For the past few decades, both foreign and domestic companies have scrambled for advantage in Brazil, striving to tap into one of the world’s greatest emerging consumer markets. But, in general, they have not thought far beyond the capital cities and major metropolitan areas. Small cities deep within Brazil’s interior account for more than half of the country’s population. But compared with the rich opportunities in bigger cities, especially along the country’s southern coast, they have been regarded as less affluent, too dispersed, and excessively hard to reach.

This view needs to change fast: the action is moving away from capital and metropolitan cities. Millions of households in interior cities, which we define as those located outside of Brazil’s major metropolitan areas and 26 capital cities, are vaulting from poverty into the ranks of the middle class and the affluent. Interior cities will become the primary drivers of growth at least through the rest of this decade. We project that, by 2020, interior cities will account for nearly half of incremental household consumption, or around $130 billion in added spending. They will be especially important sources of growth in sectors such as financial services, automobiles, and apparel.

Yet most companies are poorly positioned to capture the opportunities in Brazil’s emerging growth zones. Even many companies that are leaders in the country’s most established markets lack the physical retail presence needed to reach the interior. Some 1,400 cities, each with more than 5,000 households, have no supermarkets that belong to Brazil’s top 20 chains, for example. Although banking services are available in every Brazilian municipality, nearly 5,500 cities lack branches dedicated solely to offering premium financial services to wealthy customers—even though that segment is growing much faster in the interior than it is in bigger cities. And although middle-class and affluent families in the interior have nearly 20 percent more disposable income on average than those in capitals and metro areas, 60 interior cities out of 98 with more than 5,000 affluent households have no luxury-cardealership. Furthermore, the ability of companies to penetrate the interior is handicapped by inadequate physical infrastructure and inefficient online-sales capabilities. Companies also require a deeper understanding of the underlying drivers of interior-city consumer behavior, which differ in many ways from those in capitals.

As a result, Brazil’s interior market is vastly underserved in a number of product categories. Middle-class and affluent households in the interior spend 19 percent less on postpaid mobile-telecommunications services and 45 percent less on private education. Affluent households in the interior spend half as much on air travel as their capital- and metro-city counterparts.

To help companies gain a deeper understanding of this increasingly important market, The Boston Consulting Group’s Center for Consumer and Customer Insight surveyed more than 3,600 middle-class and affluent households in both capital and interior cities in all regions of Brazil.

Our research found that even though middle-class and affluent consumers in the interior are every bit as bullish about the future as those in the country’s capitals—and are just as eager to spend their growing incomes on product categories they care about most—companies are neither adequately meeting their needs nor in sync with their purchasing habits. Interior consumers prefer to touch and feel products before buying them, for example. But to get to stores that carry many leading brands, these consumers must travel considerable distances. They travel by air less than their big-city counterparts largely because airports are too far away and flights to desired destinations are too few. And even though interior households use the Internet as heavily as big-city consumers, they are more hesitant about buying goods online because deliveries to the interior take so long and it’s too hard to get refunds.

Companies that capture the prize in Brazil’s increasingly lucrative interior will be those that can best align their retail, operational, and marketing footprints with consumer demand. To succeed, they must gain a clear understanding of the preferences of interior-city consumers and of how to make the entire shopping experience as easy as possible. Companies must also substantially expand their coverage of interior cities and explore innovative, cost-efficient business models that can enable them to reach smaller, more remote concentrations of middle-class and affluent households.

The Rise of Interior-City Consumers

A decade of impressive economic growth and stability has enabled Brazil to emerge as one of the world’s most important consumer markets. Rising incomes and an improving standard of living are fueling this greater consumption: the number of middle-class and affluent households increased by 6 million from 2000 through 2010 alone. By 2020, they will account for 36 percent of Brazilian households, compared with around 29 percent in 2010.

