Order to cash (O2C) is one of an organization’s most critical and complex processes, yet executives rarely pay any real attention to it. It is simply the collection of all activities—from receiving an order through processing it and getting paid—that relate to making a sale and realizing the revenues from it. Whether in a B2B or a B2C business, it’s a complicated process that no off-the-shelf, end-to-end solution can handle. Because of the complexity, few corporations ever look to make O2C improvements—until a crisis shocks them into realizing the problems and pitfalls of inefficient O2C processes.

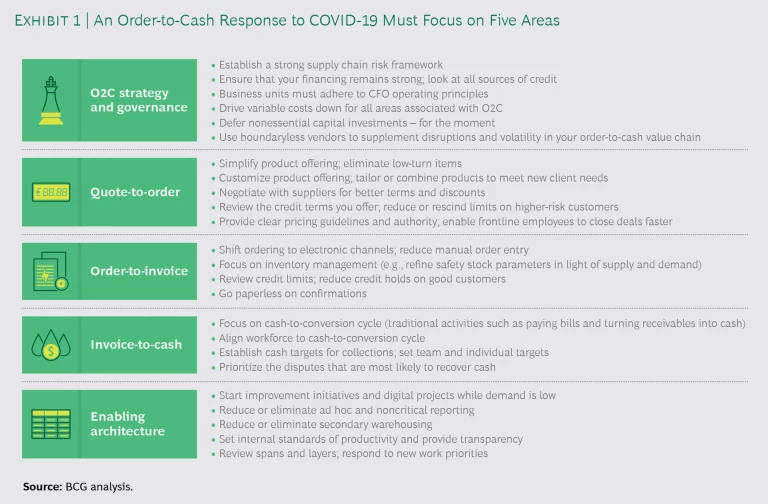

In the ongoing COVID-19 pandemic, for instance, companies all over the world woke up to the fact that to generate liquidity and conserve cash for their very survival, they need to minimize the risks in—and maximize the returns from—the O2C process. For a volatile, uncertain, and hypercompetitive postpandemic world, optimization is critical. (See Exhibit 1, which lists the many ways O2C must be addressed to preserve liquidity during the pandemic.)

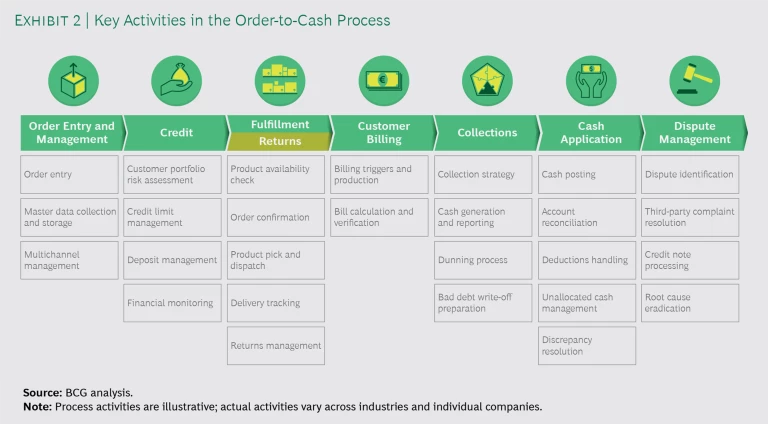

Although it operates deep in the background, the order-to-cash process can improve almost every aspect of the customer journey. The process is transversal, cutting across many departments—marketing, sales, pricing, contracting, collections, warehousing, finance, and, of course, customer service, to name just a few. Our analysis of O2C in a sample of manufacturing and service companies found that it comprised as many as 27 subprocesses across seven different functions. (See Exhibit 2.) That’s why O2C often falls between the cracks or is regarded as being too complicated to reengineer.

Although it isn’t easy, transforming the O2C process by creating a digital platform can help companies boost sales, improve customer satisfaction, reduce costs, and make life easier for employees and, crucially, for customers. Indeed, the benefits of transforming the process accrue in both the short term and the long term. Over time, companies that deploy O2C platforms and reengineer the process boost revenues by 1% to 3% a year.

