Published monthly, the COVID-19 Australian Consumer Sentiment Snapshot highlights insights drawn from a BCG consumer survey that we execute every four weeks with coding and sampling partner, Dynata. Our research is designed to uncover consumer perceptions, attitudes, and behaviour and spending changes related to COVID-19 as they evolve. This snapshot presents insights from round 3 of survey completed in the Australian market and other countries from July 2nd to July 5th, 2020. We have also drawn comparisons with research completed in round 1 from April 20th to April 24th, 2020 and round 2 from May 21st to May 25th and supplemented the quantitative survey with a series of qualitative interviews.

COVID-19 infections continue to rise globally but decreased spread in some countries has led to easing restrictions and a much-needed boost in consumer confidence. In Australia, optimism about the future has risen marginally since our last survey and consumers have reported a slight return to a feeling of normality.

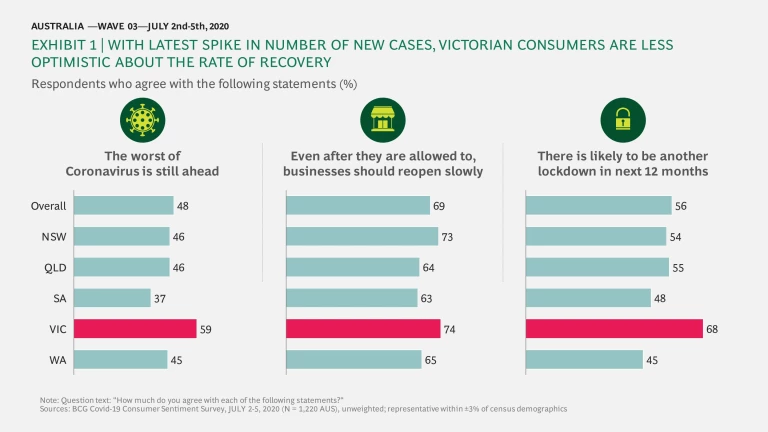

In Australia, a new turn in the COVID-19 curve has seen Victoria grappling with a growth in infection rates. Metropolitan Melbourne has gone into lockdown, New South Wales has closed its border with Victoria, and other states have banned visitors from the state. Victorian consumers feel more at risk compared to those in other Australian states. Perhaps unsurprisingly they are also more pessimistic about the chance of future lockdowns and are cautious about the rate at which the easing of restrictions should occur [See Exhibit 1].

Fear of virus continues, financial concerns linger

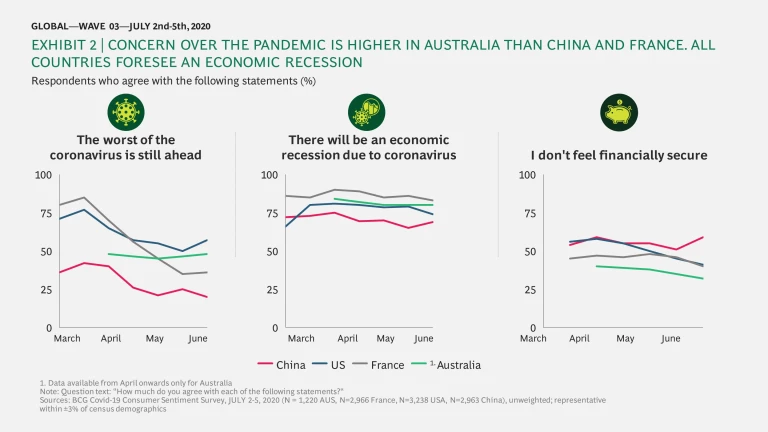

China and France are showing the greatest uptick in consumer confidence, and notwithstanding the pessimistic outlook from Victorian consumers, Australian consumer confidence overall is positive, although flat compared to our previous survey results (May 21st to 26th), with 48% of consumers saying the worst of COVID-19 is still to come – a marginal 3 ppt increase. 56% of Australian consumers predict that there could be another lockdown in the next 12 months, while more than two thirds of Victorians anticipated the lockdown that occurred shortly after the survey period.

