Sustainability commitments have skyrocketed in recent years, but there’s a growing problem. In certain sectors, the demand for sustainability-related resources will soon outstrip the supply.

In the past year, sustainability commitments have gone mainstream. Hundreds of corporations have publicly taken a stand on net-zero emissions, some of the world’s largest asset managers are calling on companies to align with the net-zero economy, and the upcoming COP26 summit will undoubtedly spark even greater sustainability commitments from the public sector that will have ramifications for businesses.

While this surge of commitments is clearly a boon for the global community, there is a problem. As companies race to fulfill their sustainability commitments, they may quickly find that much-needed resources, infrastructures, and capabilities are not readily available. In the coming years, we anticipate periods during which demand for the inputs to sustainable solutions will surpass supply—creating troubling scarcities of resources.

To ensure access to critical resources, leaders must move quickly. Companies that can identify novel ways to address their scarcity issues will mitigate risk, build resilience, and capture economic premiums. Scarcity advantage will help determine the winners in the race to sustainability.

For example, the current extraction of raw materials is less than one-third of what will be required to meet battery demand in 2030; BCG analysis suggests that the net supply of carbon credits coming onto the market will fall short of demand by 300 million metric tons of carbon dioxide equivalent in 2030; and industry experts estimate that the production of tree seedlings in the US will need to increase 2.4-fold to keep up with demand for reforestation and carbon offsets.

In this article, we highlight the dynamic factors that businesses must examine to determine where, when, and how significant scarcities will emerge. With these insights, companies can not only mitigate business risks but also capture new opportunities to innovate and drive forward the green economy.

Identify Risks, Bottlenecks, and Scarcities

To identify potential business risks, bottlenecks, and scarcities, companies must first expand the business canvas by mapping the wider socioeconomic ecosystem of stakeholders and societal issues in which the business operates. This involves mapping out the full set of players in the system—and their value chains. The goal is to identify key inputs, including the goods (such as raw materials, manufacturing tools, and storage facilities) and services (such as expertise and critical capabilities) that are likely to face a surge in demand.

Next, companies must stress-test the business model to understand where rapid changes in demand, driven by environmental and societal trends, will create critical shortages in the system—and therefore vulnerabilities to the business. A company should simulate an increase in demand for sustainable resources or products, based on actual projections, to anticipate effects on the ecosystem and the business model. If demand for a particular input increased by a factor of ten, could the company still easily acquire it? Would this create pressure on the value chain? Are critical inputs in the ecosystem also important to other industries and ecosystems? For example, graphite is essential for scaling up green hydrogen, but it is also a critical input for scaling up electric vehicles, so it’s critical to stay on top of emerging trends across industries that may be competing for the same sustainable resources.

Using this approach, companies can identify strategic intervention points at which targeted action or innovation can alter stakeholder dynamics, positively impact environmental or societal issues, reduce vulnerabilities within the business model, and create new business opportunities.

Understand Which Scarcities Will Affect Your Sustainable Business Strategy

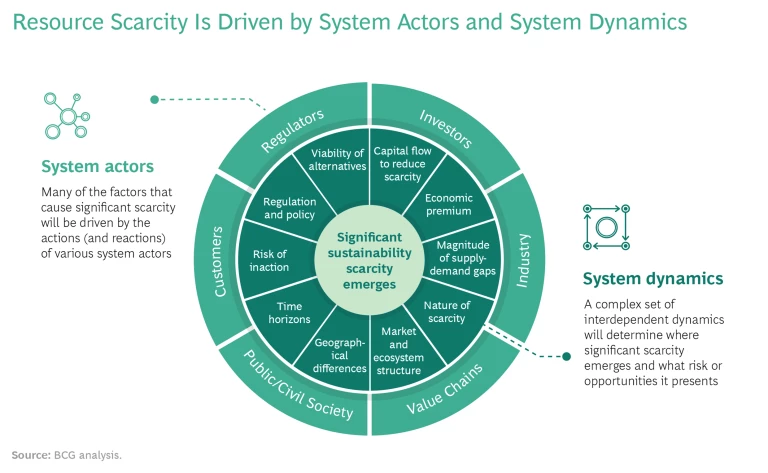

After identifying potential scarcities, companies can then assess the risk and materiality of each potential scarcity by analyzing ten dynamic factors. (See the exhibit.)