Untangling O2C Complexity

There are as many O2C variants as there are combinations of product, company, industry, country, and customer segments. Even within a single company, the process can vary depending on whether a sale is a transaction or an RFP, whether fulfillment is handled directly or through a distributor, whether a transaction is domestic or international, and other factors. Increasingly, the O2C process must also adapt to omnichannel commerce, which alters the scope of various subprocesses according to the route to market. Clearly, it’s impossible to find a readymade technology application that can optimize the entire O2C process.

Companies are slowly realizing that O2C must deliver results on two fronts at the same time. On the one hand, the process must help deliver customer satisfaction, ensuring that orders are fulfilled correctly the first time and that buyers have the best possible experiences. On the other, the O2C process must meet the organization’s goals for profit maximization by maximizing revenues and being cost-effective and cash-efficient.

However, many current O2C processes have higher costs and points of potential delay built into them because they entail several manual steps. Moreover, many companies are no longer content with a collection of discrete processes in which data is available only at certain stages; they expect O2C to be transparent, with data and performance visible in real time, all the time. Customers have also come to expect real-time data and transparency. The process cannot be standardized without the development of bionic capabilities—executing with a blend of people and technology.

Identifying the Shortcomings

Unsurprisingly, the performance of the O2C process is far from ideal in most companies. Siloed operations, lack of data, and inflexible legacy systems are the three key problems. The platform approach can help address these pain points.

At present, O2C processes are usually supported by siloed systems that are owned by different functions. Typically, finance manages the invoicing, billing, and collections systems; operations is accountable for distribution and shipping systems; and the commercial functions handle order processing and sales. That creates a complex and creaky system, often with limited exchange of information. Customer support, for example, often struggles to provide in real time such basic information as order status, estimated delivery time, and payment receipt. In most companies, employees must manually switch between different systems and applications to transfer data—converting information from an e-invoicing system to a debtor management system, for instance—which can result in more errors, more time, and more stress.

Moreover, executives are bound to lack data about processing times; workflows cross over different applications, so information is not always up to date. Because it’s tough to connect different systems and solutions, many companies rely on employees who have used multiple systems to serve as human application program interfaces and make those connections possible. The paying customer is hardly at the center of the process. Customer data is spread across multiple systems, so finding the right information often takes significant amounts of time and money. The O2C process runs slowly, and companies are unable to serve customers efficiently.

Process problems are often compounded by legacy IT systems that make improvement difficult and hinder the identification of root causes. A monolithic system with heterogeneous ERP systems that have been customized to cover several contingencies results in enormous complexity and cost. Data is scattered over several legacy systems and data lakes; organizations lack transversal technologies and APIs that provide a single view of the data for decision making; and software development is characterized by long release cycles, limited flexibility, and late failures. This quagmire doesn’t change easily; the relationship between IT and the business often suffers from siloed thinking and limited innovation.

The Power of the O2C Platform

As the importance of the customer experience continues to grow, companies must do everything possible to make their order-to-cash processes run smoothly, ensuring that they are paid as quickly as possible while giving customers reason enough to remain loyal. That shouldn’t pose a problem if all the links in the chain seamlessly integrate and applications can readily exchange data.

Platform organizations—a change from the traditional organizations based on geography, product, or function—are uniquely positioned to tackle the challenge. An O2C platform facilitates all of the exchanges between the relevant functions in the buyer and the seller organizations for every transaction. Every company needs to develop an O2C platform that unites the associated functions using tried-and-tested technologies and best-of-breed applications. That approach is preferable to deploying different systems for each subprocess or, worse, using a solution that claims to support all the modules effectively but, in reality, offers different features, different levels of ease, and different customer and employee experiences for each subprocess.

