Over the past five years, the consumer durables sector has delivered very strong value creation, thanks to the global economic recovery and a business cycle that is slowly gathering momentum, particularly in the housing sector.

In 2014, as in past years, The Boston Consulting Group conducted an annual study of total shareholder return among 1,620 publicly traded companies in 26 industry sectors, of which 53 were in the consumer durables

(For the complete analysis of all industry sectors, see Turnaround: Transforming Value Creation, the 2014 BCG Value Creators report, July 2014.) Overall, from 2009 through 2013, the durables companies in our sample returned an annualized TSR of 26 percent. Durables ranked second among the five groups of consumer companies studied—fashion and luxury (which ranked first), retail, consumer nondurables, and travel and tourism were the other four—and seventh among all 26 industry sectors. (For an overview of the performance of the five consumer sectors, see “2014 Consumer Value Creators Series: Rising Volatility, Growing Opportunity,” the BCG 2014 Consumer Value Creators Series, December 2014.)

The strong value creation performance of consumer durables reflects the recovering global economy and the way in which many companies in the sector have improved their profitability. During the downturn, the sector was among the hardest hit, as skittish businesses and consumers delayed the purchase of durable goods. In response, many durables companies took steps to streamline their operations, reduce head count, and restructure their cost base. Once the economy began to recover, these companies were better positioned to capitalize, with stronger cash flow and higher profit margins. In addition, the recovery in the housing market (particularly in the U.S.) has boosted the performance of many companies in the sector. U.S. housing starts have climbed back from a low of 750,000 per year to more than 1 million and are slowly returning to the historical average of approximately 1.5 million.

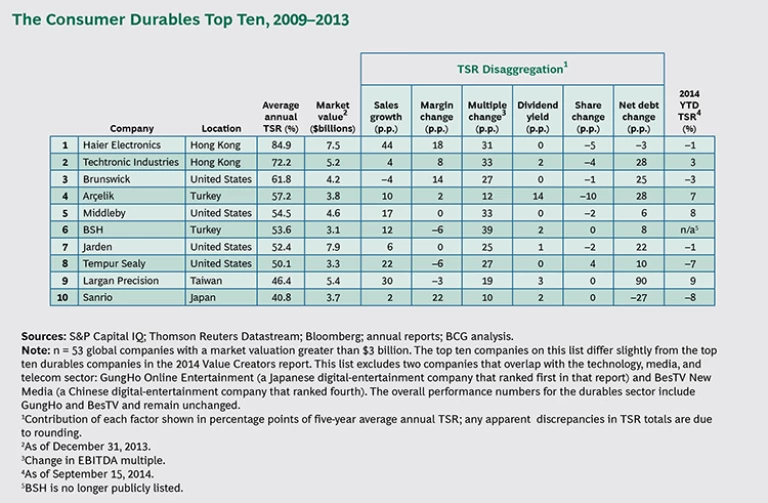

The exhibit shows the breakdown of TSR drivers for the top ten companies in the sector over the five-year period we

Four of the top ten durables companies are based in the U.S., four are based in Asia, and the remaining two are based in Turkey. (The absence of any companies from Western Europe likely reflects that region’s current economic challenges and the struggle of some companies in Europe to remain competitive.)

The TSR disaggregation illustrates several key insights, described below, for all consumer durables companies.

Reshaping the Portfolio

The top players in the sector moved beyond basic cost cutting as they emerged from the downturn and have opportunistically reevaluated their portfolio strategy to improve long-term shareholder returns. They have done this by asking two key questions of each business unit: What is the strategic position (in terms of market outlook and competitive advantage)? And what is the fundamental health and value creation outlook? Winning companies have invested in high-return businesses to speed their recovery and drive growth, while taking a hard look at underperforming units and either launching aggressive measures to improve returns or divesting such units entirely.

For example, Brunswick (which finished third among the top ten companies) experienced a major decline in the demand for boats late in the first decade of the 2000s—not surprising, since boats are a large, discretionary purchase not often made during a recession. In response, the company sold several underperforming brands in its boat division, reduced employee head count accordingly, and restructured its operations to improve profitability at lower production levels. It was able to reinvest in production innovation among faster-growing segments such as small boats, where demand has recovered more rapidly.

Other companies are launching targeted M&A efforts to strengthen their core positions. Techtronic Industries (second among the top ten) owns the Hoover brand of vacuum cleaners and in July 2013 bought a bankrupt rival, Oreck. It expects the combined business to be profitable by 2015.

Investing for Growth

After cutting deeply during the downturn, many durables companies have struggled to anticipate changing market conditions and have been cautious about investing ahead of growth. As a result, their production capacity has lagged demand—owing to long lead times in getting factories online—and they have been unable to take full advantage of the recovery. Similarly, as growth has slowed in large emerging markets like China and Brazil, some durables companies have been overly cautious—and even considered scaling back investments. This puts them at risk of losing ground to committed and aggressive local competitors.

In contrast, many of the leading players have identified the right portfolio for growth and have been confident enough about the future to invest to support those assets—regardless of short-term contractions. These companies have developed the right mind-set—aggressive growth and appropriate risk taking—and thus have been able to increase their market share in an improving business cycle. For example, Haier Electronics (the top performer in both this year’s and last year’s analysis) has continued to invest heavily in China. It aggressively expanded into third- and fourth-tier markets in the country, built out its distribution network, and offered new value-based lines and innovative new products. This ambitious strategy has paid off—Haier generated the largest TSR contribution from growth among companies in the top ten, and the second-highest contribution from margin change.

Maintaining a Shareholder Mind-Set

For many durables companies, particularly those in mature markets, improving the top line faster than their peers can be challenging and costly. Yet that doesn’t automatically limit value creation. (As noted above, growth wasn’t the principal value-creation driver among the top ten performers.) Companies facing moderate prospects for top-line growth can still deliver value to shareholders by generating greater cash flow, by opportunistically deploying that capital, and by consistently meeting earnings-per-share goals. For four companies among the top ten—Techtronic, Brunswick, Arçelik (which ranked fourth), and Jarden (ranked seventh)—returning cash to shareholders or improving their operating leverage accounted for one third to one half of total TSR.

For example, Jarden has taken a balanced approach to value creation through organic sales growth, margin expansion, and shareholder-friendly financial strategies. The company balances its use of capital effectively, reinvesting in the business and also striking opportunistic deals for assets (such as the 2013 acquisition of Yankee Candle) that fit into its portfolio of consumer brands. Jarden’s strong performance—returning an average annual TSR of 52 percent to shareholders—made it one of three companies to appear on both the 2013 and 2014 lists of top ten value creators in the sector (along with Haier and Arçelik).

In sum, our TSR analysis shows that there are real opportunities for durables companies to outperform in creating value for shareholders. Reshaping the portfolio, maintaining a shareholder mind-set, and investing for growth will be crucial objectives for management teams for the foreseeable future.