In recent years, as leading wealth and asset management firms have increased their share of industry profits at the expense of most other firms, top performers have focused not on cutting costs but on optimizing their pricing strategy. This entails treating pricing as a capability rather than a one-time positioning exercise, and it involves taking a carefully calibrated approach to such key considerations as customer segmentation, value proposition, pricing structure, and price realization.

To gain maximum advantage from a price optimization effort, wealth management firms must adjust their business models, technology, and competency frameworks. This is not a simple task, but the benefits of smart pricing can be impressive—most notably, a revenue uplift of between 8% and 12%—and they can make the difference between winning and losing in the years ahead.

The Wheat and the Chaff

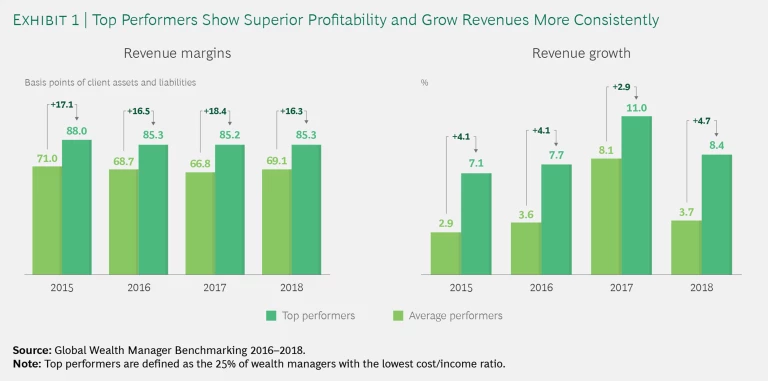

Winning in wealth management, as in most things, can become a habit when properly cultivated. Winners have the knack of consistently outperforming their peers, and over the past four years the top quartile of firms achieved a significant advantage in overall revenue growth and return on assets. (See Exhibit 1.)

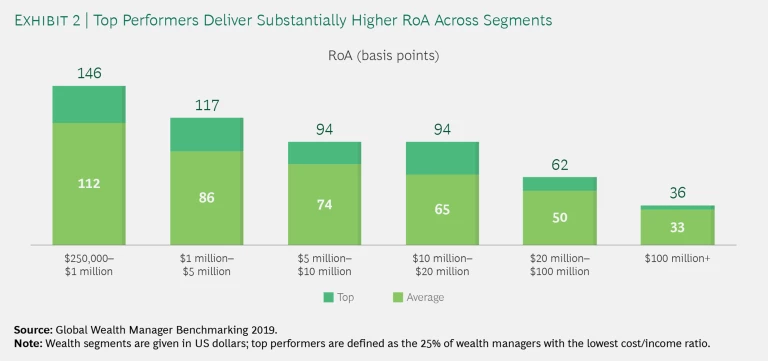

In 2018, the return on assets of the top quartile was 85 basis points, compared with an industry average of 69 basis points, according to BCG Global Wealth Manager Benchmarking of 150 institutions. This tendency was consistent across wealth bands. (See Exhibit 2.) The group posted a pretax profit that was almost twice as much as the average amount (34 bps compared with 18 bps), and it grew revenues 5 percentage points faster. Individual relationship managers (RMs) also outperformed the pack, earning 25% to 30% more than the average RM.

Outperformance and underperformance are especially relevant in an increasingly tough business environment. The value of assets under management (AuM) fell by 4% globally in 2018, to $74.3 trillion from $77.3 trillion. This was the first significant year-on-year decline in global AuM since the crisis year of 2008. Continuing fee compression also led to another drop in industry revenue margin (the ratio of revenues to AuM), which has declined steadily in recent years, from 30.1 basis points in 2013 to 26.2 basis points in 2018.

In many industries the primary driver of performance is operational efficiency, which many companies achieve through cost cutting. In contrast, leading wealth managers, on the whole, haven’t relied on job cuts to boost their bottom line. Costs in 2018 were flat against average AuM but rose in absolute terms, as asset managers invested in areas such as information technology. Perhaps most notably, successful managers offset rising costs by building their revenues. More than 90% of wealth management outperformance is attributable to superior revenue generation, BCG research shows.

More than 90% of wealth management outperformance is attributable to superior revenue generation.

Our analysis reveals two crucial and consistent drivers of revenue growth: smart pricing (the focus of this report), and a superior customer experience (which we will address in detail in an upcoming publication). In a dynamic investment environment, these two strategic tools are critical differentiators that separate the wheat from the chaff.