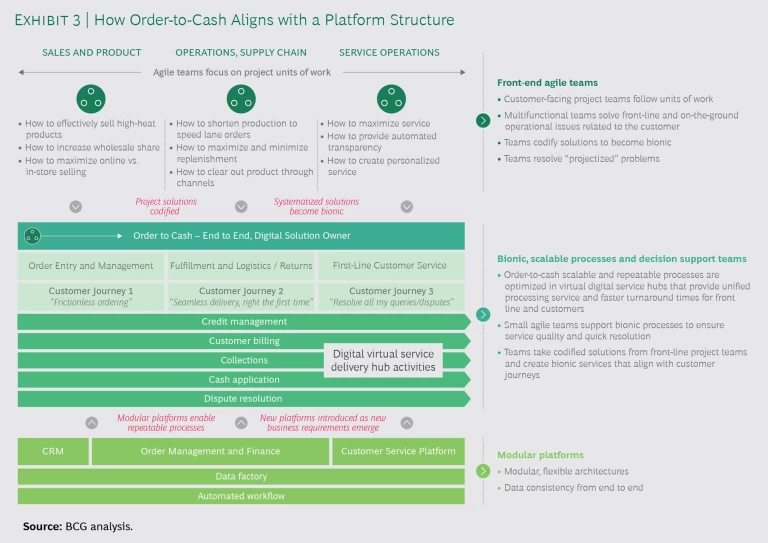

The future of organizations is clearly bionic. Companies must learn to unleash the potential of humans and machines through a combination of modular data and technology architecture, scalable processes and decision support teams, and the use of agile front-end teams. The state-of-the-art O2C platform is a digitally enabled bionic process. (See Exhibit 3.) At the front end, multifunction teams work with customers to develop frictionless solutions and ensure a seamless experience. Underpinning the front end are agile teams that use digital applications and end-to-end processes to serve as the factory for O2C services. Supporting all are a modular infrastructure and applications in an ecosystem that can rapidly evolve to meet changing customer and organizational requirements.

O2C platforms can resolve many of the pain points that companies experience. They’re client facing; they interact with customers to deliver value, with machine learning and AI processes that identify the common challenges and scaled solutions that drive synergies and learning while incubating solutions to minimize risk. And their modular data and technology architectures drive quicker deployment of new solutions.

Integration is key to conquering complexity. An O2C platform must be able to adapt by incorporating new technologies as fresh solutions to customer needs become available. That’s why the platform’s technology is important. It’s critical for companies to work with open technology that can be easily linked through APIs and readily accessed through web services. Connections, in turn, become richer, with data moving in both directions. The integration of data streams opens up opportunities to manage workflows differently and creates greater transparency for upstream and downstream users.

Optimizing an O2C process by deploying a platform involves three measurable goals:

- Reduce the process cost per order, as measured by the number of orders per employee or the labor cost per order, as well as the share of automated transactions.

- Reduce the number of days’ sales outstanding, by shrinking the process time and the dispute-resolution cycle and avoiding mistakes in activities like pricing, delivery, and invoicing.

- Increase customer satisfaction, by reducing the deductions per order or invoice and increasing the payments received on time and in full.

O2C Platform Design Rules

Companies can create an effective order-to-cash platform by following three simple imperatives: integration, customer centricity, and shared responsibility.

Integration. The platform must synchronize with technological solutions both internally and externally. Integrating systems is critical to ensure that data is shared. By connecting systems, companies can create hybrid platforms on which the organization’s applications and those of third parties can run in tandem. That will create a boundaryless ecosystem that optimizes process performance. For example, a leading industrial goods manufacturer used disparate ERP applications in different countries because many of its B2B customers and distributors had global footprints. It migrated to a universal O2C platform that connected its CRM and mobile pricing system to its order management, fulfillment, credit limit, and accounts receivable modules. As a result, it was able to minimize the number of orders that go into limbo, improve customer self-service, reduce inbound calls, and reduce cycle time by 40%, increasing the speed at which the company can recognize revenues.

Customer Centricity. An effective O2C platform must be programmed around the interoperability between commercial and scalable processing activities, technologies, and customers. Blending the process with technology is critical to achieving customer centricity. For instance, a global pharmaceuticals manufacturer established a one-click portal where customers can log on to reorder products. The portal ensures smooth self-service ordering and provides real-time data about order status, delivery schedules, and payment requirements. It has increased the manufacturer’s customer satisfaction scores dramatically and reduced the need for manual service intervention to fulfill orders.

Shared Responsibility. When several functions must work in conjunction, it’s necessary to be crystal clear about who’s responsible for each part of the platform. Should the platform break down, for instance, it’s important to know who will be responsible for assisting the customer. Companies can gain clarity on who should do what by developing and working through scenarios. Standards are still evolving, so it’s best to follow the advice of the technology partner building the platform.