At a macro level, concerns over the economy remain, and more than one third of Australian consumers continue to feel insecure about their finances, although they feel more financially secure than consumers in other markets. For example, despite the early easing of restrictions in China, Chinese consumers there are more worried about financial security than they were a month ago [See Exhibit 2].

Small steps towards normality

Aside from metropolitan Melbourne’s lockdown, Australia has been progressively opening schools and businesses, allowing consumers’ lives to return to some normality. We have seen an 8 ppt drop in the number of consumers who said that their daily lifestyle is different today due to COVID-19, from 68% in our previous survey results to 60% in this survey results, suggesting a marginal return to pre-COVID normality. Reopening has also stimulated a slight positive increase in optimism, with 35% of consumers now saying that their spending habits will quickly return to normal compared to 30% in previous survey results.

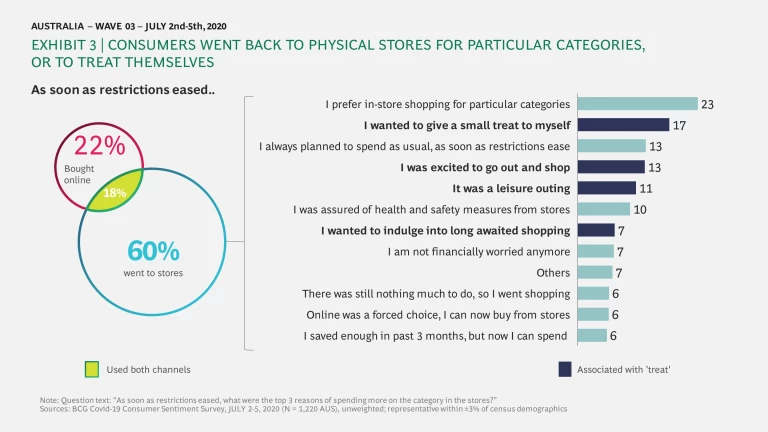

As restrictions eased around the Australia, consumers stepped out and returned to in-store shopping, often to treat themselves, or for entertainment. Sixty-one percent say they preferred physical stores, whereas 22% preferred online channels to make their purchases. Eighteen percent of consumers expressed no preference for either channel over the other. Consumers who visited stores did so for purchases in four main categories: groceries (36%), eating out at restaurants (25%), apparel purchases (12%) and home decor and maintenance product purchases (11%). However, consumers remain in a ‘wait and watch’ mode; only 13% of consumers claimed that this was a return to their normal shopping behaviour [See Exhibit 3].

For better or for worse: COVID-19 will drive shifting lifestyle habits

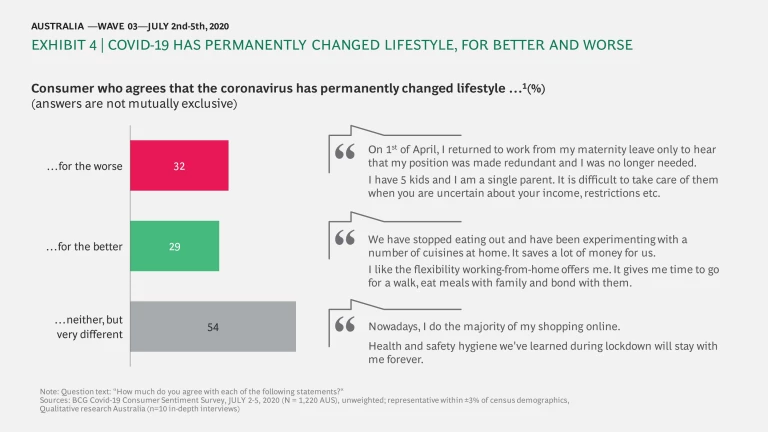

Many consumers believe that COVID-19 has permanently changed their lifestyle, with 29% saying it has changed for the better [See Exhibit 4]. New working arrangements seem to be the most profound positive influence; our research reveals that 52% of consumers are embracing working from home. A Gen-Z environment-assessment analyst from NSW told us, “We are a family of six and we used to be a full-house only on Sundays. The rest of the week, we were either working or partying with our friends. Lockdown has pushed all of us to spend more time together. We all accommodate each other’s working style to effectively manage working from home. Even when the situation is back to normal, I would like to work from home at least two days a week.”

