Supply chain leaders among consumer packaged goods (CPG) companies in the US are feeling tremendous pressure in 2019 as the industry continues to undergo seismic changes. Increased demand volatility and shorter lead times from retailers have become major concerns, hurting service and inventory levels.

Although these challenges arise externally from retailers, greater focus on top-line growth has increased the pressure on supply chains from within the business as well. In addition to these factors, constraints on trucking capacity are diminishing the ability to deliver customers’ orders on time and at a reasonable cost.

In response, many CPG companies are eyeing digital transformation as a way to address these challenges and support future growth. Although CPG companies have not historically operated at the forefront of digital change, the intense and competing demands they face today require exactly the type of game-changing approaches that digital can deliver.

This 2019 study, one of a series released over the past 10 years, is based on in-depth benchmarking of leading CPG companies and retailers by the Grocery Manufacturers Association (GMA) and Boston Consulting Group (BCG). (See “About the Study.”)

ABOUT THE STUDY

ABOUT THE STUDY

The Grocery Manufacturers Association (GMA) has partnered with Boston Consulting Group (BCG) to conduct the 2019 Supply Chain Benchmarking Study, the seventh in a series of studies focusing on US CPG manufacturers’ outbound supply chains.

The study is based on the 2019 GMA Supply Chain survey of 20 CPG companies, including in-depth interviews with top supply-chain executives and industry experts, and BCG research on supply chain trends and practices. The study was conducted in 2019 and is based on 2018 data.

This effort covers US CPG manufacturers, excluding food services, with assessments of their warehouse-based supply chains and the impact of digital technologies on those supply chains. We asked our survey participants a number of quantitative and qualitative questions, and we ranked their performance on specific metrics. In past surveys, we focused our questions on transportation, warehousing, service, and planning. This year, we also focused on digital supply-chain operations and manufacturing.

We then analyzed and interpreted the survey findings and connected the dots to understand industry performance, including the correlation between supply chain metrics. To ensure data validity and quality, we cleaned the data extensively, followed up with individuals, and compared outliers with peers as well as with historical data.

Our most recent previous study, published in January 2018, revealed that a powerful transition was already taking place in the industry—a transition linked to a growing pool of online retailers, convenience stores, and food service businesses, with diverse formats and high service expectations. CPG companies at the time were focusing on improving bottom-line performance, but supply chain leaders were also expressing rising concern about their ability to maintain strong performance in an era of increasing channel proliferation.

Fast-forward to today, and the challenges remain. CPG supply-chain leaders that hope to overcome these challenges through digital transformation must go beyond simple plug-and-play solutions, investing in technologies that address multifaceted issues along the entire supply chain. Such complex solutions require complex change, including a strong commitment to transformation throughout the organization, a vision for the digital supply chain, extensive cross-functional coordination, targets tied to business priorities, and a robust transformation agenda.

What’s Worrying Supply Chain Leaders Now

Leading North American CPG companies have spent the past few years focusing on the bottom line, and they have done so with good success, increasing operating margins from 16.8% in 2014 to 20.7% in 2017. This year, however, growth enablers have become much more prominent on the priority list, putting greater pressure on the supply chain to perform and highlighting issues related to service levels, inventory, and trucking capacity.

Leading North American CPG companies have increased operating margins from 16.8% in 2014 to 20.7% in 2017.

Service and Inventory Levels

Recently, CPG leaders have been most worried about their ability to keep service levels high and reduce their days of inventory on hand (DIOH). And our 2019 survey validates these concerns, as service levels have indeed taken a downward turn, while inventory has increased. On the service side, for example, median on-time delivery—as measured by the requested arrival date—fell to 87.1%, a drop of 2.7 percentage points, from 2016 to 2018. On the inventory side, the average DIOH for finished goods increased from 35 to 37 for ambient goods and from 13 to 17 for refrigerated goods over the same period.

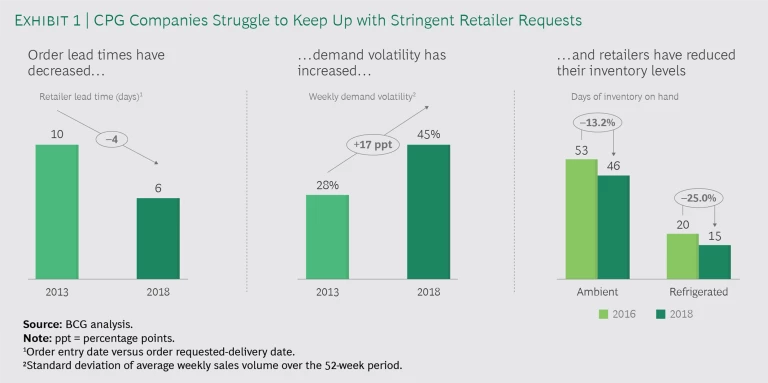

The primary cause of the decline in service levels is the behavior of retail grocery chains, which have steadily raised the bar, in particular by cutting their order lead times—from an average of ten days in 2013 to an average of six days in 2018. (See Exhibit 1.) In addition, retail grocery chains are ordering more often and in smaller quantities, boosting order volatility. In fact, weekly sales-order volatility increased from about 28% in 2013 to about 45% in 2018. As a result, CPG companies are finding it much harder to forecast demand, manufacture the right products, and stock the right inventory at the right location.

