The retail industry is rife with digital innovation and organizational change. Consumers— drawn to the ease and convenience of always being just a click away from user reviews, comparison pricing, and endless aisles—have come to rely on online and mobile shopping. It is no surprise that traditional retailers are bringing digital channels into stores to tap those consumer preferences. At the same time, historically pure-play online retailers are increasingly opening brick-and-mortar shops in high-profile locations, seeking to capitalize on the tangible experiences that cannot be delivered through a device. Both traditional stores and pure-play online retailers are working toward the same goal: to create a highly personalized, consistent, and integrated shopping experience across all points of contact between retailers and customers.

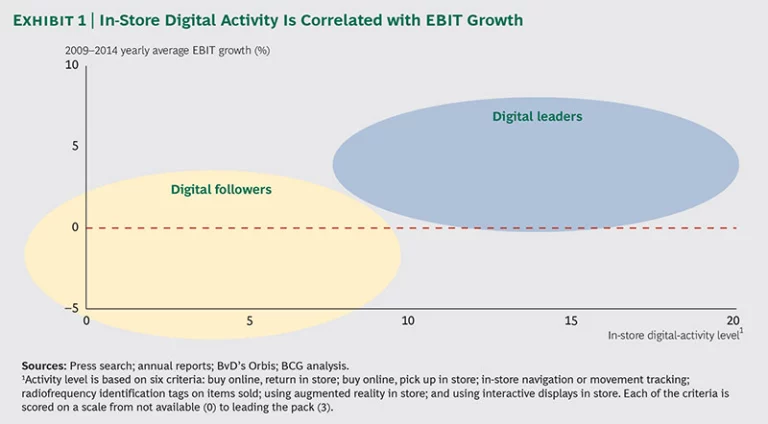

Because so many traditional retailers have begun to experiment with digital technologies in stores, The Boston Consulting Group examined how companies with advanced digital strategies are performing relative to their peers. BCG’s analysis indicates that brick-and-mortar retailers that implement digital technologies in stores—both to enhance the customer experience and to improve employee performance—tend to outperform retailers that have not yet implemented a digital strategy. In our survey of 25 fashion retailers based in Europe and North America, companies that are leaders of digital implementation in stores showed stronger EBIT growth than digital followers. (See Exhibit 1.) We define leaders as those that have fully integrated digital technologies into their daily activities, pursued a multichannel strategy, developed a data analytics capability, and integrated digital into the in-store experience.

As the pace of innovation accelerates and as digital technologies influence the buying decisions of a growing percentage of customers, retailers need to act. Our research shows that even a modest investment can deliver rewards, particularly as digital solutions—often powered by third-party developers—become increasingly available and financially accessible. The truly cutting-edge innovations may be most appropriate for companies with the resources, customers, and culture to support the required investment, but affordable solutions are now available to retailers of all sizes that seek to launch an in-store digital strategy.

The Rise of In-Store Digital Strategies

Just a few years ago, the leading technologies in stores were point-of-sale systems and bar code scanners; now, new digital solutions are popping up everywhere. In-store technologies can increase employees’ effectiveness by providing data at the moment it is needed to execute a task (whether that is interacting with a customer on the sales floor or managing inventory in the back). Employees of companies such as The Container Store and Tesco are carrying or wearing in-store solutions to assist with work flow management, merchandising, and day-to-day tactical management of the sales floor.

For the customer, digital technologies can integrate online and off-line sales channels and drive a seamless shopping experience. In-store touch screens that provide customers with “endless aisles” (that is, the full range of available products); “magic mirrors” that offer product information, recommendations, and virtual fittings; “clienteling” (an approach by which well-informed store staff using data on individual customers’ preferences and buying habits create a customized in-store experience)—all of these in-store digital solutions are transforming customers’ omnichannel-shopping experiences. (See Exhibit 2.)

Four Enablers of In-Store Digital Success

Although many companies have established a digital presence—a website, some digital advertising, a presence in social media—only a small percentage are truly tapping the potential of an omnichannel strategy. To enable maximum digital impact in stores, retailers must first drive organizational change in four key dimensions.