A global professional services firm recognized that its O2C process was fragmented. It didn’t help that the resulting multiplicity of interactions with every client caused confusion. Appointing an O2C process owner with responsibilities across functions immediately helped optimize the process. The proportion of faulty orders processed fell to less than 2%, a major improvement, and the flow-through of orders speeded up.

The Challenges of a Platform Rollout

Companies face several major challenges when planning an order-to-cash platform rollout. First, there needs to be buy-in from all relevant functions about the value the platform will create. All too often the process becomes a tug-of-war among the finance, supply chain, distribution, sales, and customer service functions. That’s why appointing an O2C process owner, who will bind it together, is necessary.

Second, companies must design the end-to-end service and digital solutions so that everyone benefits from tangible value creation. If the focus is exclusively on the customer experience when prices are quoted and does not address how the company analyzes the credit limits and creditworthiness of customers, gets the right contracts in place, and ensures that sales adheres to pricing guidelines, there is bound to be a bullwhip effect on the finance and customer dispute functions.

Third, reneging on the capital investment for an O2C solution is a problem in many organizations. There may not be an immediate payback from the investment; the revenue boost, the working capital reduction, and the improvement in customer experience happen only over time. Our studies show that, in the long run, companies stand to gain by way of revenues that are ten times greater than their investment in an O2C platform.

Fourth, many companies defer the O2C transformation process because they mistakenly believe that they will need to upgrade their entire ERP solution. That’s an outdated paradigm; today’s digital solutions and bolt-on applications can operate with legacy ERP systems. Moreover, they will still be usable if and when the company does decide to invest in a new ERP system.

Finally, it’s important for companies to understand that transforming the O2C process isn’t simple; it takes a lot of effort and resources to train internal teams cross-functionally. Companies that invest in change management in advance of the transformation will find it easier.

Although O2C platforms offer a range of solutions that supports the entire process, that doesn’t necessarily mean that companies have to implement all of them at once. Most companies find it daunting to replace the entire process in one fell swoop. They do well to start with the most significant needs, implement the solutions that address them, and expand the platform later.

Companies can start by asking themselves, “Where are our biggest pain points, and how can they be tackled?” A flexible approach not only enables solutions to be integrated but also allows them to be retrofitted into the existing infrastructure. Thus, the creation of a next-generation O2C process need not be a big bang; it can be modular, agile, and flexible, so that it meets the company’s needs both now and over time.

The Tangible Benefits of O2C

Done right, an order-to-cash transformation can make quite an impact. Our studies show that companies can reap the following benefits:

- A 1% to 3% increase in sales revenue, because the O2C platform helps increase the availability of goods, allows dynamic pricing and promotions, enables greater precision in blocking frauds, and boosts the capacity of sales reps.

- A 15% to 30% savings in cost, owing to automated order creation and the resulting drop in back-office effort, digital invoicing and cash application, fewer disputes that need resolution, and fewer penalties for late or incomplete fulfillment of orders.

- Up to 30% shorter days sales outstanding, thanks to appropriate stock levels, lower process lead times, less revenue locked up in collections, and gentle, proactive dunning.

- A major boost in customer satisfaction, thanks to a simplified order experience, real-time complaint resolution, fewer disputed invoices, and greater process transparency.

- Increased employee satisfaction, because work is less repetitive, more time is available for strategic tasks, complexity is reduced, and a spirit of innovation is evident.

Companies should keep in mind that in addition to bringing more efficient use of resources, healthier cashflows, and process transparency, optimization of O2C can turn an administrative process into a business driver. When end-to-end process data is integrated, new insights are created. And that can drive better service. For instance, data may provide insights about the creditworthiness of new customers and changes in the creditworthiness of existing clients. Low-risk customers can be given different payment arrangements than high-risk customers.

Integrated data can also help companies increase customer satisfaction. A customer who always pays on time but suddenly fails to pay may not need a strongly worded reminder; it may be preferable to approach the customer through the account manager, ascertain if the lapse is due to a misunderstanding, and let the customer pay as soon as possible. The customer then feels happy about the supplier’s empathy. Kicking off such a virtuous cycle of customer satisfaction would be impossible without the development and deployment of an end-to-end O2C platform.