Authentic ESG. We all know what it isn’t—greenwashing, empty commitments, and obligatory disclosures. As environmental, social, and governance (ESG) topics rise on corporate agendas, too many companies are mired in old ways of thinking, treating ESG measures as acts of compliance, altruism, or corporate responsibility. They have hired a chief sustainability officer, but they haven’t yet mobilized the organization to adopt a robust sustainability strategy and operating plan. They have diversity, equity, and inclusion (DEI) on their scorecard, but they haven’t yet built the cultural and business foundation to support those goals. They have published disclosures, but they haven’t crafted a distinctive story to share. They have used an ESG agenda to guide donations, but they haven’t let it influence their biggest strategic decisions.

To get an authentic ESG strategy right, really right, takes more than avoiding these pitfalls. Leaders should use the company’s purpose to identify areas that are not just material but meaningful to the company and its stakeholders, and then harness the energy of the organization to drive innovative and value-creating ESG changes across the business. A true ESG strategy is not about what a company does with the money it makes. It is about how a company makes its money.

Business leaders must take a holistic approach to embedding an authentic ESG mindset in every corner of the organization—across its strategy, culture, operations, brand, and story—in order to be able to tell the company’s story with pride, credibility, and sensitivity. Leaders must also have courage—particularly the courage to be uncomfortable—in order to build coalitions that may include competitors, to take on issues that feel intractable, and to lead and work differently. The companies that lead with courage will see the advantage that’s gained when their ESG measures become a calling rather than an act of compliance.

The Backdrop

Business leaders and institutional investors are experiencing a collective awakening. As the climate crisis deepens and the uncertainty of the global pandemic lingers, employees, consumers, communities, and investors are increasingly holding companies to account for ESG stewardship. Simultaneously, the growth of socially responsible investing (SRI) is accelerating; SRI assets now represent more than 36% of global assets under management, and they are projected to total $53 trillion by 2025.

There is a growing vanguard of voices, including that of BlackRock CEO Larry Fink, insisting that purpose and ESG leadership are key to long-term performance. Study after study bears that out; BCG has found that companies with a strong sense of purpose are more than twice as likely to rank in the top two quartiles of ten-year total shareholder return performance than their low-scoring peers. And top performers on ESG topics are rewarded with valuation multiples that are 3% to 19% higher than those of median performers on those topics. Top performers on ESG topics are also better able to attract and retain talent; according to a report by Marsh and McLennan, the companies that are most appealing to students and young professionals scored 25% higher than their peers on ESG metrics.

Top performers on ESG topics are rewarded with higher valuation multiples.

Against this backdrop, CEOs and boards of directors are trying to get their arms around their company’s ESG strategy—what it means, where they stand, what they should measure, and how they should drive it inside their organizations. Meanwhile, the goalpost for becoming an ESG leader continues to move, and the risks of moving too slowly or timidly mount.

Despite good intentions and significant investment, many companies are coming up short. Their commitments are not bold enough for the challenges they face. They shy away from tackling the thorny issues in their business. Their efforts are disjointed, incremental, or generic. They communicate hastily before they take the right actions. Or they don’t communicate at all, waiting for the day that they have only good news to report. As a result, their ESG story comes across for what it is: inauthentic. And stakeholders respond accordingly—they take their résumé, their business, or their capital elsewhere.

