These strategic steps can help companies in developed and developing countries alike realize their decarbonization commitments.

More and more companies around the globe are making bold commitments to address the climate change that imperils the planet. Yet many of them struggle to realize these commitments because of the formidable implementation challenges involved in making decarbonization viable. To achieve their goals, companies must address an array of financial, organizational, and regulatory requirements.

From our work with climate leaders in developed and emerging markets, we have identified five practices that are especially helpful—from reexamining overlooked strategic levers to facilitating a just

The Roadblocks to Successful Transition

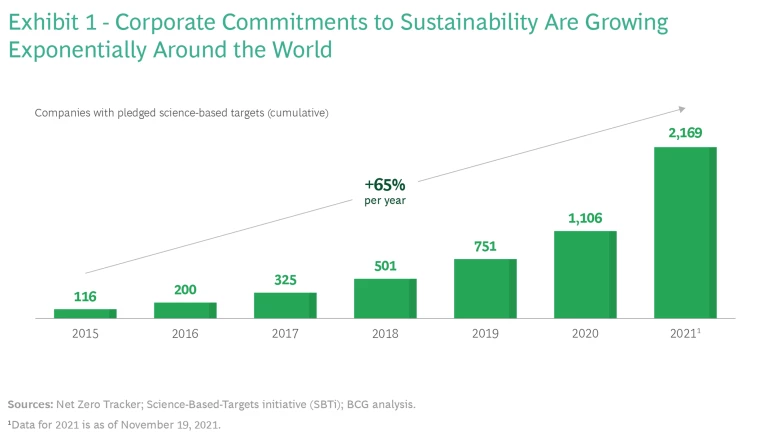

The number of companies worldwide that have made sustainability commitments has grown significantly over the past 18 months. (See Exhibit 1.) As of June 2022, one-third (702) of the world’s largest publicly traded corporations have set net-zero emission targets, up from one-fifth (417) in December 2020, according to the 2022 Net Zero Stocktake report.

Our analysis suggests, however, that many companies will miss their targets because of the massive obstacles standing in their way. Decarbonization technologies require significant amounts of capital, forcing some companies to make difficult investment tradeoffs. The time horizons are long, with many targets set for 2050. And companies must navigate compliance requirements at a time when the regulatory environment is in flux. Organizational challenges are daunting as well—from acquiring the needed climate expertise, to obtaining full organizational support for the company’s decarbonization priorities, to ensuring that all stakeholders take part in the journey.

Setting the Scene for Net Zero

To overcome these obstacles, augment sustainability readiness, and accelerate the transition to net zero, five practices are critical.

Reexamine Overlooked Strategic Levers

Today, making climate action a central focus of strategy and purpose is so commonplace that it won’t distinguish one company from the next. To find sources of what BCG calls a sustainability advantage, companies should seek differentiation in strategic levers that other companies may have overlooked.

As a first step, companies should assess their products and services against peer offerings to ensure that the portfolio is adequately green. They should decarbonize products where possible and consider withdrawing offerings that are not eco-conscious in favor of ones that are. These short-term actions will help fund the long-term agenda.

Organizations should also take advantage of the fact that investors increasingly favor companies that focus on green growth. As a 2022 study by World Economic Forum and BCG detailed, such companies receive higher valuations and obtain access to cheaper capital. With these points in mind, companies may consider restructuring their businesses to make them more attractive to investors, and those with renewables units may choose to spin them off to achieve higher valuations and secure more funds for broader decarbonization of their businesses.

Redesign the Organization to Deliver Impact

Even if its portfolio is green, a company may struggle to realize its net-zero aspirations unless appropriate leadership, organizational structures, and roles are in place.

Since climate action comes from the top, company leaders must fully align on their net-zero ambitions. They must also ensure that employees understand the organization’s climate goals and their own roles in the transition.

A dedicated unit should monitor the execution of the climate strategy. To prevent duplication of effort, the unit should clearly distinguish the roles of the corporate entities, which provide strategic guidance, from those of the business units, which are responsible for development and implementation. BP, for example, has set up its Strategy, Sustainability & Ventures business entity to define the company’s strategic direction and to guide other business units in developing and implementing climate mitigation initiatives.

It's also critical to have the right talent and skill sets on hand. Companies will need to adjust their hiring strategies to build expertise in areas such as ESG policy, renewables, carbon measurement, accounting and management, and green financing.

Build Collaborative Ecosystems

The energy transition requires an unprecedented level of collaboration across organizations, sectors, and value chains. Only by forging ecosystems of diverse, committed players will organizations be able to mobilize large-scale change at the required speed.

