Empty store aisles and widespread stockouts belie the success that many CPG companies are experiencing during the pandemic. Building new capabilities and developing supply chain resilience are key.

Few industries have gone unscathed by the vicissitudes of 2020. The year was certainly a whirlwind for consumer packaged goods (CPG) companies, which were forced to adapt rapidly to meet the challenges posed by lockdowns, soaring consumer demand, and socioeconomic uncertainty.

But while empty store aisles and widespread stockouts may have left a lasting impression on many shoppers, these elements belie the success that many CPG companies have experienced during the pandemic. Revenues in the US grew by 10.4% in 2020, with dramatic growth spikes in several consumer categories. Even sales volume grew by 6.4% across the industry, as food-away-from-home sales shifted to retail, and e-commerce channels and businesses scrambled to respond to panic buying around the globe.

To better understand the vital measures that organizations took to survive the first year of the pandemic, and to derive lessons for how they can withstand shocks in the future, we took a closer look at the industry’s 2020 performance and surveyed leaders from more than ten major CPG companies. Here’s what we found.

A New Chapter

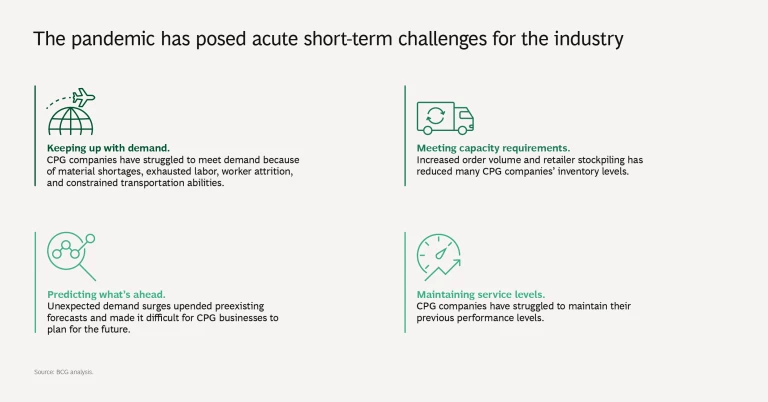

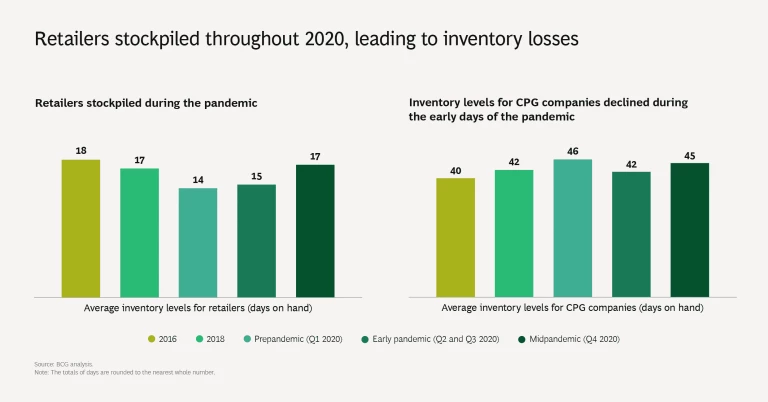

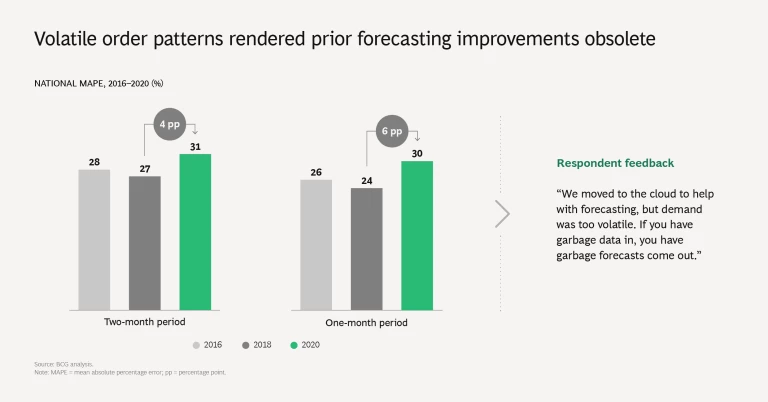

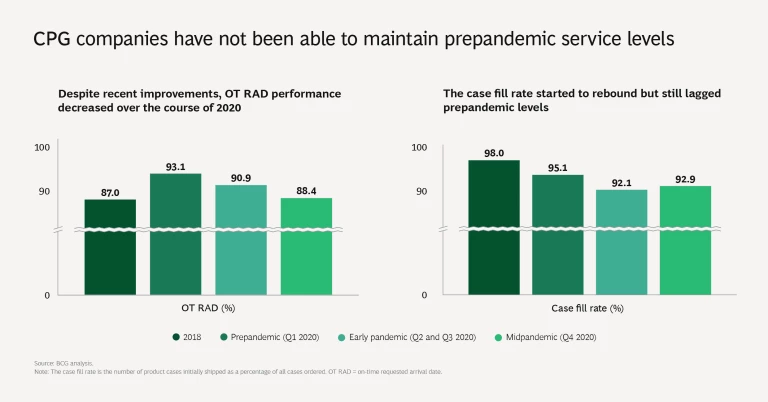