Reframing the Company’s ESG Perspective

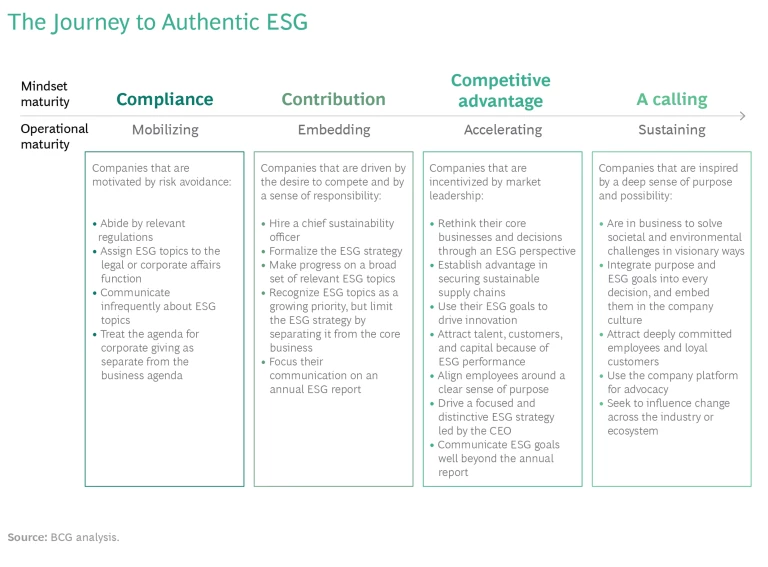

Companies that are leading on ESG topics understand that the goal is not to check all the boxes for industry analysts. It’s to fundamentally transform the company—to seize an opportunity to create business and societal value by making their ESG approach part of the core business. Rather than continuing to think about ESG commitments as an obligation or a societal contribution, leading companies shift and treat them as a competitive advantage and, ultimately, a calling. (See the exhibit.)

How do companies do it? How do they move beyond a generic approach and unleash the full power of their ESG initiatives?

There are clear action items that should be on every company’s to-do list as it seeks to upgrade its ESG strategy: understand which topics are most material to the company and industry, set ambitions that will have a significant and constructive impact on those topics, launch a group of initiatives to achieve those ambitions, and build a rigorous tracking and reporting muscle.

The problem is, it’s very possible to do all these steps well and end up with an approach that falls flat with the stakeholders the company wants to engage the most. In addition to the rigor of metrics, the company needs a compelling narrative and true emotional engagement across the organization. It needs an approach that is borne of conviction, distinctive for its brand, meaningful to its stakeholders, motivating to its employees, resonant in the marketplace, aligned with its purpose, and consistent with its values. In short, the company needs an authentic ESG strategy.

To reframe the company’s perspective, consider four principles and four steps that go further than the standard to-do list above.

FOUR PRINCIPLES

Four principles capture essential mindset shifts that leaders must embrace to make a truly transformative move toward an authentic ESG strategy.

It’s the CEO’s job. One of the challenges companies face as they attempt bold action on ESG issues is overcoming a fragmented organizational approach. Often, social impact topics have grown up under the corporate social responsibility or corporate affairs function, or even in the company foundation. DEI topics may be managed by human resources, while sustainability sits inside the operations or supply chain function. All are logical homes, but the problem is that for an ESG strategy to be successful, it must be implemented company-wide, across functions. And for it to drive the business, it must be part of the CEO’s strategy, supported by the C-suite, championed by the board, and lived, believed, and owned by the full organization.

Bold leadership on ESG topics is often an expectation of CEOs. But when they relegate it to a function or delegate it down the chain of command, they miss the opportunity to lead, and they hamper the organization’s ability to move in big, breakthrough ways. Supported by robust centers of excellence and functional expertise, it is the CEO’s job to drive—with purpose as fuel—a fundamental transformation of the business to create sustainable economic and ESG value.

Profitability is scalable. One of the most critical mindset shifts for leaders is moving away from the idea that ESG goals and initiatives are altruistic. The mechanics of running a business mean that if it is losing money on its ESG effort long term, the company won’t stick with it. If the ESG effort is a cost center, there will always be pressure to limit the programs. But when the ESG effort becomes a profit center, a scalability enabler, a customer and talent magnet, and an innovation engine—that’s when its benefit truly compounds. Profitable endeavors are scalable endeavors, and scaling ESG goals and initiatives in the core of the business is how real, game-changing impact will be made.

The benefit of an ESG effort compounds when it becomes a profit center, a customer and talent magnet, and an innovation engine.

That does not mean that a socially beneficial or sustainably made product has to be as profitable as a company’s traditional products. In fact, entering a lower-margin business that is aligned with the company’s ESG goals is a sure sign of an authentic strategy in action. Many innovations require investment upfront, including ESG innovations, and ESG initiatives should be viewed as long-term investments in business resilience. Still, the objective is to maximize the overlap and minimize the conflict between ESG goals and business performance.

If you’re not uncomfortable, you’re not doing it right. Executing an authentic ESG strategy entails more than making donations and disclosures. It means reexamining and rethinking the value drivers of the business. Reducing the negative impact of existing business activity is an important first step, but the real value of an ESG approach lies in finding the win-win solutions that provide both economic and ESG benefits.