Four Ingredients of Smart Pricing

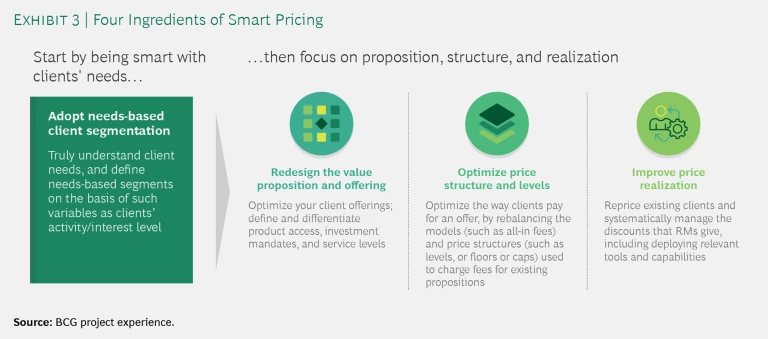

Wealth managers can increase their revenues by 8% to 12% by being smarter on pricing. Getting there does not require significant investment, but it does demand adoption of a more nuanced and tech-driven approach in which pricing drives value and enables relationships.

The first step is to invest in understanding individual clients better. In the modern era of tailored experiences, standardized experiences are no longer adequate. Firms must invest in advanced data and analytics and in comprehensive evaluation to better understand clients’ actual needs and pain points. A consciously differentiated proposition and a simple menu of advisory mandates are important accompaniments to better segmentation. Another a key element is price realization, which involves thinking carefully about how RMs approach their interactions and what training they need. (See Exhibit 3.)

Segment on the Basis of Clients’ Needs

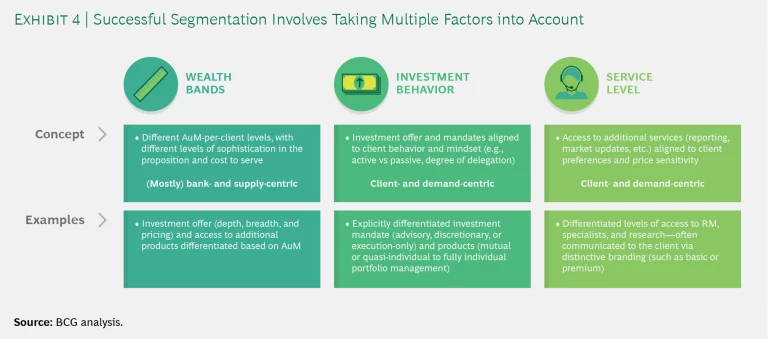

In order to design more personal and appropriate value propositions, firms must strengthen their understanding of clients. Traditionally, banks have adopted wealth-based segmentation, following a simple cost-plus model. This approach is founded on the presumption that wealthier clients generate more revenue and therefore deserve a more expensive service model. In practice, however, this presumption may be mistaken. Wealth is not necessarily an indicator of the complexity of a client’s needs; some wealthy clients may require only a very simple range of products and services. A much more effective approach, therefore, is to align the proposition with the individual client’s real needs.

In our experience, a good approach is to combine qualitative insights (in-depth client interviews and RM input) with output from advanced data and analytics. The aim of this combination is to help RMs understand, distinguish, and profile clients through deep analysis of their motivations and behaviors. Useful questions to ask clients include the following:

- How much do you wish to be actively involved?

- How much do you wish to participate in investment decision making?

- To what extend do you believe that active investment management pays for itself in the form of higher returns?

- How interested are you in sophisticated products—for example, private equity, hedge funds, or other alternatives—and do you believe that these add value?

Under this qualitative approach, the client’s or client group’s AuM is just one of a number of dimensions that the manager takes into account, rather than being the sole parameter for gauging needs. The result is a more nuanced understanding of clients’ willingness to pay. A smaller client may accept a relatively high fee in the expectation that active management and more sophisticated products will generate higher returns. A much larger client, meanwhile, may be content with a relatively basic proposition consisting of a portfolio of exchange-traded funds (ETFs), a robo-advisory service, and an annual review of asset allocation.