Consumers welcomed the virtual world that helped them stay connected with friends, family and colleagues. They are also embracing digital to equip themselves with knowledge related to health and well-being and have enjoyed using this knowledge to cook more meals at home.

At the same time, 32% of consumers say their lifestyle has changed for the worse, with job losses amongst the reasons for this.

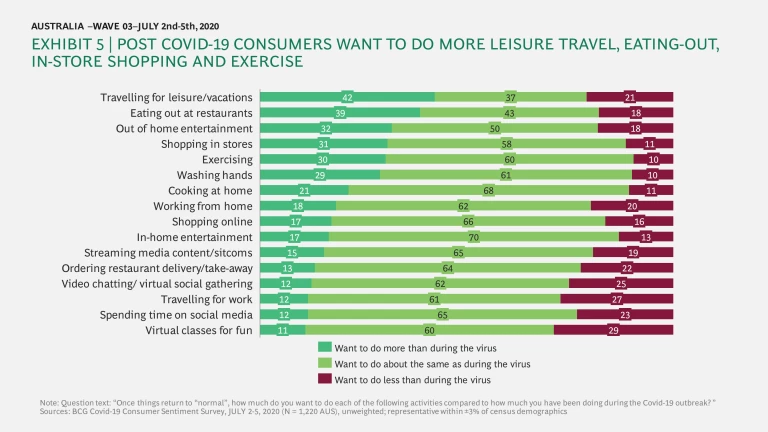

As consumers try to carve their path forward, they plan to embrace a mix of old and new habits [Refer Exhibit 5]. It will come as no surprise that consumers are excited to go back to restaurants and to meet family and friends in person. In fact, 39% of consumers want to eat out more in the coming month than they did during lockdown.

Forty-two percent of consumers want to do more leisure travel post COVID-19. With the COVID-19 situation in flux in many countries, consumers’ preference is to either travel within driving distance of their home (46%) or further, but still within Australia (32%). A retired couple residing in Sydney told us, “We don’t have much to do. If this had been a normal situation, we would have gone to Melbourne to visit our son between July to September and then to Singapore for three months to visit our other son. But in this situation, we can’t even step out.”

When considering what consumers want to do less of after COVID-19, virtual classes for fun (29%), travelling for work (27%) and virtual social gatherings (25%) are the activities consumers are most eager to do away with.

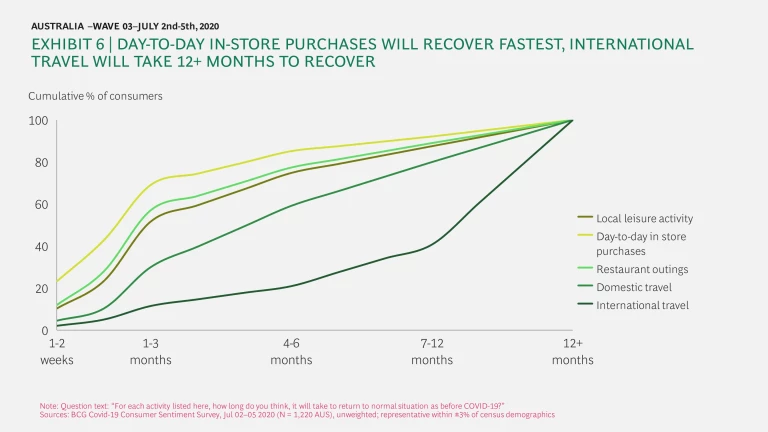

While consumers are eager to travel and dine out, some activities will take longer to become part of their usual routine again. Consumers expect normal in-store shopping behaviour, local leisure activities and eating out at restaurants to resume within a month. They think domestic travel is likely to take another four to six months to return to normal, and for international travel to take the longer, more than 12 months, according to consumers [Refer Exhibit 6].