This is a significant shift in the objective function of most corporations that aim to become finely tuned profit-maximization machines. Putting a “Save the planet!” bumper sticker on that machine won’t change anything. Leaders have to go beneath the surface to get inside and re-engineer the machine. And that is neither easy nor comfortable. Meaningful change never is.

But discomfort is necessary for the growth of individuals and organizations. Growth means that company leaders must ask themselves hard questions: Are we willing to take a lower price? Are there markets that seemed risky before that we should now consider entering? Are we truly willing to incentivize our leaders to achieve the bold ESG outcomes we want? Those companies with the courage to embrace the discomfort by rethinking their assumptions, tackling the intractable issues, and telling their story even when it’s imperfect are the companies that will be well-tuned to thrive in the era of stakeholder capitalism.

It’s about cooperation, not just competition. With a rigorous and authentic ESG strategy established, leading companies look beyond competitive advantage and embrace cooperative progress.

Pursuing an ESG strategy is in a company’s competitive self-interest, as capital and talent increasingly flow from ESG laggards to ESG leaders and as scarce sustainable sources get locked up. But if a company sticks solely to a competitive mindset, it is missing the point of pursuing an ESG approach and much of the opportunity.

No crisis has made the shared fate of all the world’s societies and organizations more palpable than the climate crisis. Visionary leaders understand that if their company stays myopic and fiercely competitive, efforts to combat climate change will slow, putting at risk not only their own future but also the future of their stakeholders and the world. These leaders see that ultimately cooperation is as beneficial to them as competition.

Visionary leaders see that cooperation is as beneficial as competition.

Industry coalitions allow competitors to band together to change complex supply chains that no individual company can change on its own. They help companies move past the prisoner’s dilemma and avoid a short-term penalty to any one company for taking on the green premium of a more costly energy source. They enable companies to share the risk of investing in new solutions, particularly where the path forward isn’t clear. And they help companies team up to suggest better standards that move the world forward while maintaining a fair playing field for all participants.

A particularly powerful example of this cooperation principle is a climate proposal published by BCG and the Federation of German Industries. The program aims to achieve net-zero emissions in Germany while maintaining German competitiveness and fairly distributing the costs.

As companies shape their ESG strategy, they should consider how they can move their industry ecosystem forward by convening as well as competing. The challenges they face require them to stop looking over their shoulder at their competitors and to, instead, look toward the future, together.

Four Steps

When a company is ready to commit, commercialize, get uncomfortable, and cooperate, the following four steps will help chart a path toward an authentic ESG strategy.

Start with purpose. Crafting a clear and compelling corporate purpose is essential to creating an authentic ESG strategy. Purpose is the why—the company’s reason for being. Making money is an insufficient reason to exist, as is a market share aspiration. Purpose answers the question, Why do employees come to work each morning? And if the company disappeared tomorrow, what would the world lose?

Defining the company’s purpose is not a writing exercise. It’s an exercise in excavation—unearthing the company’s unique strengths. It is also an exercise in exploration—taking an in-depth, wide-angle look at what the world needs from a company with just those strengths.

After articulating the purpose, it should be brought to life across the organization. Purpose motivates the company’s stakeholders, drives its strategy, and elevates its branding. Purpose acts as rocket fuel, accelerating the adoption of the ESG transformation. And purpose becomes a critical filter for developing an ESG strategy that is authentic—focused, credible, distinctive, visionary, and inspiring. For example, global toolmaker Stanley Black & Decker’s purpose, “for those who make the world,” helped them hone their ESG strategy, which focuses on supporting employees by teaching them new skills and offering them science, technology, engineering, and math educational opportunities. The company’s strategy also focuses on commercializing new innovations (such as a solar water pump) that have compelling environmental benefits.

Purpose acts as rocket fuel, accelerating the adoption of the ESG transformation.

Take a stand. A robust ESG strategy should cover a variety of topics across ESG issues, but within that agenda, there is merit in taking a spiky approach—identifying one or two areas where the company can have a significant impact. What is the one thing that the company wants to be known for, that it wants to move the needle on in an industry-shaping and society-shifting way? Where can the company best contribute?

Leaders should think about this through the perspective of purpose. Purpose can help zero in on a set of relevant, timely issues that the company can uniquely address. From that set, leaders should seek a topic that is best aligned with the company’s capabilities and that is galvanizing for its stakeholders and business, and then take a stand.

