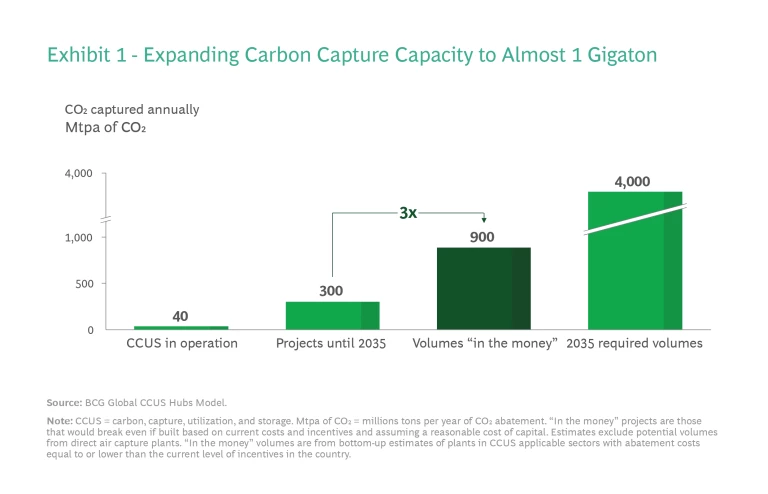

Carbon capture, utilization, and storage (CCUS) is making big strides. With multiple projects under development, capacity for the nascent climate mitigation technology is on track to reach about 300 million tons per year (Mtpa) of CO2 abatement by 2035.

This amount is almost ten times operational CCUS capacity today, but it falls far short of the approximately 4,000 Mtpa of CO2 of capacity that the International Energy Agency (IEA) estimates will be required by 2035 to achieve a 1.5℃ pathway. (In this article, the authors used the IEA’s net-zero emissions by 2050 scenario, which is among the most conservative for CCUS demand, for their analysis.)

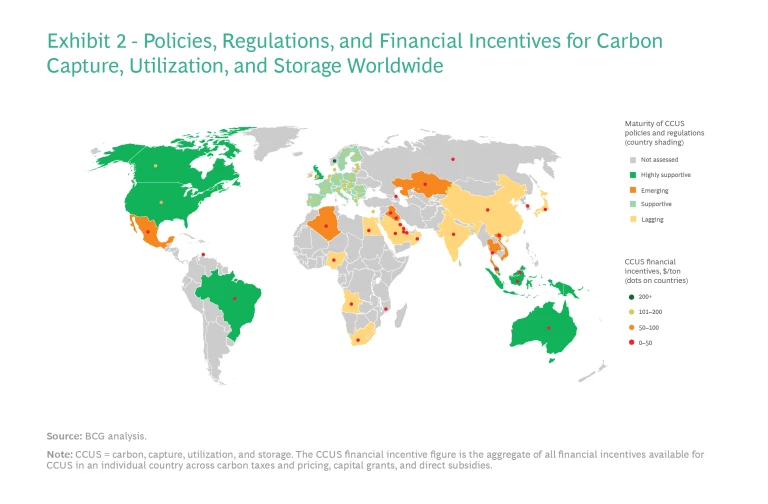

Fortunately, the extra capacity needed to hit this target won’t break the bank. Generous incentives, especially in the US and European countries such as Norway and the UK, have made many more CCUS projects commercially viable. Such incentives are driving an eight-fold increase in project announcements worldwide since 2017. The development of these projects will reduce costs for all players, particularly benefiting lower-middle income and low-income countries that are just starting to adopt CCUS.

In the same way that experience curve benefits have lowered the expense of renewable energy production, CCUS capex costs can be expected to fall as more capacity is installed. As a result of this decline, BCG estimates that a global incentives floor of $65 to $75 per ton of carbon abated—which is about one-third lower than current assumptions—will be needed to reach the goal of 4,000 Mtpa of CO2.

This is good news for governments and stakeholders confronting the climate change challenge. The realization that broad deployment of CCUS will ultimately cost less than previously estimated has the potential to accelerate its use in multiple countries and across a range of sectors. However, policymakers will still need to create favorable project conditions and regulations and define viable business models so that more projects can proceed.

Stay ahead with BCG insights on climate change and sustainability

Reasons to be Optimistic About Carbon Capture Deployment

CCUS is an essential lever for reducing global greenhouse gas emissions. As well as decarbonizing sectors with large, stationary emitters or with hard-to-abate emissions, it can also remove carbon directly from the atmosphere using engineered carbon removal solutions, direct air capture, or bioenergy with carbon capture and storage.

BCG’s work with the Oil and Gas Climate Initiative (OGCI) demonstrates that the world can reach levels of CCUS deployment needed for net-zero emissions by 2050 without breaking the bank, but it will require stakeholders across the value chain to be far more proactive.