R&D needs to be taken seriously to drive digital innovation. To make a significant impact with in-store digital strategies, retailers need to budget for digital innovation. Devoting funds to digital ventures signals that the company sanctifies initiatives that might otherwise be deemed too risky or tangential. Digital-innovation strategies are typically not prioritized within the overall IT-investment budget. For most retailers, IT funds are limited and spent primarily on maintenance and upgrades of backbone technology systems that support merchandise and supply chain functions. R&D need not be a major investment—even a small R&D budget of $100,000 annually should be enough to infuse digital experimentation into a re-

tailer’s daily operations.

Although pure-play online retailers such as Amazon.com and Zalando have taken calculated risks and embraced the notion of “failing fast,” physical retailers are accustomed to a much more conservative culture. But competing in digital requires a new mind-set. Some of the major players, such as Nordstrom and John Lewis, are leading the way through bold experimentation. For example, Nordstrom announced in 2014 that 30 percent of its capital expenditures would be in technology. It has established an innovation lab in Seattle to develop and test new products on a weekly basis; invested in e-commerce companies such as Bonobos, Trunk Club, and HauteLook to merge the online and in-store shopping experiences; and implemented interactive touch screens in fitting rooms, to name just a few initiatives.

Set up new organizational models to manage innovation. Developing digital solutions in stores to enhance the customer experience should not be viewed as an IT responsibility. The most successful models of innovation merge IT teams, which should understand the digital-technology landscape, with retail teams that know the operational challenges and customer base. (See the sidebar “Digital Innovation in Action.”) Some successful models of collaboration are as follows:

- Store Employee Teams. In-store associates, supported by IT, are given the responsibility to explore new technologies that can enhance the retail experience. These experiments may focus on behind-the-scenes operational efficiency or customer-facing digital initiatives.

- Business and IT Teams. Lean start-up-like teams inside the company are formed to develop close-to-customer innovations. These teams can focus on quick wins by staying highly responsive to customer needs.

- Innovation Labs. On-site or off-site innovation labs can help companies discover and explore digital strategies that will shape the future of retail. Some companies looking to lead the digital revolution—such as Walmart, Target, and Kohls—have set up off-site innovation labs in the epicenter of global technology innovation: Silicon Valley. Others—such as Staples, Nordstrom, and Sears—stay closer to home, at headquarters or in nearby urban environments with access to creative talent.

- A Portfolio of Start-Up Companies. To get in on the ground floor with the latest technologies, retailers need to think creatively about partnering with start-ups. Some retailers are funding start-ups (much as private equity firms do). Others are allowing start-ups to run pilot projects in the store. Kroger, for instance, recently announced a pilot program with start-up Strap that brings wearable analytics technology into the store. Some retailers are bringing start-ups in-house (serving, in effect, as incubators), providing a base of operations for innovation.

- An Ecosystem of Solution and Content Providers. Retailers that want to ramp up their digital environments quickly and efficiently have partnered with third-party players including retail-technology start-ups, established technology giants (such as eBay and Google), and universities. This option is especially beneficial for retailers lacking a core strength in digital capabilities and smaller players with a highly digital-aware customer base.

Digital Innovation in Action

These five retailers are among those that have pioneered successful models of digital innovation in stores.

Sonae’s Store-Employee Teams. Portugal’s largest retailer, Sonae, invests more than €70 million annually in R&D and innovation. More than 500 employees participate in innovation activities such as ShineOn, through which employees from various otherwise-siloed functions address real-world problems and propose solutions to the executive board. The company’s best-practice forums, held every two months, also help employees to share knowledge and streamline processes. In addition, teams of employees are recognized with innovation awards each year.

Nordstrom’s Business and IT Teams. Nordstrom has created lean, start-up-like teams that work on close-to-customer innovations. The team selects a one-week pilot project, creates a prototype, tests it on users in stores, and makes changes on the fly. The team can adapt technologies to consumers’ needs in real time, benefiting from immediate feedback.

The Home Depot’s Off-Site Innovation Lab. The Home Depot opened a 6,500-square-foot innovation center on the campus of the Georgia Institute of Technology, enabling the company to tap into nearby engineering talent. The university-based lab focuses on home automation technologies, as well as in-store technologies such as self-service kiosks and point-of-sale devices.