Our approach analyzes how the actors within the wider socioeconomic system—and the dynamics among them—create or alleviate sustainability scarcity. The system actors are organizations or groups whose actions and strategies will affect the availability of sustainable resources. This includes investors, industry players, suppliers, value chain participants, the public, customers, and regulators. System dynamics come into play when individual actors make unilateral or multilateral decisions that affect the entire system. For example, if regulators respond to an emerging scarcity by adjusting regulations and policies, this may increase the flow of capital toward a particular resource scarcity or boost the viability of alternative resources or production processes, thereby relieving scarcities by changing the underlying economics. Regulators are more likely to intervene if they believe that the risk of shortages is high enough that it should not be left purely to market forces. For example, governments have identified certain commodities, such as lithium, as essential to national security and the green transition.

By evaluating each segment of the wheel (as depicted in the exhibit), leaders can grasp which scarcities will be the most problematic, which will be most relevant for their business or their customers, and which will create the biggest competitive advantage—and act accordingly.

Understand the Wider System Dynamics That Create Resource Scarcities

We have identified ten dynamic factors that companies can analyze to evaluate the business impact of potential scarcities in sustainable resources, infrastructures, and capabilities—and to support their quest for sustainable business model innovation.

- Determine the exact nature of the scarcity.

- Quantify the gap between supply and demand under various scenarios.

- Determine when the scarcity will emerge—and how long it will last.

- Evaluate the effect of economic premiums and pricing fluctuation.

- Understand the market and ecosystem structure.

- Calculate the viability of alternatives to the scarce resources.

- Track the flow of capital to reduce scarcity.

- Examine the evolving geographical, geopolitical, and cultural contexts.

- Anticipate the effects of regulatory frameworks and policy incentives.

- Evaluate the business risks of inaction.

Determine the exact nature of the scarcity. Scarcities come in many shapes and sizes. There may be a shortage of raw material (like lithium or cobalt), a limitation in current production methods (as in sustainably produced cotton), a problem with scaling up quickly, a shortage of expertise or talent, or an underdeveloped infrastructure. It’s essential to pinpoint the exact source of the scarcity problem so that you can respond appropriately.

For example, large-scale reforestation is required to help countries combat climate change. A recent study found that the US is already short more than two billion seedlings per year—and that’s just to meet 50% of the country’s reforestation goals by 2040. One of the challenges is accessing skilled labor. Very few people know how to collect seeds, and those who do are in high demand. The US also faces a shortage of workers who know how to process seeds, nurse seedlings, replant trees, and maintain forests. So the nature of the scarcity, in this case, is not just a production problem. It’s also about the underlying talent and skills needed to scale production. The Biden Administration’s Civilian Climate Corps offers one example of the way the US is attempting to bridge this talent gap by training a new generation in climate-related public-works projects, including reforestation.

Quantify the gap between supply and demand under various scenarios. As the sustainability movement accelerates, supply and demand patterns will change. Companies need to understand where demand will increase—and where it will decrease—within their own ecosystem and in adjacent ecosystems. This requires a dynamic systems perspective because the demand for any single resource may rise and fall at the same time, depending on context.

For example, the global platinum supply has been at a deficit for the past three years, but future supply and demand issues are complicated. Demand for platinum is expected to rise as the transition to clean energy and green hydrogen ramps up, given that the element is a key input for hydrogen electrolyzers and hydrogen fuel cells. At the same time, as clean mobility gains traction and fuels the transition from internal combustion engines to electric vehicles, the demand for platinum in catalytic converters will decline. When quantifying the supply-demand gap, companies must account for such opposing market forces.