The most prominent result became immediately clear: the emergence of COVID-19 opened up a new chapter in grocery retail. But that shift did not come easily: the sudden and sustained spikes in retailer and consumer demand revealed numerous vulnerabilities in CPG supply chains. Raw-material shortages, exhausted labor, and constrained transportation capacity hindered the ability to get products onto shelves, while retailer stockpiling caused CPG companies’ stocks of backup inventory to decline. The industry’s forecasting abilities—which had seen improvements prior to the pandemic—were rendered nearly obsolete in the face of these challenges.

Nevertheless, CPG companies continued to serve retailer and consumer needs, and many jump-started the acceleration of several critical capabilities that could help usher in heightened performance during the next several years.

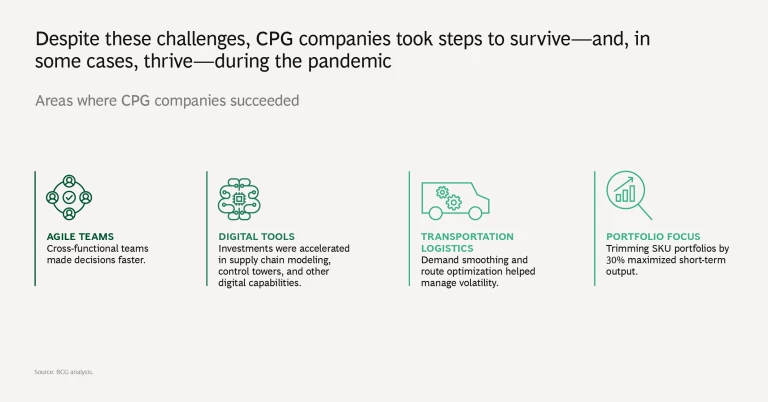

Agile Teams. To improve the decision-making process, companies set up cross-functional crisis teams that met daily and brought together representatives from the sales and supply chain organizations.

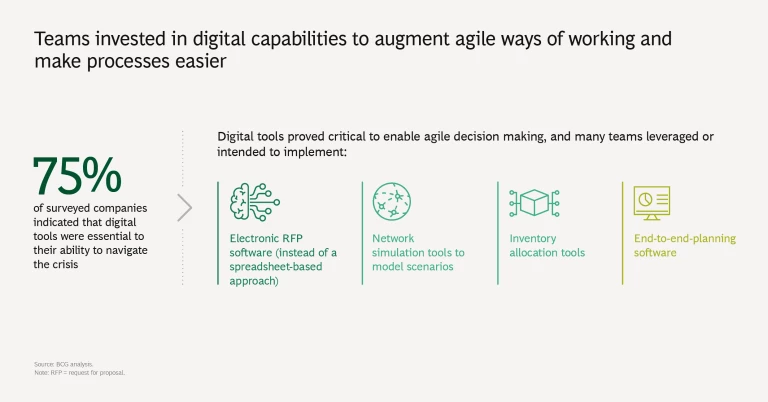

Digital Tools. CPG companies stepped-up investments in supply chain modeling, control towers, and other related capabilities. Most of the leaders we interviewed said that their digital capabilities, in particular, proved to be essential for navigating the pandemic, and they expect to increase their investments in this area.

Transportation Logistics. Companies used a wide variety of strategies to manage volatility. Demand smoothing, route optimization, and asset load utilization are among the most popular tactics.