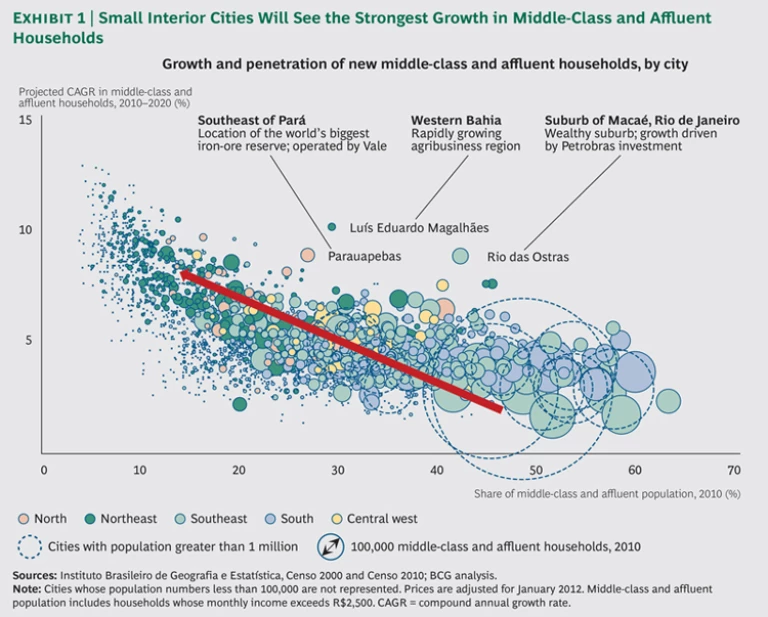

Even though the majority of Brazil’s urban population resides in interior cities, however, wealth until recently was heavily concentrated in the nation’s capital cities and their surrounding metropolitan areas. Now, this prosperity is steadily spreading through the rest of Brazil. Important new consumer clusters—which we define as areas within a 100-kilometer radius and with at least $5 billion in annual household spending—are emerging around cities such as Jequié in south-central Bahia, Açailândia in southwestern Maranhão, and Montes Claros in Minas Gerais. The number of middle-class and affluent families in thousands of small cities across the country is projected to increase by as much as 13 percent annually through 2020, while growth in cities of 1 million or more—most of which are in the south and southeast—is projected at around 2 to 5 percent. (See Exhibit 1.) Interior cities accounted for only 34.7 percent of the nation’s middle-class and affluent households in 2000. By 2010, that ratio had reached 38.4 percent. It is projected to reach 40.5 percent in 2020.

The implications for companies are profound. As BCG has noted in previous research, by 2020, companies will need to have established a footprint in more than 400 cities in order to reach 75 percent of the country’s middle-class and affluent households, compared with 345 cities today—and only 229 in 2000.