Determine when the scarcity will emerge—and how long it will last. By understanding when a scarcity will emerge and how long it will last, companies can manage economic premiums and operational constraints, identify the alternatives that could arise to fill the gap, and arbitrage options across different geographies. They can also identify opportunities for acquisition and investment. The key is to move quickly while multiple options still exist. Companies should run scenarios on the duration of each scarcity and develop a clear strategy. From the standpoint of operational resilience, a short and severe bottleneck may be tolerable with limited action, but a prolonged shortage presents serious operational and financial risks if it’s not addressed in a timely manner.

BCG analysis suggests that demand for carbon credits will begin outpacing supply by 2024. Even in a conservative scenario, the net supply of credits coming onto the market will fall short of supply by 300 million metric tons of carbon dioxide equivalent in 2030, according to our analysis. This deficit over the next decade could have a significant impact on companies’ ability to achieve their net-zero commitments, particularly those aimed at a 2030 horizon.

Evaluate the effect of economic premiums and pricing fluctuation. When a scarcity arises, companies will likely need to pay a premium for the resources in short supply. By understanding which resources will be in short supply and recognizing whether competitors are in a good position to pay a premium for that resource, companies can assess their risk and adjust the business model accordingly. What’s more, if a resource scarcity leads to high economic premiums, it can trigger a flow of capital toward alternative technologies that are more economically viable. Companies must anticipate these types of shifts.

Take battery-grade lithium for example. It has experienced significant price volatility over the past few years, but as demand from EVs and stationary energy storage rapidly increases, industry experts are warning of “perpetual deficits.” Although price forecasts vary significantly, Fitch Solutions notes that “green lithium,” which is sourced through more sustainable practices (using lower carbon intensity and lower water usage), will sell at a premium compared with conventional mining approaches. Bolstering this forecast, the EU’s regulations will require EVs and industrial batteries to have a declared carbon footprint beginning in July 2024.

Understand the market and ecosystem structure. The structure of the value chain, markets, and the broader ecosystem has a significant bearing on how quickly companies can respond to scarcity issues. A highly fragmented ecosystem with multiple players and varying regulatory frameworks will be much more difficult to navigate than a concentrated value chain. Companies should conduct a comprehensive survey of their value chain, not only to identify potential bottlenecks and mitigate shortages but also to make the supply chain more resilient.

Consider the challenges in scaling production of sustainable palm oil. In 2020, the Consumer Goods Forum (CGF) launched the “Forest Positive Coalition of Action,” a CEO-led initiative representing 20 CGF member companies who are committed to removing deforestation, forest degradation, and conversion from key commodity supply chains, including that of palm oil. Previous attempts to achieve net-zero deforestation targets with sustainable palm oil have been challenging, in part because small farmers account for 40% of palm oil production. This means large palm oil suppliers need to convince millions of small farmers to change their agricultural practices. With this market structure, it can be very difficult to systematically achieve sustainability targets.

Calculate the viability of alternatives to the scarce resources. Once companies grasp the fundamental nature of a scarcity and its significance, the next step is to evaluate the technical and economic viability of alternatives. The need for innovative alternatives is especially pronounced when it comes to limitations on raw materials because this type of scarcity cannot be solved by investing in and scaling up production or shifting to new production methods. If the scarcity is expected to last a long time or create a significant supply-demand gap, an entirely new solution that eliminates the need for the scarce resource may be needed. For each scenario, companies must understand where to invest to ensure access to critical resources.

For example, current battery manufacturing processes rely heavily on pure, high-quality graphite, but extracting high-quality graphite is challenging, and recycling at scale is not yet a well-established practice. Additionally, a great deal of waste occurs during EV battery manufacturing; approximately 30 times more graphite is required to make a battery than is present in the final product. Companies like Tesla and Unifrax are experimenting with alternatives such as silicon anodes to significantly reduce the need for graphite in EV batteries. As technology advances, silicon anodes may entirely replace the need for graphite.

