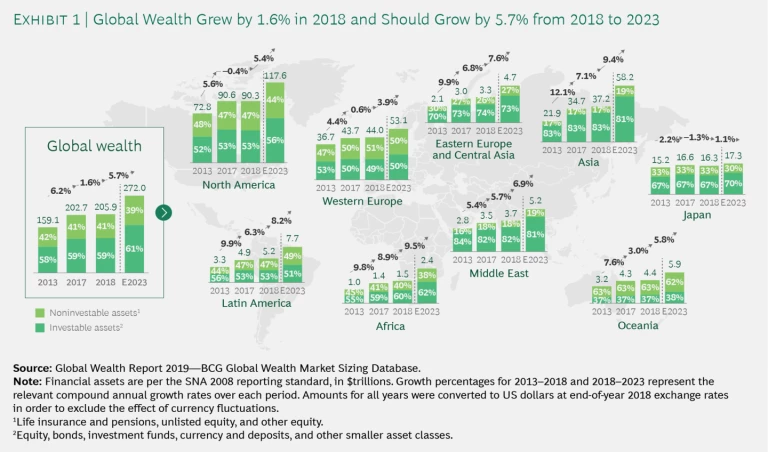

The steady rise in global wealth growth came to a sharp halt in 2018. Gains in global personal financial wealth tumbled by more than 5 percentage points year on year, the weakest performance in the past half-decade. The fourth-quarter dip in major stock indexes pulled down equities and the large regional portfolios tied to them. High valuation levels, geopolitical risks, and the challenges of returning to normal interest rate levels also contributed to the decline.

The big question now, of course, is whether the pullback in wealth growth is a precursor to deeper changes. Analysis of major segments, markets, and wealth manager performance suggests that a number of shifts are underway. One is the broadening wealth clientele. Although most of the world’s millionaires currently live in North America, the fastest growth in personal financial wealth is occurring elsewhere. By 2023, revenue pools of the private banking channel in Asia could equal or exceed those of Western Europe.

Wealth bands are evolving, too. High-net-worth (HNW) individuals hold the greatest concentrations of wealth, but the middle band of affluent households will grow significantly over the next five years. This often-overlooked segment—with its $18 trillion in investable assets—is a golden opportunity for wealth managers willing to tailor their service and coverage models to clients’ needs.

The wealth management space is becoming more crowded and more competitive, as fintechs and nontraditional players enter the market. The battle for market share will intensify as new competitors jostle with established players to meet the rising expectations of a broadening client pool.

Accustomed to the ease and convenience of digital apps, features, and channels for banking and other activities, wealth clients increasingly expect their wealth management providers to offer a similar experience. Yet many firms lag behind other sectors in employing digital tools and capabilities and in acquiring the speed, agility, and mindset to develop them. That deficit has a negative impact on the client experience, leaving value on the table and increasing the cost to serve at a time when wealth managers can ill afford it.

Finally, the slowing global economy—assessed in combination with projected rates of inflation, foreign currency movements, and market performance—suggests that wealth worldwide is likely to grow at a compound annual rate of 5.7% from 2018 to 2023, a slightly lower rate than in recent years.

To navigate this changing environment and create a strong bottom line, wealth managers must reignite growth. The most successful firms will take their business models to the next level by focusing on high-growth opportunities, amplifying advisor impact, and employing data and analytics to deliver value at scale. Surface-level changes will not suffice. To meet the heightened expectations of their sophisticated clientele and defend their market share against able and determined competitors, wealth managers will need to invest in product innovation, advanced analytics, and a robust set of digital tools and platforms to extend their reach, personalize their service, and differentiate their offering.

These are among the findings of Boston Consulting Group’s nineteenth annual analysis of the global wealth-management industry. This report includes one topic that we examine each year—global market sizing—and three special chapters. One of this year’s special chapters focuses on enlarging the customer base by addressing the needs of the rapidly expanding affluent segment, another looks at increasing scale and revenues by transforming client engagement models, and a third examines wealth managers’ urgent need to improve their cyberdefenses to protect client data and preserve client trust—arguably their most valuable assets.

The market-sizing review encompasses 97 markets that collectively account for 98% of the world’s gross domestic product. It outlines the evolution of personal wealth from global and regional perspectives, including viewpoints on different client segments and cross-border centers, and examines the opportunity that revenue pools create for wealth managers in established and growing markets. This year’s report also draws on data from more than 150 wealth managers, whose input yielded insights about the performance pressures that many firms are facing and about strategic areas for improvement.

As always with our annual global wealth reports, our goal is to present a clear and complete portrait of the business and to offer thought-provoking perspectives on issues that affect all types of players in their pursuit of growth and profitability.