Non-essentials in the firing line

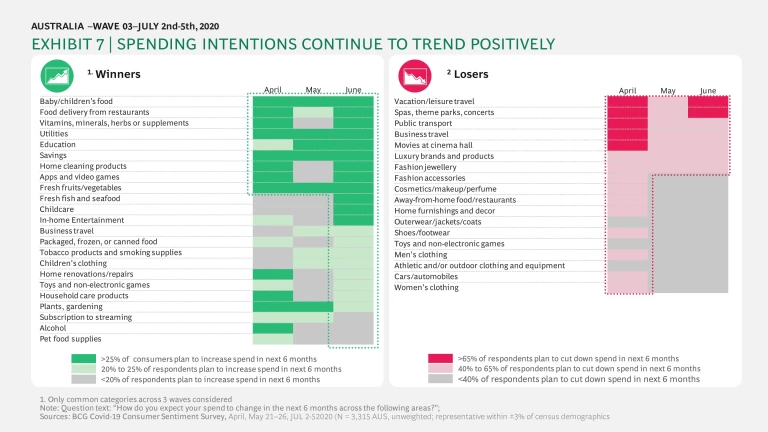

COVID-19 has also made consumers rethink which products they are spending their money on. Consumers claim that COVID-19 made them realise that basic and simple products that do the job are all they need; premium and luxury products are, in their view, unnecessary. This resonates with what they say about their spending plans in next six months: consumers in Australia show no sign of cutting spending on essentials but do express an intention to cut down on non-essentials [Refer Exhibit 7].

Activities that consumers are doing less will have a direct impact on their spending intentions. Leisure travel, out-of-home entertainment (such as movies and theatres), purchasing luxury brands and products, and visits to spas and theme parks are expected to drop off consumers’ spending plans in the near future. As consumers are doing more cooking, cleaning, home repairs and maintenance, in-home entertainment and looking after children, they intend to spend on related categories such as food and groceries, apps and video games, household cleaning and home repair products, children’s food and utilities over the next six months.

A Gen-X female finance manager told us, “I used to buy stuff even if I didn’t need it. Impulse shopping was very frequent. For example, every winter, I bought at least two new jumpers even when I didn’t need them. But this year, I am not going out anywhere. It also made me realise you can live life with simple stuff. I am probably going to get rid of impulse shopping forever. It won’t impact our spend on food and groceries whatsoever. In fact, we have been trying many new recipes and order new ingredients every week online.”

Shift in the way consumers shop

Similar to other downturns, we are seeing more pronounced ‘trading up’ and ‘trading down’ behaviours. Trading up is a willingness to spend more on a select number of items, usually ‘to treat myself’, or for quality or other valued attributes. Trading down is a desire to spend less where the consumer perceives the differentiation is small or the trade off less.

Our research suggested consumers are trading down and seeking value on products such as packaged food, alcohol, apparel & fashion and cosmetics. For other categories such as personal care, fresh food and medicines they are willing to trade up and spend more. They also feel that trading up is a way to support local businesses and sustainable causes.

Consumers’ decision to buy cheaper or more affordable brands has pushed them to experiment with the brands they wouldn’t usually buy. Approximately 50% of consumers tried at least one new brand during COVID-19. Experimentation with new brands was lowest in cosmetics (23%) and highest in packaged food (75%).

We also observed a continued willingness to support the Australian economy by buying locally grown brands: with a consumer preference to buy local increased to 42% in this survey from 37% in the previous survey. Products that promote health and wellbeing also take precedence for trading up behaviours.

An IT professional from Melbourne told us, “I have stopped going to popular coffee chains to buy a coffee. Instead, I visit local cafes to buy my coffee.” And a student from Queensland said, “Before COVID-19, I used to buy Chinese goods as they were always wallet-friendly. But since COVID-19, no matter how expensive Australian brands are, I buy them to support local people. That is the only way our local economy will flourish.”

Digital consumer segments emerge - and evolve

During the pandemic we have seen an acceleration in online purchasing behaviour all over the world and across all demographics.

Nine percent of consumers made their first digital purchase during the pandemic. In Australia, 33% of consumers claimed that they shopped online more than they had before COVID-19, while 28% of consumers said that they bought at least one new category online during COVID-19.

Consumers told us that ease and convenience of purchase, and the ability to get a good deal drove the uptick in online purchasing during COVID-19. Consumers were impressed by aggressive online sales from brands like Nike and Adidas; Kathmandu delivering orders within a day; and Woolworth’s product availability online. In contrast, consumers were often disappointed with customer support offered when they wanted to exchange or return products, or the seamlessness of web chat.