Commercial carpeting manufacturer Interface took a stand it called Mission Zero in 1994, pledging to fundamentally transform its products to have zero negative impact on the planet by 2020. Having achieved Mission Zero, Interface’s next stand is called Climate Take Back, a commitment to go beyond zero impact to positive impact by using products that draw down carbon, creating partnerships that revolutionize industry, adopting practices that let nature cool, and continually committing to “live zero” every day.

Embody the change. Too often, companies say one thing externally and do quite another internally. A company may make a public statement supporting racial justice, for example, but turn a blind eye toward in-house practices that cause their employees of color to experience bias and barriers.

To truly unlock the competitive advantage that comes from being a leader on ESG topics, it’s not enough to track KPIs and publish reports. It’s about creating congruence between the commitments that the company is making to the world and the decisions being made inside its walls. Cultural change is how commitments move beyond the C-suite and are made real by the everyday decisions that individual employees make: whether or not to travel, which supplier to work with, which consumers to serve, which material to design with, or who to promote.

Changing the culture requires inspiring employees with the ESG strategy and educating them about it. Changing the culture also means doing the hard work of shaping behavior so that it aligns with the company’s commitments and ideals. Behavioral change happens through both informal actions (choosing to celebrate decisions that forgo short-term gain for long-term resilience, for example) and formal decisions (specifying that every analysis of net present value must be accompanied by a carbon impact analysis, for instance).

Changing the culture requires inspiring employees with the ESG strategy and educating them about it.

Effectively mobilizing the organization around the ESG strategy is essential on multiple fronts: to inspire and align the organization, to ensure that commitments translate into action, to attract and retain top talent that is seeking purposeful work, and to build credibility both internally and externally.

Tell your story. In addition to a bold and clear-eyed ESG agenda, a company needs a compelling and distinctive ESG story—a strategic narrative from which all ESG-related communications flow.

The pitfalls of crafting the company’s story are abundant—greenwashing, myopia, excessive back-patting, and inauthenticity. But the benefits are equally ample, if done right.

Telling a story is not the same as publishing data. While data and disclosures are essential for driving accountability, a fact-based report is not sufficient. The company’s story should help stakeholders connect emotionally; in his research, the eminent Harvard psychologist Jerome Bruner found that people are 20 times more likely to remember facts if they are presented in the context of a story. That story should come to life across every brand touch point, not just a single ESG report.

Of course, substance is the most important element. A company’s ESG story should be supported by bold ambitions, tangible actions, and transparent progress. It should also be relevant to the concerns of key stakeholders. And it should be communicated with courageous honesty, a bold vision, and commitment:

- Courageous Honesty. It’s critical for companies to tell the story they have—not the story they wish they had. The Danish energy company Ørsted is a good example of this practice; it does not shy away from talking about its starting point as one of the most coal-intensive companies in Europe, responsible for one-third of Denmark’s emissions at one point. But it has transformed into a sustainable energy leader, and it now shares its lessons with others on the path to sustainability.

- Bold Vision. A self-congratulatory story about the company’s incremental progress on ESG metrics will not move the needle. But when the brand is used as a platform to paint a compelling vision for a brighter future, the company enrolls stakeholders in the story, and that is galvanizing. Patagonia is a good example. It is “in business to save our home planet,” and rather than focus on its own sustainability accomplishments, it uses its platform and voice to mobilize its customers toward climate action through the Patagonia Action Works platform, its partnership with activist athletes, and its promotion of responsible consumption.

- Commitment. Companies should apply the same level of strategic thoughtfulness and creative firepower to telling their ESG story that they give to other brand-building activities. Communications about purpose and ESG impact should be continuous, always building equity with stakeholders and advancing the issues that the company is committed to at every opportunity.

Together, the four principles and the four steps will help companies take more than a generic ESG approach. They chart a path to an authentic ESG strategy and to leadership in an age when companies are re-evaluating their role in society, stakeholders are demanding change, and capital is flowing to the companies that are shaping a sustainable future.

James Baldwin, the American writer and activist, said, “We made the world we’re living in, and we have it make it over.” He said it in 1960, and it’s still true today. So, while other companies are gingerly dipping a toe in the waters of stakeholder capitalism, now is the time to dive in—to get uncomfortable, find the company’s purpose, and take bold action. It’s time to go beyond treating ESG measures as an act of compliance and to instead lead with courage. It’s time to remake the world and the role of business in it.