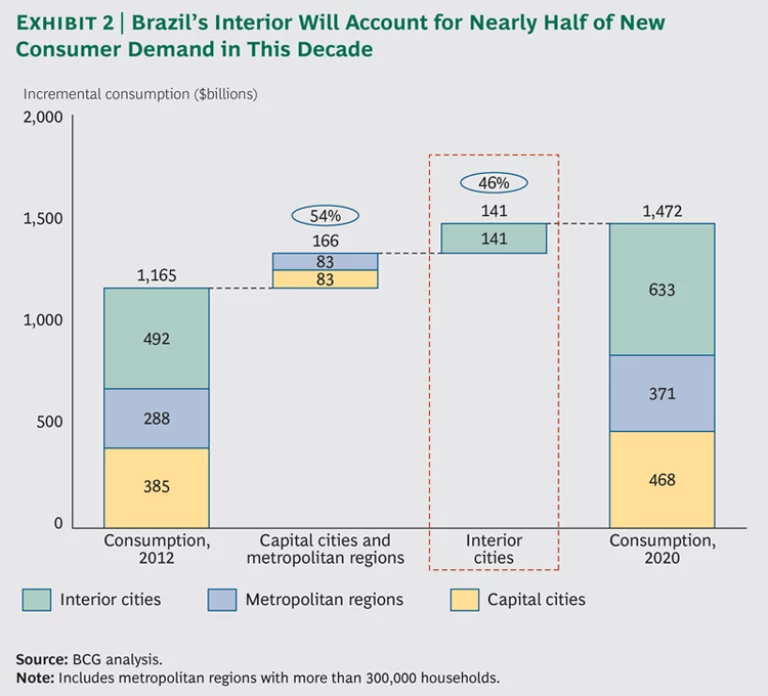

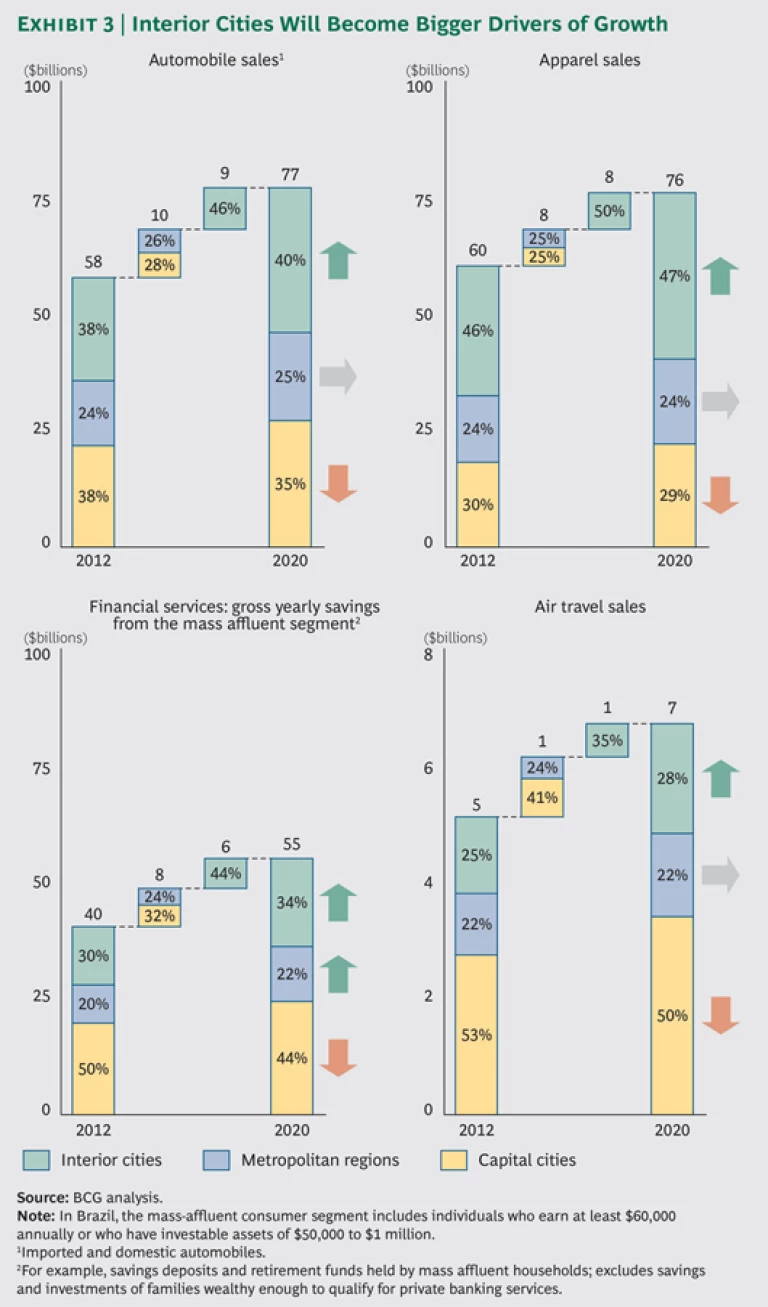

Our research also shows that the consumer market in interior cities is growing just as rapidly and is every bit as attractive as that in Brazil’s bigger cities. Consumption is projected to increase by 30 percent by 2020. Interior cities will account for 46 percent of incremental annual consumption in Brazil by 2020 and will boost their share of national consumption from 26 percent to 28 percent over that period, representing a consumer market of around $633 billion. (See Exhibit 2.) We project that by 2020, interior-city consumers will account for 28 percent of incremental growth in air travel spending, 40 percent in automobiles, and 47 percent in apparel. By then, interior cities should also account for 34 percent of the additional gross savings expected to be invested annually by those consumers that bankers refer to as mass affluent, which in Brazil means individuals who earn more than $60,000 annually or have investable assets of $50,000 to $1 million. (See Exhibit 3.)