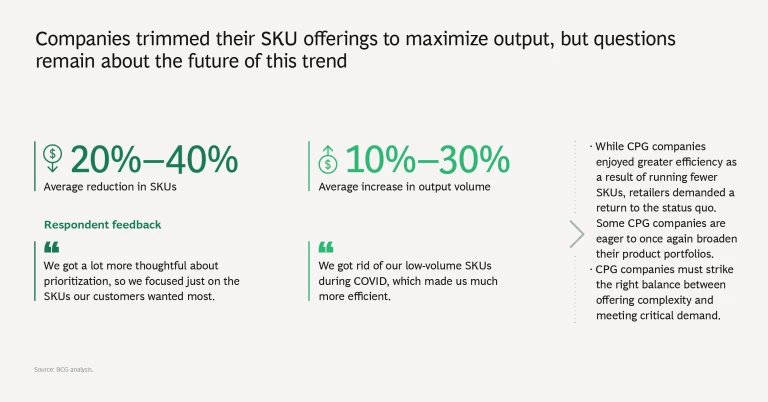

Portfolio Focus. CPG companies trimmed their SKU portfolios by 20% to 40% to maximize short-term volume output (which rose by 10% to 30%), focusing only on the items that matter most to consumers.

Trend Lines for CPG Leaders

Sharpening these capabilities gave CPG companies the edge they needed to weather the worst impacts of the crisis, but opportunities remain for industry players to gain competitive advantage in the years ahead. Supply chain resilience is rising to the top of CPG leaders’ agendas. Businesses that commit to the following priorities will emerge stronger from the current crisis—and be ready for further disruption down the line:

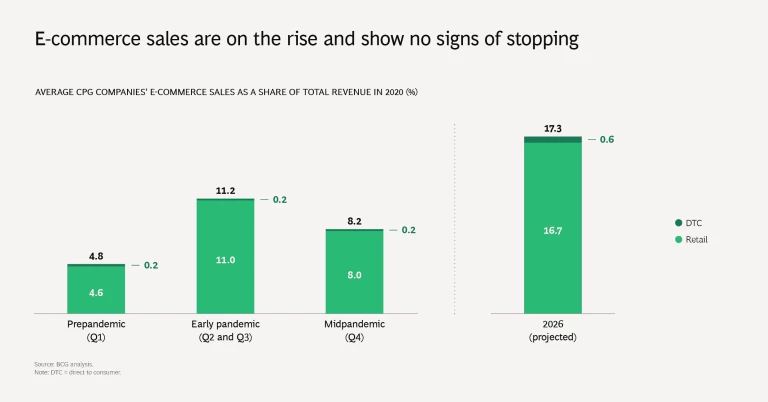

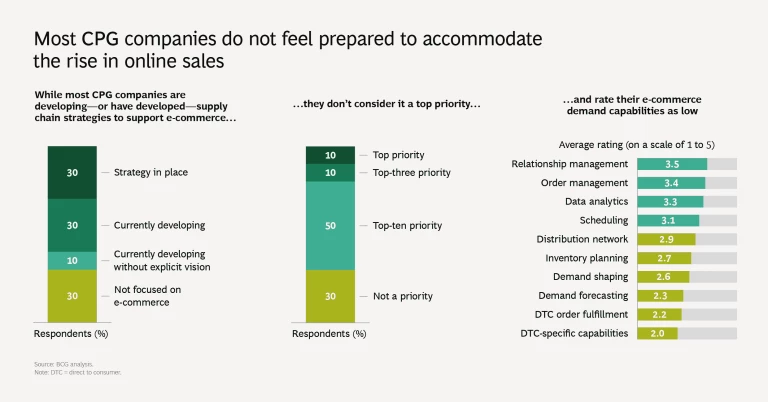

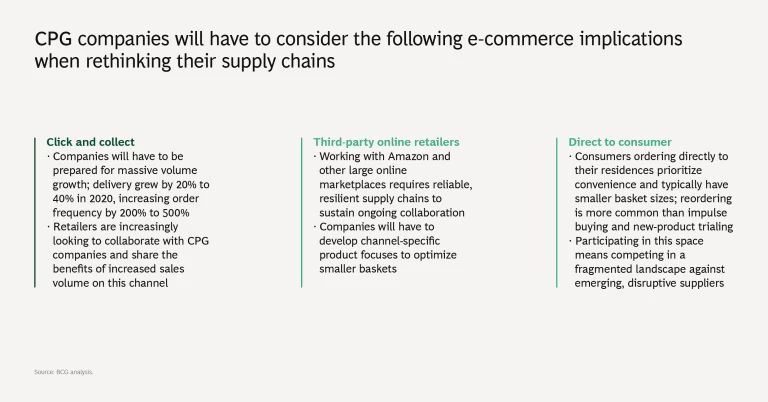

- E-Commerce. Consumers are increasingly shopping online, and many CPG companies feel unprepared to properly address their needs in this channel. These companies will have to rethink their supply chain strategies to accommodate the growing wave of e-commerce sales.