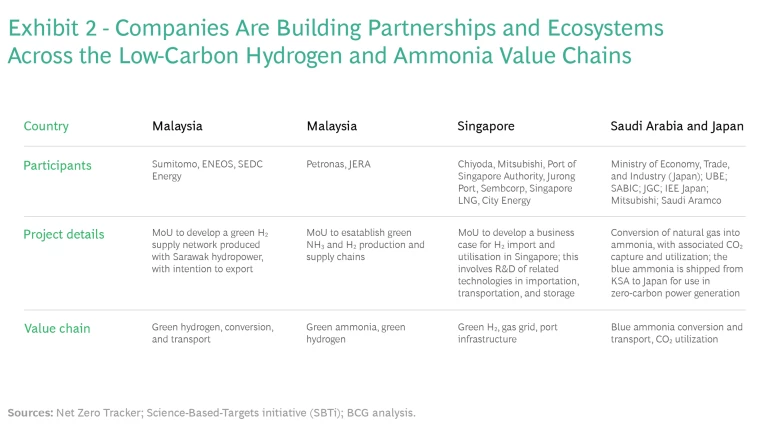

Ecosystems offer some important benefits that come only with scale. For example, they enable companies to market to a global audience and jumpstart global demand for new solutions. The networks that promote green hydrogen offer a good example. (See Exhibit 2.)

Equally important, ecosystems provide a platform for attracting and mobilizing investments that are essential for catalyzing breakthrough innovation. One example is the Climate Chain Coalition (CCC), an open global initiative of over 300 organizations in 50 countries. The CCC is dedicated to advancing blockchain and other technologies necessary for mobilizing climate finance and enhancing measurement, reporting, and verification.

Ecosystems also help create transparency and trust. The Global Centre for Maritime Decarbonization, founded in Singapore last year, aims to help shape standards, finance projects, and support collaboration across stakeholders in the maritime industry for the purpose of eliminating greenhouse gas emissions.

Advocate and Shape Green Policies and Regulations

A transparent policy landscape is crucial for companies that want to progress to net zero. When government policies are transparent, companies can deploy existing technologies more quickly and invest in new ones with greater predictability and less risk. For example, clear announcements and phasing of a carbon price mechanism will improve the business case for low-carbon solutions, thus encouraging companies to invest in clean technologies. Companies should actively engage with regulators to propose and support policies to accelerate the adoption of green technologies.

Transparent policies also promote decarbonization in public procurement because they signal to suppliers that the government views climate impact as an important selection criterion. If the government incorporates climate metrics into its procurement requirements, it can catalyze broader change in the economy.

Companies should also help build suitable regulatory frameworks and low-carbon infrastructure to support a successful transition. A good example is the California Carbon Capture Coalition, a group of more than 100 companies, unions, conservation and environmental policy organizations dedicated to developing a comprehensive policy, regulatory, and economic framework that California can use to leverage cutting-edge climate action technologies.

Plan for a Just and Orderly Transition

The net zero transition is likely to provide major benefits to society as a whole, creating new jobs and boosting GDP. However, higher energy tariffs and job losses in fossil fuel sectors may also occur.

Companies, therefore, should devise a plan for a just transition as part of their broader ESG agenda. Among other things, the plan should include programs for reskilling and upskilling workers who are affected by the climate transition.

Consider ZE PAK, a Polish coal company, which is shifting its focus to renewables. To ensure that miners are not left behind, the company launched a pilot program in 2021 to provide training in solar photovoltaic (PV) technology and installations. The program also provides assistance to people seeking employment.

A just transition plan should also ensure that low-income households and small and medium-size enterprises have access to affordable energy, and that emerging markets can obtain funding to combat climate change. As we have found in our work in South Africa, achieving a just transition in a country depends on ensuring that the nation has the financial resources it needs to tap into its supply of renewable energy. France, Germany, the UK, the US, and the European Union have created a partnership to help provide South Africa with such funding.

Although the five practices discussed here should prove helpful to companies across the board, the relevance of individual practices will vary depending on where the company is in its net-zero journey, as well as on how well developed its market is. Companies in developed markets such as those in Western Europe may have an advantage simply because they started earlier and enjoy the support of governments that have committed to decarbonization.

Developed markets typically also have access to a wider range of financing sources to support the transition. Although achieving a just and orderly transition is important everywhere, emerging markets are especially sensitive to the issues of social and economic inclusivity. Consequently, companies in emerging markets must ensure that they maintain elements such as energy affordability and security during the transition.

Regardless of whether a market is developed or emerging, the path to net zero is unlikely to be straightforward. As the recent global natural gas supply shocks have demonstrated, external circumstances can change without notice, forcing companies and countries to revisit their decarbonization plans.

Progress toward net zero must be clearly thought out and deliberate, with planning that prioritizes resilience as well as speed. The future of our planet depends on it.