Consumers in the interior are also as bullish on the future as those in the rest of Brazil, where levels of optimism are much higher than in developed economies.

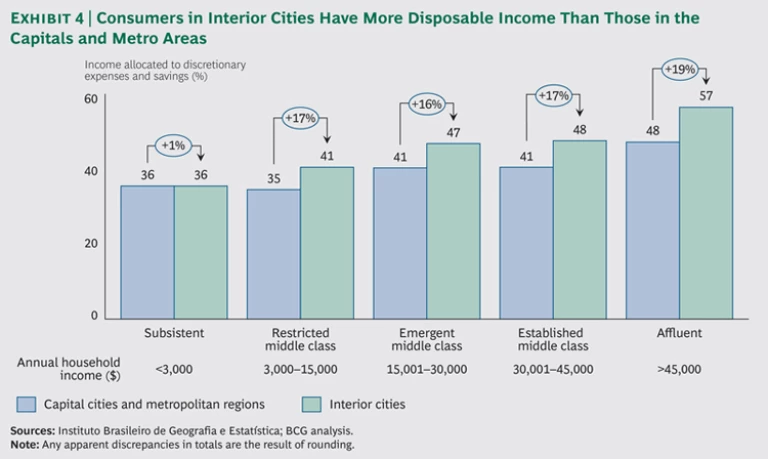

What’s more, interior-city consumers have more disposable income than their counterparts in bigger cities. Around 57 percent of annual household income among the affluent in interior cities is devoted to discretionary expenses and savings, compared with 48 percent in capitals and metro areas. In other words, interior affluent households have 19 percent more discretionary income. Established middle-class households in the interior have around 17 percent more discretionary income. (See Exhibit 4.)

As a result, households in the interior are able to spend more in product categories that they regard as priorities. The average emergent-middle-class household ($15,001 to $30,000 in annual income), for example, spends 6 percent a year more on personal care, 17 percent more on apparel, and 25 percent more on alcoholic beverages. It also saves and invests 38 percent more than families at a similar income level in capital cities and spends significantly more on luxuries such as imported cars, champagne, and jewelry.

When interior consumers were asked, given their income expectations, to name their top spending priorities for the next five years, their responses tracked fairly closely with those of consumers in capitals. The top categories included savings and investments, higher-quality food, home improvement, and private education for their children.

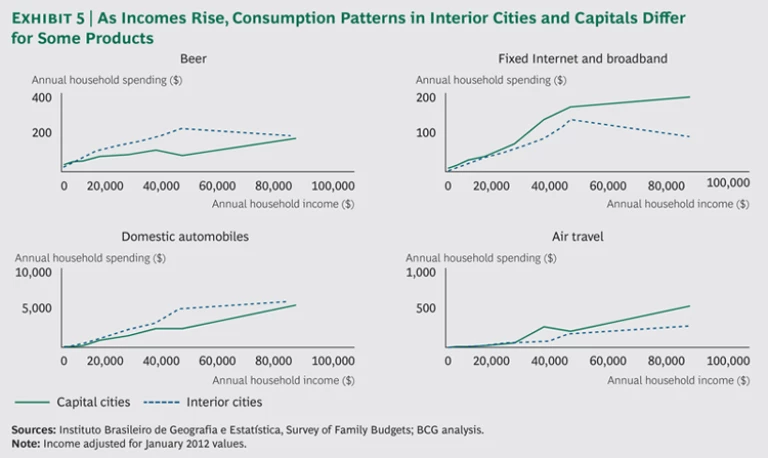

Our research has also found that purchasing patterns of interior households differ from those in capitals. We analyzed consumption curves, which track purchases of certain products as household incomes rise, for more than 200 product categories in Brazil. In capitals, for example, average households tend to increase their spending on automobiles at a steady pace as they become more affluent. Among interior-city households, spending on automobiles increases more drastically when their incomes surpass $20,000 a year and plateaus as their annual incomes approach $50,000. Likewise, spending on fixed-Internet and broadband service by capital city households jumps dramatically when incomes reach $20,000. In the interior, average household spending on Internet services declines moderately after incomes reach $50,000. (See Exhibit 5.)