Our qualitative research explored consumers’ experiences online. For one baby boomer, it was an experience which made him realise that he no longer needed to waste energy carrying groceries all the way from the store to home. Essential items are just a click away. In contrast, for another baby boomer, the quality of products and shipment charges has made him question whether he will order online in the future.

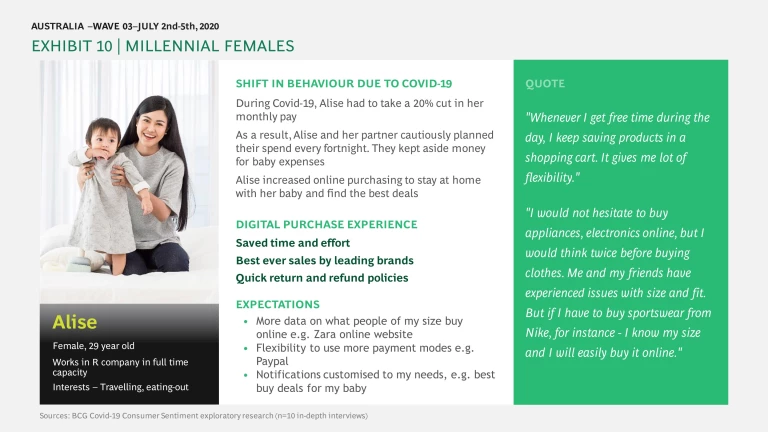

A millennial female with a one-year-old child shared several pain-points of buying online. She said, “I bought $80 shoes two months before my baby’s birthday. As his birthday got closer, his shoes still hadn’t arrived, so I called customer care. After two hours of waiting, I was told the shoes had been delivered already. But I never got them. They didn’t even issue a refund. This incident took place in April. They still haven’t returned my money.” A tech savvy Gen-X male shared a contrasting experience of researching and buying office furniture online. He is so satisfied with the consumer-friendly digital interface he experienced that it tempted him to think about changing other furniture in the house. The cutting-edge technology, he was able to visualise the furniture in his rooms. The ability to experience a close-to-store world has made him fall in love with online shopping.

It’s certainly a mixed bag of experiences, and age is not the only driving factor. As a result, different consumers have different expectations of companies they shop with. Given the sweeping nature of changes in digital purchases underway, marketers will see unique segments of digital consumers emerge during this pandemic.

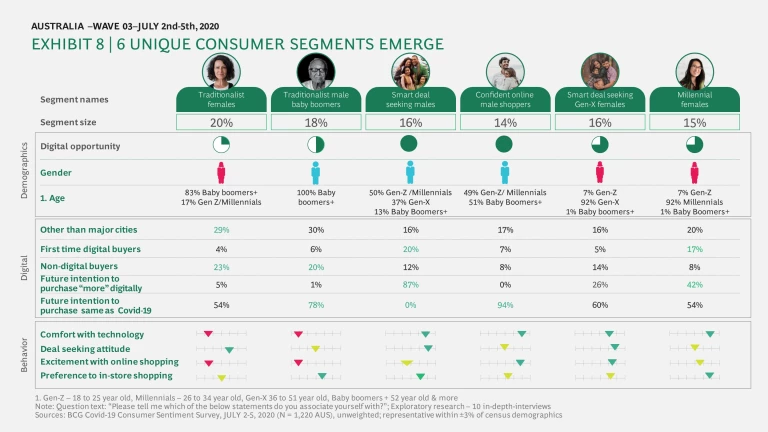

Our research has uncovered six unique segments based on their digital purchasing habits and demographics. Consumers in each segment have clear common characteristics and display their own usage patterns, lifestyle preferences and evolving online paths. [Refer Exhibit 8]

