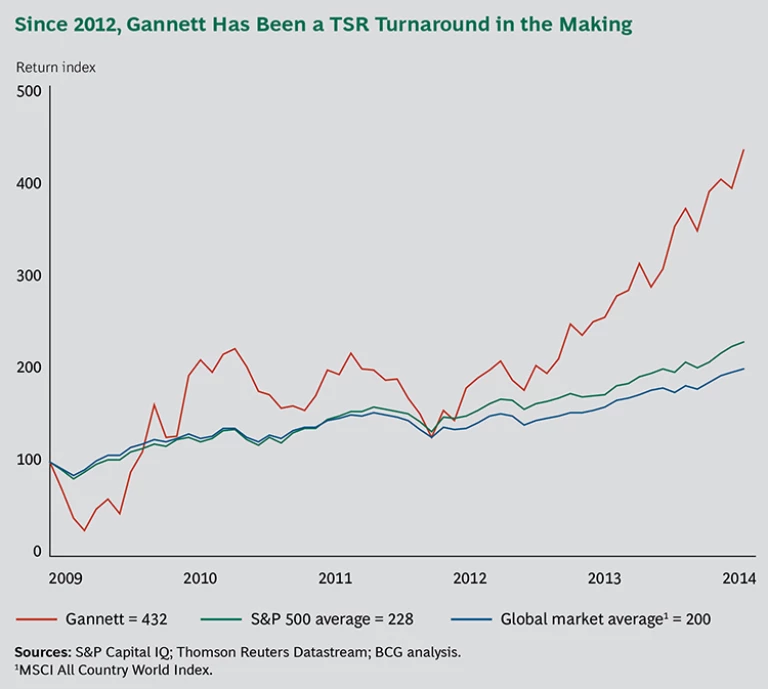

The U.S. media company Gannett is perhaps best known as the publisher of USA Today. Since announcing a new business and financial strategy in March 2012, the company has tripled its share price and been one of the top value creators in the S&P 500, powerful signs that it is a TSR turnaround in the making. (See the exhibit below.)

Gannett has a broad portfolio of digital, mobile, broadcast, and print properties. But like many media companies with roots in the newspaper business, it has had to grapple with both the reality and the perception of a secular decline in print-based readership and advertising. Since 2008, the decline in revenues of the company’s publishing segment has created an overhang on value creation—as it has for all media companies with newspaper assets. As recently as 2011, Gannett was trading at less than its breakup value. In effect, investors were valuing the company as if it had no future cash flows from its newspaper businesses.

Gannett CFO Gracia Martore (who became the company’s CEO in October 2011) and the rest of the Gannett leadership team developed a multipronged strategy to transform the business, expand margins, and boost revenue growth. The transformation included a series of actions to stabilize the newspaper business and create related adjacent businesses, to rebalance the overall portfolio of businesses through acquisition of additional broadcast-TV stations, and to leverage the company’s strong cash flow in order to directly raise TSR through a substantial increase in the company’s dividend and share buybacks. The new strategy, including a 150 percent increase in Gannett’s dividend, was officially unveiled at the company’s first-ever investor day in March 2012.

Since then, Gannett has executed a broad range of successful strategic and operational moves. The company has redesigned its subscription-pricing model, which has led to circulation revenue increases. It has also consolidated all of its printing and distribution operations into a single entity, allowing it to take advantage of scale efficiencies. At the same time, it has launched a new local-marketing and services business, aimed at helping local advertisers plan and execute integrated traditional-media and digital-marketing campaigns, and created new content services, such as USA Sports Media and a travel media group. In 2013, Gannett announced the $2.2 billion acquisition of the Belo broadcasting group, making Gannett the largest independent TV-station group of major network affiliates in the top 25 U.S. markets. And in 2014, the company rolled out a major change in its largest community newspapers, integrating content from USA Today as a separate section, which both extends USA Today’s reach and frees up editorial and reporting capacity to reinvest in local news coverage.

These changes have had a strong and immediate impact on Gannett’s performance. In 2012, the company posted its first year-over-year revenue growth since 2006. Meanwhile, it has continued to return significant cash to shareholders. The company estimates that, by 2015, it will have returned approximately $1.3 billion to investors in the form of dividends and share buybacks since the launch of the new strategy. In little more than two years, from the development of the new strategy in October 2011 through the end of 2013, Gannett delivered an exceptional average annual TSR of 71 percent, making it one of the top ten value creators in the S&P 500.