Physical Reach: A Large Barrier

The biggest obstacle to doing a better job of reaching interior households is restricted physical access. Brick-and-mortar stores are more important in the interior because most consumers still prefer to inspect a product physically before purchasing it. Eighty-one percent of affluent interior consumers said that they prefer to touch a product in a store, compared with 63 percent in capitals. Fifty-two percent of interior households reported that they had made their most recent luxury-item purchase in a store in their city, and 31 percent had purchased it in another city. Others buy such products while traveling abroad. Because there are fewer luxury stores in interior cities—and because members of interior households travel less—consumers come into contact with a smaller selection of brands.

Of course, companies could use digital media to reach more households. Like Brazilians in bigger cities, interior residents are very active online. Ninety-three percent of middle-class and affluent households surveyed cited the Internet as one of their “most frequent sources of information.” Fifty-eight percent spend at least 10 hours a week online—roughly the same percentage as in capitals and metro areas—and 32 percent are online for more than 20 hours. More than 90 percent of interior households reported that they use Facebook and other social-networking platforms.

Interior consumers are also comfortable with the Internet for shopping. Nearly 60 percent said that they trust reviews on social-networking sites from people they know; 52 percent trust companies’ websites, compared with only 40 percent who said that they trust advertisements or retailers’ printed materials. Eighty-three percent said that they often use search engines such as Google when shopping, compared with only 4 percent who reported that they rarely do so. Seventy percent often visit company or product websites, and nearly 60 percent often compare prices online. Furthermore, the vast majority reported that they were happy with product quality, the variety of choices, price competitiveness, and payment options: satisfaction levels range from 67 to 81 percent.

That said, however, interior residents remain far less prone than residents in capital cities to make purchases online. Only 17 percent said that they buy prescription drugs online, compared with 25 percent of respondents in capitals; 29 percent buy personal-care products, compared with 38 percent in capitals; and 38 percent book air travel versus 46 percent in capitals. Interior consumers also buy significantly fewer mobile phones, consumer electronics for the home, sporting goods, household appliances, and computers online.

Why this hesitancy? A major reason is that online services in the interior are less developed than in Brazil’s major cities. Around three-quarters of interior-city consumers surveyed said that the lack of reliable delivery and the difficulties associated with returning a product for a refund are among their biggest reasons for not shopping online. The spotty physical retail presence in interior cities also diminishes online sales: if consumers can’t touch and see a product in a store first, they are less likely to buy it online.

To become market leaders in the interior, companies will have to increase their retail presence and, in some cases, introduce new business models to reach consumers in smaller cities more effectively. They will also require a keener sense of consumer behavior.

Identifying the Gaps: A Look at Five Underserved Sectors

To assess how well companies are positioned in Brazil’s interior, we looked at five product categories in depth: air travel, premium banking, telecommunications, food and beverages, and apparel. In each case, we found that interior markets are underserved and that corporate footprints are not in line with consumer needs and purchasing behavior.

Air Travel. Despite their larger share of Brazil’s population and their higher levels of disposable income, interior cities, under present circumstances, are projected to account for only 35 percent of Brazil’s incremental demand for air travel by 2020—$420 million in additional annual revenues. The average affluent household in interior cities spends less on air travel—just $460 a year—than its capital and metro counterparts. Only around 60 percent have ever traveled by plane, compared with nearly 90 percent of capital city dwellers. Moreover, those who do fly, do so less frequently. Of the middle-class and affluent interior respondents who travel by plane, 46 percent said they do so less than once a year, compared with 26 percent of those in capital cities. Also, fewer interior consumers travel abroad. Only 16 percent of those who have traveled by air said that they had ever been to neighboring Argentina for personal reasons, compared with 29 percent of those in capitals. Around half as many interior-city dwellers who have traveled by air had been to the U.S. or Europe.