John Lewis’s Portfolio of Start-Up Companies. UK retailer John Lewis launched a technology incubator called JLAB that encourages businesses to develop new products and services in four categories: enhancing the company’s knowledge of its customers (and vice versa), improving the retail experience, simplifying customers’ lives, and a category called “surprise us,” where anything goes. At the end of JLAB, one winning business receives an investment of up to £100,000 and the opportunity to supply its solution to John Lewis.

Walgreens’ Ecosystem of Solution and Content Providers. Walgreens has partnered with Google’s Project Tango and the indoor-mapping start-up Aisle411 to pioneer an in-store 3-D navigation app that helps customers find products on the shelves. Employees can also use the app to see which products are in demand or difficult to locate, helping retailers to better manage inventory, restocking, and product placement.

Develop an information architecture that provides meaningful insights into customer behavior. Retailers, as they delve more deeply into digital commerce, have the potential to unlock a wealth of data on customer behavior, transactions, and consumption patterns. By providing valuable information on the end-to-end customer journey (acquired from physical stores, supply chain vendors, and banks), this data can yield insights that enable retailers to improve the customer experience, build loyalty, and enhance operational efficiency. Basic principles for information architecture include the following:

- Build nimble digital frameworks. Legacy systems contain immensely valuable data, but they cannot be upgraded easily. Where possible, decouple new digital services related to customers and vendors from historical back-office systems. Software as a service and unified communication tools can be used for this purpose.

- Invest in master data. High-value, core information on customers and products is essential to delivering a personalized shopping experience. The IT team must invest time and resources to mine high-quality master data that can help guide critical business decisions.

- Create a “data lake.” Structured and unstructured data can be hosted in a single repository—the data lake. This solution makes all data available to everyone within an organization, whether the data resides in a front-end platform or in the back offices.

- Integrate data to leverage its value. To capitalize on the value of data, companies must analyze performance in marketing, sales, and service, then use this combined information to support engagement with the customer (through cross-selling, up-selling, and more).

Construct IT systems with a stable back end and flexible front end for agile development. To maximize the impact of digital technologies, retailers need to provide a stable back end, with solid support for supply chain, merchandise, and financial transactions. On that back end, disparate platforms, applications, and information architectures—covering a range of technologies, from operations to supply chain—should be brought together in a consolidated IT architecture. Most retailers turn to enterprise-resource-planning systems, such as those offered by Oracle, JDA Software Group, Microsoft, and SAP, to aggregate and consolidate data sources and facilitate meaningful insights.

Retailers must also build or buy a flexible front-end technology platform to allow for the following:

- Agile Development. Retailers should be prepared to deliver the minimal viable product to market quickly, adapt, and iterate on the fly in response to customer feedback.

- A/B Testing. Retailers should implement A/B testing where possible; that is, test different versions of products side by side, analyze customers’ responses, and use the findings to increase sales.

- Trial and Error. Retailers that test and refine products continuously create rich opportunities to discover what does and doesn’t work with customers. Walmart discovered this with its Scan & Go app, which was implemented in 200 stores and then scrapped; along the way, the retailer discovered applications for electronic receipts, leading to the development of its Savings Catcher price-comparison app, which has been rolled out nationally.

- Scaling Up. New concepts can be tested in select stores. If those concepts are poorly received by customers, companies absorb the lessons learned and move on. If, however, pilots prove successful, companies can transfer these new concepts to the IT team and scale up rapidly.

Setting a Course

Retailers can strengthen their connection with customers by creating unique in-store and omnichannel digital experiences and improving operational efficiency for employees, but these initiatives have to be rock solid in terms of features. The digital-retail journey is already littered with canceled programs, pared-down features, scrapped pilots and prototypes, and lessons learned. Failed experiments are not necessarily a bad thing—companies that are given the freedom to fail are likely taking the kinds of risks that will ultimately lead to success. But retailers must beware of simply rushing at the next me-too product or overwhelming customers with too many digital options, rather than building an in-store digital strategy that speaks directly to their customers’ needs.

As traditional retailers push deeper into digital territory and reinvent in-store models, they must cultivate innovation at the core of their enterprise. The bar is being raised every year by pure-play online retailers, technology companies, and start-ups that have blazed the trail in e-commerce. Traditional retailers must innovate to stay relevant—not for the sake of bells and whistles but to improve internal operations and help customers shop faster and smarter.