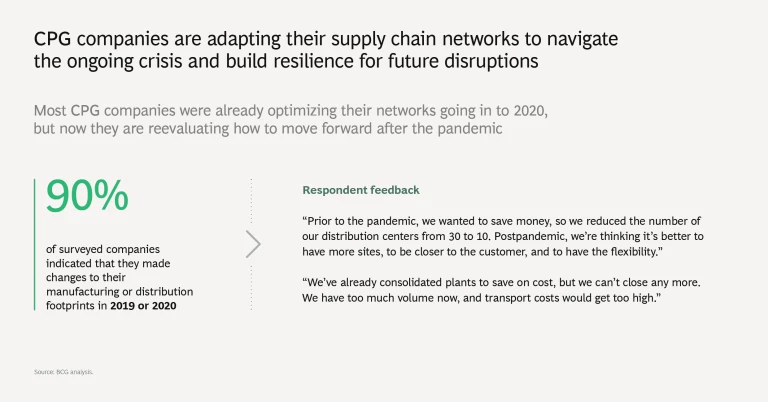

- Network Strategy. Industry players must continue to reevaluate ongoing network optimization efforts with a renewed focus on cost efficiency, resilience, and reducing carbon footprints. It’s critical for these networks to be built with a forward-looking view of rising customer requirements.

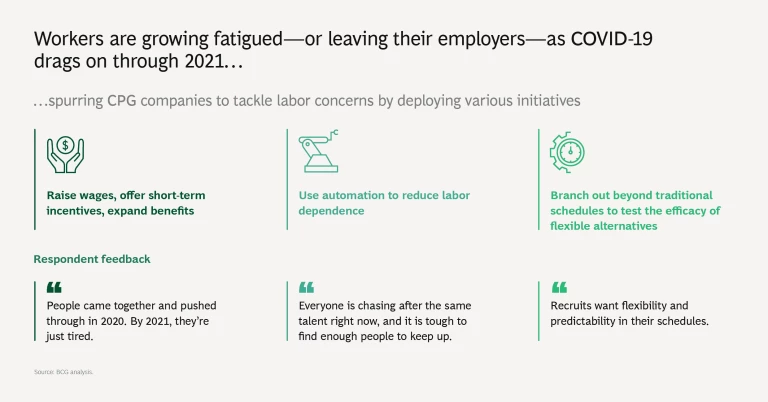

- Labor. Employees everywhere are burned out. To avoid attrition and the production losses associated with fatigued workforces, companies must improve employee pay and expand benefit packages, rethink shift structures, support wellness initiatives, and deploy automation where appropriate.

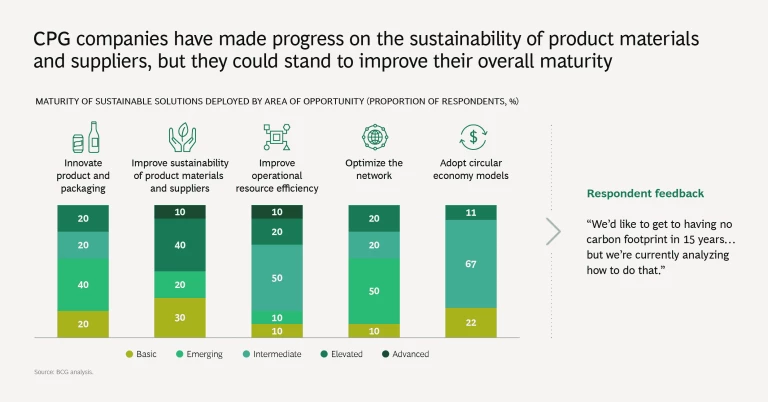

- Sustainability. The sustainability of CPG companies’ product materials and suppliers is improving, but there’s still a long way to go. Only a few companies currently contribute to the circular economy, and operations for many could certainly be greener, especially when it comes to lowering scope 3 emissions.

CPG companies are at a crossroads. Though these organizations have already learned many valuable lessons for how to weather an unprecedented crisis, the pandemic is far from over. Those that are willing to do the necessary work of building more resilient supply chains, and rethinking their organizations accordingly, will thrive in the years ahead.