Poor access partly explains why people in Brazil’s interior don’t fly more. Seventeen percent of households reported that they don’t travel by air because the closest airport is too far away, compared with only 3 percent who gave that reason in capitals. The average middle-class or affluent consumer in a capital city travels 8 kilometers to the nearest airport. In metro cities, the nearest airport is an average 37 kilometers away. But for interior residents, the average distance is 94 kilometers. Eighty-four percent of interior consumers who fly no more than once a year reported that they must drive more than an hour to get to an airport, compared with only 12 percent who travel two to four times a year. Other big reasons interior consumers cited for not doing more air travel: it’s too hard to buy tickets, there are no flights to and from their desired destinations, and the experience is “too much hassle.” In our survey, a far greater share of consumers in interior cities than in capitals cited schedules and good connections as a top reason for selecting an airline for personal travel.

Cultural preferences also help explain why interior residents fly less. Asked about their leisure and entertainment activities, the majority of interior consumers said they enjoy meeting friends and family or simply relaxing at home. Only 13 percent cited going abroad, compared with 25 percent of respondents in capitals. Far fewer interior consumers than capital city dwellers said that they would like to travel by plane to the U.S., Europe, or the Caribbean. In fact, only 17 percent said that they would like to fly domestically.

Even with these physical and cultural obstacles, we project that demand for leisure air travel will rise by around 10 percent annually by 2020. Although capital and metro areas will continue to be the biggest sources of total revenue growth, consumption will rise fastest within a 100-kilometer radius of 20 interior airports, such as those in the cities of Barreiras in Bahia and Marabá in Pará. The fastest-growing domestic routes will connect cities in Brazil’s north and northeast. If demand for air travel were to match that of capitals and metro areas, however, spending in interior cities could double by 2020, adding more than $1.4 billion in annual revenues.

Premium Banking. The rapid growth in households with investable assets of $50,000 to $1 million will make interior cities increasingly important markets for banks that offer premium services. Average affluent families in the interior save and invest $10,000 a year—13 percent more than households at similar income levels in the capitals. We project that this annual contribution to savings and investments will grow by $5.8 billion per year by 2020.

Yet in the interim, premium banking services are still offered in a limited way. Currently, interior households prefer to focus more of their investments on real estate than do households in capital cities, and less on savings accounts, mutual funds, and retirement plans. Only 28 percent of interior households report that they use investment products from banks, compared with 35 percent in the capitals; 49 percent use credit cards, compared with 54 percent in capital cities. Fewer interior households also purchase car, health, and travel insurance.

One possible reason for why premium services have yet to take off in interior markets is that those markets don’t yet have high enough concentrations of wealth. The threshold appears to be at least 5,000 affluent households per city. All Brazilian capitals fall into this category compared with just a handful of interior cities. Only around 1 percent of the nearly 5,000 interior cities with 5,000 or fewer affluent households have branches dedicated solely to premium banking. But 86 percent of interior cities with 5,000 to 10,000 affluent households have at least one dedicated premium branch.

It is important not to ignore the future growth potential of this market. Our research indicates that the nearly 5,500 cities with fewer than 5,000 affluent households and no dedicated premium branches will increase their savings and investments by a compound annual growth rate (CAGR) of 5.9 percent until 2020. This compares with a 2.9 percent savings-and-investment CAGR in the 86 cities that currently meet this threshold and have at least one premium-focused branch. And even in cities with more than 5,000 affluent households, the premium-branch presence is heavily concentrated in southeastern Brazil.

Building full-scale branches in areas with low densities of upmarket consumers might not be economically feasible, but there are several alternative approaches to reaching the interior market. For instance, outside of Brazil, some banks offer a range of small, flexibly configured offices that can range from 100 square meters, with little more than ATMs, a receptionist, and a single meeting room for sales discussions, to mobile branches of less than 30 square meters.