Retailers are working hard to protect their own fragile margins. They face rising competition from a growing number of alternative retail-grocery formats, as well as increasing product proliferation and growing consumer demand for fresher products. Inventory dynamics throughout the supply chain reflect these trends. Although overall inventory levels are fairly flat from plant to shelf, retailers have caused a shift in the inventory holding pattern, reducing their own inventory levels but putting pressure on their CPG suppliers to hold more. This allows them to restock their shelves quickly and keep orders flowing.

To combat these pressures, CPG players are improving their forecasting algorithms and capabilities. And they are seeing results: from 2016 to 2018, the national CPG two-month mean absolute percentage error improved by 5 percentage points from about 32% to about 27%. One CPG company is partnering with a leading provider of demand-planning solutions to improve its forecasting technology and boost customer service. Another has announced a new demand-forecasting tool that will enhance its predictions by integrating with its ERP system to include more data sets.

Yet accurate demand forecasting and effective demand planning remain a challenge. Many of the CPG companies that we interviewed believe that they’ve reached the limits of what they can achieve alone and that further improvements will require downstream collaboration with retailers. Others are exploring the potential to improve demand forecasting, deploy the right inventory, and optimize costs by investing in transformational digital initiatives.

From 2016 to 2018, the national CPG two-month mean absolute percentage error improved by 5 percentage, points from about 32% to about 27%.

Trucking Capacity Constraints

Customer service levels are not CPG companies’ only concern. Transportation continues to be a sore spot, too. Demand for trucking capacity has increased steadily over the past two years—including a growing appetite for less-than-truckload (LTL) trips as growth in e-commerce and demands from retail grocers push CPG companies to ship goods in smaller loads. Yet growth in trucking capacity has not kept pace, and driver shortages are exacerbating the problem. Despite an average wage increase of approximately 10% over the past two years, the driver attrition rate for large carriers has risen by about 20 percentage points. Meanwhile, some carriers have been holding some of their existing capacity in reserve in order to participate in today’s robust spot market.

These constraints have resulted in higher logistics costs for CPG players. While many CPG companies cite recent spot-market price relief, the market’s pricing floor has risen over the past two years, and overall costs have followed suit, with replenishment freight costs up by about 15.4% and customer freight costs up by about 7%. CPG companies have offset some of these increases by making their warehousing more efficient, cutting warehousing costs by an average of 4.4%. Nonetheless, logistics costs have increased by 5.5% overall among the companies we surveyed.

Companies are using three key mechanisms to address this issue. First, they are reducing delivery distances through routing optimization, greater use of backhauling, and network redesign. Second, they are increasing their asset utilization, in terms of both volume and weight, by working to moderate demand, improve their use of drivers, and optimize truckloads. And finally, they are exploring alternative delivery modes, such as rail, and new digital platforms, such as Uber Freight.

Just as with efforts to resolve the industry’s customer-service issues, however, companies need help from new digital technologies in order to implement these potential solutions, whether in the form of data gathering and decision-making algorithms or of advancing the entire supply chain into the digital age.

Prioritizing Transformation

As digital technologies steadily become cheaper and more effective—and as pressure rises on all sides of the business—the case for digital transformation of the CPG supply chain becomes increasingly compelling. According to a BCG–Google study completed in 2018, supply-chain use cases are among the highest-impact AI and analytics applications for CPG companies. Improved demand forecasting in the supply chain, for example, offers potential sales growth of at least 2.5%, while the ability to individualize store assortments—analyzing sales data at the SKU level and redesigning the supply chain to prioritize those SKUs—permits sales growth of at least 1% to 2%.

Supply-chain use cases are among the highest-impact AI and analytics applications for CPG companies.

We therefore asked our respondents this year about the active steps they are taking with respect to their digital supply-chain goals. We found that 21% have a vision for the digital supply chain and another 58% are working toward such a vision. Approximately 26% of the CPG companies we surveyed said that “digital in the supply chain” is a top priority for the business, and about half reported piloting 15 or more digital use cases. They have launched these pilots across the spectrum of manufacturing and logistics, to achieve objectives ranging from production planning and dynamic routing to automated quality inspection and predictive retailer inventory management.