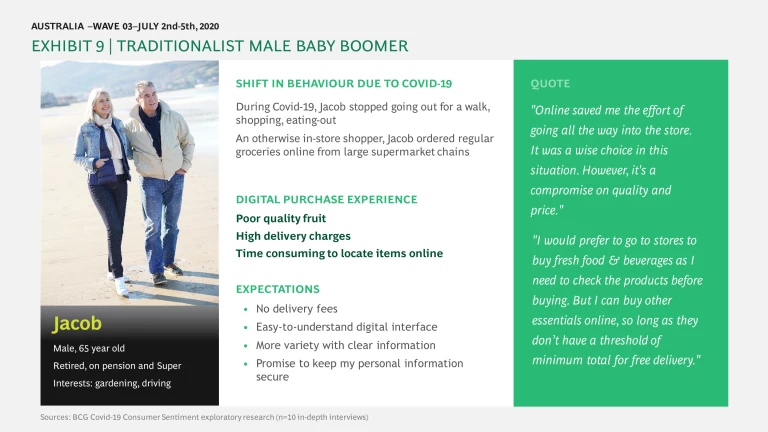

Let’s explore two contrasting consumer profiles. [Refer Exhibits 9 & 10].

Jacob, a traditionalist male baby boomer, told us, “My sons encouraged me not to go out to buy groceries. That’s why I tried the supermarket’s website. However, I had to spend more than $50 to make it a free delivery purchase. The bananas I got online were too ripe to eat. I don’t think I ever want to buy groceries online again.”

A millennial female told us, “I wasn’t planning on changing my work furniture in my home. But to bring in some energy and a positive vibe to the room, I decided to upgrade. I figured out the websites that create a near-to-real virtual world which helped me to buy furniture of the exact dimensions, designs and colours I was looking for. For the first time, I didn’t feel the need to go to the store. I could compare prices on multiple websites sitting at home.”

Each consumer segment has different levels of digital maturity and is likely to see a unique growth pattern in the future. For example, the traditionalist male baby-boomer segment is much more likely to return to in-store shopping for a greater number of product purchases, whereas confident online male shoppers are likely to show stable digital purchasing behaviour across product categories. With an expanding and diversifying base of digital buyers, companies that overlook this shift risk missing out on a rapidly growing channel for marketing, brand influence and engagement.

Looking ahead

Companies in Australia and elsewhere are exploring how to transition their business models to an online environment and are developing new products and engagement models that are likely to endure in the post COVID-19 world. As we move closer towards recovery, there are a number of actions for companies to consider in response to COVID-19:

Adapt creatively with the situation for long-term benefits – While we do see some signs of recovery and improvement in Australia, progress so far has been slow, suggesting that it will be critical for companies to adapt creatively to situations that arise during the recovery period. For example, Accor, a multinational French hotel chain, is partnering with an insurance company to offer instant online medical consultations to customers who fall ill during their hotel stays. We have also seen restaurants in Australia beginning to deliver meal ingredients, while cosmetic chains are providing beauty consultations via video and social media.

Create a sense of security and confidence among the most impacted segments – In Australia, labour market economist Conrad Liveris says women have benefitted from more flexible working practices during the pandemic. When we start looking at flexible working and maintaining the childcare sector, those are real opportunities to support women back into the workforce longer term. "Flexible work and working from home were already increasing but now we have an evidence base that all of the things we thought could work, actually can.”

Shift to digital is profound, but not for all – The move to online purchasing was a forced shift for some consumers and an ongoing habit for many. While a high proportion of consumers are likely to purchase online more in the future, their online purchasing habits may evolve with the recovery. Distinct consumer cohorts will have similar shopping needs and behaviours. Companies need to analyse customer segments closely to brand, market, innovate and price their products appropriately and gain the right traction online.

Necessity drives invention – Ecommerce platforms lead innovation around attracting consumers post COVID-19. In China, for example, three trends are emerging: the first is evidenced by Xiao Longkang - the hot-pot dining chain – selling through social media livestream and short videos. The chain often employs influencers to interact with customers live, or to produce short videos for consumers to watch, with coupons to complete their purchases. Secondly, group buying allows a groups friends, neighbours, or co-workers to make shared purchases at a group discount. And lastly, one-on-one selling by brand representatives through social media allows companies to engage on new products and promotions with buyers going forward. [Consumer sentiment snapshot 12] There many creative ways businesses can engage with customers, but whatever they decide, they must meet the rapidly evolving needs of consumers to win in the new normal.

The post COVID-19 world offers a profound opportunity for companies to make significant changes to their business models and innovate in ways that improve customer outcomes and increase operational efficiency. Companies that listen to the unique needs of their customers and respond boldly will emerge the winners.