We found that the banks in Brazil that have invested aggressively to penetrate the interior-city market are in a strong position to capture this growth. Banco Bradesco has 20 percent of its 305 premium Prime agencies in interior cities, and Banco do Brasil has 18 percent of its 142 premium Estilo agencies there. We also found that consumers have a more positive view of banks that have a stronger presence. For example, Banco do Brasil was rated among the country’s top three banks by all middle-class and affluent households we surveyed, but its rating was even higher in the interior, where it has a more differentiated presence, than in the capitals.

Telecommunications. The interior is projected to account for around $5 billion in additional annual demand for telecom services by 2020, around 45 percent of incremental revenue growth for the sector. But this growth would be much higher if middle-class and affluent households made as much use of higher-end telecom services as those in capitals and metro areas.

Relatively few households in interior cities currently subscribe to broadband Internet service. Consider Feira de Santana, a relatively affluent city in the northeastern state of Bahia. On the basis of penetration rates in Brazilian cities with similar income levels, around half of households in Feira de Santana should have broadband Internet service. Yet only around 20 percent subscribe. Similarly large gaps are found in many other interior cities.

Interior households also devote less of their budgets to mobile telephony. Emergent-middle-class households (those with annual incomes ranging from $15,001 to $30,000) in interior cities, for example, spend an average $540 per year on mobile telephony—12 percent less than those in capitals and metro areas.

One major reason for this lower spending is that interior consumers are prone to use prepaid services rather than more expensive packages that are paid for at the end of the month. Half of interior middle-class and affluent consumers surveyed said that they use prepaid data services on their mobile devices, compared with

44 percent in capitals, for example, and 67 percent said that they use prepaid voice service versus 62 percent in capitals. Consumers in the interior also use their mobile devices less to access the Internet. Only 44 percent of interior middle-class and affluent households surveyed reported that they use cell phones to access the Internet, compared with 52 percent in capitals. And just 25 percent use tablet PCs. This lower mobile use of the Internet is observed across all income groups, but it is most pronounced among households with monthly incomes exceeding $3,000.

Our research indicates that this is related, in part, to a cultural preference to spend more entertainment and leisure time at home. The differences in Internet usage are also a result of inadequate broadband infrastructure and cellular-network coverage in the interior. As in capital cities, network quality is the reason interior households cite most for choosing a mobile operator.

Food and Beverages. Interior cities constitute Brazil’s biggest market for food and beverages and will generate an additional $29 billion in annual sales by 2020, 47 percent of total incremental growth. Interior cities in the southeast and northeast will be the biggest contributors to growth in those regions.

But supermarket chains do not have enough stores in place to fully penetrate most interior cities, especially in Brazil’s north and midwest. As a result, the market is highly fragmented.

None of Brazil’s 20 largest supermarket chains reaches more than about 30 percent of the country’s potential food and beverage market. Indeed, some 1,400 cities with more than 5,000 households have no supermarkets that belong to the top 20 chains.

The vacuum has allowed a number of small, independent chains to advance and gain leadership positions over larger chains in certain regions. Small, low-cost food stores controlled by large groups such as Wal-Mart, Carrefour, and Cencosud have also made inroads by establishing stores in a range of formats and sizes in interior cities. Each market leader tends to be strong in a particular region, however.

Even though Grupo Pão de Açúcar is the national leader with approximately 2,000 stores, the midsize independent chain Y. Yamada leads in interior cities in the north with 36 stores. Super Muffato (which has 45 stores) has the most store-space square footage in interior cities in the south. In northeastern interior cities, the TodoDia chain owned by Wal-Mart is the market leader and is a good example of how a smaller-chain format can be effective.

The success of Super Muffato illustrates that interior cities, despite their lower density of middle-class and affluent households, can be highly profitable. Super Muffato’s stores bring in around $24,000 in annual revenues per square meter—on a par with the performance of the most successful leading chains in major cities. The Muffato chain maintained an average annual growth rate of about 15 percent from 2008 through 2013. It added 20 new stores during that period, a pace that was at least as fast as most major chains active in Brazil.