By improving their understanding of clients’ investment attitudes, firms can gain valuable insights for designing personalized propositions at different price points that are likely to straddle wealth bands. Smartly deployed, these can enable a much more effective allocation of resources. In parallel, management firms may adjust the time that RMs spend with different clients to ensure that the time they invest matches the firm’s and each client’s needs. (See Exhibit 4.)

Redesign the Value Proposition

Pricing should always be married to a specific proposition. At many banks, however, the proposition itself may be ill defined or inconsistently delivered. The latter can result from one or more RMs’ inability to consistently execute. The situation presents a challenge to clients (and often to RMs) because it forces clients to navigate murky waters in search of suitable investment options. In many instances, clients falter and are left to cope with the feeling that they are being inadequately served.

Another common problem that firms face is the lack of a precise definition of their services. Mandates may not spell out when to expect switch proposals and what instrument universe is covered. As a result, clients tend to be more price sensitive and less inclined to opt for active-management options. In addition, they might choose execution-only mandates but still contact RMs for advice and opinion.

A smart approach to designing the proposition is to aim for simplicity and transparency. It makes sense to start with a few standard mandates (such as DPM, advisory, and execution only) and then to differentiate within these. At this more granular level, firms may formulate advisory mandates on the basis of varying levels of access to products and services (which may include the scope of advised investment instruments, the frequency of interaction with the RM, and direct access to IMs or brokerage desks). Alternatively, they may offer a basic advisory proposition tied to a short menu of bundled service extensions—comprising access to specific equity reports or trading in certain asset classes, for example.

Clarity of proposition, with prices calibrated to the value delivered to clients, is the foundation for building a smart pricing strategy.

Identify an Appropriate Pricing Structure

This step entails deciding how much clients should pay for the proposition or its variants. In many cases, industry pricing structures have evolved over time into models that rely less on management and custody fees and more on transaction fees. This situation, in turn, has led RMs to focus more on transactionally active clients. But in becoming more oriented toward execution, firms may miss more-valuable opportunities in advisory management, active management, and wealth planning. Such offerings are particularly attractive to clients when grounded in an understanding of their particular needs, interests, ambitions, and goals.

The banking industry is moving toward value-based fee models in which banks charge clients either an all-in advisory/DPM fee or a performance-based fee.

There is widespread movement in the banking industry toward value-based fee models, in which banks charge either an all-in advisory/discretionary portfolio management (DPM) fee—sometimes a single fee that reflects the client’s choice between advisory and DPM—or a performance-based fee. (See Exhibit 5.) Clients generally appreciate these structures.

Admittedly, the models are not free of traps—such as the risk that transaction-intensive clients may overuse the flat-fee advisory model. But they also bring multiple benefits:

- They increase the share of AuM under active advisory or DPM, while reducing the share of “lazy assets.”

- All-in advisory/DPM fees stabilize income because they rely less on trading volume, which fluctuates over market cycles and tends to be weak in declining markets.

- The models promote cost-effectiveness by driving a shift from advisory to DPM mandates.

As firms revisit their pricing structures, they should be wary of some common pitfalls:

- Failing to Impose Minimum Absolute Fee Levels. This oversight can result in underpaid small portfolios with costly service-intensive mandates for clients who may not even be eligible for them.

- Applying Group- or Family-Based Discounts Too Broadly. Firms may wish to revisit their standard AuM-based definitions in this regard, with an eye toward more narrowly defining family group. Firms may also consider applying group discounts more selectively.

- Setting Price Levels as Function of Client Total AuM Rather Than of AuM Under a Specific Mandate. In the area of AuM-based pricing components, there is a big cost difference between a large lump sum associated with a single portfolio and smaller sums divided among different portfolios, which may contain various restrictions and overlays.

Focus on Price Realization

RMs’ wish to please clients leads many of them to offer the lowest price possible. But widespread discounting contributes to making pricing leakage a persistent challenge and an obvious area for remediation. In fact, RM decisions are responsible for much of the gap between top- and bottom-performing asset managers. Top-quartile RMs typically realize prices that are from 20% to 40% better than bottom-quartile RMs do, while achieving comparable or higher net new asset growth.

One way to address pricing leakage is through dedicated systems and governance frameworks that support a value-based approach—applying discounts where appropriate and removing them when they are no longer necessary. Price realization metrics are simple but powerful tools designed to measure the actual price achieved against the client-specific target price. Such metrics are particularly effective when embedded in individual performance goals. In any event, firms should apply embedded metrics not as a stick but as a carrot—one that becomes even more appetizing when offered in association with the right supporting systems and policies.

