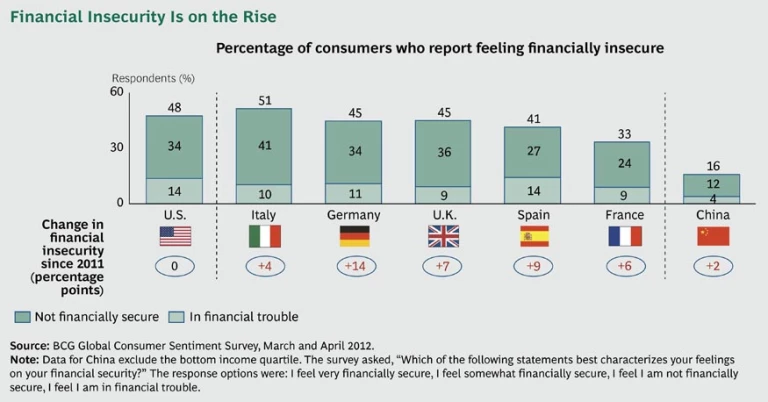

Perceived financial security—a function of a person’s current and projected financial situation—is an important barometer of consumers’ propensity to spend or save. BCG’s latest consumer sentiment research found high and rising levels of financial insecurity in mature markets. Trudging through a recovery that has been slow and at times halting, consumers have had trouble shaking a recession mentality. Many are bracing for a sustained period of weak income growth.

Consumers in developed economies—and in Europe in particular—recognize that this is not a normal downturn, in which short-lived constraint is followed by a period of sustained “normality.” The changes in spending behavior are therefore likely to persist.

Consumers have started to de-emphasize luxury, status, and superfluous possessions in favor of savings, value, health, stability, and family. They are trading down across a wide variety of categories including jewelry, mobile phones, fast food, paper products, luxury goods, hair care products, personal care, household cleaners, toys and games, and sporting goods. There are now only a few categories in which they are still willing to say, “I want the best.” These include food, travel, appliances, and the home.

Consumers in China remain upbeat. A slight rise in financial insecurity since 2011 could be a sign that Chinese consumers are feeling the effects of a slowing economy, but the vast majority are confident about their financial well-being.