Apparel. Around half of incremental spending on apparel in Brazil until 2020 will happen in interior cities, generating annual revenues of around $28 billion. Middle-class and affluent households in the interior spend nearly $1,100 a year on apparel, around 20 percent more than their counterparts in capitals and metro areas.

Still, apparel sales—especially of luxury brands—would likely be far higher in the interior if there were more shopping malls. Because consumers in Brazil’s interior prefer to see clothes physically before they buy them, the multibrand stores typically found in shopping malls play a particularly important role in garment retailing. Nearly all of the middle-class and affluent interior households surveyed reported that they had purchased apparel in a multibrand store during the previous three months, compared with around 40 percent in capitals. Less than 20 percent bought garments over the Internet. Around 40 percent purchased footwear in multibrand stores, compared with 34 percent in capitals.

Property developers recognize the opportunity. Whereas only around 10 percent of shopping malls that opened in 2010 were in interior cities, in 2012, that share was 38 percent. More were built in 2013, and more are scheduled for 2014. They include Iguatemi Ribeirão Preto, a shopping mall that features such brands as Daslu, Hugo Boss, and Tommy Hilfiger.

Companies should establish a robust brand presence in Brazil. Our research shows that apparel brands don’t matter greatly to interior consumers. Only half of middle-class and affluent households surveyed reported that they regard brands as important when they buy apparel, compared with 70 to 80 percent who regard brands as important when they buy mobile-phone service, food and beverages, cars, personal-care items, and consumer durables.

The good news in this finding is that brand preferences are not yet fixed in the minds of a large share of interior-city consumers. There is, therefore, considerable opportunity for apparel companies to establish their brands as market leaders in the interior.

Seizing the Opportunity in Brazil’s Interior

Most companies that have made Brazil’s growing consumer market a top priority have already established a strong presence in its capital cities and major metropolitan areas. These companies must now just as energetically penetrate the many lucrative, untapped opportunities in the country’s neglected interior, which will drive growth in consumer spending in a range of product categories for the foreseeable future.

Capturing the prize in Brazil’s interior cities will require companies to do the following:

- Map the “consumer journey” of interior-city households. Companies must first gain a clear understanding of how consumers in Brazil’s interior cities come into contact with brands and make their purchasing decisions. By systematically mapping what marketers refer to as the consumer journey in their product categories, companies can learn how to position, market, and retail their products in interior-city markets.

- Build effective go-to-market strategies. Most companies must substantially increase their footprint—both physical and online—in interior cities. In most cases, this will mean building more retail outlets in cities or clusters of cities in order to be closer to growing concentrations of middle-class and affluent households. This physical presence needs to be supported with stronger on-the-ground capabilities in marketing, supply chain management, and, perhaps, local manufacturing. Companies must also upgrade their e-commerce capabilities to make the consumer’s online purchasing experience as efficient and reliable as possible.

- Adopt innovative business models. Many companies may rightfully decide that it is not yet time to build full-scale bank branches or hypermarkets, for instance, in small and remote Brazilian cities with low concentrations of middle-class and affluent households. Companies can, however, successfully penetrate these markets with innovative business models. For example, they can introduce a variety of small-scale and flexible retail formats and concepts—brick-and-mortar and digital—that are economically viable and also do a good job of addressing the specific preferences and needs of interior consumers.

Taking a slow and incremental approach to expanding into Brazil’s interior cities will be insufficient for companies that aim to be leaders in that country’s growing consumer market. Millions of middle-class and affluent households already represent a crucial market, and they are forming brand loyalty ties that will likely endure for many years. The time to establish a leading presence is now.

Acknowledgments

This report would not have been possible without the efforts of our BCG colleagues Lisandro Zarate, Bruna Keiserman, Julio Bezerra, Christian Orglmeister, Eduardo Leone, and Miki Tsusaka. The authors also acknowledge the many Brazilian households that contributed to the qualitative and quantitative research underpinning this work.