Unfortunately, many of the pilots have been less successful than the companies had hoped: almost half have had little or no impact, and 34% have had only incremental impact.

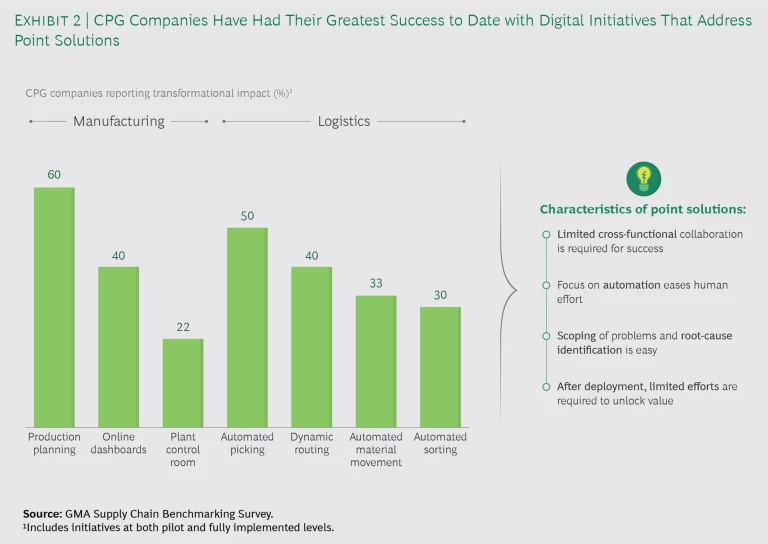

So far, supply chain leaders have had the greatest success with simple plug-and-play solutions for specific supply-chain issues. (See Exhibit 2.) On the shop floor, these solutions include digital production planning and online dashboards. In warehousing and logistics, they include automated picking and dynamic routing. Such point solutions tend to be relatively straightforward to implement, require relatively little cross-functional coordination, and are generally limited in scope to one area of the supply chain.

In contrast, respondents report achieving far less success from investments in integrated solutions involving technologies intended to solve multifaceted supply-chain problems—investments that require extensive cross-functional coordination and substantial change to core business and supply chain processes. (See Exhibit 3.) These include, for example, digitally enabled sales and operations planning, demand sensing, and digital supply-chain segmentation.

Yet solutions of the latter type could have the largest impact on supply chain results. Why have they failed? Our survey participants told us that achieving the full benefit of digital in the supply chain requires more than the latest technology: it requires successful change management, the elimination of functional silos, and strong technical capabilities. In our experience, only about 10% of the full value of digital comes from the algorithms, and about 20% comes from IT.

In our experience, only about 10% of the full value of digital comes from the algorithms, and about 20% comes from IT.

The remaining 70% comes from business transformation. And when companies don’t clearly link the vision for this transformation to their strategic needs and business goals, the effort tends to stall. Such complex changes also require an unwavering commitment to the transformation, a fundamental shift in ways of working, extensive collaboration efforts, and a robust change-management agenda that ensures buy-in from the entire organization.

The positive results can be substantial. For example, one global consumer goods company offered its retailers over 3,000 SKUs, but the retailers, on average, carried only 80 SKUs in their stores. In many instances, not surprisingly, customers couldn’t find the items they wanted, leading to sales losses, increased logistic costs, and unhappy retail partners.

The company resolved the issue by creating a big-data engine—a software tool that inputs billions of proprietary and publicly available data points into an in-house demand-sensing algorithm developed to optimize business decisions. The algorithm uses advanced analytics to determine demand for each of the thousands of stores that stock its products and helps the company understand which and how many of the SKUs to stock. One major reason for the tool’s success is that it relies not just on historical sales data, but also on micro-market information from car registrations, traffic patterns, and customer behavior. As a result, about 80% of the retailers’ customers now get the SKUs they seek, which has caused customer satisfaction to rise noticeably. In addition, the company has realized around $120 million in new EBIT per annum through sales growth, lower logistics costs, and a reduction in outdated and unsold inventory.

The demands on CPG companies have come from all sides, and there is no reason to believe that the pressure will ease. Meanwhile, for those hoping to fundamentally improve their performance, digitally enabled solutions are becoming increasingly important. CPG companies should respond by elevating and accelerating the digital transformation of the supply chain as a C-suite priority, setting clear goals tied directly to key business issues.

The Grocery Manufacturers Association represents the world’s leading consumer packaged goods companies. The CPG industry plays a unique role as the single largest U.S. manufacturing employment sector, delivering products vital to the wellbeing of people’s lives every day. GMA’s mission is to empower the industry to grow and thrive. For more information, visit gmaonline.org.