Finally, experience suggests that the most effective frontline employees combine hard technical skills with softer interpersonal and negotiation aptitude. With that in mind, RMs should resist seeing pricing as a linear up-or-down-focused discussion. Instead, they should broaden the discussion—for example, by aligning price with changes in client AuM over time or with different services levels. RMs can acquire these more subtle skills through training, coaching, and incentives; and leading firms are at the forefront of launching such initiatives.

Approaching Pricing as a Capability, Not a One-Off Exercise

Smart pricing is not a tactical decision but a strategic course of direction. Once set, it should become an entrenched cultural characteristic of the firm. Because there is no such thing as a perfect pricing model, wealth managers should aim to develop an approach that is flexible enough to adjust to a dynamic commercial environment. In our view, five pillars of pricing capability lead to outstanding execution:

- Develop a clear, well-defined strategy. Firms should align pricing to a strategic priority in each segment, product, or market and make explicit choices on the basis of each priority. For instance, they may decide to price out certain clients from unprofitable service models, accepting possible negative impact on net new assets in the short-term but creating space (and RM capacity) for more-profitable growth in the medium to long term.

- Give precedence to quality over quantity. It is better to start small—focusing on a limited number of markets, products, segments, and levers—and gradually expand over time. For instance, firms may commence with a deep repricing effort that focuses on a single major market. The aim at the outset should be to maximize impact and establish best practice. Firms can use lessons from that first step to build out capabilities and create common approaches and tools that they can roll out across markets and perhaps accelerate over time.

- Obtain buy-in. Pricing should not be solely the responsibility of senior management teams. Firms should work to obtain buy-in from frontline managers and other management layers. They may rely on a small group of RMs or regional heads as a sounding board, or they may assemble a task force of RMs to design solutions—actively involving them in the design and enlisting them as advocates of the change process. Firms should also aim for cross-team alignment on objectives and KPIs, as well as on a shared understanding across the firm of the critical role that pricing plays in business performance.

- Promote pricing as a core competence. A key enabler of success is a strong pricing platform, consisting of pricing processes and governance, market intelligence, data and tools, and—most important—the right pricing competence. Instead of relying entirely on external consultants, firms may wish to leverage them wisely to support their teams and develop their capabilities. (See Exhibit 6). In these cases, the internal team remains responsible for driving pricing strategy and initiatives. At larger organizations, the team may also work to share best practices across geographies and advise on potential responses to changing market or regulatory conditions.

- Leverage data and analytics. Data and analytics are essential tools in building a smart-price capability, from segmentation to monitoring, and in understanding how dynamic prices affect client decisions. The information that these tools generate can help guide negotiations with clients and support decision making on an individualized basis. One useful tool is a target price algorithm oriented to individual clients and underlying mandates, which can help RMs develop their skills and shape their pricing discussions.

Pricing must also be clear, comprehensible, and reasonable. A price that is too high for the given proposition will push clients to choose a cheaper option or migrate to a competitor. Of course, in the case of subscale or low-prospect clients, this outcome may be desirable. But overall, the primary aim must be to match propositions to clients’ needs in order to produce a higher RoA.

A firm should predicate changes in its approach to pricing on a deep understanding of the firm’s strategic imperatives, following robust prototyping and testing of alternative propositions (which involves leveraging client research, applying qualitative insights, and using advanced analytics) and modeling of financial impact.

What Wealth Managers Should Do Next

Top-performing wealth mangers are realizing a higher return on assets, stronger profit growth, and a faster expansion because they are ahead of the curve on pricing. Many managers, however, have yet to properly engage on this critical subject. In a fast-changing and increasingly competitive environment, managers must plan and act to strengthen their market position.

A number of questions can inform the strategic process:

- What is our ambition and what are our objectives for smart pricing?

- Which levers are applicable to which markets, segments, and products?

- What is the starting point (for example, size of commercial leakage from contract or ad hoc discounts), and what is the full revenue potential of the strategy?

- Do we have the right team and governance in place to make it happen?

- Should we recruit someone or develop our own people?

- Do senior managers have a clear understanding of and commitment to the process?

Answering these questions is an essential precondition to starting strong and staying on the right path. If, in due course, firms can make the most of the levers around segmentation, value proposition, pricing structure, and price realization, they are likely to see a more satisfied client base and a significant boost to the bottom line.