Track the flow of capital to reduce scarcity. The amount of capital directed toward scarce resources signals how long a shortage may last and how severe it might be. The more capital that is deployed to address the scarcity, the higher the likelihood is that production will ramp up quickly or new alternatives will be developed. Lower levels of investment indicate that companies may face more difficult obstacles in resolving the scarcity. By tracking the flow of capital, companies can see where and how shortages are being addressed and find the best path forward to secure the sustainable resources they need.

For example, according to the World Energy Outlook 2020 report, more than $3 trillion in investment will be needed between now and 2050 to scale up carbon capture, utilization, and storage (CCUS) infrastructure. Oil giants, multinational corporations, governments, and multilateral organizations are all investing in the CCUS economy, but the investments are falling far short of what’s needed. In 2020, Europe, the Middle East, and Africa invested just $2 billion in CCUS. Unless large, transformative investments are made soon, CCUS capacity will not meet the demand.

Examine the evolving geographical, geopolitical, and cultural contexts. Some scarcities occur within a specific context owing to changing government regulations, export restrictions, natural disasters, or geopolitical turmoil in a resource-rich region. They may also be driven by cultural context, consumer mindsets, and global demand trends. Companies must recognize the short-term and long-term effects of these potential disruptions and changes and make the moves necessary to alleviate or capitalize on any constraints—or create advantage by actively managing the different supply and pricing dynamics for sustainability scarcities across various geographies.

Again, sustainable palm oil offers a useful example. In some emerging markets, the demand for products containing palm oil is growing quickly; however, efforts to shift consumer preferences and promote the use of certified sustainable palm oil in these markets are still nascent.

Anticipate the effects of regulatory frameworks and policy incentives. Government policy interventions can have a significant effect on sustainability scarcities. Government incentives, subsidies, and direct investment can increase the flow of capital for alternatives to sustainability resources, increasing investment, availability, and their economic viability. Over the past two decades, for example, government tax incentives have increased investment in wind turbine technology and production capacity in the United States, accelerating adoption of this renewable energy. Companies should develop scenarios on possible regulatory changes—and strategize ways to manage disruptions or capitalize on potential changes.

Looking ahead, the worldwide lithium-battery market, for example, is expected to grow by a factor of five to ten in the next decade. In response to this vast increase in market demand, the US Department of Energy released a “National Blueprint for Lithium Batteries” in June 2021. The blueprint guides investment in a domestic lithium-battery manufacturing value chain to ensure that US companies benefit from domestic and global market growth and avoid the risk of “long-term dependence on foreign sources of batteries and critical materials.” Companies that can capitalize on government investments can gain a strong competitive advantage in this fast-growing global market.

Evaluate the business risks of inaction. Sustainability can be a source of competitive advantage, and, when devising a company strategy, it’s important to understand how competitors are pursuing sustainability. As more and more companies pledge net-zero commitments, for example, a certain subset will inevitably fall short of their targets. When these companies scramble to meet their goals, the scarcity of sustainable resources will worsen, ramping up risk for companies unprepared for these changing dynamics. Inaction can present obvious operational risks (you can’t access the talent you need to fulfill a sustainability commitment) and financial risks (you will be fined for using unsustainable resources). But the risks aren’t always so clear cut (you miss sustainability targets and draw negative press coverage, but this doesn’t harm sales or investor sentiment).

Historically, companies that fall short of sustainability targets have not faced serious repercussions, but the risk is growing now that broader accountability mechanisms exist for investors, consumers, and regulators. Running cost-benefit scenarios reveals the true cost of not taking action to address sustainability scarcities.

For companies to meet—or even exceed—their sustainability goals, they must continuously monitor the sustainability landscape. The ten-factor analysis described here offers a clear view into the ways that various actors across all industries and geographies will affect availability of the resources necessary to achieve sustainability commitments.

Time is of the essence. Sustainability commitments are surging, but sustainability-related resources are in limited supply. Companies that continuously scan their ecosystems for sustainability scarcities will be prepared to circumvent shortages—or capitalize on them—and unlock new opportunities for long-term growth and competitive advantage.