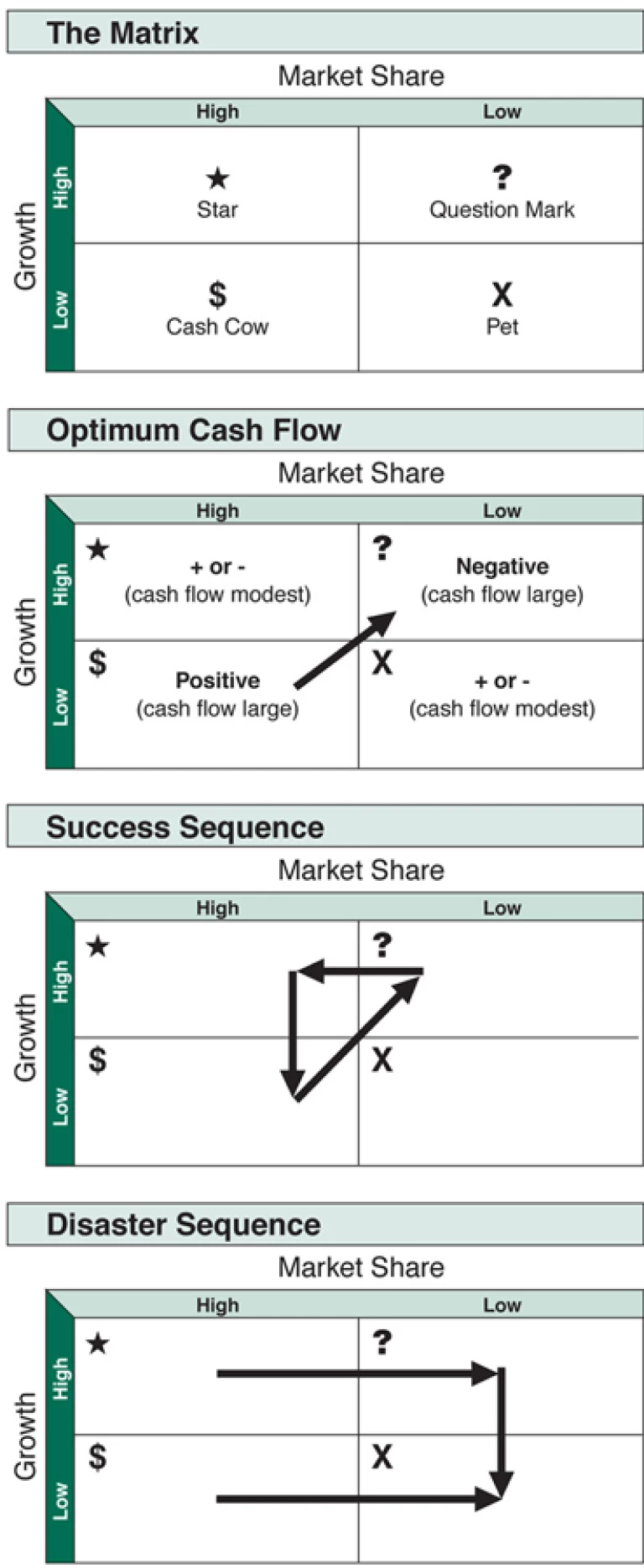

To be successful, a company should have a portfolio of products with different growth rates and different market shares. The portfolio composition is a function of the balance between cash flows. High growth products require cash inputs to grow. Low growth products should generate excess cash. Both kinds are needed simultaneously.

Four rules determine the cash flow of a product.

- Margins and cash generated are a function of market share. High margins and high market share go together. This is a matter of common observation, explained by the experience curve effect.

- Growth requires cash input to finance added assets. The added cash required to hold share is a function of growth rates.

- High market share must be earned or bought. Buying market share requires an additional increment of investment.

- No product market can grow indefinitely. The payoff from growth must come when the growth slows, or it never will. The payoff is cash that cannot be reinvested in that product.

Products with high market share and slow growth are “cash cows.” Characteristically, they generate large amounts of cash, in excess of the reinvestment required to maintain share. This excess need not, and should not, be reinvested in those products. In fact, if the rate of return exceeds the growth rate, the cash cannot be reinvested indefinitely, except by depressing returns.

Products with low market share and slow growth are “pets.” They may show an accounting profit, but the profit must be reinvested to maintain share, leaving no cash throwoff. The product is essentially worthless, except in liquidation.

All products eventually become either cash cows or pets. The value of a product is completely dependent upon obtaining a leading share of its market before the growth slows.

Low market share, high growth products are the “question marks.” They almost always require far more cash than they can generate. If cash is not supplied, they fall behind and die. Even when the cash is supplied, if they only hold their share, they are still pets when the growth stops. The question marks require large added cash investment for market share to be purchased. The low market share, high growth product is a liability unless it becomes a leader. It requires very large cash inputs that it cannot generate itself.

The high share, high growth product is the “star.” It nearly always shows reported profits, but it may or may not generate all of its own cash. If it stays a leader, however, it will become a large cash generator when growth slows and its reinvestment requirements diminish. The star eventually becomes the cash cow, providing high volume, high margin, high stability, security, and cash throwoff for reinvestment elsewhere.

The payoff for leadership is very high indeed, if it is achieved early and maintained until growth slows. Investment in market share during the growth phase can be very attractive, if you have the cash. Growth in market is compounded by growth in share. Increases in share increase the margin. High margin permits higher leverage with equal safety. The resulting profitability permits higher payment of earnings after financing normal growth. The return on investment is enormous.

The need for a portfolio of businesses becomes obvious. Every company needs products in which to invest cash. Every company needs products that generate cash. And every product should eventually be a cash generator; otherwise it is worthless.

Only a diversified company with a balanced portfolio can use its strengths to truly capitalize on its growth opportunities. The balanced portfolio has:

- stars whose high share and high growth assure the future;

- cash cows that supply funds for that future growth; and

- question marks to be converted into stars with the added funds.

Pets are not necessary. They are evidence of failure either to obtain a leadership position during the growth phase, or to get out and cut the losses.