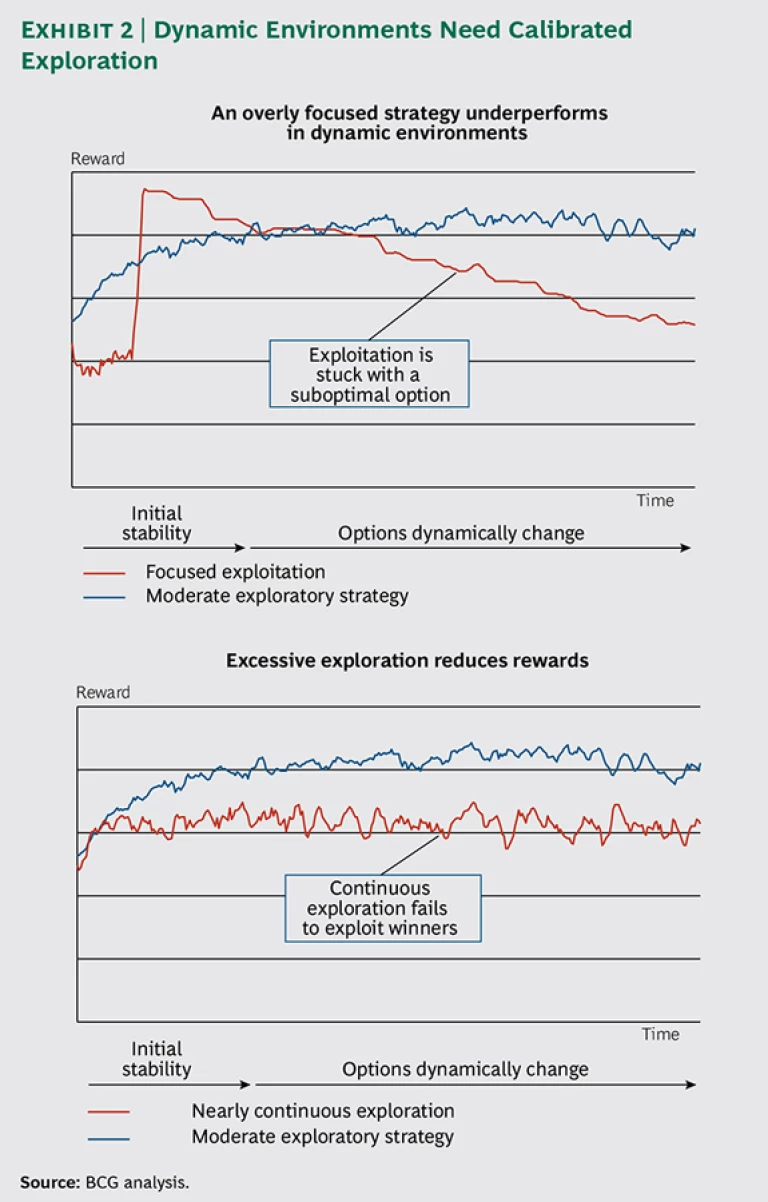

- Focus Trap. A company pursues only focused exploitation of familiar options when a change in circumstances or uncertainty demands broader exploration. We can demonstrate, using algorithms similar to those employed by Netflix, Google, and Amazon, that such focused strategies are suboptimal under high uncertainty or dynamism. (See “Modeling the Exploration-Exploitation Tradeoff.”)

MODELING THE EXPLORATION-EXPLOITATION TRADEOFF

We modeled the impact of balancing exploration and exploitation with different strategies in different environments, using an algorithm similar to that used by, for example, Google and Netflix (a so-called multiarmed bandit algorithm). We considered a scenario with 30 options and ran hundreds of rounds of exploration-versus-exploitation tradeoffs, updating the algorithm for every piece of new information obtained.

The model included a range of business environments that varied with respect to the dynamism and uncertainty of the rewards associated with each scenario. Furthermore, we tested a range of strategies in each environment, which allowed us to explore the effectiveness of a variety of approaches.

Further details of these simulations will be published in a forth-coming in-depth report on the evolvable enterprise.

- Pessimism Trap. Uncertainty leads a company to explore insufficiently and to assume that if the value of something cannot be quantified or is currently unknown, it is not actually there.

- Excessive-Exploration Trap. This is the flip side of excessive focus or pessimism. Even in highly dynamic environments, continual experimentation can lead to diminishing returns, given the (opportunity) cost of exploration and the need to recoup exploration investments with periods of exploitation. (See Exhibit 2.)

- Resource Inertia. A company whose organizational incentives and processes are geared toward reinforcing existing strategies, beliefs, and power structures may be inclined to allocate insufficient resources to exploration.

- Cannonball Trap. Making only big bets (“cannonballs”), a company increases risk and limits the total number of exploratory bets (“bullets”) it can make and the speed at which they generate learnings.

- Fixed-Formula Trap. A company spends a fixed share of resources (for example, a specified percentage of sales) on exploration, leading it to explore insufficiently (or too much) whenever environmental dynamism increases (or decreases).

- Individual-Practices Trap. Although a company mimics the individual practices (for example, experimentation, metrics, and personnel policies) of companies that master evolvable strategy, it fails to create an integrated learning algorithm.