Here’s how the math works out. While CCUS capacity is on track to reach about 300 Mtpa of CO2 by 2035, a further 600 Mtpa of CO2 of projects are “in the money” today (meaning they would break even if built based on current costs and incentives and assuming a reasonable cost of capital) in locations where they can be bundled into hubs that share infrastructure and reduce operational risks.

These projects have yet to be announced as they still need better regulations, permitting, and government-backed commercial arrangements before they can go ahead. Importantly, however, there’s a line of sight to almost 1,000 Mtpa of CO2 of capacity. (See Exhibit 1.)

This still leaves a requirement for approximately 3,000 Mtpa of CO2 of capacity. However, in the authors’ view, experience curve effects will reduce the cost of closing this gap. CCUS can be expected to follow a similar trajectory to other industrial technologies, such as sulfur and nitrous oxide scrubbers which have seen capex costs decline by 10–12% every time capacity doubles.

Deploying CCUS at the scale of announced projects—about 300 Mtpa of CO2 by 2035—has the potential to cut capex costs by 30%, with overall abatement costs, once this capacity has been installed, roughly 80% of what they are today.

Because capex costs are reduced, the volume of financial incentives required to make CCUS projects profitable is also lower. BCG calculates that a floor in per-country incentives of $65–$75 per ton of carbon abated will be needed to deliver an extra 3,000 Mtpa of CO2 of CCUS capacity by 2035. Incentives include tax credits, capital grants, and carbon pricing schemes.

This figure, which is significantly below the $100 per ton that most climate economists estimate is required to achieve net-zero emissions by 2050, is possible because incentives in high-income countries, such as Norway, the UK, and the US, are already generous, which means that lower-middle income and low-income countries can pay less. (See Exhibit 2 for an analysis of current CCUS incentives and policy maturity in different countries.)

Stakeholders Need to Take Action in Three Areas

BCG estimates that the total capex costs involved in reaching 4,000 Mtpa of CO2 of CCUS capacity will be $1.2 trillion after taking into account experience curve benefits. But while this amount—which will require both public and private-sector investment—is a significant one in aggregate, it is expected that CCUS capex will be affordable at a national level. It represents between 1% and 2% of annual government expenditure or less than 0.5% of GDP in most countries with high CCUS potential.

To make CCUS projects happen at scale, policymakers and companies will also need to take actions in the following areas:

- Accelerating deployment where incentives already exist. For governments, this means finalizing viable business models (the US is in the lead here) and speeding up the resolution of regulatory issues like permitting and clarity on the treatment of long-term storage liabilities. The latter is an area where most countries are still taking too long to act. For companies, it means reviewing their decarbonization plans and asking if there is scope to deploy CCUS earlier than 2030. Companies can also take advantage of recent policy developments in supportive geographies to boost capacity. By maximizing deployment in the US and Europe, where they can benefit from the US’ expanded 45Q tax credit and other policy mechanisms, they can gain greater experience and drive down costs more aggressively across the value chain.

Expanding carbon pricing and financing schemes worldwide. This is primarily an action for governments. We are starting to see positive unilateral initiatives like the European Union’s Carbon Border Adjustment Mechanism, which aims to tackle carbon emissions from imported goods. This could encourage countries outside the EU to set up carbon pricing schemes, especially in high emitting sectors. An alternative proposal from the IMF involves an international carbon price floor for high-emitting countries. Both approaches are aimed at solving the problem of carbon leakage (the replacement of local products with more carbon-intensive imports). And by putting a price on carbon, they incentivize companies to reduce or capture their emissions. To reduce complexity and red tape, a single global system is the best option but remains some way off.

Companies can also contribute to greater CCUS deployment by purchasing carbon credits linked to projects involving carbon capture technologies in the voluntary carbon market. Recent initiatives include CCS+, which aims to encourage the expansion of carbon capture projects by creating a rigorous emissions verification process managed by project registry Verra. The emerging role of CCUS in the voluntary market has the potential to unlock significant private financing for projects from outside the emitter’s value chain.

- Creating demand for low-carbon products and services. We are starting to see the development of markets for green steel and low-carbon hydrogen, among other products. However, so far these markets have largely been driven by companies seeking to address their Scope 3 emissions. The authors believe that governments can supercharge market development by procuring green cement and steel for public construction projects and setting targets for using low-carbon energy. Power, steel, and cement are all hard-to-abate sectors that will need CCUS to achieve their decarbonization goals.

CCUS is essential if we are to limit global warming. BCG’s finding that broad deployment of the technology could cost significantly less than previously estimated should encourage more countries to provide the incentives needed to make projects a reality. However, financial support is only part of the puzzle. Both governments and companies must also take targeted actions, such as improving permitting and establishing markets for low-carbon goods and services, to make CCUS a success at scale.

The authors thank BCG’s Lily Bailey, Nico Lake, Carlos Larrea Castro, Albert Diaz, and Valeria Boesso for their contributions to this article.